- Nearly eight in 10 say saving is a high priority, but seven

in 10 are not using accounts that offer higher interest

rates.

- Saving a portion of a tax refund in a high-yield savings

account, as part of a savings plan, could generate thousands of

dollars over time.

- Seven in 10 Americans are optimistic they will save more

this year, with younger generations being the most

confident.

- More than three-quarters of current high-yield savings

accountholders wish they had opened their accounts sooner.

Santander Bank, N.A. (“Santander Bank”) today announced the

results of a new survey that found while nearly eight in 10

consumers (78%) say saving is a high priority, seven in 10 (69%) do

not use higher-rate accounts — such as high-yield savings accounts,

money market accounts and certificates of deposit (CDs) — that

would accelerate progress toward their goals. The findings were

part of the fourth installment of Santander Bank’s Openbank Growing

Personal Savings (“GPS”) Tracker, a research series exploring

Americans’ spending and savings habits.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250226804852/en/

As Americans focus on building their savings, the beginning of

the year is when consumers have been most successful at saving.

According to the GPS Tracker, consumers were most likely to add to

their savings and meet their savings goals in the first quarter,

followed by the second quarter. With 58% anticipating a tax refund

and 35% expecting an annual work bonus in the coming months, savers

can leverage higher-rate account options as a part of a savings

strategy.

“Now is the time for savers to put their hard-earned money to

work for them,” said Swati Bhatia, Head of Retail Banking and

Transformation at Santander Bank, which recently announced the U.S.

launch of Openbank, its national digital banking platform. “With

cash infusions such as tax refunds on the horizon, consumers have a

prime opportunity to jumpstart their savings goals — especially for

younger savers who have time on their side.”

For instance, a $2,000 tax refund with subsequent $100 monthly

contributions into a high-yield savings account earning a 4.00%

Annual Percentage Yield (APY) grows to $9,072 after five years and

$17,707 after 10 years. This includes $1,072 in interest after five

years and $3,707 after 10 years1.

Americans Struggled to Save in Q4, But

Have Optimism for 2025

Americans will look to overcome the savings hurdles they faced

late last year. More than eight in 10 (82%) reported a savings

obstacle in Q4, with too many bills and planned expenses (35%),

unexpected expenses (31%) and debt repayment (26%) being the top

barriers. Meanwhile, fewer savers added to their balances in Q4

compared to the first half of the year. More than eight in 10 (82%)

say persistent inflation made it harder to save, and nearly

three-quarters (74%) admit saving became more difficult as the year

went on.

Despite these shortcomings, seven in 10 Americans are optimistic

they will save more in 2025, with younger generations being the

most confident. Encouragingly, more consumers are beginning to take

advantage of the opportunity to earn higher rates on their money.

More than one in five (22%) recently moved money to a

higher-yielding account in December. As a result, of those who know

the interest rate on their primary savings account, 45% are earning

at least a 3.00% Annual Percentage Yield (APY), up from 40% at the

start of the year. Gen Z and millennial savers are more likely than

older generations to be earning at least 3.00%, which could

contribute to their feelings of optimism.

High-Yield Savings Accounts Make a Big

Difference, But Misperceptions Limit Usage

High-yield savings accountholders overwhelmingly agree these

accounts build confidence and generate meaningful yield. In fact,

more than three quarters (77%) regret not opening their accounts

sooner. Nearly all high-yield savings accountholders (92%) would

encourage others to open one, with most believing it has helped

them build their savings faster (90%) and made it easier to reach

their savings goals (89%). Overall, 77% of these accountholders are

pleased with their financial progress last year, compared to 50%

who only have a traditional savings account.

Despite the positive sentiments among accountholders,

misperceptions about high-yield savings accounts may be responsible

for their low usage. For example, three-quarters of savers with

only a traditional savings account are unaware money in a

high-yield savings account is not locked up for an extended period,

such as six months or one year, and 34% do not use these accounts

for worry of not having quick access to their money. Additionally,

nearly six in 10 (58%) do not realize you can open a high-yield

savings account without ending your relationship with your primary

bank, and 27% cite this as a specific reason for not using these

accounts.

Another common misperception is that interest rates on

high-yield savings accounts or CDs will not generate meaningful

dollars. However, the typical saver with $8,0002 in a high-yield

savings account earning an Annual Percentage Yield (APY) of 4.00%

could generate more than $300 in interest after one year, which is

nearly 10x what they would earn in a savings account paying the

national average3. Nearly everyone with only a traditional savings

account (85%) agrees $300 would be meaningful to their

finances.

Methodology

This research on growing personal savings, conducted by Morning

Consult on behalf of Santander Bank, surveyed 2,256 Americans

adults. This Q4 study was conducted between December 20 – 23, 2024.

The interviews were conducted online, and the margin of error is

+/- 2 percentage points for the total audience at a 95% confidence

level. This data was weighted to target population proportions for

a representative sample based on age, gender, ethnicity, region,

and education. Monthly measures were based on additional monthly

survey pulses, conducted by Morning Consult on behalf of Santander

Bank, of approximately 2,200 Americans adults per month. The

monthly iterations were conducted October 15 - 17, November 15 - 17

and December 16 - 17, 2024 to measure month-over-month changes.

Each monthly survey was conducted online, and the margin of error

is +/- 2 percentage points for the total audience at a 95%

confidence level.

The full report and more information about the Santander Bank,

N.A. survey can be found here.

About Santander Bank,

N.A

Santander Bank, N.A. is one of the country’s leading

retail and commercial banks, with $102 billion in assets as of

December 31, 2024. With its corporate offices in Boston, the Bank’s

more than 4,400 employees and more than 1.8 million customers are

principally located in Massachusetts, New Hampshire, Connecticut,

Rhode Island, New York, New Jersey, Pennsylvania and Delaware. The

Bank is a wholly-owned subsidiary of Madrid-based Banco Santander,

S.A. (NYSE: SAN), recognized as one of the world’s most admired

companies by Fortune Magazine in 2024, with approximately 173

million customers in the U.S., Europe, and Latin America. It is

overseen by Santander Holdings USA, Inc., Banco Santander’s

intermediate holding company in the U.S. For more information on

Santander Bank, please visit www.santanderbank.com.

Openbank in the United States is a division of Santander

Bank, N.A., which is a Member of FDIC and a wholly owned subsidiary

of Banco Santander, S.A. © 2025 Santander Bank, N.A. All rights

reserved. Santander, Santander Bank, Openbank, the Flame Logo are

trademarks of Banco Santander, S.A. or its subsidiaries in the

United States or other countries. All other trademarks are the

property of their respective owners. For more information on

Openbank in the United States, please visit www.openbank.us.

1Assumes a 4.00% Annual Percentage Yield (APY) for duration with

interest compounding monthly. High-yield savings accounts have a

variable rate, which may change over time.

2The median savings in bank accounts is $8,000, according to the

Federal Reserve.

3The typical savings account has an Annual Percentage Yield

(APY) of 0.41%, according to the FDIC as of January 30, 2025.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226804852/en/

Media Contact

Andrew Simonelli

andrew.simonelli@santander.us Caroline

Connolly caroline.connolly@santander.us

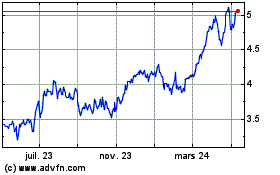

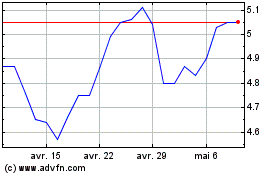

Banco Santander (NYSE:SAN)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Banco Santander (NYSE:SAN)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025