UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under §240.14a-12 |

SDCL EDGE Acquisition Corp

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required. |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

SDCL EDGE ACQUISITION CORP

60 East 42nd Street, Suite 1100,

New York, NY 10165

PROXY STATEMENT SUPPLEMENT

October 23, 2023

Dear Shareholders of SDCL EDGE Acquisition Corp:

This is a supplement (this “Supplement”) to the definitive proxy statement of SDCL EDGE Acquisition Corp (the “Company”), dated October 4, 2023 (the “Proxy Statement”), that was sent to you in connection with the Company’s special meeting of shareholders scheduled for 9:00 a.m., Eastern Time, on October 30, 2023, virtually, at https://www.cstproxy.com/sdcledge/ext2023 (the “Extension Meeting”).

At the Extension Meeting, the Company’s shareholders will be asked to consider and vote upon a proposal to amend the Company’s Amended and Restated Memorandum and Articles of Association to extend the date by which the Company must (1) consummate a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses or entities (an “initial business combination”) or (2) (i) cease its operations except for the purpose of winding up if it fails to complete such initial business combination and (ii) redeem all of the Class A ordinary shares, par value $0.0001 per share, of the Company (the “Class A Ordinary Shares”) included as part of the units sold in the Company’s initial public offering that was consummated on November 2, 2021 (the “IPO”), from November 2, 2023 to March 2, 2024 (the “Extended Date”) and to allow the board of directors of the Company (the “Board”), without another shareholder vote, to elect to further extend the date to consummate an initial business combination after the Extended Date up to four times, by an additional month each time, upon two days’ advance notice prior to the applicable deadline, up to July 2, 2024 (the “Additional Extension Date” and together with the Extended Date the “Extension,” and such proposal, the “Extension Proposal”).

Additional

Amount to be deposited into the Trust Account

The Company has filed this

Supplement with the Securities and Exchange Commission to advise shareholders that each of SDCL EDGE Sponsor LLC (the “Sponsor”),

Sustainable Investors Fund, LP (“Capricorn”), and Seaside Holdings (Nominee) Limited (“Seaside” and, together

with Capricorn, the “A Anchor Investors”) has agreed that if the Extension Proposal is approved and the Extension becomes

effective, it will make deposits of additional funds (the “Extension Deposits”), as described below, into the trust account

established in connection with the Company’s IPO (the “Trust Account”) for the aggregate benefit of public shares that

are not redeemed by the public shareholders in connection with the Extension Proposal (collectively, the “Remaining Public Shares”).

If the Extension Proposal is

approved at the Extension Meeting, promptly following such Extension Meeting, the Company will enter into a funding undertaking and promissory

note agreement (each a “Funding Agreement” and together, the “Funding Agreements”) with each of the Sponsor and

the A Anchor Investors pursuant to which each of the Sponsor and the A Anchor Investors will agree, severally and not jointly, that for

each month, or pro rata portion thereof if less than a month, until the earlier of (i) the date of the extraordinary general meeting held

in connection with the shareholder vote to approve an initial business combination and (ii) July 2, 2024 (or any earlier date of termination,

dissolution or winding up of the Company as determined in the sole discretion of the Company’s board of directors), the Sponsor

and each of the A Anchor Investors will make, in aggregate, Extension Deposits of $0.025 into the Trust Account for each Remaining Public

Share, up to a total of $250,000 per month.

Pursuant to the terms of the

Funding Agreements, the Company undertakes, solely in the event its initial business combination is consummated, to pay the Sponsor and

the A Anchor Investors an amount equal to the aggregate Extension Deposits amounts funded by them. In addition, pursuant to the terms

of the Sponsor’s Funding Agreement, and solely in the event its initial business combination is consummated, the Company undertakes

to issue or procure the issuance of up to 15,000 Class A Ordinary Shares to the Sponsor (assuming no redemptions and that the full Extension

period is needed to execute the initial business combination).

Trust proceeds to be held in an interest-bearing demand deposit account

The Company will instruct Continental Stock Transfer & Trust Company, the trustee of the Trust Account, to, on or prior to the Extension Meeting, liquidate the U.S. government treasury obligations or money market funds held in the Company trust account and thereafter to hold all funds in the Trust Account in cash in an interest-bearing demand deposit account until the earlier of consummation of the Company’s initial business combination or liquidation.

General information

The Company would like to remind its shareholders that only holders of record of the Company’s ordinary shares at the close of business on September 27, 2023, which is the record date for the Extension Meeting, are entitled to notice of the Extension Meeting and to vote and have their votes counted at the Extension Meeting and any adjournments or postponements of the Extension Meeting. On the record date, there were 24,994,057 Ordinary Shares issued and outstanding, including 19,995,246 Class A Ordinary Shares and 4,998,811 Class B Ordinary Shares, par value $0.0001, of the Company. Each share is entitled to one vote per share at the Extension Meeting.

All holders of public shares, regardless of whether they vote for or against the Extension Proposal or do not vote at all, may elect to convert their public shares into their pro rata portion of the trust account if the Extension is approved. To exercise your redemption rights, you must demand in writing that your shares of Class A Ordinary Shares are redeemed for a pro rata portion of the funds held in the trust account and tender your shares to Continental Stock Transfer & Trust Company, the Company’s transfer agent, at least two business days prior to the vote at the Extension Meeting. In order to exercise your redemption right, you need to identify yourself as a beneficial holder and provide your legal name, phone number and address in your written demand. You may tender your shares by either delivering your share certificate to the transfer agent or by delivering your shares electronically using The Depository Trust Company’s DWAC (Deposit/Withdrawal At Custodian) System. If you hold the shares in street name, you will need to instruct the account executive at your bank or broker to withdraw the shares from your account in order to exercise your redemption rights.

Before you vote, you should read the Proxy Statement and other documents that the Company has filed with the Securities and Exchange Commission, together with this Supplement, for more complete information about the Company and the Extension. If you have questions about the Extension or if you need additional copies of the Proxy Statement or the proxy card you should contact:

Morrow Sodali LLC

333 Ludlow Street, 5th Floor, South Tower

Stamford, CT 06902

Individuals call toll-free (800) 662-5200

Banks and brokers call (203) 658-9400

Email: SEDA.info@investor.morrowsodali.com

By Order of the Board,

| /s/ Jonathan Maxwell |

|

|

Jonathan Maxwell

Co-Chief Executive Officer and Director |

|

You are not being asked to vote on any proposed business combination at this time. If the Extension is implemented and you do not elect to redeem your public shares, provided that you are a shareholder on the record date for the shareholder meeting to consider a proposed business combination, you will be entitled to vote on such proposed business combination when it is submitted to shareholders and will retain the right to redeem your public shares for cash in the event such proposed business combination is approved and completed or we have not consummated a proposed business combination by the Extended Date or the Additional Extension Date, as applicable.

Neither the Securities and Exchange Commission nor any state securities commission has determined if the Proxy Statement, as supplemented by this Supplement, is accurate or complete. Any representation to the contrary is a criminal offense.

Your

vote is important. Proxy voting permits shareholders unable to attend the Extension Meeting in person to vote their shares through a

proxy. By appointing a proxy, your shares will be represented and voted in accordance with your instructions. You can vote your

shares by completing and returning your proxy card or by completing the voting instruction form provided to you by your broker.

Proxy cards that are signed and returned but do not include voting instructions will be voted by the proxy as recommended by the

Board. You can change your voting instructions or revoke your proxy at any time prior to the Extension Meeting by

following the instructions included in this proxy statement and on the proxy card.

This Supplement is dated October 23, 2023.

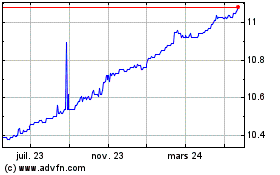

SDCL EDGE Acquisition (NYSE:SEDA)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

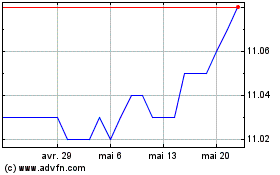

SDCL EDGE Acquisition (NYSE:SEDA)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025