Blue Gold Holdings Limited, a gold mining platform and Perception

Capital Corp. IV (NYSE: RCFA, RCFA WS and RCFA.U) (“Perception”),

the expected new name for a special purpose acquisition company

(SPAC) currently known as RCF Acquisition Corp., today announced

they have entered into a definitive business combination agreement

for a business combination (the “Transaction”). Perception

currently has over $52 million cash in trust after a shareholder

vote on December 5, 2023 to approve an extension of its term to

November 5, 2024. Under the terms of the business combination

agreement, a newly-formed entity (“PubCo”) will undertake a share

exchange with Blue Gold and the holders of the outstanding Blue

Gold shares will receive equity in PubCo valued at $114.5

million, subject to adjustments.

The boards of directors of both Blue Gold and

Perception have unanimously approved the proposed Transaction,

which is subject to customary closing conditions, including receipt

of all regulatory approvals, as well as the approval of the

proposed Transaction by Perception’s and Blue Gold’s shareholders.

The closing of the Transaction is anticipated to occur in the

second quarter of 2024 and Blue Gold is anticipated to list on The

New York Stock Exchange.

The transaction is expected to catalyze Blue

Gold’s acquisition and investment of capital into premier gold

mining assets initially focused on Ghana’s Ashanti gold belt. Blue

Gold will acquire mining leases and invest capital for growth.

“This transaction will put Blue Gold in a

position to invest capital in high quality mining assets within our

initial target geography of the Ashanti gold belt in Ghana,” said

Andrew Cavaghan, Executive Chairman of Blue Gold. “We look forward

to bringing investment to and building a company that our

shareholders and our communities will be proud of.”

“We are delighted to support and advance the

Blue Gold platform through this proposed combination,” said Rick

Gaenzle, Chief Executive Officer of Perception. “We are excited by

the Blue Gold team’s plan to quickly acquire and start production,

and its eventual growth and development into a world-class Tier 1

gold mining company. We have always believed in supporting strong

businesses run by strong operators and Blue Gold is no exception.

Perception partner Tao Tan will join the board of directors, and we

all look forward to rolling up our sleeves and supporting Blue

Gold."

Advisors

Cohen & Company Capital Markets, a division of J.V.B.

Financial Group, LLC (“CCM”), is serving as exclusive financial

advisor and lead capital markets advisor to Perception. Loeb &

Loeb LLP is serving as counsel to Perception. Nelson Mullins Riley

& Scarborough LLP is serving as counsel to Blue Gold.

About Blue Gold Holdings

Limited

Blue Gold is a newly-formed company incorporated

in the United Kingdom, with the intent to acquire Tier 1 gold

mining assets. Blue Gold’s initial activities will be focused on

the Ashanti gold belt located in Ghana.

About Perception Capital Corp.

IV

Perception is a special purpose acquisition

company affiliated with Perception Capital Partners, a private and

public equity investor.

Forward-Looking Statements

This press release includes "forward-looking

statements" within the meaning of the safe harbor for

forward-looking statements provided by Section 21E of the

Securities Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995 including, without

limitation: statements related to the parties likelihood to enter

into a binding or definitive agreement(s); statements related to

the parties’ ability to close the proposed Transaction, including

the ability of both companies to secure all required regulatory,

third-party and shareholder approvals for the proposed Transaction;

the anticipated benefits of the proposed Transaction, including the

potential amount of cash that may be available to the combined

company upon consummation of the Transaction; the anticipated

enterprise value of the combined company following the Transaction;

sources and uses of cash from the transaction; the anticipated

timing to close the Transaction; PubCo’s expectation that its

ordinary shares will be accepted for listing on The New York Stock

Exchange following the closing of the Transaction; the financial

and business performance of PubCo; and PubCo’s anticipated future

operating results.

You are cautioned not to place undue reliance on

these forward-looking statements, which are current only as of the

date of this press release. Each of these forward-looking

statements involves risks and uncertainties. Important factors that

could cause actual results to differ materially from those

discussed or implied in the forward-looking statements include, but

are not limited to: the risk that the Transaction may not be

completed in a timely manner or at all; the failure to obtain

requisite approval for the transaction or meet other closing

conditions; the occurrence of any event, change or other

circumstances that could give rise to the termination of the merger

agreement in respect of the Transaction; failure to achieve

sufficient cash available (taking into account all available

financing sources) following any redemptions of RCFA’s public

stockholders; failure to obtain the requisite approval of RCFA’s

and BGHL’s respective stockholders; failure to meet relevant

listing standards in connection with the consummation of the

Transaction; failure to recognize the anticipated benefits of the

Transaction, which may be affected by, among other things,

competition, the ability of the combined entity to maintain

relationships with customers and suppliers and strategic alliance

third parties, and to retain its management and key employees;

potential litigation relating to the proposed Transaction; changes

to the proposed structure of the Transaction that may be required

or appropriate as a result of the announcement and execution of the

Transaction; unexpected costs and expenses related to the

Transaction; estimates of the combined company’s financial

performance being materially incorrect predictions; general

economic or political conditions; negative economic conditions that

could impact BGHL and the gold industry in general; reduction in

demand for BGHL’s products; changes in the markets that Blue Gold

targets or that the combined company intends to target; any change

in laws applicable to RCFA or BGHL or any regulatory or judicial

interpretation thereof; and other factors, risks and uncertainties,

including those to be included under the heading “Risk Factors” in

the proxy statement/prospectus to be later filed with the SEC, and

those disclosed in RCFA's SEC filings, under the heading “Risk

Factors,” including its Annual Report on Form 10-K for the year

ended December 31, 2022 filed with the SEC on March 7, 2023,

Quarterly Report on Form 10-Q for the quarter ended September 30,

2023 filed with the SEC on November 7, 2023 and any subsequent

filings.

All forward-looking statements are expressly

qualified in their entirety by such factors. RCFA does not

undertake any duty to update any forward-looking statement except

as required by law.

Additional Information and Where to Find It

In connection with the Business Combination Agreement and the

proposed business combination, RCFA intends to file with the

Securities and Exchange Commission (the “SEC”) a registration

statement on Form F-4 (the “Registration Statement”), which will

include a preliminary proxy statement/prospectus certain other

related documents, which will be both the proxy statement to be

distributed to the shareholders of RCFA in connection with RCFA’s

solicitation of proxies for the vote by its shareholders with

respect to the proposed Transaction and other matters as may be

described in the definitive proxy statement/prospectus, as well as

a prospectus relating to the offer and sale of the securities to be

issued in the proposed Transaction. Shareholders are encouraged to

read the Registration Statement, when available, as it will contain

important information.

This press release does not contain any information that should

be considered by RCFA’s or Blue Gold’s stockholders concerning the

proposed Transaction and is not intended to constitute the basis of

any voting or investment decision in respect of the proposed

Transaction or the securities of the combined company. The

respective stockholders of RCFA and Blue Gold and other interested

persons are advised to read, when available, the preliminary proxy

statement/prospectus and the amendments thereto and the joint

definitive proxy statement/prospectus and documents incorporated by

reference therein filed in connection with the business

combination, as these materials will contain important information

about RCFA, Blue Gold, the merger agreement and the business

combination.

When available, the definitive proxy statement/prospectus and

other relevant materials for the business combination will be

mailed to shareholders of RCFA as of a record date to be

established for voting on the business combination. Shareholders of

RCFA will also be able to obtain copies of the Registration

Statement, the preliminary proxy statement/prospectus, the

definitive proxy statement/prospectus and other documents filed

with the SEC, without charge, once available, at the SEC's web site

at www.sec.gov or by directing a request to: RCF Acquisition

Corp., 3109 W. 50th Street, #207, Minneapolis, MN 55410, Attention:

Investor Relations or by email at

investors@perceptioncapitalpartners.com.

Participants in Solicitation

RCFA, Blue Gold, PubCo and their respective

directors, executive officers, other members of management and

employees may be deemed participants in the solicitation of proxies

from RCFA's stockholders with respect to the proposed business

combination. Investors and securityholders may obtain more detailed

information regarding the names and interests in the business

combination of the directors and officers of each of RCFA and Blue

Gold with respect to the proposed business combination in the proxy

statement/prospectus for the proposed business combination when

available and in such companies' respective filings with the

SEC.

No Offer or Solicitation

This press release shall not constitute a solicitation of a

proxy, consent, or authorization with respect to any securities or

in respect of the proposed business combination. This press release

shall also not constitute an offer to sell or the solicitation of

an offer to buy any securities, nor shall there be any sale of

securities in any states or jurisdictions in which such offer,

solicitation, or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended, or an exemption therefrom.

ContactBlue Gold Holdings LimitedAndrew

CavaghanExecutive Chairmaninvestors@bluegld.com

Perception Capital Corp. IVRick GaenzleChief Executive

Officerinvestors@perceptioncapitalpartners.com

###

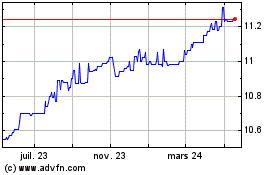

RCF Acquisition (NYSE:RCFA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

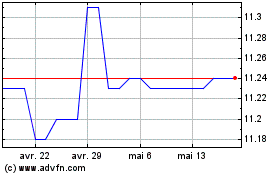

RCF Acquisition (NYSE:RCFA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024