Ritchie Bros. Sells US $250+ Million of Heavy Equipment Assets and Vehicles in its 2025 Premier Global Auction Event in Orlando, FL

26 Février 2025 - 2:30PM

Business Wire

Five-day public auction attracted 19,000+

bidders from 75+ countries competing for 16,000+ equipment

items

RB Global, Inc. (NYSE: RBA) (TSX: RBA), the trusted global

marketplace for insights, services and transaction solutions for

commercial assets and vehicles, today announced that Ritchie Bros.

Auctioneers sold 16,000+ equipment items, trucks and vehicles at

its Feb. 17-21 premier global auction event in Orlando, FL,

generating US$250+ million in gross transaction value (GTV).

The premier global auction event attracted 19,000+ people from

75+ countries, with approximately 88% of the equipment selling to

U.S. buyers, including 23% purchased by Floridians. The remaining

12% of the equipment was purchased by international buyers from as

far away as Australia, Singapore and Israel.

Featured equipment sold during the auction includes:

- 2007 Liebherr LTM 1400-7.1 500 ton All Terrain Crane

- Sold for $910,000 to a buyer in North Dakota

- Physical Selling Location: St. Louis, Missouri

- 2023 Cat 395 VG Tracked Excavator

- Sold for $900,000 to a buyer in Florida

- Physical Selling Location: Davenport, Florida (Orlando

Site)

- 2020 Kenworth T880 T/A Truck Tractor

- Sold for $117,500 to a buyer in Virginia

- Physical Selling Location: Davenport, Florida (Orlando

Site)

“I want to offer a huge thank you to our customers participating

onsite and online for providing the largest selection of equipment

available for sale at one time and making this year’s premier

global auction in Orlando a major success,” said Jeff Jeter, Chief

Revenue Officer at RB Global. “With 16,000+ equipment items sold

between our Orlando lot and through our Virtual Sales Option

featuring IronClad Assurance, we continue to grow our global buyer

base and provide valuable returns to our sellers. We also saw

strong engagement from customers onsite looking to take advantage

of our value-added services, like VeriTread and Ritchie Bros.

Financial Services, to transport or finance the equipment they were

purchasing at the Orlando sale.”

About RB Global

RB Global, Inc. (NYSE: RBA) (TSX: RBA) is a leading, omnichannel

marketplace and trusted provider of value-added insights, services

and transaction solutions for buyers and sellers of commercial

assets and vehicles worldwide. Through its global network of

auction sites and digital platform, RB Global serves customers

worldwide across a variety of asset classes, including automotive,

construction, commercial transportation, government surplus,

lifting and material handling, energy, mining and agriculture. The

company’s end-to-end marketplace solutions include Ritchie Bros.,

IAA, Rouse Services, SmartEquip and VeriTread. For more information

about RB Global, visit www.rbglobal.com.

Forward-Looking Statements

Certain statements contained in this release include

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 (the “Securities Act”) and Section 21E

of the Securities Exchange Act of 1934 (the “Exchange Act”) and

Canadian securities laws. Forward-looking statements are typically

identified by such words as “aim”, “anticipate”, “believe”,

“could”, “continue”, “estimate”, “expect”, “intend”, “may”,

“ongoing”, “plan”, “potential”, “predict”, “will”, “should”,

“would”, “could”, “likely”, “generally”, “future”, “long-term”, or

the negative of these terms, and similar expressions intended to

identify forward-looking statements. Forward-looking statements are

based on current expectations and assumptions that are subject to

risks and uncertainties that may cause actual results to differ

materially. These statements are based on our current expectations

and estimates about our business and markets, and may include,

among others, statements relating to the February 2025 Orlando

Auction Event and other subjects of this release on our business

and plans regarding our future strategy, objectives, targets,

projections and performance; our ability to drive shareholder

value; potential growth and market opportunities; the level of

participation in our auctions and the success of our online

marketplaces; our ability to grow our businesses, acquire new

customers, enhance our sector reach, drive geographic depth, and

scale our operations; the impact of our initiatives, services,

investments, and acquisitions on us and our customers; the

acquisition or disposition of properties; potential future mergers

and acquisitions; our ability to integrate acquisitions; our future

capital expenditures and returns on those expenditures; our ability

to add new business and information solutions, including, among

others, our ability to maximize and integrate technology to enhance

our existing services and support additional value-added service

offerings; the supply trend of equipment and vehicles in the market

and the anticipated price environment, as well as the resulting

effect on our business and Gross Transaction Value (“GTV”); our

compliance with laws, rules, regulations, and requirements that

affect our business; effects of various economic, financial,

industry, and market conditions or policies, including inflation,

the supply and demand for property, equipment, or natural

resources; the behavior of commercial assets and vehicle pricing;

the relative percentage of GTV represented by straight commission

or underwritten (guarantee and inventory) contracts, and its impact

on revenues and profitability; our future capital expenditures and

returns on those expenditures; the effect of any currency exchange

and interest rate fluctuations on our results of operations; the

effect of any tariffs on our results of operations; the grant and

satisfaction of equity awards pursuant to our compensation plans;

any future declaration and payment of dividends, including the tax

treatment of any such dividends; financing available to us from our

credit facilities or other sources, our ability to refinance

borrowings, and the sufficiency of our working capital to meet our

financial needs; and, our ability to satisfy our present operating

requirements and fund future growth through existing working

capital, credit facilities and debt. While we have not described

all potential risks related to our business and owning our common

shares, the factors discussed in “Part I, Item 1A: Risk Factors” of

our Annual Report on Form 10-K for the year ended December 31,

2023, as such risk factors may be amended, supplemented or

superseded from time to time by other reports we file with the SEC,

including subsequent Quarterly Reports on Form 10-Q and Annual

Reports on Form 10-K, are among those that may affect our

performance materially or could cause our actual results,

performance or achievements to differ materially from those

expressed or implied by forward-looking statements. The

forward-looking statements included in this release are made only

as of the date hereof. Except as required by applicable securities

law and regulations of relevant securities exchanges, we do not

intend to update publicly any forward-looking statements, even if

our expectations have been affected by new information, future

events or other developments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226074504/en/

RB Global Contacts

Media Inquiries: Val Alitovska | RB Global, Inc.

Director, Corporate Communications (312) 505-9900

valitovska@rbglobal.com

Analyst Inquiries: Sameer Rathod | RB Global, Inc. VP,

Investor Relations/Market Intelligence (510) 381-7584

srathod@rbglobal.com

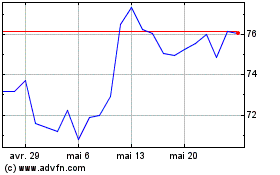

RB Global (NYSE:RBA)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

RB Global (NYSE:RBA)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025