REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

To the Shareholders and Board of Directors of

RiverNorth Opportunities Fund, Inc.

In planning and performing our audit of the financial

statements of RiverNorth Opportunities Fund, Inc. (the “Fund”) as of and for the year ended July 31, 2023, in accordance with

the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), we considered the Fund’s internal control

over financial reporting, including controls over safeguarding securities, as a basis for designing our auditing procedures for the purpose

of expressing our opinion on the financial statements and to comply with the requirements of Form N- CEN, but not for the purpose of expressing

an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

The management of the Fund is responsible for establishing

and maintaining effective internal control over financial reporting. In fulfilling this responsibility, estimates and judgments by management

are required to assess the expected benefits and related costs of controls. A fund’s internal control over financial reporting is

a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements

for external purposes in accordance with generally accepted accounting principles (GAAP). A fund’s internal control over financial

reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately

and fairly reflect the transactions and dispositions of the assets of the fund; (2) provide reasonable assurance that transactions are

recorded as necessary to permit preparation of financial statements in accordance with GAAP, and that receipts and expenditures of the

fund are being made only in accordance with authorizations of management and directors of the fund; and (3) provide reasonable assurance

regarding prevention or timely detection of unauthorized acquisition, use or disposition of a fund’s assets that could have a material

effect on the financial statements.

Because of its inherent limitations, internal control

over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods

are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the

policies or procedures may deteriorate.

A deficiency in internal control over financial reporting

exists when the design or operation of a control does not allow management or employees, in the normal course of performing their assigned

functions, to prevent or detect misstatements on a timely basis. A material weakness is a deficiency, or combination of deficiencies,

in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Fund’s

annual or interim financial statements will not be prevented or detected on a timely basis.

Our consideration of the Fund’s internal control

over financial reporting was for the limited purpose described in the first paragraph and would not necessarily disclose all deficiencies

in internal control that might be material weaknesses under standards established by the PCAOB. However, we noted no deficiencies in the

Fund’s internal control over financial reporting and its operation, including controls over safeguarding securities, that we consider

to be a material weakness as defined above as of July 31, 2023.

This report is intended solely for the information

and use of management and the Board of Directors of the Fund and the Securities and Exchange Commission and is not intended to be and

should not be used by anyone other than these specified parties.

COHEN & COMPANY, LTD.

Cleveland, Ohio

September 28, 2023

COHEN & COMPANY, LTD.

800.229.1099 | 866.818.4538 fax |

cohencpa.com

Registered with the Public Company Accounting Oversight Board

MANAGEMENT

AGREEMENT

| TO: | RiverNorth Capital Management, LLC |

360 South Rosemary Avenue, Suite 1420

West Palm Beach, Florida 33401

Dear Sirs:

RiverNorth Opportunities

Fund, Inc. (the “Company”) herewith confirms our agreement with you.

The Company has been

organized to engage in the business of a closed-end management investment company.

You have been selected

to act as the sole investment manager of the series of the Company set forth on the Exhibit to this Agreement (the “Fund”)

and to provide certain other services, as more fully set forth below, and you are willing to act as such investment manager and

to perform such services under the terms and conditions hereinafter set forth. Accordingly, the Company agrees with you as follows

effective upon the date of the execution of this Agreement.

Subject to the supervision

of the Board of Directors of the Company, you will provide or arrange to be provided to the Fund such investment advice as you

in your discretion deem advisable and will furnish or arrange to be furnished a continuous investment program for the Fund consistent

with the Fund’s investment objective and policies. You will determine or arrange for others to determine the securities to

be purchased for the Fund, the portfolio securities to be held or sold by the Fund and the portion of the Fund’s assets to

be held uninvested, subject always to the Fund’s investment objective, policies and restrictions, as each of the same shall

be from time to time in effect, and subject further to such policies and instructions as the Board may from time to time establish.

You will furnish such reports, evaluations, information or analyses to the Company as the Board of Directors of the Company may

request from time to time or as you may deem to be desirable. You also will advise and assist the officers of the Company in taking

such steps as are necessary or appropriate to carry out the decisions of the Board and the appropriate committees of the Board

regarding the conduct of the business of the Company.

You may delegate any

or all of the responsibilities, rights or duties described above to one or more sub-advisers who shall enter into agreements with

you, provided the agreements are approved and ratified (i) by the Board including a majority of the Directors who are not interested

persons of you or of the Company, cast in person at a meeting called for the purpose of voting on such approval, and (ii) if required

under interpretations of the Investment Company Act of 1940, as amended (the “Act”) by the Securities and Exchange

Commission or its staff, by vote of the holders of a majority of the outstanding voting securities of the applicable Fund (unless

the Company has obtained an exemption from the provisions of Section 15(a) of the Act). Any such delegation shall not relieve you

from any liability hereunder.

| 3. | ALLOCATION OF CHARGES AND EXPENSES |

As part of the unified

management fee payable hereunder, you will provide or cause to be furnished all supervisory and administrative and other services

reasonably necessary for the operation of the Fund, except (unless otherwise described in the Fund’s Prospectus or otherwise

agreed to in writing), the Fund will pay, in addition to the unified management fee, taxes and governmental fees, if any, levied

against the Fund; brokerage fees and commissions and other portfolio transaction expenses incurred by or for the Fund; costs, including

interest expenses, of borrowing money or engaging in other types of leverage financing including, without limit, through the use

by the Fund of tender option bond transactions; costs, including dividend and/or interest expenses and other costs (including,

without limit, offering and related legal costs, fees to brokers, fees to auction agents, fees to transfer agents, fees to ratings

agencies and fees to auditors associated with satisfying ratings agency requirements for preferred shares or other securities issued

by the Fund and other related requirements in the Fund’s organizational documents) associated with the Fund’s issuance,

offering, redemption and maintenance of preferred shares or other instruments (such as the use of tender option bond transactions)

for the purpose of incurring leverage; fees and expenses of any Underlying Funds in which the Fund invests; dividend and interest

expenses on short positions taken by the Fund; fees and expenses, including travel expenses and fees and expenses of legal counsel

retained for the benefit of the Fund or directors of the Fund who are not officers, employees, partners, shareholders or members

of the Adviser or its affiliates; fees and expenses associated with and incident to shareholder meetings and proxy solicitations

involving contested elections of directors, shareholder proposals or other non-routine matters that are not initiated

or proposed by the Adviser; legal, marketing, printing, accounting and other expenses associated with any future share offerings,

such as rights offerings and shelf offerings, following the Fund’s initial offering; expenses associated with tender offers

and other share repurchases and redemptions; and other extraordinary expenses, including extraordinary legal expenses, as may arise,

including, without limit, expenses incurred in connection with litigation, proceedings, other claims and the legal obligations

of the Fund to indemnify its directors, officers, employees, shareholders, distributors and agents with respect thereto.

You will also pay the

compensation of any sub-adviser retained pursuant to paragraph 2 above and the compensation and expenses of any persons rendering

portfolio management services to the Company who are directors, officers, employees, members or stockholders of your corporation

or limited liability company. You will make available to the Board of Directors, without expense to the Fund, such of your employees

as the Board may request to participate in Board meetings and provide such reports and other assistance as the Directors may reasonably

request.

| 4. | COMPENSATION OF THE MANAGER |

For all of the services

to be rendered as provided in this Agreement, as of the last business day of each month, the Fund will pay you a fee based on the

average value of the daily managed assets of the Fund and paid at an annual rate as set forth on the Exhibit executed with respect

to the Fund and attached hereto.

The average value of

the daily managed assets of a Fund shall be determined pursuant to the applicable provisions of the Articles of Incorporation or

a resolution of the Board of Directors, if required. If, pursuant to such provisions, the determination of net asset value of a

Fund is suspended for any particular business day, then for the purposes of this paragraph, the value of the managed assets of

the Fund as last determined shall be deemed to be the value of the net assets as of the close of the business day, or as of such

other time as the value of the Fund’s net assets may lawfully be determined, on that day. If the determination of the net

asset value of a Fund has been suspended for a period including such month, your compensation payable at the end of such month

shall be computed on the basis of the value of the net assets of the Fund as last determined (whether during or prior to such month).

| 5. | EXECUTION OF PURCHASE AND SALE ORDERS |

In connection with

purchases or sales of portfolio securities for the account of a Fund, it is understood that you (or the applicable sub-adviser

retained pursuant to paragraph 2 above) will arrange for the placing of all orders for the purchase and sale of portfolio securities

for the account with brokers or dealers selected by you (or the sub-adviser), subject to review of this selection by the Board

of Directors from time to time. You (or the sub-adviser) will be responsible for the negotiation and the allocation of principal

business and portfolio brokerage. In the selection of such brokers or dealers and the placing of such orders, you (or the sub-adviser)

are directed at all times to seek for the Fund the best qualitative execution, taking into account such factors as price (including

the applicable brokerage commission or dealer spread), the execution capability, financial responsibility and responsiveness of

the broker or dealer and the brokerage and research services provided by the broker or dealer.

You (or the sub-adviser)

should generally seek favorable prices and commission rates that are reasonable in relation to the benefits received. In seeking

best qualitative execution, you (or the sub-adviser) are authorized to select brokers or dealers who also provide brokerage and

research services to the Fund and/or the other accounts over which you exercise investment discretion. You (or the sub-adviser)

are authorized to pay a broker or dealer who provides such brokerage and research services a commission for executing a Fund portfolio

transaction which is in excess of the amount of commission another broker or dealer would have charged for effecting that transaction

if you (or the sub-adviser) determine in good faith that the amount of the commission is reasonable in relation to the value of

the brokerage and research services provided by the executing broker or dealer. The determination may be viewed in terms of either

a particular transaction or your (or the sub-adviser’s) overall responsibilities with respect to the Fund and to accounts

over which you (or the sub-adviser) exercise investment discretion. The Fund and you (and the sub-adviser) understand and acknowledge

that, although the information may be useful to the Fund and you (and the sub-adviser), it is not possible to place a dollar value

on such information. The Board of Directors shall periodically review the commissions paid by the Fund to determine if the commissions

paid over representative periods of time were reasonable in relation to the benefits to the Fund.

A broker’s or

dealer's sale or promotion of Fund shares shall not be a factor considered by your personnel responsible for selecting brokers

to effect securities transactions on behalf of the Fund. You and your personnel shall not enter into any written or oral agreement

or arrangement to compensate a broker or dealer for any promotion or sale of Fund shares by directing to such broker or dealer

(i) the Fund's portfolio securities transactions or (ii) any remuneration, including but not limited to, any commission, mark-up,

mark down or other fee received or to be received from the Fund's portfolio transactions through such broker or dealer. However,

you may place Fund portfolio transactions with brokers or dealers that sell or promote shares of the Fund provided the Board of

Directors has adopted policies and procedures under Rule 12b-1(h) under the Act and such transactions are conducted in compliance

with those policies and procedures.

Subject to the provisions

of the Act, and other applicable law, you (or the sub-adviser), any of your (and the sub-adviser’s) affiliates or any affiliates

of your (or the sub-adviser’s) affiliates may retain compensation in connection with effecting a Fund’s portfolio transactions,

including transactions effected through others. If any occasion should arise in which you (or the sub-adviser) give any advice

to your clients (or clients of the sub-adviser) concerning the shares of a Fund, you (or the sub-adviser) will act solely as investment

counsel for such client and not in any way on behalf of the Fund.

You will vote, or make

arrangements to have voted, all proxies solicited by or with respect to the issuers of securities in which assets of the Fund may

be invested from time to time. Such proxies will be voted in a manner that you deem, in good faith, to be in the best interest

of the Fund and in accordance with your proxy voting policy. You agree to provide a copy of your proxy voting policy, and any amendments

thereto, to the Company prior to the execution of this Agreement

You have adopted a

written code of ethics complying with the requirements of Rule 17j-1 under the Act and will provide the Company with a copy of

the code and evidence of its adoption. Within 45 days of the last calendar quarter of each year while this Agreement is in effect,

you will provide to the Board of Directors of the Company a written report that describes any issues arising under the code of

ethics since the last report to the Board of Directors, including, but not limited to, information about material violations of

the code and sanctions imposed in response to the material violations; and which certifies that you have adopted procedures reasonably

necessary to prevent access persons (as that term is defined in Rule 17j-1) from violating the code.

| 8. | SERVICES NOT EXCLUSIVE/USE OF NAME |

Your services to the

Fund pursuant to this Agreement are not to be deemed to be exclusive, and it is understood that you may render investment advice,

management and other services to others, including other registered investment companies, provided, however, that such other services

and activities do not, during the term of this Agreement, interfere in a material manner, with your ability to meet all of your

obligations with respect to rendering services to the Fund.

The Company and you

acknowledge that all rights to the name “RiverNorth” or any variation thereof belong to you, and that the Company is

being granted a limited license to use such words in its Fund name or in any class name. In the event you cease to be the adviser

to the Fund, the Company’s right to the use of the name “RiverNorth” shall automatically cease on the ninetieth

day following the termination of this Agreement. The right to the name may also be withdrawn by you during the term of this Agreement

upon ninety (90) days’ written notice by you to the Company. Nothing contained herein shall impair or diminish in any respect,

your right to use the name “RiverNorth” in the name of, or in connection with, any other business enterprises with

which you are or may become associated. There is no charge to the Company for the right to use this name.

| 9. | LIMITATION OF LIABILITY OF MANAGER |

You may rely on information

reasonably believed by you to be accurate and reliable. Except as may otherwise be required by the Act or the rules thereunder,

neither you nor your directors, officers, employees, shareholders, members, agents, control persons or affiliates of any thereof

shall be subject to any liability for, or any damages, expenses or losses incurred by the Company in connection with, any error

of judgment, mistake of law, any act or omission connected with or arising out of any services rendered under, or payments made

pursuant to, this Agreement or any other matter to which this Agreement relates, except by reason of willful misfeasance, bad faith

or gross negligence on the part of any such persons in the performance of your duties under this Agreement, or by reason of reckless

disregard by any of such persons of your obligations and duties under this Agreement.

Any person, even though

also a director, officer, employee, shareholder, member or agent of you, who may be or become a Director, officer, employee or

agent of the Company, shall be deemed, when rendering services to the Company or acting on any business of the Company (other than

services or business in connection with your duties hereunder), to be rendering such services to or acting solely for the Company

and not as a director, officer, employee, shareholder, member, or agent of you, or one under your control or direction, even though

paid by you.

| 10. | DURATION AND TERMINATION OF THIS AGREEMENT |

The term of this Agreement

shall begin on the date of this Agreement for the Fund that has executed an Exhibit hereto as of the date of this Agreement and

shall continue in effect with respect to the Fund (and any subsequent Fund added pursuant to an Exhibit executed during the initial

two-year term of this Agreement) for a period of two years. This Agreement shall continue in effect from year to year thereafter,

subject to termination as hereinafter provided, if such continuance is approved at least annually by (a) a majority of the outstanding

voting securities of the Fund or by vote of the Company’s Board of Directors, cast in person at a meeting called for the

purpose of voting on such approval, and (b) by vote of a majority of the Directors of the Company who are not parties to this Agreement

or “interested persons” of any party to this Agreement, cast in person at a meeting called for the purpose of voting

on such approval. If a Fund is added pursuant to an Exhibit executed after the date of this Agreement as described above, this

Agreement shall become effective with respect to that Fund upon execution of the applicable Exhibit and shall continue in effect

for a period of two years from the date thereof and from year to year thereafter, subject to approval as described above.

This Agreement may,

on sixty (60) days written notice, be terminated with respect to the Fund, at any time without the payment of any penalty, by the

Board of Directors, by a vote of a majority of the outstanding voting securities of the Fund, or by you. This Agreement shall automatically

terminate in the event of its assignment.

| 11. | AMENDMENT OF THIS AGREEMENT |

No provision of this

Agreement may be changed, waived, discharged or terminated orally, and no amendment of this Agreement shall be effective until

approved by the Board of Directors, including a majority of the Directors who are not interested persons of you or of the Company,

cast in person at a meeting called for the purpose of voting on such approval, and (if required under interpretations of the Act

by the Securities and Exchange Commission or its staff) by vote of the holders of a majority of the outstanding voting securities

of the Fund to which the amendment relates.

| 12. | LIMITATION OF LIABILITY TO COMPANY PROPERTY |

The term “RiverNorth

Funds” means and refers to the Directors from time to time serving under the Company’s Articles of Incorporation as

the same may subsequently thereto have been, or subsequently hereto be, amended. It is expressly agreed that the obligations of

the Company hereunder shall not be binding upon any of Directors, officers, employees, agents or nominees of the Company, or any

shareholders of any series of the Company, personally, but bind only the property of the Company (and only the property of the

applicable Fund), as provided in the Articles of Incorporation. The execution and delivery of this Agreement have been authorized

by the Directors and shareholders of the applicable Fund and signed by officers of the Company, acting as such, and neither such

authorization by such Directors and shareholders nor such execution and delivery by such officers shall be deemed to have been

made by any of them individually or to impose any liability on any of them personally, but shall bind only the property of the

Company (and only the property of applicable Fund) as provided in its Articles of Incorporation. A copy of the Articles of Incorporation

is on file with the Secretary of State of Maryland.

In the event any provision

of this Agreement is determined to be void or unenforceable, such determination shall not affect the remainder of this Agreement,

which shall continue to be in force.

In compliance with

the requirements of Rule 31a-3 under the Act, you agree that all record which you maintain for the Company are the property of

the Company and you agree to surrender promptly to the Company such records upon the Company’s request. You further agree

to preserve for the periods prescribed by Rule 31a-2 under the Act all records which you maintain for the Company that are required

to be maintained by Rule 31a-1 under the Act.

| 15. | QUESTIONS OF INTERPRETATION |

(a) This

Agreement shall be governed by the laws of the State of Maryland.

(b) For

the purpose of this Agreement, the terms “assignment,” “majority of the outstanding voting securities,”

“control” and “interested person” shall have their respective meanings as defined in the Act and rules

and regulations thereunder, subject, however, to such exemptions as may be granted by the Securities and Exchange Commission under

the Act; and the term “brokerage and research services” shall have the meaning given in the Securities Exchange Act

of 1934.

(c) Any

question of interpretation of any term or provision of this Agreement having a counterpart in or otherwise derived from a term

or provision of the Act shall be resolved by reference to such term or provision of the Act and to interpretation thereof, if any,

by the United States courts or in the absence of any controlling decision of any such court, by the Securities and Exchange Commission

or its staff. In addition, where the effect of a requirement of the Act, reflected in any provision of this Agreement, is revised

by rule, regulation, order or interpretation of the Securities and Exchange Commission or its staff, such provision shall be deemed

to incorporate the effect of such rule, regulation, order or interpretation.

Any notices under this Agreement shall be in writing, addressed

and delivered or mailed postage paid to the other party at such address as such other party may designate for the receipt of such

notice. Until further notice to the other party, it is agreed that the address of the Company is 325 N. LaSalle Street, Suite 645

Chicago, IL 60610.

You agree to treat

all records and other information relating to the Company and the securities holdings of the Fund as confidential and shall not

disclose any such records or information to any other person unless (i) the Board of Directors of the Company has approved the

disclosure or (ii) such disclosure is compelled by law. In addition, you, and your officers, directors and employees are prohibited

from receiving compensation or other consideration, for themselves or on behalf of the Fund, as a result of disclosing the Fund’s

portfolio holdings. You agree that, consistent with your Code of Ethics, neither your nor your officers, directors or employees

may engage in personal securities transactions based on nonpublic information about the Fund's portfolio holdings.

This Agreement may

be executed in one or more counterparts, each of which shall be deemed an original, but all of which together shall constitute

one and the same instrument.

Each of the undersigned

expressly warrants and represents that he has the full power and authority to sign this Agreement on behalf of the party indicated,

and that his signature will operate to bind the party indicated to the foregoing terms.

The captions in this

Agreement are included for convenience of reference only and in no way define or delimit any of the provisions hereof or otherwise

affect their construction or effect.

If you are in agreement

with the foregoing, please sign the form of acceptance on the accompanying counterpart of this letter and return such counterpart

to the Company, whereupon this letter shall become a binding contract upon the date thereof.

| |

Yours very truly, |

|

| |

|

|

|

| |

RiverNorth Opportunities Fund, Inc.

|

|

| |

|

|

| Dated: as of October 1, 2022 |

By: |

|

|

| |

Print Name: |

Patrick W. Galley |

|

| |

Title: |

President and Chairman of the Board |

|

ACCEPTANCE:

The foregoing Agreement is hereby accepted.

| |

RiverNorth Capital Management, LLC |

|

| |

|

|

|

| Dated: as of October 1, 2022 |

By: |

|

|

|

Print Name: |

Jonathan M. Mohrhardt |

|

| |

Title: |

President and Chief Operating Officer |

|

Exhibit 1

| |

|

Percentage of Average |

| Fund |

|

Daily

Managed Assets |

| RiverNorth Opportunities Fund, Inc. |

|

1.30% |

-8-

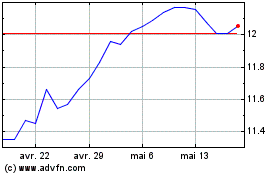

RiverNorth Opportunities (NYSE:RIV)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

RiverNorth Opportunities (NYSE:RIV)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024