UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM __________ TO

________

COMMISSION FILE NUMBER 001-39384

VICARIOUS SURGICAL INC.

(Exact name of registrant as specified in its

charter)

| Delaware | | 87-2678169 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification Number) |

| | | |

| 78 Fourth Avenue | | |

| Waltham, Massachusetts | | 02451 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including

area code: (617) 868-1700

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class | | Trading Symbols | | Name of each exchange on which registered |

| Class A common stock, $0.0001 par value per share | | RBOT | | The New York Stock Exchange |

| Warrants to purchase one share of Class A common stock, each at an exercise price of $11.50 per share | | RBOT WS | | The New York Stock Exchange |

Securities registered pursuant to Section 12(g)

of the Act: None

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such

filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant

(1) has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and has been subject

to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Smaller reporting company ☒ |

| | | | Emerging growth company ☒ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report. ☐

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error

corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s

executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the registrant’s

voting and non-voting equity held by non-affiliates of the registrant (without admitting that any person whose securities are not included

in such calculation is an affiliate) computed by reference to the price at which the Class A common stock was last sold as of June 30,

2023, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $193.5 million.

As of February 23, 2024, the registrant had 156,131,913 shares

of Class A common stock outstanding and 19,619,760 shares of Class B common stock outstanding.

TABLE OF CONTENTS

DOCUMENTS INCORPORATED BY REFERENCE

The following documents (or parts thereof) are incorporated by reference

into the following parts of this Form 10-K: Certain information required in Part III of this Annual Report on Form 10-K is incorporated

by reference from the Registrant’s Proxy Statement for the 2024 Annual Meeting of Stockholders to be filed with the Securities and

Exchange Commission.

EXPLANATORY NOTE

In this Annual Report on Form 10-K, the terms “we,” “us,”

“our,” the “Company” and “Vicarious Surgical” mean Vicarious Surgical Inc. (formerly D8 Holdings Corp.)

and our subsidiaries. On September 17, 2021 (the “Closing Date”), D8 Holdings Corp., a Delaware corporation that was previously

a Cayman Islands exempted company (“D8” and after the Business Combination described herein, the “Company”) that

migrated to and domesticated (the “Domestication”), consummated the previously announced business combination (the “Business

Combination”) pursuant to the terms of the Agreement and Plan of Merger, dated as of April 15, 2021 (the “Business Combination

Agreement”), by and among D8, Snowball Merger Sub, Inc., a Delaware corporation (“Merger Sub”), and Vicarious Surgical

Inc., a Delaware corporation (“Legacy Vicarious”). Immediately upon the consummation of the Business Combination, the Domestication

and the other transactions contemplated by the Business Combination Agreement (collectively, the “Transactions”, and such

completion, the “Closing”), Merger Sub merged with and into Legacy Vicarious, with Legacy Vicarious surviving the Business

Combination as a wholly-owned subsidiary of D8 (the “Merger”). In connection with the Transactions, D8 changed its name to

“Vicarious Surgical Inc.” and Legacy Vicarious changed its name to “Vicarious Surgical US Inc.”

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), that relate to future events, our future operations or financial

performance, or our plans, strategies and prospects. These statements are based on the beliefs and assumptions of our management team.

Although we believe that our plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable,

we cannot assure that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject

to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning possible

or assumed future actions, business strategies, events or performance, are forward-looking statements. These statements may be preceded

by, followed by or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,”

“may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates”

or “intends” or the negative of these terms, or other comparable terminology intended to identify statements about the future,

although not all forward-looking statements contain these identifying words. The forward-looking statements are based on projections prepared

by, and are the responsibility of, our management team. Forward-looking statements contained in this Annual Report on Form 10-K include,

but are not limited to, statements about:

| ● | the

ability to maintain the listing of our Class A common stock on the New York Stock Exchange (“NYSE”); |

| |

● |

the success, cost and timing of our product and service development activities; |

| |

● |

the approval, commercialization and adoption of our initial product candidates and the success of our single-port surgical robot, called the Vicarious Surgical System, and any of our future product candidates and service offerings; |

| |

● |

the potential attributes and benefits of the Vicarious Surgical System and any of our other product and service offerings once commercialized; |

| |

● |

our ability to obtain and maintain regulatory authorization for the Vicarious Surgical System and our product and service offerings on the timeline we expect, and without unexpected restrictions and limitations of any authorized product or service offering; |

| |

● |

changes in U.S. and foreign laws; |

| |

● |

our ability to identify, in-license or acquire additional technology; |

| |

● |

our ability to maintain our existing license agreements and manufacturing arrangements and scale manufacturing of the Vicarious Surgical System and any future product candidates to commercial quantities; |

| |

● |

our ability to compete with other companies currently marketing or engaged in the development of products and services for use in ventral hernia repair procedures and additional surgical applications, as well as with the use of open surgeries; |

| |

● |

the size and growth potential of the markets for the Vicarious Surgical System and any of our future product and service offerings, and the ability of each to serve those markets once commercialized, either alone or in partnership with others; |

| |

● |

our estimates regarding expenses, future revenue, capital requirements, cash runway and needs for additional financing; |

| |

● |

our ability to raise financing in the future; |

| |

● |

our financial performance; |

| |

● |

our intellectual property rights and our ability to protect or enforce these rights, and the impact on our business, results and financial condition if we are unsuccessful in doing so; |

| |

● |

our ability to address economic downturns and political and market conditions beyond our control and their potential to adversely affect our business, financial condition and results of operations, including, but not limited to, increasing our expenses and cost of capital and adverse impacting our supply chain; and |

| |

● |

other factors detailed under the section titled “Risk Factors.” |

These forward-looking statements are based on information available

as of the date of this report, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties.

Important factors could cause actual results, performance or achievements to differ materially from those indicated or implied by forward-looking

statements such as those described under the caption “Risk Factors” in Item 1A of Part I of this Annual Report on Form 10-K,

elsewhere herein and in other filings that we make from time to time with the Securities and Exchange Commission. The risks described

under the heading “Risk Factors” are not exhaustive. New risk factors emerge from time to time, and it is not possible to

predict all such risk factors, nor can we assess the impact of all such risk factors on our business or the extent to which any factor

or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. Forward-looking

statements are not guarantees of performance. You should not put undue reliance on these statements, which speak only as of the date hereof.

All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing

cautionary statements. We undertake no obligations to update or revise publicly any forward-looking statements, whether as a result of

new information, future events or otherwise, except as required by law.

SUMMARY OF RISK FACTORS

We are providing the following summary of the risk factors contained

in this Annual Report on Form 10-K to enhance the readability and accessibility of our risk factor disclosures. The risk factors described

below are a summary of the principal risk factors associated with an investment in us. These are not the only risks we face. You should

carefully review the full risk factors contained in this Annual Report on Form 10-K in their entirety for additional information regarding

the material factors that make an investment in our securities speculative or risky. These risks and uncertainties include, but are not

limited to, the following:

| |

● |

We have a limited operating history on which to assess the prospects for our business, we have not generated any revenue from sales of our product candidates, and we have incurred losses since inception. We anticipate that we will continue to incur significant losses for at least the next several years as we develop and commercialize our product candidates and applications. |

| |

● |

We may need to raise additional funding to develop and commercialize the Vicarious Surgical System and to expand our research and development efforts. This additional financing may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product commercialization or development efforts or other operations. |

| |

● |

We are a development stage company with a limited history of operations and no product candidates with marketing authorization in any jurisdiction, and we cannot assure you that we will ever have a commercialized product. |

| |

● |

Our success depends upon market acceptance of our product candidates, our ability to develop and commercialize our product candidates and additional applications and generate revenues, and our ability to identify new markets for our technology. |

| |

● |

We are highly dependent upon the continued contributions of our key personnel. The loss of their services could harm our business, and if we are unable to attract, recruit, train, retain, motivate and integrate key personnel, we may not achieve our goals. |

| |

● |

We have no experience in marketing and selling our product candidates and if we are unable to successfully commercialize our product candidates, our business and operating results will be adversely affected. |

| |

● |

We expect to generate an increasing portion of our revenue internationally in the future and may become subject to various additional risks relating to our international activities, which could adversely affect our business, operating results and financial condition. |

| |

● |

We rely on limited or sole suppliers for some of the materials and components used in our product candidates, and we may not be able to find replacements or immediately transition to alternative suppliers, which could have a material adverse effect on our business, financial condition, results of operations, and reputation. |

| |

● |

If we do not successfully develop, optimize, and operate our sales and distribution channels or we do not effectively expand and update infrastructure, our operating results and customer experience may be negatively impacted. |

| |

● |

If we are unable to establish and maintain adequate sales and marketing capabilities or enter into and maintain arrangements with third parties to sell and market our product candidates, our business may be harmed. |

| |

● |

We have identified a material weakness in our internal control over financial reporting. If we are unable to successfully remediate this material weakness in our internal control over financial reporting, we may not be able to report our financial condition or results of operations accurately or in a timely manner, which may adversely affect investor confidence in us and, as a result, materially and adversely affect our business and the value of our Class A common stock. |

| |

● |

We are subject to extensive government regulation, which could restrict the development, marketing, sale and distribution of our product candidates and technologies and could cause us to incur significant costs. |

| |

● |

There is no guarantee that the U.S. Food and Drug Administration (the “FDA”) will grant marketing authorization for our product candidates or any of our future product candidates and technologies, and failure to obtain necessary marketing authorization for our current product candidates and our future product candidates and technologies would adversely affect our ability to grow our business. |

| |

● |

If we are unable to protect our intellectual property, our ability to maintain any technological or competitive advantage over our competitors and potential competitors would be adversely impacted, and our business may be harmed. |

| |

● |

We may need or may choose to obtain licenses from third parties to advance our research or allow commercialization of our current or future product candidates and technologies, and we cannot provide any assurances that we would be able to obtain such licenses. |

| |

● |

We and our partners may be sued for infringing the intellectual property rights of third parties. If that happens, such litigation would be costly and time consuming, and an unfavorable outcome in any such litigation could have a material adverse effect on our business. |

| |

● |

In addition to IP litigation risks (referenced above), we face the risk of product liability claims and may be subject to damages, fines, penalties and injunctions, among other things. |

PART

I

ITEM 1. BUSINESS.

The following discussion reflects the business of Vicarious Surgical,

as currently embodied by Vicarious Surgical. Unless the context otherwise requires, all references in this section to the “Company”,

“we”, “us” and “our” generally refer to Vicarious Surgical in the present tense or Vicarious Surgical

from and after the Business Combination.

Overview

We are combining advanced miniaturized robotics, computer science,

sensing and 3D visualization to build an intelligent and affordable, single-port surgical robot, called the Vicarious Surgical System,

that virtually transports surgeons inside the patient to perform minimally invasive surgery. With our disruptive next-generation

robotics technology, we are seeking to increase the efficiency of surgical procedures, improve patient outcomes and reduce healthcare

costs. Led by a visionary team of engineers from the Massachusetts Institute of Technology, or MIT, we intend to deliver the next generation

in robotic-assisted surgery, designed to solve the shortcomings of open surgery, and current laparoscopic and robot-assisted minimally

invasive surgery. We have developed multiple prototypes, have had pre-submission meetings with the FDA to align on our regulatory

strategy, and plan to file a de novo application with the FDA for use in ventral hernia procedures as our first indication.

The Vicarious Surgical System is uniquely designed to overcome the

deficiencies that have limited broad adoption of robot-assisted minimally invasive surgery to date. By fundamentally engineering a better

solution, we believe we have created a more capable surgical robot than those currently available on the market, and if authorized by

the FDA, the Vicarious Surgical System will offer surgeons the ability to perform surgical procedures with greater dexterity and greater

access to the entire abdomen, with better visibility and sensor-based feedback, through a small single incision in the abdomen. The Vicarious

Surgical System features proprietary “de-coupled” actuators, which are intended to enable a cascade of benefits, including

improved robotic mobility, reduced size, improved functionality and lower materials costs. If authorized by the FDA, the Vicarious Surgical

System is designed to enable surgeons to perform procedures inside the abdomen with human-equivalent motion, with a full nine degrees

of freedom per robotic arm, providing an experience that is more natural, and more akin to the surgeon’s own upper body movements.

In surgical procedures conducted on cadavers, the Vicarious Surgical System provides exceptional reach within the abdomen, and if authorized

by the FDA, it will enable the surgeon to enter the abdomen from nearly any angle and work in nearly any direction, without having to

triangulate to the surgical area from multiple incisions or to operate only within the limited area directly in front of a single incision.

The Vicarious Surgical System is designed to provide exceptional visualization, with a high-performance, stereoscopic camera that rotates

in three degrees of freedom (yaw, pitch, and roll) to provide the surgeon with stereoscopic imaging of nearly every surface in the abdomen.

The Vicarious Surgical System also contains 28 sensors per instrument arm, which allows the system to provide real-time feedback to the

surgeon on force, motion and other data that are intended to enhance surgical procedures and patient outcomes.

The Vicarious Surgical System is being developed to provide attractive

advantages to hospitals and ambulatory surgical centers, or ASCs, which we believe will drive rapid and widespread adoption. Unlike the

large footprints of legacy surgical robotic systems that require a construction build-out and a dedicated operating room, the Vicarious

Surgical System is mobile and much smaller and could be easily moved to any operating room throughout a medical facility. We anticipate

that, if authorized by the FDA, the smaller size and advanced engineering of the Vicarious Surgical System and related disposable instruments

will be offered at a cost-effective price point compared to existing legacy robotic systems. Hospitals and ASCs would not be required

to dedicate permanent space and would reduce expenses relating to sterilization and operating room turnover. We believe that, if authorized

by the FDA, adoption of the Vicarious Surgical System could be facilitated by a streamlined training regimen, where surgeons will be able

to develop proficiency much more quickly than for legacy robotic systems. This is due to the design features of the Vicarious Surgical

System, such as the ease of use and more natural, human-equivalent motion of the Vicarious Surgical System, the reduced surgeon burden

during setup, and the fact that the Vicarious Surgical System would not be confined to a dedicated operating suite and therefore could

have more availability for training purposes. In addition, with its increased capability and dexterity, the Vicarious Surgical System

is designed to enable many procedures to be performed faster and more effectively, with less injury and risk to the patient, significantly

reducing overall healthcare costs. Because the Vicarious Surgical System has not yet been authorized by the FDA or commercialized, the

intended advantages of the Vicarious Surgical System have not yet been realized and are dependent upon the successful development of the

Vicarious Surgical System and a timely authorization by the FDA.

We estimate that there are 45 million soft tissue abdominal and

gynecological surgical procedures performed annually worldwide that could be addressed with the Vicarious Surgical System, including use

for ventral hernia, other types of hernia, hysterectomy, cholecystectomy (gall bladder) and certain other gastrointestinal procedures.

We intend for use in ventral hernia procedures to be the first clinical application for the Vicarious Surgical System, of which there

are estimated to be 3.9 million cases worldwide and 0.9 million in the U.S. annually. We then intend to seek FDA clearance

or authorization to enable the expansion into the other applications addressable by the Vicarious Surgical System.

Industry Background

Despite the advancements in manual and robot-assisted minimally invasive

surgery over the last 40 years, of the estimated 45 million annual worldwide procedures addressable by the Vicarious Surgical

System, it is estimated that more than 50% are currently performed by open surgery and less than 5% are performed by existing robot-assisted

minimally invasive surgery technologies today. The large incisions required for open surgery, while allowing the surgeon to see with their

own eyes and operate with their own hands, create significant trauma to the patient, resulting in long hospitalization and recovery times,

high hospitalization costs, as well as significant pain and suffering. Due to the significant trauma to the patient associated with open

surgery, 15% to 20% of such surgeries result in tissue or internal organs pushing through the muscle into the abdomen, or incisional hernias,

caused by the operation, requiring additional complex surgery to correct. Although there have been significant improvements in minimally

invasive surgery procedures over open surgery, the following limitations associated with minimally invasive surgery still exist:

| |

● |

Laparoscopic surgery results in improved patient outcomes, but it presents significant challenges for surgeons, primarily associated with using long, rigid instruments through multiple incisions across the abdominal wall, which introduces the “fulcrum effect” requiring the surgeon to adjust for the inversion and scaling of movements. These laparoscopic instruments are difficult to manipulate, have limited degrees of freedom, limited reach and reduced depth-perception and visibility, which requires significant coordination among the surgical team to perform the procedure. |

| |

● |

Multi-port robotic systems introduced in the early 2000s have managed to overcome some of the challenges associated with laparoscopy, but they require multiple incisions. While the wristed robotic instruments provide more dexterity than the long, rigid instruments used in laparoscopy, these robotic systems still require multiple systems and require the surgeon to define the workspace and kinematic motion profile of the robotic system for every procedure, based on where they create the incisions and where they intend to operate. Additionally, these systems are expensive and require a difficult learning-curve for surgeons. In addition, these systems are often underutilized because they have large footprints, limited portability and require extensive setup and longer operating room turnover time. |

| |

● |

More recently, single-port surgical robots have been developed, but these systems are limited in that they rely on legacy robotic architecture, and thus require a much larger incision than multi-port robotic systems, have limited motion, strength, and visualization, and can only operate in a small procedural area. Given the relatively large size of the trocar incision required to be made by the surgeon to accommodate existing single-port robotic systems, among other limitations, these existing single-port robots have unfortunately resulted in significantly higher rates of complications with higher levels of injury to the patient, with less capability for the surgeon. For all these reasons, legacy single-port robotic solutions, much like multi-port manual and robotic minimally invasive surgery, have received limited adoption to date. |

We believe the slow adoption of robot-assisted surgery, estimated to

be less than 5% of the estimated 45 million addressable abdominal soft-tissue surgical procedures performed worldwide annually, has

occurred because of several factors, including the following:

| |

● |

Significant Capital Investment. Legacy robotic systems require high upfront acquisition costs and burdensome annual service contracts that are often prohibitively expensive, especially in outpatient settings. We estimate these capital costs to be up to $2.0 million or more per system upfront, plus an additional 10% to 20% annually for maintenance and service contracts. |

| |

● |

Low Utilization. In addition to the significant acquisition costs, existing robotic systems create inefficiencies and increase costs to medical facilities considering adoption. Due to their large size and limited portability, existing robotic systems require the construction of a dedicated operating room, occupying valuable real estate within the hospital. Once in place, these robotic systems require extensive set-up and operating room turnover times, which limits the number of procedures that can be performed with the robotic system. |

| |

● |

Limited Capabilities. Existing robotic systems have limited capabilities and are ill-suited for many outpatient procedures. Due to their limited degrees of freedom inside the abdomen, they depend on significant, complicated, robotic motion outside the body, and they have limited ability to operate in multiple quadrants, difficulty operating on the “ceiling” of the abdomen, create collisions inside and outside of the patient’s abdomen, and restrict overall access of the operating team to the patient. |

| |

● |

Difficult to Use. Existing robotic systems require the surgeon to develop an extensive procedure plan in advance to determine appropriate incision sites and angles for each procedure, in order to avoid collisions inside and outside of the patient’s abdomen. Surgeons must develop this plan with fewer degrees of freedom than they would employ using open surgery, restricting their natural movements. To become proficient at manipulating these legacy robotic systems to perform the procedures they otherwise were trained to perform via open surgery requires extensive training and several dozen procedures on live patients. As these systems are maintained in dedicated, expensive, operating rooms, obtaining access to train on the system becomes a significant impediment to adoption, resulting in more open surgeries. |

The Vicarious Surgical System

The single-port Vicarious Surgical System with advanced, miniaturized

robotics and exceptional visualization is designed to address the significant limitations of open surgery and existing single- and multi-port

robotic surgical approaches and intended to improve patient outcomes and enhance adoption by hospitals and other medical facilities. The

Vicarious Surgical System is designed with a fundamentally different architecture, and proprietary “de-coupled actuators,”

to overcome many of the limitations of open surgery or existing robot-assisted surgical procedures with a minimally invasive and more

capable robotic system. This architecture enables unprecedented dexterity inside the abdomen through an ultra-thin support tube, providing

significant improvement over existing legacy robotic systems and minimizing the complications and trauma associated with open surgery.

The Vicarious Surgical System has not yet been authorized by the FDA. We have had pre-submission meetings with the FDA to align on

our regulatory strategy and plan to file a de novo application with the FDA for use in ventral hernia procedures as our first indication.

| (1) | The

Vicarious Surgical System is capable of incision sizes as low as 1.2cm. Current disposables require 1.8cm incisions. We are developing

and expect to launch disposables requiring 1.5cm incisions. |

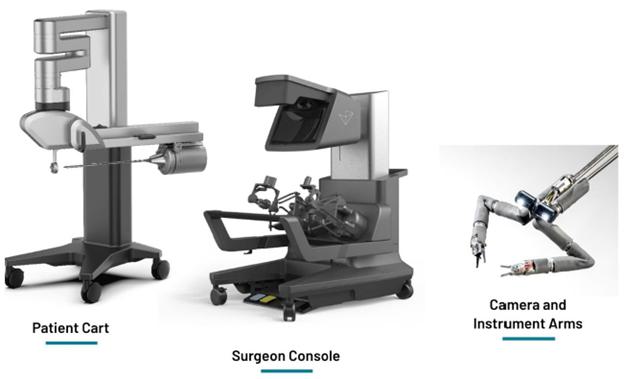

The Vicarious Surgical System consists of the following components:

| |

● |

Camera and Instrument Arms. The Vicarious Surgical System has a high-performance stereoscopic camera that, when combined with robotic motion, provides full 360-degree viewing capability and is being developed to continuously map the depth of the abdominal cavity. The camera moves in any direction and, together with the instrument arms, based on cadaver studies, the Vicarious Surgical System is capable of operating in nearly every direction within the abdomen, including rotating back and operating around the trocar incision point, unlike any robotic system on the market today. The Vicarious Surgical System’s surgical instrument arms each have nine degrees of movement, completely mimicking the degrees of freedom in the surgeon’s own wrists, elbows and shoulders, providing for a more complete and more natural range of motion for the surgeon. While existing robotic systems are limited to operating in a small section directly in front of the rigid instrument, the Vicarious Surgical System’s unique ability to operate in nearly every direction is designed to provide significantly more capability to the surgeon, while minimizing the injury and trauma to the patient. The camera and both instrument arms are being developed to enter the abdomen through a single, 1.8 centimeter trocar, which is anticipated to be reduced to a 1.5 centimeter trocar as development continues, that is within the size of conventional minimally invasive surgery trocars. If authorized by the FDA, the Vicarious Surgical System will be able to provide significantly more sensing capability than existing systems, due to the smaller size. The Vicarious Surgical System features 28 sensors per arm, to provide valuable feedback to the surgeon in real-time, and the sensors will also be capable of providing robust intraoperative data to continually enhance surgeon capabilities over the long-term. |

| |

● |

Surgeon Console. The Vicarious Surgical System surgeon console is designed to provide all the systems necessary for the surgeon to have an effective, immersive experience, visualizing the surgical field and controlling all the motions of the robot. If authorized by the FDA, the surgeon console will enable performance and patient outcomes that are not available on other existing systems. The console includes a peer-in stereoscopic vision screen that gives surgeons the ability to operate in a 3D environment without the use of 3D glasses, while maintaining awareness and line of sight to the operating room. |

| |

● |

Patient Cart. The Vicarious Surgical System patient cart is designed to pass through the doorways of hospitals, outpatient clinics, ambulatory surgical centers, and any standard doorway, alleviating the equipment maneuverability concerns experienced by healthcare providers with competitor surgical robotics systems. Unlike existing robotic systems, the Vicarious Surgical System, if authorized by the FDA, would not require a dedicated operating room and could be wheeled into or out of any room, or stored in the hall, as the hospital does with other medical devices, significantly expanding accessibility to the system. Further, as most of the robotic motion occurs inside the abdomen through a single port, the Vicarious Surgical System does not have multiple, expensive, high-performance robotic arms outside the body, pivoting around the incision point to make small movements inside the body. We believe that these factors, together with the ability to utilize more advanced, sometimes less expensive manufacturing processes, will enable the Vicarious Surgical System to be significantly less expensive to build than competitive robotic systems, based on their publicly available data. |

Vicarious Surgical System Advantages

We believe that to overcome the issues that have limited broad adoption

of robot-assisted minimally invasive surgery procedures to date: cost, size, capability, ease of use, fast setup, high throughput, streamlined

training, and improved patient outcomes, it is imperative to provide a solution that addresses all these concerns. The Vicarious Surgical

System, with its advanced engineering and “de-coupled actuators,” which enable a revolutionary approach to the development

of surgical robotics, is designed to be uniquely able to significantly improve upon each of these factors. Because of its proprietary

engineering advantage, the Vicarious Surgical System is designed to offer more degrees of freedom and dexterity with which the surgeon

can more naturally operate, and to provide greater visibility, sensing and functionality to the surgeon, all through a small, single port

that is designed to offer more capability and fewer challenges than any single or multi-port surgical modality available. Because the

Vicarious Surgical System had not yet been authorized by the FDA or commercialized, the intended advantages of the Vicarious Surgical

System have not yet been realized and are dependent upon the successful development of the Vicarious Surgical System and a timely authorization

by the FDA.

| |

● |

Decoupled Actuators. Robotic arms are controlled by actuators at each joint. Traditionally, these actuators are “coupled,” meaning that movement of one joint causes movement at each subsequent or prior joint. This coupled motion can be corrected by legacy robots via complicated software to coordinate and eliminate the unwanted motion between these joints that would otherwise be created. However, the software cannot eliminate the exponential buildup of force across these joints caused by this coupled action. This exponential force buildup requires stronger cables and pulleys and other expensive and larger components, which adds significant size, cost, and limits the available mobility of legacy robotic systems. By fundamentally engineering a better solution, we have decoupled the motion between these actuators, reducing cost and integrating components and materials that enable enhanced visibility, flexibility and strength, which in turn are intended to provide significant benefits for surgeons, hospitals, ASCs and patients. |

| |

● |

Human Equivalent Motion — Nine Degrees of Freedom. The Vicarious Surgical System is the only robotic system, compared to all legacy single- or multi-port solutions, to offer the same nine full degrees of freedom that exist in the natural motion of the surgeon’s own wrists, elbows and shoulders, providing unprecedented dexterity in a robot-assisted minimally invasive surgery. While other legacy robotic systems require the surgeon to conform and limit their movements to what the robot will enable, based on data from cadaver studies, the Vicarious Surgical System offers the nearly full range of motion of the surgeon’s own upper body, providing an experience that is more natural, and more akin to what they know best, open surgery, except miniaturized and transformed inside the body. |

| |

● |

Expanded Reach Inside the Abdomen. With the full nine degrees of freedom provided by the Vicarious Surgical System, as shown in cadaver studies, the surgeon can enter the abdomen from nearly any angle and work in nearly any direction, with more freedom, all through a small single incision. Legacy robotic systems and manual minimally invasive surgery require the surgeon to triangulate to the surgical area and limit the surgeon to performing only in a small section directly in front of the incision. The Vicarious Surgical System’s unprecedented reach is designed to enable the surgeon to pivot in nearly any direction during surgery and the surgeon can even pivot backwards and operate near the incision site. |

| |

● |

Sensing, Visualization and Future AI. The surgeon can utilize the peer-in screen on the console for visualization. The Vicarious Surgical System’s high-performance, stereoscopic camera can rotate in nearly every direction, similar to the natural motion of the surgeon’s head, and is being developed to provide full 3D mapping. The Vicarious Surgical System contains more than two dozen sensors per arm, designed to provide unmatched sensing capability that is being developed to deliver valuable feedback on force, motion and other key data, to the surgeon in real-time. These sensors also will be used to feed our rapidly expanding need for data and future AI development, which will be utilized to further enhance surgical procedures and provide a significant link and insight between pre- and peri-operative data and patient outcomes. |

| ● | Hospital

and Ambulatory Surgical Center (ASC) Advantages |

| |

● |

System Size. Unlike legacy systems that require a construction build-out simply to fit their system into a dedicated operating room, the Vicarious Surgical System is designed to be small enough to fit through a single door. This is intended to enable faster set-up and break-down times, allowing the Vicarious Surgical System to be used anywhere within the facility. |

| |

● |

Training. Because of the more natural motion of the Vicarious Surgical System, together with the fact that it is not confined to a dedicated operating suite like most legacy robotic systems, the Vicarious Surgical System can be more available for surgeons to practice, and it is expected that surgeons would be able to develop proficiency more quickly and easily than with legacy systems, which could improve surgeon adoption and enhance hospital and ASC return on investment. |

| |

● |

Economics/System Cost. If authorized by the FDA, we intend to offer the Vicarious Surgical System, maintenance, and service support at more attractive pricing to existing legacy systems. With its increased capability and dexterity, it is expected that many procedures could be performed faster and more effectively, which could greatly reduce overall hospital costs. |

| |

● |

Disposability. Our instruments and accessories have been designed and will be offered at a price that enables them to be used once and then disposed. Hospitals and ASCs will no longer need to dedicate space and expense to ensure these items are properly sterilized and available for re-use. |

| |

● |

Enhanced Capability. The Vicarious Surgical System will be designed to provide increased visualization and capability to the surgeon, and if the FDA authorizes the Vicarious Surgical System, it is intended to allow the surgeon to more easily perform advanced techniques that are proven in existing clinical use to provide for better patient outcomes. |

| |

● |

Smaller Trocar — Fewer Complications. In open surgery, due to the large size of the incision, the incision fails to heal properly 15-20% of the time, a complication that may require additional surgery to fix. Multi-port manual and robot-assisted minimally invasive surgery, while significantly less capable than the Vicarious Surgical System is designed to be, utilize small trocars (i.e., 8mm to 12mm), which greatly reduces this risk to approximately 1%. Existing single-port robots utilize at least a 25mm trocar size, which have a failure rate of nearly 10%, beginning to approach the failure rate of open surgery. The Vicarious Surgical System, like multi-port minimally invasive surgery, is designed to utilize a small trocar, which could enable superior results with the lowest overall risk. Currently, the Vicarious Surgical System utilizes an 18mm trocar, which is anticipated to be reduced to a 15mm trocar as development continues. |

Our Strategy

With revolutionary advancements in design, we seek to democratize surgery

through widespread access to a more capable and more affordable surgical robotic platform. Our objective is to become the leading provider

of surgical robotic platforms for soft tissue surgery. To achieve this objective, we are pursuing the following business strategies, all

of which are dependent upon the receipt of FDA authorization:

| |

● |

Drive adoption of the Vicarious Surgical System initially in the ventral hernia market. We plan to initially focus our marketing efforts on surgeons, hospitals and ASC’s performing surgical procedures in general surgery that will benefit from our single incision platform. We believe our innovative system will deliver clinical and economic value that will address the unmet need in today’s surgical operating rooms. Our strategy is to work with key thought leaders in general surgery who can help provide feedback that will help guide our product roadmap and surgical techniques. |

| |

● |

Expand indications. The ability to have universal access to the abdomen with the Vicarious Surgical System also presents opportunities for other procedures that we plan to target in the near future. Some of the future indications that are being targeted are inguinal and hiatal hernias, hysterectomy, cholecystectomy (gallbladder), colorectal and other gastrointestinal procedures. We estimate that 39 million of these procedures are performed annually worldwide today. |

| |

● |

Generate recurring revenue. After the initial installation of the Vicarious Surgical System, our goal is to increase the utilization of the Vicarious Surgical System by demonstrating the procedural and workflow efficiency of the System. Faster set up and procedure times with the Vicarious Surgical System can enable hospitals and ASCs to potentially schedule more procedures, which would in turn drive volume sales of single use components, including the robotic arms, camera and instrument tips. |

| |

● |

Demonstrate clinical and financial value proposition. Over 50% of ventral hernia procedures are performed as open surgical procedures in the hospital. We aim to capitalize on the trend of moving procedures from hospitals to ASCs. Additionally, we believe that the Vicarious Surgical System can accelerate the ability to perform complex hernia surgeries with a minimally invasive surgery procedure in an ASC as opposed to a hospital. However, ASCs typically do not have significant capital budgets to justify large capital purchases, nor do they have infrastructure budgets to undertake the construction of a dedicated operating suite. The Vicarious Surgical System’s value proposition is designed to appeal to these ASCs. |

| |

● |

Expand product offerings. We believe that technologies such as virtual reality and AI have the potential to further enhance a surgeon’s capabilities. We plan to develop advanced AI features, such as 3D depth mapping, and automated suturing, to be incorporated into future generations of the Vicarious Surgical System. |

| |

● |

Commercialization outside U.S. If the FDA authorizes the Vicarious Surgical System for commercialization in the U.S., we intend to seek applicable regulatory clearances or approvals in Asia, Europe and the rest of the world to commercialize the Vicarious Surgical System worldwide. |

Historical Development of the Vicarious Surgical System and Regulatory

Pathway

The technology for our robot was developed by Legacy Vicarious founders

Adam Sachs, Sammy Khalifa, and Barry Greene between 2009 and 2015. After considerable prototyping and experimentation, the team discovered

and patented a cable pathway through the robotic arm to fully de-couple the motion of the robotic device. This series of innovations enabled

the first successful prototype of a complete robotic arm that resembles the motion of the surgeon’s body. The founding team went

on to take this design and create a full prototype of the device, machining the parts themselves and funding the project out of pocket.

After the first fully functioning robotic arm was created, integrated with software designed by the Legacy Vicarious founders, as well

as a surgeon input tracking system, the founding team was able to raise outside capital and successfully grow the team in order to continue

to drive development and growth.

We have conducted, and continue to conduct, several cadaver studies

with the prototype Vicarious Surgical System. The goal of each study was to refine the performance of the Vicarious Surgical System. In

these cadaver studies, the Vicarious Surgical System prototype was used to perform several ventral hernia repair procedures, hysterectomy

procedures and cholecystectomy procedures. In addition, in these cadaver studies, surgeons have used the Vicarious Surgical System prototype

to perform various techniques for ventral hernia repair, including robotic transabdominal preperitoneal, or rTAPP, retrorectus, and intraperitoneal

onlay mesh repair (IPOM) plus. These studies were used to gather insights regarding:

| |

● |

The length of the robotic instruments needed to perform ventral hernia repair procedures; |

| |

● |

Field and depth of view of the robotic camera; |

| |

● |

User interface elements, such as the clutch pedal, navigation pedals and digital interface elements; |

| |

● |

Quality of robotic end-effector motion in response to surgeon hand motion; |

| |

● |

Insertion and extraction workflow; and |

| |

● |

Reliability of the robotic instruments and camera. |

In November 2019, we received FDA Breakthrough Device designation

for a prior version of the Vicarious Surgical System with a proposed indication for use in ventral hernia repair procedures. The Vicarious

Surgical System is considered a Class II medical device. We have had pre-submission meetings with the FDA to align on our regulatory

strategy and plan to file a de novo application with the FDA for use in ventral hernia procedures as our first indication.

A preliminary meeting with the FDA was conducted in December 2021 to

discuss with the FDA our decision to make two technology changes to the Vicarious Surgical System design that was granted Breakthrough

Device designation in November 2019. Based on these changes, the FDA has determined that the current Vicarious Surgical System design

that is planned for the initial limited launch and was submitted to the FDA in the November 2021 FDA pre-submission meeting request is

different from the device that was granted Breakthrough Device designation for the device design filed in November 2019. The FDA stated

that the Breakthrough Device designation remains active for the prior device design granted Breakthrough Device designation in November

2019. In the future, we may attempt to reincorporate the technologies from such prior device design to leverage the previously granted

Breakthrough Device designation. The process of medical device development is inherently uncertain and there is no guarantee that a Breakthrough

Device designation will be granted to a different device design, and if it were granted, there is no guarantee that such designation will

accelerate the timeline for authorization or make it more likely that the Vicarious Surgical System will be authorized.

In February 2022, a pre-submission meeting was held with the FDA to

gain alignment on the current Vicarious Surgical System. Feedback provided by the FDA indicated that each robotic-assisted surgical system

has distinctive kinetics, connections, data transmission and interfaces, including interfaces for the user, patient and environment, the

combination of which composes a unique and multifaceted system. Additionally, the FDA indicated that each robotic-assisted surgical system

has unique inputs and outputs and must account for uncertainty and instability in different ways. Taken together, these different technological

characteristics raise different questions of safety or effectiveness that are not applicable to a predicate device and may pose a significant

safety or effectiveness concern for the Vicarious Surgical System. For example, the way that a robotic-assisted surgical system is constructed

and implemented will have a direct bearing on the safety and effectiveness profile of the device and different robotic-assisted surgical

systems are not sufficiently similar to allow for meaningful comparison between the Vicarious Surgical System and predicate robotic-assisted

surgical systems. The FDA indicated that the evaluation of the complex Vicarious Surgical System requires a holistic approach of the performance

testing, such as software, bench, animal, human factors and usability, and clinical data to determine how each element establishes the

Vicarious Surgical System’s integration approach to the intended use and more specifically the indicated procedures. Therefore,

each robotic-assisted surgical system carries new or different risks and an evaluation of these risks will require an independent evaluation

of the safety and effectiveness of the Vicarious Surgical System due to the technology and the implementation into the clinical care.

Based on this feedback, the FDA has determined that a 510(k) submission would likely be found not substantially equivalent to a predicate

robotic-assisted surgical system. In accordance with this FDA feedback, we have revised our regulatory roadmap for market authorization,

as discussed below.

Regulatory Roadmap for Market Authorization

Based on the outcome of the pre-submission meeting with the FDA in

February 2022, the FDA has determined that there is no legally marketed predicate device. Therefore, we will plan to file a de novo classification

request for the proposed initial indication for use in ventral hernia repair procedures as a regulatory pathway to classify the Vicarious

Surgical System. Devices that are classified into Class I or Class II through a de novo classification request may be marketed and used

as predicates for future premarket notification 510(k) submissions, when applicable. Accordingly, we believe that 510(k) filings will

be available as a regulatory pathway for the Vicarious Surgical System with respect to future indications.

We plan to conduct a prospective human pivotal clinical investigation

under an FDA Investigational Device Exemption (IDE) to evaluate the safety, effectiveness, and performance of the Vicarious Surgical System

to support a de novo classification request and obtain U.S. market authorization for the proposed indication for use in ventral hernia

repair procedures. In addition to conducting a human pivotal clinical investigation, we plan to conduct non-clinical testing activities

to verify and validate the safety, performance, effectiveness, functionality, usability and reliability characteristics of the Vicarious

Surgical System with respect to the intended use and defined requirements. A verification and validation process is expected to provide

the necessary data to submit to the FDA for IDE approval.

We expect that non-clinical verification and validation testing will

be conducted to verify and validate that the Vicarious Surgical System meets all design specifications for its intended use. These tests

will include in-vitro, simulated clinical bench testing and cadaver studies, as well as animal studies to support and demonstrate the

safety, performance, effectiveness, functionality, usability, and reliability characteristics of the Vicarious Surgical System with respect

to the intended use and defined requirements. Cadaver studies, representing realistic dimensions and contours of the human abdominal space,

will be used primarily to verify and validate system functionality, performance, and safety relevant to patient anatomy and contexts of

use with respect to insertion, access and movement within the abdominal cavity, visualization, manipulating tissue, cutting, and suturing

as needed during a simulated ventral hernia repair procedure. Animal studies will be used primarily to demonstrate performance, safety,

efficacy, and usability of the system as relevant to a live model with respect to insertion, access and movement within the abdominal

cavity, visualization, manipulating tissue, cutting, coagulating, and suturing, during a simulated ventral hernia repair procedure. This

testing may also be used to demonstrate that applicable risk mitigation features, including software alarms, alerts, extraction of multi-jointed

instrumentation in case of system failure, misuse, or other errors are adequate and perform to specifications. Summative usability testing

will be conducted by surgeons, nurses and technicians in a simulated operating room environment to provide objective evidence that the

Vicarious Surgical System can be used safely and effectively by end users for its intended uses, the device functions as expected and

intended, and all risk mitigations implemented are safe and effective. In addition, we plan to conduct simulated bench-top testing on

transparent anatomical models to evaluate, among other things, how the Vicarious Surgical System performs in “worst case”

scenarios to verify and validate safe anatomical access, instrument/camera angulation and movement at the extremes of various surgical

procedures with respect to patient anatomy and dimensions that cannot be readily controlled for when using live animal and human cadaver

models.

Future Indications

We plan to expand upon our claims and/or indication for use to address

additional unmet clinical needs in different anatomical areas as well as therapeutic procedures. Following the initial authorization for

use in ventral hernia repair procedures under a de novo classification, if obtained by the FDA, we plan to submit 510(k) filings for other

indications for use, using the Vicarious Surgical System’s first de novo authorization as a predicate, along with other predicate

devices with similar cleared indications for use. We have identified several potential future indications and procedures that align well

with the Vicarious Surgical System’s ability to access and visualize the abdominal cavity. Possible future indications may include

but not be limited to inguinal and hiatal hernias, hysterectomy, cholecystectomy (gallbladder), colorectal and other gastrointestinal

procedures. We will perform an assessment to determine the appropriate regulatory strategy required to expand claims and obtain applicable

regulatory clearances in the United States and in other global markets.

Intellectual Property

We strive to protect and enhance the proprietary technology, inventions

and improvements that are important to our business by seeking, maintaining and defending our intellectual property, all of which has

been developed internally and not in-licensed from third parties. We also rely on trade secrets, know-how, continuing technological innovation

and in-licensing opportunities to develop, strengthen and maintain our proprietary position in the field of surgical robotics. Additionally,

we intend to rely on regulatory protection afforded through data exclusivity and market exclusivity as well as patent term extensions,

where available.

We currently do not rely heavily on technologies from third parties.

However, in the future, we may need to rely or be dependent on patented or proprietary technologies that we may license from third parties.

We maintain a patent portfolio that includes issued U.S. and foreign

patents as well as pending U.S. and foreign patent applications, which include claims directed towards our proprietary technology.

We intend to pursue additional intellectual property protection to the extent we believe it would be beneficial and cost-effective. As

of January 26, 2024, we owned approximately eleven (11) issued U.S. utility patents, approximately seven (7) issued utility

patents in foreign jurisdictions including two (2) in China, four (4) in Japan, and one (1) issued by the European Patent Office.

We also had approximately 132 pending utility patent applications in the U.S. and foreign jurisdictions, including in Canada, China,

Europe, Japan, Hong Kong and India, and approximately two (2) U.S. design patent applications. These issued utility patents and pending

utility patent applications (if they were to issue as patents) have expected expiration dates ranging between 2035 and 2043. Our patents

and patent applications are directed to, among other things, our core technology. This includes the surgical robotic and camera system;

sensing capabilities, controls and visualization interfaces; the surgical tools suite; and related technologies.

The term of individual patents may vary based on the countries in which

they are obtained. Generally, patents issued for applications filed in the United States are effective for 20 years from the

earliest effective non-provisional filing date. In addition, in certain instances, a patent term can be extended to recapture a portion

of the term effectively lost as a result of the FDA regulatory review period. The restoration period cannot be longer than five years

and the total patent term, including the restoration period, must not exceed 14 years following FDA approval. The duration of patents

outside of the United States varies in accordance with provisions of applicable local law, but typically is also 20 years from

the earliest effective filing date.

In addition to patents and patent applications, we rely on trade secrets

and know-how to develop and maintain our competitive position. However, trade secrets can be difficult to protect. We seek to protect

our proprietary technology and processes, and obtain and maintain ownership of certain technologies, in part, through confidentiality

agreements and invention assignment agreements with our employees, consultants, scientific advisors, contractors and commercial partners.

We also seek to preserve the integrity and confidentiality of our data, trade secrets and know-how, including by implementing measures

intended to maintain the physical security of our premises and the physical and electronic security of our information technology systems.

Our future commercial success depends, in part, on our ability to obtain

and maintain patent and other proprietary protection for commercially important technology, inventions and know-how related to our business;

defend and enforce our patents; preserve the confidentiality of our trade secrets; and operate without infringing the valid enforceable

patents and proprietary rights of third parties. Our ability to stop third parties from making, using, selling, offering to sell or importing

our product candidates will depend on the extent to which we have rights under valid and enforceable patents or trade secrets that cover

these activities. Moreover, we may be unable to obtain patent protection for the Vicarious Surgical System generally, as well as with

respect to certain surgical indications. See the section entitled “Risk Factors — Risks Related to Our Intellectual

Property” for a more comprehensive description of risks related to our intellectual property.

Research and Development

As of January 26, 2024, our research and development programs

are generally pursued by our 66 engineering, scientific and technical personnel employed by us in our offices in Massachusetts on a full-time

basis or as consultants, or through partnerships with industry leaders in manufacturing and design and with researchers in academia. We

are also working with subcontractors in developing specific components of our technologies.

The primary objectives of our research and development efforts are

to continue to introduce incremental enhancements to the capabilities of the Vicarious Surgical System and to advance development.

For the fiscal years ended December 31, 2023 and 2022, we incurred

research and development expenses of $47.6 million and $43.9 million, respectively.

Manufacturing

We have expanded our manufacturing capabilities with the development

of a manufacturing facility, including a clean room, within our headquarters in Waltham, Massachusetts, and have hired key manufacturing

personnel. We currently rely, and expect to continue to rely, on third parties for the manufacturing of certain products for preclinical

and clinical testing, as well as for commercial manufacturing.

We purchase both custom and off-the-shelf components from a large number

of suppliers and subject them to stringent quality specifications and processes. Some of the components necessary for the assembly of

the Vicarious Surgical System are currently provided to us by sole-sourced suppliers or single-sourced suppliers.

We are committed to developing an ethical, safe and sustainable supply

chain. This extends to our supplier base as well, so we are seeking partnerships with suppliers who share our commitment to strong ethics

and full compliance with all applicable laws.

We promote the following basic principles in our supply chain:

| |

● |

Business practices that respect human rights that align with international

standards of responsible business conduct; |

| |

● |

Compliance with conflict mineral laws; |

| |

● |

Environmental responsibility and sustainability; |

| |

● |

Protection of confidential information. |

Competition

We face competition in the forms of existing open surgery, conventional

minimally invasive surgery, drug therapies, radiation treatment, and emerging interventional surgical approaches. Our success depends

on continued clinical and technical innovation, quality and reliability, as well as educating hospitals, surgeons, and patients on the

results associated with robotic-assisted surgery using the Vicarious Surgical System and our value proposition relative to other techniques.

We also face competition from several companies that have introduced or are developing new approaches and products for the minimally invasive

surgery market. We believe that the entrance or emergence of competition validates robotic-assisted surgery.

We face competition from larger and well-established companies. The

companies that have introduced products in the field of robotic-assisted surgery or have made explicit statements about their efforts

to enter the field, include, but are not limited to: Intuitive Surgical, Inc.; Johnson & Johnson (including their wholly-owned

subsidiaries Ethicon Endo-Surgery, Inc., Auris Health, Inc. and Verb Surgical Inc.); Medtronic plc (including their wholly-owned subsidiary

Covidien LP); Virtual Incision Corporation; Titan Medical Inc.; Stryker Corporation; and CMR Surgical Ltd. Other companies with substantial

experience in industrial robotics could potentially expand into the field of surgical robotics and become a competitor. In addition, research

efforts utilizing computers and robotics in surgery are underway at various companies and research institutions. Our ability to generate

future revenue may be adversely impacted as competitors announce their intent to enter these markets and as our potential customers anticipate

the availability of competing products.

Commercialization

We have not yet established a sales or product distribution infrastructure

for the Vicarious Surgical System. We plan to access the U.S. market with the Vicarious Surgical System through strategic partnerships

and also develop our own focused, specialized sales force or distribution channels once we have commercialized the Vicarious Surgical

System.

Government Regulation

Our operations are subject to comprehensive federal, state, and local

laws and regulations in the jurisdictions in which we or our research and development partners or affiliates do business. The laws and

regulations governing our business and interpretations of those laws and regulations are subject to frequent change. Our ability to operate

profitably will depend in part upon our ability, and that of our research and development partners and affiliates, to operate in compliance

with applicable laws and regulations. The laws and regulations relating to medical products and healthcare services that apply to our

business and that of our partners and affiliates continue to evolve, and we must, therefore, devote significant resources to monitoring

developments in legislation, enforcement, and regulation in such areas. As the applicable laws and regulations change, we are likely to

make conforming modifications in our business processes from time to time. We cannot provide assurance that a review of our business by

courts or regulatory authorities will not result in determinations that could adversely affect our operations or that the regulatory environment

will not change in a way that restricts our operations.

FDA Regulation

Medical devices are strictly regulated by the FDA, in the United States.

Under the Federal Food, Drug, and Cosmetic Act (“FDCA”), a medical device is defined as “an instrument, apparatus, implement,

machine, contrivance, implant, in vitro reagent, or other similar or related article, including a component, part or accessory which is,

among other things: intended for use in the diagnosis of disease or other conditions, or in the cure, mitigation, treatment, or prevention

of disease, in man or other animals; or intended to affect the structure or any function of the body of man or other animals, and which

does not achieve its primary intended purposes through chemical action within or on the body of man or other animals and which is not

dependent upon being metabolized for the achievement of any of its primary intended purposes.” This definition provides a clear

distinction between a medical device and other FDA regulated products such as drugs. If the primary intended use of a medical product

is achieved through chemical action or by being metabolized by the body, the product is usually a drug or biologic. If not, it is generally

a medical device.

We are currently developing a robotic-assisted surgical system, which

is regulated by the FDA as a medical device under the FDCA, as implemented and enforced by the FDA. The FDA regulates the development,

testing, manufacturing, labeling, packaging, storage, installation, servicing, advertising, promotion, marketing, distribution, import,

export, and post-market surveillance of medical devices.

Device Premarket Regulatory Requirements

Before being introduced into the U.S. market, each medical device must

obtain marketing clearance, authorization, or approval from the FDA through the premarket notification (510(k)) process, the de novo classification

process, or the premarket approval (“PMA”) process, unless they are determined to be Class I devices or to otherwise qualify

for an exemption from one of these available forms of premarket review and clearance, authorization, or approval by the FDA. Under the

FDCA, medical devices are classified into one of three classes — Class I, Class II or Class III — depending on the degree

of risk associated with each medical device and the extent of control needed to provide reasonable assurance of safety and effectiveness.

Classification of a device is important because the class to which a device is assigned determines, among other things, the necessity

and type of FDA review required prior to marketing the device. Class I devices are those for which reasonable assurance of safety and

effectiveness can be maintained through adherence to general controls that include compliance with the applicable portions of the FDA’s

Quality System Regulation (“QSR”), as well as regulations requiring establishment registration and device listing, reporting

of adverse medical events, and appropriate, truthful and non-misleading labeling and promotional materials. The Class I designation also

applies to devices for which there is insufficient information to determine that general controls are sufficient to provide reasonable

assurance of the safety and effectiveness of the device or to establish special controls to provide such assurance, but that are not life-supporting

or life-sustaining or for a use which is of substantial importance in preventing impairment of human health, and that do not present a

potential, unreasonable risk of illness or injury.

Class II devices are those for which general controls alone are insufficient

to provide reasonable assurance of safety and effectiveness and there is sufficient information to establish “special controls.”

These special controls can include performance standards, post-market surveillance requirements, patient registries and FDA guidance documents

describing device-specific special controls. While most Class I devices are exempt from the 510(k) premarket notification requirement,

most Class II devices require a clearance of a 510(k) premarket notification prior to commercialization in the United States; however,

the FDA has the authority to exempt Class II devices from the premarket notification requirement under certain circumstances. As a result,

manufacturers of most Class II devices must submit 510(k) premarket notifications to the FDA in order to obtain the necessary clearance

to market or commercially distribute such devices. To obtain 510(k) clearance, manufacturers must submit to the FDA adequate information

demonstrating that the proposed device is “substantially equivalent” to a “predicate device” that is already on

the market. A predicate device is a legally marketed device that is not subject to PMA, meaning, (i) a device that was legally marketed

prior to May 28, 1976 (“preamendments device”) and for which a PMA is not required, (ii) a device that has been reclassified

from Class III to Class II or I, or (iii) a device that was found substantially equivalent through the 510(k) process. If the FDA agrees

that the device is substantially equivalent to the predicate device identified by the applicant in a premarket notification submission,

the FDA will grant 510(k) clearance for the new device, permitting the applicant to commercialize the device. Premarket notifications

are subject to user fees, unless a specific exemption applies.

If there is no adequate predicate to which a manufacturer can compare

its proposed device, the proposed device is automatically classified as a Class III device. In such cases, a device manufacturer must

then fulfill the more rigorous PMA requirements or can request a risk-based classification determination for its device in accordance

with the de novo classification process.

Devices that are intended to be life sustaining or life supporting,

devices that are implantable, devices that present a potential unreasonable risk of harm or are of substantial importance in preventing

impairment of health, and devices that are not substantially equivalent to a predicate device and for which safety and effectiveness cannot

be assured solely by the general controls and special controls are placed in Class III. Such devices generally require FDA approval through

the PMA process, unless the device is a preamendments device not yet subject to a regulation requiring premarket approval. The PMA process

is more demanding than the 510(k) process. For a PMA, the manufacturer must demonstrate through extensive data, including data from preclinical

studies and one or more clinical trials, that the device is safe and effective for its proposed indication. The PMA must also contain

a full description of the device and its components, a full description of the methods, facilities and controls used for manufacturing,

and proposed labeling. Following receipt of a PMA submission, the FDA determines whether the application is sufficiently complete to permit

a substantive review. If the FDA accepts the application for review, it has 180 days under the FDCA to complete its review and determine

whether the proposed device can be approved for commercialization, although in practice, PMA reviews often take significantly longer,

and it can take up to several years for the FDA to issue a final decision. Before approving a PMA, the FDA generally also performs an

on-site inspection of manufacturing facilities for the product to ensure compliance with the QSR.

The de novo classification process allows a manufacturer whose novel

device is automatically classified into Class III to request down-classification of its device to Class I or Class II, on the basis that

the device presents low or moderate risk, as an alternative to following the typical Class III device pathway requiring the submission

and approval of a PMA application. Under the Food and Drug Administration Safety and Innovation Act of 2012, the FDA is required to classify

a device within 120 days following receipt of the de novo classification request from an applicant; however, the most recent FDA premarket

review goals state that in fiscal year 2023, FDA will attempt to issue a decision within 150 days of receipt on 70% of all de novo classification

requests received during the year. If the manufacturer seeks reclassification into Class II, the classification request must include a

draft proposal for special controls that are necessary to provide a reasonable assurance of the safety and effectiveness of the medical