0001501072

false

424B2

0001501072

2022-01-25

2022-01-25

0001501072

riv:SeriesACumulativePreferredStockMember

2021-08-01

2022-07-31

0001501072

riv:CreditFacilityMember

2020-08-01

2021-07-31

0001501072

riv:CreditFacilityMember

2019-08-01

2020-07-31

0001501072

riv:CreditFacilityMember

2018-08-01

2019-07-31

0001501072

riv:CreditFacilityMember

2017-11-01

2018-07-31

0001501072

riv:CreditFacilityMember

2016-11-01

2017-10-31

0001501072

riv:CreditFacilityMember

2015-12-24

2016-10-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Filed

Pursuant to Rule 424(b)(2)

Registration

No. 333-261239

Prospectus

Supplement

(to Prospectus dated January 25, 2022)

RiverNorth

Opportunities Fund, Inc.

6,227,000

Shares of Common Stock

Subscription

Rights for Shares of Common Stock

6,227,000

Shares of Common Stock Issuable Upon Exercise of Rights to Subscribe for Such Shares

RiverNorth

Opportunities Fund, Inc. (the “Fund”) is issuing transferable subscription rights (“Rights”) to its stockholders

of record as of October 14, 2022 (the “Record Date” and such stockholders, “Record Date Stockholders”).

These Rights will allow Record Date Stockholders to subscribe for new shares of common stock, $0.0001 par value per share (the

“Common Shares”), of the Fund in an aggregate amount of up to 6,227,000 Common Shares (the “Offer”). Record

Date Stockholders will receive one Right for each Common Share held on the Record Date. For every three Rights held, a Record

Date Stockholder is entitled to purchase one Common Share of the Fund. Record Date Stockholders who fully exercise their Rights

may also, in certain circumstances, purchase additional Common Shares pursuant to an over-subscription privilege. The number of

Rights to be issued to a Record Date Stockholder will be rounded up to the nearest number of Rights evenly divisible by three.

Fractional shares will not be issued upon the exercise of the Rights. Accordingly, new Common Shares may be purchased only pursuant

to the exercise of Rights in integral multiples of three.

The

Rights are transferable and will be admitted for trading on the New York Stock Exchange (“NYSE”) under the symbol

“RIV RT” during the course of the Offer. The Fund’s Common Shares are currently listed, and the new Common Shares

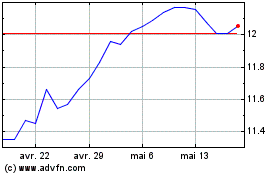

issued in this Offer will also be listed, on the NYSE under the symbol “RIV.” As of October 3, 2022, the last reported

net asset value (“NAV”) per Common Share was $12.44, and the last reported sales price per Common Share on the NYSE

was $12.88.

The

Offer will expire at 5:00 p.m., Eastern Time, on November 8, 2022, unless the Offer is extended as described in this Prospectus

Supplement (the “Expiration Date”). The subscription price per Common Share will be determined based upon a formula

equal to 95% of the reported NAV or 95% of the market price per Common Share, whichever is higher, on the Expiration Date, unless

the Offer is extended. Market price per Common Share will be determined based on the average of the last reported sales price

of a Common Share on the NYSE for the five trading days preceding (and not inclusive of) the Expiration Date.

Rights

holders will not know the subscription price at the time of exercise and will be required initially to pay for both the Common

Shares subscribed for pursuant to the primary subscription and, if eligible, any additional Common Shares subscribed for pursuant

to the over-subscription privilege, at the estimated subscription price of $11.82 per Common Share and, except in limited circumstances,

will not be able to rescind their subscription. Rights acquired in the secondary market may not participate in the over-subscription

privilege.

Exercising

your Rights and investing in the Fund involves a high degree of risk and may be considered speculative. Before exercising your

Rights and investing in the Fund, you should read the discussion of the material risks in “Risks” beginning on page

19 of the accompanying Prospectus.

In

addition, you should consider the following:

| ● | Stockholders

who do not exercise their Rights will, at the completion of the Offer, own a smaller

proportional interest in the Fund than if they exercised their Rights, which will proportionately

decrease the relative voting power of those stockholders. |

| ● | Because

the Subscription Price per Common Share may be below the NAV per Common Share on the

Expiration Date, you will likely experience an immediate dilution of the aggregate NAV

of your Common Shares if you do not participate in the Offer and you will likely experience

a reduction in the NAV per share of your common stock whether or not you participate

in the Offer. |

| ● | All

participating and non-participating stockholders will experience an immediate dilution

of the aggregate NAV of your Common Shares because you will indirectly bear the expenses

of the Offer. This will disproportionately affect holders of Common Shares (“Stockholders”)

who do not exercise their Rights. |

| ● | The

Fund cannot state precisely the extent of this dilution if you do not exercise your Rights

because the Fund does not know what the Subscription Price per Common Share will be when

the Offer expires, or what proportion of the Rights will be exercised. Assuming the full

Primary Subscription is exercised, the Fund’s NAV per share of common stock would

be decreased by approximately $0.16 or 1.29% per Common Share. Actual amounts may vary

due to rounding, the final subscription price, the amount of Rights exercised and other

estimates. |

Neither

the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of

these securities or determined if this Prospectus Supplement or the accompanying Prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

| |

Per

Common Share |

Total(3) |

| Estimated subscription price(1) |

$11.82 |

$73,603,140 |

| Estimated sales load |

$0.00 |

$0.00 |

| Estimated primary offering expenses(2) |

$0.02 |

$154,306 |

| Estimated net proceeds to Fund(1) |

$11.80 |

$73,448,834 |

| (1) | Estimated

as if October 3, 2022 was the expiration date. As of the close of October 3, 2022, the

Fund’s NAV per Common Share was $12.44 and the average of the last reported sales

price the five trading days preceding (and not inclusive of) October 3, 2022 was $12.17.

See “Terms of the Offer - The Subscription Price.” |

| (2) | Offering

expenses payable by the Fund (and indirectly by all of the Fund’s Stockholders,

including those who do not exercise their Rights) are estimated at approximately $154,306,

which includes fees to the subscription agent and information agent estimated to be approximately

$55,000 in the aggregate, inclusive of out of pocket expenses. |

| (3) | Assumes

all Rights are exercised at the estimated subscription price per Common Share. All of

the Rights offered may not be exercised and the price may be higher or lower than the

estimated amount. |

Assuming

all Common Shares offered are purchased in the Offer, the proportionate interest held by non-exercising Stockholders will decrease

upon completion of the Offer. As with any Common Shares, the price of the Fund’s Common Shares fluctuates with market conditions

and other factors. As of October 3, 2022, the Common Shares were trading at a premium to their NAV. Since the inception of the

Fund, the Common Shares have traded at a premium of as much as 11.89% and a discount of as much as 15.76%. As described more fully

in this Prospectus Supplement, Record Date Stockholders who fully exercise all Rights initially issued to them are entitled to

buy those Common Shares referred to as “over-subscription shares,” that were not purchased by other Rights holders.

If enough over-subscription shares are available, all such requests will be honored in full. If the requests for over-subscription

shares exceed the over-subscription shares available, the available over-subscription shares will be allocated pro rata

among those fully exercising Record Date Stockholders who over-subscribe based on the number of Rights originally issued to them

by the Fund.

The

Fund is a diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended

(the “1940 Act”). The Fund’s investment objective is total return consisting of capital appreciation and current

income. The Fund seeks to achieve its investment objective by pursuing a tactical asset allocation strategy and opportunistically

investing under normal circumstances in closed-end funds, exchange-traded funds (“ETFs”), business development companies

(“BDCs”) and special purpose acquisition companies (“SPACs” and collectively, “Underlying Funds”).

Under normal market conditions, the Fund will invest at least 80% of its Managed Assets in Underlying Funds. “Managed Assets”

means the total assets of the Fund, including assets attributable to leverage, minus liabilities (other than debt representing

leverage and any preferred stock that may be outstanding). The Underlying Funds in which the Fund invests will not include those

that are advised or subadvised by RiverNorth Capital Management, LLC (the “Adviser” or “RiverNorth”) or

its affiliates.

Effective

October 1, 2022, RiverNorth serves as the adviser to the Fund pursuant to the Fund's investment management agreement with RiverNorth

dated October 1, 2022.

As

of July 31, 2022, RiverNorth had approximately $5.4 billion of assets under management. The Adviser’s address is 360 South

Rosemary Avenue, Suite 1420, West Palm Beach, FL 33401 and its telephone number is (561) 484-7185. The Fund’s address is

1290 Broadway, Suite 1000, Denver, Colorado 80203, and its telephone number is (303) 623-2577.

An

investment in the Fund is not appropriate for all investors. There is no assurance that the Fund will achieve its investment objective.

This

Prospectus Supplement and accompanying Prospectus sets forth concisely the information about the Fund and the Offer that a prospective

investor ought to know before investing in the Fund and participating in the Offer. You should read this Prospectus Supplement

and accompanying Prospectus, which contains important information about the Fund, before deciding whether to invest in the Fund’s

Common Shares, and retain it for future reference. A Statement of Additional Information dated January 25, 2022 (the “SAI”),

containing additional information about the Fund, has been filed with the SEC and is incorporated by reference in its entirety

into the accompanying Prospectus, which means that it is part of the accompanying Prospectus for legal purposes. You may request

a free copy of the SAI, the Fund’s Annual and Semi-Annual Reports, request other information about the Fund and make stockholder

inquiries by calling (855) 830-1222, (toll-free) or by writing to the Fund at 1290 Broadway, Suite 1000, Denver, Colorado 80203,

or obtain a copy of such documents (and other information regarding the Fund) by visiting the Fund’s website at www.rivernorth.com/riv

(information included on the website does not form a part of this Prospectus Supplement or accompanying Prospectus), or from

the SEC’s website (http://www.sec.gov). For additional information all holders of Rights should contact the Information

Agent, Georgeson LLC (“Georgeson” or the “Information Agent”) toll free at (888) 624-2255 or send a written

request to Georgeson at 1290 Avenue of the Americas, 9th floor, New York, NY 10104.

Investing

in the Fund’s Common Shares involves certain risks. See “Risks” beginning on page 19 of the accompanying Prospectus.

Principal

Investment Strategies. The Fund seeks to achieve its investment objective by pursuing a tactical asset allocation strategy

and opportunistically investing under normal circumstances in Underlying Funds. Under normal market conditions, the Fund will

invest at least 80% of its Managed Assets in Underlying Funds. “Managed Assets” means the total assets of the Fund,

including assets attributable to leverage, minus liabilities (other than debt representing leverage and any preferred stock that

may be outstanding). The Underlying Funds in which the Fund invests will not include those that are advised or subadvised by the

Adviser or its affiliates.

In

selecting closed-end funds, the Adviser will opportunistically utilize a combination of short-term and longer-term trading strategies

to seek to derive value from the discount and premium spreads associated with closed-end funds. The Adviser employs both a quantitative

and qualitative approach in its selection of closed-end funds and has developed proprietary screening models and trading algorithms

to trade closed-end funds. The Fund will invest in other Underlying Funds (that are not closed-end funds) to gain exposure to

specific asset classes when the Adviser believes closed-end fund discount or premium spreads are not attractive or to manage overall

closed-end fund exposure in the Fund.

The

Adviser has the flexibility to change the Fund’s asset allocation based on its ongoing analysis of the equity, fixed income

and alternative asset markets. The Adviser considers various quantitative and qualitative factors relating to the domestic and

foreign securities markets and economies when making asset allocation and security selection decisions. While the Adviser continuously

evaluates these factors, material shifts in the Fund’s asset class exposures will typically take place over longer periods

of time.

Under

normal market conditions, the Fund intends to maintain long positions in Underlying Funds, but may engage in short sales for investment

purposes. When the Fund engages in a short sale, it sells a security it does not own and, to complete the sale, borrows the same

security from a broker or other institution. The Fund may benefit from a short position when the shorted security decreased in

value. The Fund may also at times establish hedging positions. Hedging positions may include short sales and derivatives, such

as options and swaps. Under normal market conditions, no more than 30% of the Fund’s Managed Assets will be in hedging positions.

The Fund’s investments in derivatives will be included under the 80% policy noted above so long as the underlying asset

of such derivatives is a closed-end fund or Underlying Fund, respectively.

The

Fund also may invest up to 20% of its Managed Assets in exchange-traded notes (“ETNs”), certain derivatives, such

as options and swaps, cash and cash equivalents. Such investments will not be counted towards the Fund’s 80% policy.

The

Fund’s NAV will vary and its distribution rate may vary and both may be affected by numerous factors, including changes

in the market spread over a specified benchmark, market interest rates and performance. Fluctuations in NAV may be magnified as

a result of the Fund’s use of leverage. An investment in the Fund may not be appropriate for all investors.

Leverage.

The Fund may borrow money and/or issue preferred stock, notes or debt securities for investment purposes. These practices

are known as leveraging. Since the holders of Common Shares pay all expenses related to the issuance of debt or use of leverage,

any use of leverage would create a greater risk of loss for the Common Shares than if leverage is not used. The Fund currently

anticipates that if employed, leverage will primarily be obtained through the use of bank borrowings or other similar term loans.

The provisions of the 1940 Act further provide that the Fund may borrow or issue notes or debt securities in an amount up to 33

1/3% of its total assets or may issue preferred shares in an amount up to 50% of the Fund’s total assets (including the

proceeds from leverage). Notwithstanding each of the limits discussed above, the Fund may enter into derivatives or other transactions

(e.g., total return swaps) that may provide leverage (other than through borrowings or the issuance of preferred stock), but which

are not subject to the above foregoing limitations, if the Fund earmarks or segregates liquid assets (or enters into offsetting

positions) in accordance with applicable SEC regulations and interpretations to cover its obligations under those transactions

and instruments. However, these transactions will entail additional expenses (e.g., transaction costs) which will be borne by

the Fund.

The

Fund’s Common Shares do not represent a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other

insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation, the Federal Reserve

Board or any other government agency.

Capitalized

terms used herein that are not otherwise defined shall have the meanings assigned to them in the accompanying Prospectus.

Prospectus

Supplement dated October 11, 2022

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

| |

Page |

| Prospectus Summary |

1 |

| Summary of Fund Expenses |

18 |

| Financial Highlights |

19 |

| The Fund |

22 |

| The Offering |

22 |

| Use of Proceeds |

23 |

| Investment Objective, Strategies

and Policies |

23 |

| Use of Leverage |

26 |

| Risks |

26 |

| Management of the Fund |

27 |

| Net Asset Value |

28 |

| Dividends and Distributions |

29 |

| Plan of Distribution |

30 |

| Dividend Reinvestment Plan |

32 |

| Description of the Common Shares |

33 |

| Certain Provisions of the Fund’s

Charter and Bylaws and of Maryland Law |

37 |

| Repurchase of Shares |

43 |

| Conversion to Open-End Fund |

43 |

| U.S. Federal Income Tax Matters |

44 |

| Custodian and Transfer Agent |

47 |

| Legal Matters |

47 |

| Control Persons |

47 |

| Additional Information |

48 |

| The Fund’s Privacy Policy |

48 |

CAUTIONARY

NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This

Prospectus Supplement, the accompanying Prospectus and the statement of additional information contain “forward-looking

statements.” Forward-looking statements can be identified by the words “may,” “will,” “intend,”

“expect,” “estimate,” “continue,” “plan,” “anticipate,” and similar

terms and the negative of such terms. By their nature, all forward-looking statements involve risks and uncertainties, and actual

results could differ materially from those contemplated by the forward-looking statements. Several factors that could materially

affect the Fund’s actual results are the performance of the portfolio of securities the Fund holds, the price at which the

Fund’s Common Shares will trade in the public markets and other factors discussed in the Fund’s periodic filings with

the SEC. Currently known risk factors that could cause actual results to differ materially from the Fund’s expectations

include, but are not limited to, the factors described in the “Risks” section of the accompanying Prospectus. The

Fund urges you to review carefully that section for a more detailed discussion of the risks of an investment in the Fund’s

securities.

Although

the Fund believes that the expectations expressed in the Fund’s forward-looking statements are reasonable, actual results

could differ materially from those projected or assumed in the Fund’s forward-looking statements. The Fund’s future

financial condition and results of operations, as well as any forward-looking statements, are subject to change and are subject

to inherent risks and uncertainties, such as those disclosed in the “Risks” section of the accompanying Prospectus.

All forward-looking statements contained or incorporated by reference in this Prospectus Supplement or the accompanying Prospectus

are made as of the date of this Prospectus Supplement or the accompanying Prospectus, as the case may be. Except for the Fund’s

ongoing obligations under the federal securities laws, the Fund does not intend, and the Fund undertakes no obligation, to update

any forward-looking statement.

PROSPECTUS

SUPPLEMENT SUMMARY

This

is only a summary of information contained elsewhere in this Prospectus Supplement and the accompanying Prospectus. This summary

does not contain all of the information that you should consider before investing in the Fund’s shares of common stock (the

“Common Shares”). You should carefully read the more detailed information contained in this Prospectus Supplement

and the accompanying Prospectus and the statement of additional information (“SAI”), dated January 25, 2022, especially

the information set forth under the heading “Risks.”

The

Fund

RiverNorth

Opportunities Fund, Inc. (the “Fund”) is a Maryland corporation registered as a diversified, closed-end management

investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). An investment in the Fund

may not be appropriate for all investors. There can be no assurance that the Fund will achieve its investment objective.

Purpose

of the Offer

The

Board of Directors of the Fund (the “Board”), based on the recommendation of RiverNorth Capital Management, LLC (the

“Adviser” or “RiverNorth”), has determined that it would be in the best interest of the Fund and its existing

stockholders to increase the assets of the Fund so that the Fund may be in a better position to take advantage of investment opportunities

that may arise without having to reduce existing Fund holdings.

The

Board also believes that a larger number of outstanding Common Shares and a larger number of holders of common stock (“Stockholders”)

could increase the level of market interest in and visibility of the Fund, and improve the trading liquidity of the Fund’s

shares on the NYSE. In making this determination, the Board considered a number of factors, including potential benefits and costs.

This rights offering seeks to reward existing Stockholders by giving them the opportunity to purchase additional Common Shares

at a price that may be below the market price and/or NAV without incurring any commission or charge. The distribution of these

rights, which themselves may have intrinsic value, will also give non-participating Stockholders the potential of receiving a

cash payment upon the sale of their rights, which may be viewed as partial compensation for the possible dilution of their interests

in the Fund as a result of this offer.

The

Board believes that increasing the size of the Fund may result in certain economies of scale which may lower the Fund’s

expenses as a proportion of average net assets because the Fund’s fixed costs can be spread over a larger asset base. There

can be no assurance that by increasing the size of the Fund, the Fund’s expense ratio will be lowered. There can be no assurance

that this rights offering (or the investment of the proceeds of this rights offering) will be successful or that the level of

trading on the Fund’s shares on the NYSE will increase.

Important

Terms of the Offer

The

Fund is issuing transferable subscription rights (“Rights”) to its Stockholders of record as of October 14, 2022 (the

“Record Date” and such stockholders, “Record Date Stockholders”). These Rights will allow Record Date

Stockholders to subscribe for new Common Shares of the Fund in an aggregate amount of approximately 6,227,000 Common Shares (the

“Offer”). Record Date Stockholders will receive one Right for each Common Share held on the Record Date. For every

three Rights held, you are entitled to purchase one new Common Share of the Fund. Record Date Stockholders who fully exercise

their Rights may also, in certain circumstances, purchase additional Common Shares pursuant to an over-subscription privilege.

The number of Rights to be issued to each Record Date Stockholder will be rounded up to the nearest number of Rights evenly divisible

by three. Fractional shares will not be issued upon the exercise of the Rights. Accordingly, new Common Shares may be purchased

only pursuant to the exercise of Rights in integral multiples of three.

The

Rights are transferable and will be admitted for trading on the NYSE under the symbol “RIV RT” during the course of

the Offer. The Fund’s Common Shares are currently listed, and the new Common Shares issued in this Offer will also be listed,

on the NYSE under the symbol “RIV”. On October 3, 2022, the last reported net asset value (“NAV”) per

Common Share was $12.44, and the last reported sales price per Common Share on the NYSE was $12.88.

The

Offer will expire at 5:00 p.m., Eastern Time, on November 8, 2022, unless the Offer is extended as described in this Prospectus

Supplement (the “Expiration Date”).

The

subscription price (“Subscription Price”) per Common Share will be determined based upon a formula equal to 95% of

the reported NAV or 95% of the market price per Common Share, whichever is higher, on the Expiration Date, unless the Offer is

extended. Market price per Common Share will be determined based on the average of the last reported sales price of a Common Share

on the NYSE for the five trading days preceding (and not inclusive of) the Expiration Date. Common Shares of the Fund, as a closed-end

fund, can trade at a discount to NAV. Upon expiration of the Offer, the Fund expects that Common Shares will likely be issued

at a price below NAV per share.

Rights

holders may not know the Subscription Price at the time of exercise and will be required initially to pay for both the Common

Shares subscribed for pursuant to the primary subscription and, if eligible, any additional Common Shares subscribed for pursuant

to the over-subscription privilege at the estimated Subscription Price of $11.82 per Common Share and, except in limited circumstances,

will not be able to rescind their subscription.

Rights

acquired in the secondary market may not participate in the over-subscription privilege.

The

Rights exercisable for one Common Share for each three Rights exercised at the Subscription Price will be referred to in the remainder

of this Prospectus Supplement as the “primary subscription.”

The

Fund will not be issuing share certificates for the Common Shares issued pursuant to this Offer. Issuance of Common Shares will

be made electronically via book entry by DST Systems, Inc. (“DST”), the Fund’s transfer agent.

Important

Dates to Remember

Please

note that the dates in the table below may change if the Offer is extended.

Event |

Date |

| Record

Date |

October

14, 2022 |

| Subscription

Period |

October

17 to November 8, 2022* |

| Expiration

Date |

November

8, 2022* |

| Payment

for Guarantees of Delivery Due |

November

10, 2022* |

| Confirmation

to Participants |

November

17, 2022* |

| * | Unless

the Offer is extended. |

Over-Subscription

Privilege

Record

Date Stockholders who fully exercise all Rights initially issued to them are entitled to buy those Common Shares, referred to

as “over-subscription shares,” that were not purchased by other Rights holders at the same Subscription Price. If

enough over-subscription shares are available, all such requests will be honored in full. If the requests for over-subscription

shares exceed the over-subscription shares available, the available over-subscription shares will be allocated pro rata

among those fully exercising Record Date Stockholders who over-subscribe based on the number of Rights originally issued to them

by the Fund. Common Shares acquired pursuant to the over-subscription privilege are subject to allotment.

Rights

acquired in the secondary market may not participate in the over-subscription privilege.

If

Stockholders do not participate in the over-subscription offer (if any), their percentage ownership may be further diluted.

Notwithstanding

the above, the Board has the right in its absolute discretion, to eliminate the over-subscription privilege with respect to the

over-subscription shares if it considers it to be in the best interest of the Fund to do so. The Board may make that determination

at any time, without prior notice to Rights holders or others, up to and including the seventh day following the Expiration Date.

See “Terms of the Offer - Over-Subscription Privilege.”

Sale

of Rights

The

Rights are transferable until the completion of the Subscription Period and will be admitted for trading on the NYSE. Although

no assurance can be given that a market for the Rights will develop, trading in the Rights on the NYSE will begin on or around

the Record Date and may be conducted until the close of trading on the last NYSE trading day prior to the completion of the Subscription

Period. For purposes of this Prospectus Supplement, a “Business Day” means any day on which trading is conducted on

the NYSE.

The

value of the Rights, if any, will be reflected by the market price. Rights may be sold by individual holders or may be submitted

to the Subscription Agent for sale (please see “Terms of the Offer - Method of Transferring Rights”). Any Rights submitted

to the Subscription Agent for sale must be received by the Subscription Agent on or before November 1, 2022, five Business Days

prior to the completion of the Subscription Period, due to normal settlement procedures. Selling stockholders are responsible

for all brokerage commissions incurred by the Subscription Agent as well as other fees and expenses associated with a transfer

of Rights.

Rights

that are sold will not confer any right to acquire any Common Shares in the over-subscription, and any Record Date Stockholder

who sells any Rights initially issued to such Stockholder will not be eligible to participate in the over-subscription.

Trading

of the Rights on the NYSE will be conducted on a when-issued basis until and including the date on which the Subscription Certificates

are mailed to Record Date Stockholders, and thereafter will be conducted on a regular way basis until and including the last NYSE

trading day prior to the completion of the Subscription Period. Common Shares will begin trading ex-Rights one Business Day prior

to the Record Date.

If

the Subscription Agent receives Rights for sale in a timely manner, it will use its best efforts to sell the Rights on the NYSE.

The Subscription Agent will also attempt to sell any Rights (i) a Rights holder is unable to exercise because the Rights represent

the right to subscribe for less than one new Common Share or (ii) attributable to Stockholders whose record addresses are outside

the United States or who have an Army Post Office (“APO”) or Fleet Post Office (“FPO”) address. See “Restrictions

on Foreign Stockholders” and “Terms of the Offer - Foreign Restrictions.”

Any

commissions will be paid by the selling Rights holders. Neither the Fund nor the Subscription Agent will be responsible if Rights

cannot be sold and neither has guaranteed any minimum sales price for the Rights. If the Rights can be sold, sales of these Rights

will be deemed to have been effected at the weighted average price received by the Subscription Agent on the day such Rights are

sold, less any applicable brokerage commissions, taxes and other expenses.

Stockholders

are urged to obtain a recent trading price for the Rights on the NYSE from their broker, bank, financial advisor or the financial

press.

Banks,

broker-dealers and trust companies that hold Common Shares for the accounts of others are advised to notify those persons who

purchase Rights in the secondary market that such Rights will not participate in the over-subscription privilege.

Method

for Exercising Rights

Rights

may be exercised by completing and signing the reverse side of the subscription certificate evidencing the Rights (the “Subscription

Certificate”) and mailing it in the envelope provided, or otherwise delivering the completed and signed Subscription Certificate

to Computershare Trust Company, N.A. and Computershare Inc. (the “Subscription Agent”), together with payment for

the Common Shares as described below under “Payment for Shares of Stock.” Rights may also be exercised through a Rights

holder’s broker, who may charge the Rights holder a servicing fee in connection with such exercise. See “Terms of

the Offer - Method for Exercising Rights” and “Terms of the Offer - Payment for Shares of Stock.”

Restrictions

on Foreign Stockholders

Subscription

Certificates will only be mailed to Record Date Stockholders whose addresses are within the United States (other than an APO or

FPO address). Record Date Stockholders whose addresses are outside the United States or who have an APO or FPO address and who

wish to subscribe to the Offer either in part or in full should contact the Information Agent or Subscription Agent in writing

or by recorded telephone conversation no later than five Business Days prior to the Expiration Date. The Fund will determine whether

the Offer may be made to any such Record Date Stockholder. The Offer will not be made in any jurisdiction where it would be unlawful

to do so. If the Subscription Agent has received no instruction by the fifth Business Day prior to the Expiration Date or the

Fund has determined that the Offer may not be made to a particular Record Date Stockholder, the Subscription Agent will attempt

to sell all of such stockholder’s Rights and remit the net proceeds, if any, to such stockholder. If the Rights can be sold,

sales of these Rights will be deemed to have been effected at the weighted average price received by the Subscription Agent on

the day the Rights are sold, less any applicable brokerage commissions, taxes and other expenses.

U.S.

Federal Income Tax Matters

The

Fund urges you to consult your own tax adviser with respect to the particular tax consequences of the Offer. See “Terms

of the Offer-Certain U.S. Federal Income Tax Matters” for more information on the tax consequences of the Offer.

Adviser

Effective

October 1, 2022, RiverNorth Capital Management, LLC (the “Adviser” or “RiverNorth”) serves as the adviser

to the Fund pursuant to the Fund's investment management agreement with RiverNorth dated October 1, 2022.

As

of July 31, 2022, RiverNorth had approximately $5.4 billion of assets under management. The Adviser’s address is 360 South

Rosemary Avenue, Suite 1420, West Palm Beach, FL 33401 and its telephone number is (561) 484-7185. The Fund’s address is

1290 Broadway, Suite 1000, Denver, Colorado 80203, and its telephone number is (303) 623-2577.

Effective

October 1, 2022, the Fund pays the Adviser a management fee payable on a monthly basis at the annual rate of 1.30% of the Fund’s

average daily Managed Assets for the services it provides. This management fee paid by the Fund to the Adviser is essentially

an all-in fee structure (the “unified management fee”) and, as part of the unified management fee, the Adviser provides

or causes to be furnished all supervisory and administrative and other services reasonably necessary for the operation of the

Fund, except (unless otherwise described in this Prospectus or otherwise agreed to in writing), the Fund pays, in addition to

the unified management fee, taxes and governmental fees (if any) levied against the Fund; brokerage fees and commissions and other

portfolio transaction expenses incurred by or for the Fund; costs of borrowing money including interest expenses or engaging in

other types of leverage financing; dividend and/or interest expenses and other costs associated with the Fund’s issuance,

offering, redemption and maintenance of preferred shares or other instruments for the purpose of incurring leverage; fees and

expenses of any underlying funds in which the Fund invests; dividend and interest expenses on short positions taken by the Fund;

fees and expenses, including travel expenses and fees and expenses of legal counsel retained for the benefit of the Fund or directors

of the Fund who are not officers, employees, partners, stockholders or members of the Adviser or its affiliates; fees and expenses

associated with and incident to stockholder meetings and proxy solicitations involving contested elections of directors, stockholder

proposals or other non-routine matters that are not initiated or proposed by the Adviser; legal, marketing, printing, accounting

and other expenses associated with any future share offerings, such as rights offerings and shelf offerings, following the Fund’s

initial offering; expenses associated with tender offers and other share repurchases and redemptions; and other extraordinary

expenses, including extraordinary legal expenses, as may arise, including, without limit, expenses incurred in connection with

litigation, proceedings, other claims and the legal obligations of the Fund to indemnify its directors, officers, employees, stockholders,

distributors and agents with respect thereto. Prior to October 1, 2022, ALPS Advisors, Inc. (“ALPS”) served as the

Fund’s investment adviser, and the Fund paid ALPS a management fee payable on a monthly basis at the annual rate of 1.00%

of the Fund’s average daily Managed Assets for the services and facilities it provides. The management fee paid by the Fund

to ALPS was essentially a variable fee structure where the Fund paid an advisory fee under the prior investment advisory agreement

with ALPS and also paid “variable fees” to cover other Fund expenses (including administrative services).

Benefits

to the Adviser

The

Adviser will benefit from the Offer because each firm’s fee is based on the Fund’s Managed Assets. See “Management

of the Fund” on page 19 of the accompanying Prospectus. It is not possible to state precisely the amount of additional

compensation the Adviser will receive as a result of the Offer because the proceeds of the Offer will be invested in additional

portfolio securities, which will fluctuate in value. However, assuming all Rights are exercised at the estimated Subscription

Price of $11.82 and that the Fund receives the maximum proceeds of the Offer, the annual compensation to be received by the Adviser

would be increased by approximately $955,000. In determining that the Offer was in the best interest of stockholders, the Board

was cognizant of this benefit.

Dilution

and other Investment Considerations

Stockholders

who do not exercise their Rights will, at the completion of the Offer, own a smaller proportional interest in the Fund than if

they exercised their Rights, which will proportionately decrease the relative voting power of those stockholders. Because the

Subscription Price per Common Share may be below the NAV per Common Share on the Expiration Date, you will likely experience a

reduction in the NAV per Common Share of your Common Shares whether or not you participate in the Offer. In addition, whether

or not you exercise your Rights, you will experience a dilution of NAV of the Common Shares because you will indirectly bear the

expenses of this Offer, which include, among other items, SEC registration fees, printing expenses and the fees assessed by service

providers. This dilution of NAV will disproportionately affect Stockholders who do not exercise their Rights. The Fund cannot

state precisely the extent of this dilution if you do not exercise your Rights because the Fund does not know what the NAV per

Common Share will be when the Offer expires, or what proportion of the Rights will be exercised.

Assuming,

for example, that all Rights are exercised, the Subscription Price is $11.82 and the Fund’s NAV per Common Share at the

expiration of the Offer is $12.44, the Fund’s NAV per Common Share (after payment of estimated offering expenses) would

be reduced by approximately $0.16 or 1.29% per Common Share. See “Dilution and other Investment Considerations.”

If

you do not wish to exercise your Rights, you should consider selling them as set forth in this Prospectus Supplement. The Fund

cannot give any assurance, however, that a market for the Rights will develop or that the Rights will have any marketable value.

The

offer may increase the volatility of the market price of the Common Shares. In addition, the Offer could be under-subscribed,

in which case ALPS will not have as much proceeds to invest on behalf of the Fund. See “Dilution and other Investment Considerations.”

Use

of Proceeds

Unless

otherwise specified in this Prospectus Supplement, the Fund anticipates that investment of the proceeds will be made in accordance

with the Fund’s investment objective and policies as appropriate investment opportunities are identified. It is currently

anticipated that the Fund will be able to invest substantially all of the net proceeds of an offering of Common Shares in accordance

with its investment objective and policies within three months after the completion of such offering. Pending such investment,

the proceeds will be held in high quality short-term debt securities and instruments. See “Use of Proceeds.”

Dividends

and Distributions

The

Board approved an amended distribution policy under which the Fund intends to make regular monthly distributions to stockholders

at a constant and fixed (but not guaranteed) rate that is reset annually to a rate equal to a percentage of the average of the

Fund’s NAV per share (the “Distribution Amount”), as reported for the final five trading days of the preceding

calendar year (the “Distribution Rate Calculation”). The Distribution Amount is set by the Board and may be adjusted

from time to time. The Fund’s intention is that monthly distributions paid to stockholders throughout a calendar year will

be at least equal to the Distribution Amount (plus any additional amounts that may be required to be included in a distribution

for federal or excise tax purposes) and that, on the close of the calendar year, the Distribution Amount applicable to the following

calendar year will be reset based upon the new results of the Distribution Rate Calculation. At times, to maintain a stable level

of distributions, the Fund may pay out less than all of its net investment income or pay out accumulated undistributed income,

or return capital, in addition to current net investment income. Any distribution that is treated as a return of capital generally

will reduce a stockholder’s basis in his or her shares, which may increase the capital gain or reduce the capital loss realized

upon the sale of such shares. Any amounts received in excess of a shareholder’s basis are generally treated as capital gain,

assuming the shares are held as capital assets. See “Dividends and Distributions.”

SUMMARY

OF FUND EXPENSES

The

following table is intended to assist investors in understanding the fees and expenses (annualized) that an investor in Common

Shares would bear, directly or indirectly.

The

table shows Fund expenses as a percentage of net assets attributable to Common Shares. The following table should not be considered

a representation of the Fund’s future expenses. Actual expenses may be greater or less than those shown below.

Stockholder

Transaction Expenses |

|

| Sales

Load |

None |

| Dividend

Reinvestment Plan Fees |

None(2) |

Expenses

of the Offer |

|

Offering

Expenses Borne by Stockholders of the Fund

(as a percentage of net assets attributable to Common

Shares before the Offer) |

0.07%(1) |

Annual

Expenses |

As

a Percentage of Net Assets

Attributable to Common

Shares(1)(6) |

| Management

Fee(3) |

1.81% |

| Interest

Expense on Borrowings(5) |

0.07% |

| Dividends

on Preferred Shares(4) |

2.36% |

| Dividend

and Interest Expense on Short Sales(5) |

0.27% |

| Other

Expenses(5) |

0.05% |

| Acquired

Fund Fees and Expenses(6) |

1.24% |

| Total

Annual Expenses(7) |

5.80% |

Expense

Example(6)

The

purpose of the following table is to help a holder of Common Shares understand the fees and expenses that such holder would bear

directly or indirectly. The following example illustrates the expenses that you would pay on a $1,000 investment in Common Shares,

including the estimated costs of the Offer to be borne by the Stockholders of $154,306, assuming (1) that the Fund’s net

assets following (and after giving effect to) the Offer do not increase or decrease, (2) that the Fund incurs total annual expenses

of 5.80% of its net assets in years 1 through 10 and (3) a 5% annual return.

| |

1

year |

3

years |

5

years |

10

years |

| Total

Expenses Incurred |

$58 |

$172 |

$285 |

$558 |

The

example should not be considered a representation of future expenses. Actual expenses may be greater or less than those assumed.

| (1) | The

fees and expenses of the Offer will be borne by the Fund and indirectly by all of its Stockholders, including those who did not

exercise their Rights. The amount shown as Offering Expenses Borne by Stockholders of the Fund is calculated as a percentage of

the Fund’s net assets as of October 3, 2022, and assumes no Common Shares are sold in the Offer. Assuming a fully subscribed

Offer, this percentage would equal 0.05%. The expenses of the Offer to be paid by the Fund are not included in the Annual Expenses

table. Offering expenses borne by Stockholders will result in a reduction of capital of the Fund and the NAV of the Common Shares. |

| (2) | There

will be no brokerage charges with respect to Common Shares issued directly by the Fund under the dividend reinvestment plan. You

may pay brokerage charges in connection with open market purchases or if you direct the plan agent to sell your Common Shares

held in a dividend reinvestment account. |

| (3) | The

management fee paid by the Fund to the Adviser is essentially an all-in fee structure (the “unified management fee”),

including the fee paid to the Adviser for advisory, supervisory, administrative, shareholder servicing and other services. However,

the Fund (and not the Adviser) will be responsible for certain additional fees and expenses, which are reflected in the table

above, that are not covered by the unified management fee. The unified management fee is charged as a percentage of the Fund’s

average daily Managed Assets, as opposed to net assets. If leverage is used, Managed Assets will be greater in amount than net

assets, because Managed Assets includes borrowings for investment purposes. The management fee of 1.30% of the Fund’s Managed

Assets represents 1.81% of net assets attributable to Common Shares. |

| (4) | Dividends

on Preferred Shares represent the estimated dividend expense adjusted to assume (i) 3,910,000 shares of 6.00% Series A Cumulative

Perpetual Preferred Stock with a liquidation preference of $97,750,000 was outstanding for the entire 12 months of operations

after July 31, 2022. |

| (5) | Other

Expenses, Interest Expense on Borrowings and Dividend and Interest Expense on Short Sales are estimated as of July 31, 2022. |

| (6) | The

“Acquired Fund Fees and Expenses” disclosed above are based on the expense ratios for the most recent fiscal year

of the Underlying Funds in which the Fund anticipates investing, which may change substantially over time and, therefore, significantly

affect Acquired Fund Fees and Expenses. These amounts are based on the total expense ratio disclosed in each Underlying Fund’s

most recent stockholder report. Some of the Underlying Funds in which the Fund intends to invest charge incentive fees based on

the Underlying Funds’ performance. The 1.24% shown as Acquired Fund Fees and Expenses reflects estimated operating expenses

of the Underlying Funds and transaction-related fees. Certain Underlying Funds in which the Fund intends to invest generally charge

a management fee of 1.00% to 2.00%, which are included in “Acquired Fund Fees and Expenses,” as applicable. The Acquired

Fund Fees and Expenses disclosed above, however, do not reflect any performance-based fees or allocations paid by the Underlying

Funds that are calculated solely on the realization and/or distribution of gains, or on the sum of such gains and unrealized appreciation

of assets distributed in-kind, as such fees and allocations for a particular period may be unrelated to the cost of investing

in the Underlying Funds. Acquired Fund Fees and Expenses are borne indirectly by the Fund, but they will not be reflected in the

Fund’s financial statements; and the information presented in the table will differ from that presented in the Fund’s

financial highlights. |

| (7) | The

example should not be considered a representation of future expenses and includes the expenses of the Offer. The example assumes

that the estimated “Other Expenses” set forth in the table are accurate and that all dividends and distributions are

reinvested at the NAV of the Common Shares. Actual expenses may be greater or less than those assumed. Moreover, the Fund’s

actual rate of return may be greater or less than the hypothetical 5% annual return shown in the example. |

The

purpose of the table and the example above is to help investors understand the fees and expenses that they, as Stockholders, would

bear directly or indirectly. For additional information with respect to the Fund’s expenses, see “Management of the

Fund” on page 19 of the accompanying Prospectus.

INFORMATION

REGARDING SENIOR SECURITIES

The

following table sets forth certain information regarding the Fund’s senior securities as of the end of each of

the Fund’s prior fiscal periods since the Fund’s inception. This information has been derived from our audited financial

statements, which are incorporated by reference into the statement of additional information. The Fund’s senior securities

during this time period are comprised of outstanding indebtedness, which constitutes a “senior security” as defined

in the 1940 Act.

Senior

Securities Representing Indebtedness

Period/Fiscal Year

Ended | | |

Senior Securities | |

Principal Amount Outstanding | | |

Asset Coverage | | |

Involuntary Liquidating Preference per Unit | | |

Average Market Value Per Unit (4) | |

| July 31, 2022 | | |

Credit Facility | |

| | | |

| | | |

| | | |

| | |

| | | |

Series A Cumulative Preferred Stock | |

$ | 97,750,000 | | |

$ | 89 | (3) | |

$ | 25.00 | | |

$ | 24.41 | |

| July 31, 2021 | | |

Credit Facility | |

$ | -- | | |

$ | -- | | |

$ | -- | | |

$ | -- | |

| July 31, 2020 | | |

Credit Facility | |

$ | 7,500,000 | (1) | |

$ | 19,556 | (2) | |

$ | -- | | |

$ | -- | |

| July 31, 2019 | | |

Credit Facility | |

$ | -- | | |

$ | -- | | |

$ | -- | | |

$ | -- | |

| July 31, 2018(5) | | |

Credit Facility | |

$ | -- | | |

$ | -- | | |

$ | -- | | |

$ | -- | |

| October 31, 2017 | | |

Credit Facility | |

$ | -- | | |

$ | -- | | |

$ | -- | | |

$ | -- | |

| October 31, 2016(6) | | |

Credit Facility | |

$ | -- | | |

$ | -- | | |

$ | -- | | |

$ | -- | |

| (1) | Principal amount outstanding represents the principal amount

owed by the Fund to lenders under credit facility arrangements in place at the time. |

| (2) | The asset coverage ratio for the Credit Facility is calculated

by subtracting the Fund's total liabilities and indebtedness not represented by senior securities from the Fund's total assets, dividing

the result by the aggregate amount of the Fund's senior securities representing indebtedness then outstanding, and then multiplying by

$1,000. |

| (3) | The asset coverage ratio for a class of senior securities representing

stock is calculated as the Fund's total assets, less all liabilities and indebtedness not represented by the Fund's senior securities,

divided by secured senior securities representing indebtedness plus the aggregate of the involuntary liquidation preference of secured

senior securities which are stock. With respect to the Preferred Stock, the asset coverage per unit figure is expressed in terms of dollar

amounts per share of outstanding Preferred Stock (based on a liquidation preference of $25). |

| (4) | Represents the average of the daily closing market price per

share as reported on the NYSE during the respective period. |

| (5) | Effective July 16, 2018, the Board approved changing the fiscal

year-end of the Fund from October 31 to July 31. |

| (6) | For the period December 24, 2015, commencement of operations,

to October 31, 2016. |

CAPITALIZATION

The

following table sets forth the Fund’s capitalization using figures for the Offer as of October 3, 2022:

| ● | on

a historical basis as of July 31, 2022 |

| ● | on

a pro forma as adjusted basis to reflect (1) the assumed sale of 6,227,000 of the Fund’s

Common Shares at $11.82 per share (the estimated the Subscription Price) in an offering

under this Prospectus Supplement and the accompanying Prospectus, and (2) the investment

of net proceeds assumed from such offering in accordance with the Fund’s investment

objective and policies, after deducting the estimated offering expenses payable by the

Fund of $154,306. |

| | |

Actual | | |

As

Adjusted

(unaudited) | |

Common Shares, $0.0001 par value per share,

37,500,000 shares authorized,

18,291,243 outstanding (actual), 24,518,243 shares outstanding (as adjusted) | |

$ |

268,860,599 | | |

$ |

342,309,433 | |

| Total

Distributable Earnings (Loss) | |

| (20,170,869 | ) | |

| (20,170,869 | ) |

| Total

Capitalization | |

$ | 248,689,730 | | |

$ | 322,138,564 | |

USE

OF PROCEEDS

The

Fund estimates the net proceeds of the Offer to be approximately $73,448,834. This figure is based on an estimated Subscription

Price per Common Share of $11.82 and assumes all new Common Shares offered are sold and that the expenses related to the Offer

estimated at approximately $154,306 are paid.

The

Adviser anticipates that investment of the proceeds will be made in accordance with the Fund’s investment objective and

policies as appropriate investment opportunities are identified, which is expected to be completed or substantially completed

within approximately three months from receipt. Pending such investment, the proceeds will be held in high quality short-term

debt securities and instruments.

DESCRIPTION

OF THE OFFER

Purpose

of the Offer

The

Board has determined, based on the recommendation of the Adviser, that it would be in the best interests of the Fund and its existing

Stockholders to increase the assets of the Fund available for investment, thereby permitting the Fund to be in a better position

to more fully take advantage of investment opportunities that may arise without having to reduce existing Fund holdings. In making

this determination, the Board considered a number of factors, including potential benefits and costs. The Offer seeks to reward

existing Stockholders by giving them the right to purchase additional Common Shares at a price that may be below market and/or

NAV without incurring any commission charge. The distribution to Stockholders of transferable Rights, which themselves may have

intrinsic value, will also afford non-subscribing stockholders the potential of receiving a cash payment upon sale of such Rights,

receipt of which may be viewed as partial compensation for the possible dilution of their interests in the Fund.

The

Adviser will benefit from the Offer because each firm’s fee is based on the Fund’s Managed Assets. See “Management

of the Fund” in the accompanying Prospectus. It is not possible to state precisely the amount of additional compensation

the Adviser will receive as a result of the Offer because the proceeds of the Offer will be invested in additional portfolio securities,

which will fluctuate in value. However, assuming all Rights are exercised at the estimated Subscription Price of $11.82 and that

the Fund receives the maximum proceeds of the Offer, the annual compensation to be received by the Adviser would be increased

by approximately $955,000. In determining that the Offer was in the best interest of Stockholders, the Board was cognizant of

this benefit.

This

is the Fund’s sixth rights offering. The Fund may, in the future and at its discretion, choose to make additional rights

offerings from time to time for a number of shares and on terms that may not be similar to the Offer. The Offer may not be successful.

The completion of the Offer may result in an immediate dilution of the NAV per Common Share for all existing Stockholders, including

those who fully exercise their Rights.

Important

Terms of the Offer

The

Fund is issuing to Record Date Stockholders Rights to subscribe for additional Common Shares. Each Record Date Stockholder is

being issued one transferable Right for each Common Share owned on the Record Date. The Offer entitles the holder to acquire at

the Subscription Price one Common Share for each three Rights held, rounded up to the nearest number of Rights evenly divisible

by three. Fractional shares will not be issued upon the exercise of the Rights. Accordingly, Common Shares may be purchased only

pursuant to the exercise of Rights in integral multiples of three.

In

the case of Common Shares held of record by Cede & Co. (“Cede”) as nominee for the Depository Trust Company (“DTC”)

or any other depository or nominee, the number of Rights issued to Cede or such other depository or nominee will be adjusted to

permit rounding up (to the nearest number of Rights evenly divisible by three) of the Rights to be received by beneficial owners

for whom it is the holder of record only if Cede or such other depository or nominee provides to the Fund on or before the close

of business on October 24, 2022 a written representation to the number of Rights required for such rounding.

Rights

may be exercised at any time during the period (the “Subscription Period”), which commences on October 17, 2022 and

ends at 5:00 p.m., Eastern Time, on November 8, 2022, unless extended by the Fund. See “Expiration of the Offer.”

If

all of the Rights are exercised in the primary subscription, the Fund will experience an approximate 33% increase in Common Shares

outstanding.

In

addition, any Record Date Stockholder who fully exercises all Rights initially issued to him is entitled to subscribe for Common

Shares available for Primary Subscription (the “Primary Subscription Shares”) that were not otherwise subscribed for

by other Rights holders on the Primary Subscription.

The

entitlement to subscribe for unsubscribed Primary Subscription Shares is available only to those Record Date Stockholders who

fully exercise all Rights initially issued to them and only on the basis of their Record Date holdings and will be referred to

in the remainder of this Prospectus Supplement as the “Over-Subscription Privilege.”

For

purposes of determining the maximum number of Shares a Record Date Stockholder may acquire pursuant to the Offer, broker-dealers

whose Common Shares are held of record by Cede, nominee for DTC, or by any other depository or nominee, will be deemed to be the

holders of the Rights that are issued to Cede or such other depository or nominee on their behalf. Common Shares acquired pursuant

to the Over-Subscription Privilege are subject to allotment, which is more fully discussed below under “Over-Subscription

Privilege.” Rights acquired in the secondary market may not participate in the Over-Subscription Privilege.

The

method by which Rights may be exercised and Common Shares paid for is set forth below in “Method of Exercising Rights”

and “Payment for Shares of Stock.” A Rights holder will have no right to rescind a purchase after the Subscription

Agent has received payment. See “Payment for Shares of Stock” below. Common Shares issued pursuant to an exercise

of Rights will be listed on the NYSE. Common Shares issued in connection with the Offer will not be evidenced by share certificates.

The

Rights are transferable until the Expiration Date and will be admitted for trading on the NYSE. Although no assurance can be given

that a market for the Rights will develop, trading in the Rights on the NYSE will begin on or around the Record Date and may be

conducted until the close of trading on the last NYSE trading day prior to the Expiration Date due to normal settlement procedures.

Rights

that are sold will not confer any right to acquire any Common Shares in the Over-Subscription Privilege. Trading of the Rights

on the NYSE will be conducted on a when-issued basis until and including the date on which the Subscription Certificates are mailed

to Record Date Stockholders and thereafter, will be conducted on a regular way basis until and including the last NYSE trading

day prior to the Expiration Date. The method by which Rights may be transferred is set forth below under “Method of Transferring

Rights.” The Common Shares will begin trading ex-Rights one Business Day prior to the Record Date.

Nominees

who hold Common Shares for the account of others, such as banks, broker-dealers, or depositories for securities, should notify

the respective beneficial owners of such Shares as soon as possible to ascertain such beneficial owners’ intentions and

to obtain instructions with respect to the Rights. Nominees should also notify holders purchasing Rights in the secondary market

that such Rights may not participate in the Over-Subscription Privilege. If the beneficial owner so instructs, the nominee will

complete the Subscription Certificate and submit it to the Subscription Agent with proper payment. In addition, beneficial owners

of the Common Shares or Rights held through such a nominee should contact the nominee and request the nominee to effect transactions

in accordance with such beneficial owner’s instructions.

The

Fund will not be issuing share certificates for the Common Shares issued pursuant to this Offer. Issuance of Common Shares will

be made electronically via book entry by DST, the Fund’s transfer agent.

Subscription

Price

The

Subscription Price will be determined based upon a formula equal to 95% of the reported NAV or 95% of the market price per Common

Share, whichever is higher, on the Expiration Date, unless the Offer is extended. Market price per Common Share will be determined

based on the average of the last reported sales price of a Common Share on the NYSE for the five trading days preceding (and not

inclusive of) the Expiration Date. Based on reported NAV and market price per Common Share as of October 3, 2022, the Subscription

Price would be $11.82 (the “estimated Subscription Price”).

Because

the expiration date of the subscription period will be November 8, 2022 (unless the Fund extends the Subscription Period), Rights

holders may not know the Subscription Price at the time of exercise and will be required initially to pay for both the Common

Shares subscribed for pursuant to the Primary Subscription (i.e., the Rights to acquire new Common Shares during the Subscription

Period) and, if eligible, any additional Common Shares subscribed for pursuant to the Over-Subscription Privilege at the estimated

Subscription Price of $11.82 per Common Share and, except in limited circumstances, will not be able to rescind their subscription.

The

Fund announced the Offer after the close of trading on October 4, 2022. The NAV per Common Share at the close of business on October

3, 2022 was $12.44. The last reported sales price of a Common Share on the NYSE on that date was $12.88, representing a premium

of 3.54% in relation to the then current NAV per Common Share and a discount of -2.17% in relation to the estimated Subscription

Price.

Common

Shares of the Fund, as a closed-end fund, can trade at a discount to NAV. Upon expiration of the Offer, Common Shares will likely

be issued at a price below NAV per share.

Over-Subscription

Privilege

The

Board has the right in its absolute discretion to eliminate the Over-Subscription Privilege if it considers it to be in the best

interest of the Fund to do so. The Board may make that determination at any time, without prior notice to Rights holders or others,

up to and including the seventh day following the Expiration Date. If the Over-Subscription Privilege is not eliminated, it will

operate as set forth below.

Rights

holders who are Record Date Stockholders are entitled to subscribe for additional Common Shares at the same Subscription Price

pursuant to the Over-Subscription Privilege, subject to certain limitations and subject to allotment.

Record

Date Stockholders who fully exercise all Rights initially issued to them are entitled to buy those Common Shares that were not

purchased by other Rights holders (the “Over-Subscription Shares”) at the same Subscription Price. If enough Over-Subscription

Shares are available, all such requests will be honored in full. If the requests for Over-Subscription Shares exceed the Over-Subscription

Shares available, the available Over-Subscription Shares will be allocated pro rata among those Record Date Stockholders

who over-subscribe based on the number of Rights originally issued to them by the Fund.

Record

Date Stockholders who are fully exercising their Rights during the Subscription Period should indicate, on the Subscription Certificate

that they submit with respect to the exercise of the Rights issued to them, how many Common Shares they are willing to acquire

pursuant to the Over-Subscription Privilege. Rights acquired in the secondary market may not participate in the Over-Subscription

Privilege.

To

the extent sufficient Over-Subscription Shares are not available to fulfill all over-subscription requests, the Over-Subscription

Shares will be allocated pro-rata among those Record Date Stockholders who over-subscribe based on the number of Rights originally

issued to them by the Fund. The allocation process may involve a series of allocations in order to assure that the Over-Subscription

Shares available are distributed on a pro rata basis.

The

formula to be used in allocating the Over-Subscription Shares available is as follows: (Stockholder’s number of Rights originally

issued to them by the Fund divided by the total number of Rights of all over-subscribing Record Date Stockholders) multiplied

by Over-Subscription Shares available for distribution.

Banks,

broker-dealers, trustees and other nominee holders of Rights will be required to certify to the Subscription Agent, before any

Over-Subscription Privilege may be exercised with respect to any particular beneficial owner, as to the aggregate number of Rights

exercised during the Subscription Period and the number of Common Shares subscribed for pursuant to the Over-Subscription Privilege

by such beneficial owner and that such beneficial owner’s subscription was exercised in full. Nominee holder over-subscription

forms and beneficial owner certification forms will be distributed to banks, broker-dealers, trustees and other nominee holders

of rights with the Subscription Certificates. Nominees should also notify holders purchasing Rights in the secondary market that

such Rights may not participate in the Over-Subscription Privilege.

The

Fund will not offer or sell any Common Shares that are not subscribed for during the Subscription Period or pursuant to the Over-Subscription

Privilege.

Sale

and Transferability of Rights

The

value of the Rights, if any, will be reflected by the market price of the Rights. Rights may be sold by individual holders or

may be submitted to the Subscription Agent for sale. Any Rights submitted to the Subscription Agent for sale must be received

by the Subscription Agent on or before November 1, 2022, five Business Days prior to the completion of the Subscription Period,

due to normal settlement procedures.

Rights

that are sold will not confer any right to acquire any Common Shares in the Over-Subscription, and any Record Date Stockholder

who sells any Rights initially issued to such Stockholder will not be eligible to participate in the Over-Subscription Privilege.

The

Rights evidenced by a single Subscription Certificate may be transferred in whole by endorsing the Subscription Certificate for

transfer in accordance with the accompanying instructions. A portion of the Rights evidenced by a single Subscription Certificate

(but not fractional Rights) may be transferred by delivering to the Subscription Agent a Subscription Certificate properly endorsed

for transfer, with instructions to register the portion of the Rights evidenced thereby in the name of the transferee (and to

issue a new Subscription Certificate to the transferee evidencing the transferred Rights). In this event, a new Subscription Certificate

evidencing the balance of the Rights will be issued to the Rights holder or, if the Rights holder so instructs, to an additional

transferee.

Holders

wishing to transfer all or a portion of their Rights (but not fractional Rights) should allow at least five Business Days prior

to the Expiration Date for (i) the transfer instructions to be received and processed by the Subscription Agent, (ii) a new Subscription

Certificate to be issued and transmitted to the transferee or transferees with respect to transferred Rights, and to the transferor

with respect to retained Rights, if any, and (iii) the Rights evidenced by the new Subscription Certificates to be exercised or

sold by the recipients thereof. Neither the Fund nor the Subscription Agent shall have any liability to a transferee or transferor

of Rights if Subscription Certificates are not received in time for exercise or sale prior to the Expiration Date.

Except

for the fees charged by the Subscription Agent (which will be paid by the Fund as described below), all commissions, fees and

other expenses (including brokerage commissions and transfer taxes) incurred in connection with the purchase, sale or exercise

of Rights will be for the account of the transferor of the Rights, and none of these commissions, fees or expenses will be paid

by the Fund or the Subscription Agent.

The

Fund anticipates that the Rights will be eligible for transfer through, and that the exercise of the Offer may be effected through,

the facilities of DTC.

Sales

by Subscription Agent

Holders

of Rights who are unable or do not wish to exercise any or all of their Rights may instruct the Subscription Agent to sell any

unexercised Rights. The Subscription Certificates representing the Rights to be sold by the Subscription Agent must be received

on or before November 1, 2022, the fifth business day before the Expiration Date. Upon the timely receipt of the appropriate instructions

to sell Rights, the Subscription Agent will use its best efforts to complete the sale and will remit the proceeds of sale, net

of commissions, to the holders. The Subscription Agent will also attempt to sell any Rights (i) a Rights holder is unable to exercise

because the Rights represent the right to subscribe for less than one new Common Share or (ii) attributable to stockholders whose

record addresses are outside the United States or who have an APO or FPO address.

If

the Rights can be sold, sales of the Rights will be deemed to have been effected at the weighted average price received by the

Subscription Agent on the day such Rights are sold, less any applicable brokerage commissions, taxes and other expenses. The selling

Rights holder will pay all brokerage commissions incurred by the Subscription Agent.

The

Subscription Agent will automatically attempt to sell any unexercised Rights that remain unclaimed as a result of Subscription

Certificates being returned by the postal authorities as undeliverable as of the fifth Business Day prior to the Expiration Date.

These sales will be made net of commissions on behalf of the nonclaiming Rights holders. Proceeds from those sales will be held

by the Fund’s transfer agent, for the account of the nonclaiming Rights holder until the proceeds are either claimed or

escheated. There can be no assurance that the Subscription Agent will be able to complete the sale of any of these Rights and

neither the Fund nor the Subscription Agent has guaranteed any minimum sales price for the Rights. All of these Rights will be

sold at the market price, if any, through an exchange or market trading the Rights.

Stockholders

are urged to obtain a recent trading price for the Rights on the NYSE from their broker, bank, financial advisor or the financial

press.

Method

for Exercising Rights

Rights

may be exercised by completing and signing the reverse side of the Subscription Certificate and mailing it in the envelope provided,

or otherwise delivering the completed and signed Subscription Certificate to the Subscription Agent, together with payment for

the Common Shares as described below under “Payment for Shares of Stock.” Rights may also be exercised through a Rights

holder’s broker, who may charge the Rights holder a servicing fee in connection with such exercise.

Completed

Subscription Certificates must be received by the Subscription Agent prior to 5:00 p.m. Eastern Time, on the Expiration Date (unless

payment is effected by means of a notice of guaranteed delivery as described below under “Payment for Shares of Stock”).

The Subscription Certificate and payment should be delivered to the Subscription Agent at the following addresses:

| If

By Mail: |

Computershare

Trust Company, N.A.

Attn: Corporate Actions Voluntary Offer

P.O. Box 43011

Providence, RI 02940-3011 |

| |

|

| If

By Overnight Courier: |

Computershare

Trust Company, N.A.

Attn: Corporate Actions Voluntary Offer

150 Royall Street

Suite V

Canton, MA 02021 |

Subscription

Agent

The

Subscription Agent is Computershare Trust Company, N.A. and Computershare Inc., collectively. The Subscription Agent will receive

from the Fund an amount estimated to be approximately $45,000, comprised of the fee for its services and the reimbursement for

certain expenses related to the Offer.

Information

Agent

Inquiries

by all holders of Rights should be directed to: the Information Agent, Georgeson, toll-free at (888) 624-2255 or please send a

written request to: 1290 Avenue of the Americas, 9th floor, New York, NY 10104; holders may also consult their brokers or nominees.

Expiration