0001012100SEALED AIR CORP/DEfalse00010121002023-11-082023-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 8, 2023

SEALED AIR CORPORATION

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-12139 | | 65-0654331 |

(State or Other

Jurisdiction of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 2415 Cascade Pointe Boulevard | | | |

| Charlotte | North Carolina | | | 28208 |

| (Address of Principal Executive Offices) | | | (Zip Code) |

Registrant’s telephone number, including area code: 980-221-3235

Not Applicable

(Former Name or Former Address, If Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.10 per share | SEE | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On November 8, 2023,Sealed Air Corporation (the “Company”) announced, together with Sealed Air Corporation (US), a wholly owned subsidiary of the Company (together with the Company, the “Issuers”), the pricing of the Issuers’ offering of $425 million aggregate principal amount of 7.250% senior notes due 2031 (the “Notes”). The Issuers expect the offering to close on November 20, 2023, subject to customary closing conditions. A copy of the press release, dated November 8, 2023, announcing the pricing of the offering of the Notes is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File--the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| | SEALED AIR CORPORATION |

| | | |

| | | |

| | By: | /s/ Dustin J. Semach |

| | Name: | Dustin J. Semach |

| | Title: | Interim Co-President and Co-Chief Executive Officer, and Chief Financial Officer |

| Dated: November 8, 2023 | | |

SEE Announces Pricing of Senior Notes

CHARLOTTE, N.C., November 8, 2023 — Sealed Air Corporation (“SEE”) (NYSE: SEE) today announced, together with Sealed Air Corporation (US) (together with SEE, the “Issuers”), the pricing of the Issuers’ offering of 7.250% senior notes due 2031 (the “Notes”). The Notes will be jointly and severally, and irrevocably and unconditionally, guaranteed on a senior unsecured basis by each of SEE’s existing and future wholly owned domestic subsidiaries that guarantee its senior secured credit facilities, subject to release under certain circumstances, although, for purposes of this offering, Sealed Air Corporation (US) is a co-issuer and not a guarantor.

The Issuers intend to use the net proceeds from the offering of the Notes, (i) to repurchase any or all of SEE’s outstanding 5.125% senior notes due 2024 (the “2024 Notes”) pursuant to the tender offer commenced by SEE today and to pay related premiums, fees and expenses in connection therewith, and (ii) to the extent of any remaining proceeds after giving effect to the foregoing transaction, for general corporate purposes. The tender offer is conditioned upon, among other things, the completion of the offering of the Notes; however, the closing of the offering of the Notes is not conditioned on the consummation of the tender offer. If SEE purchases less than the full aggregate principal amount of the outstanding 2024 Notes, SEE intends to satisfy and discharge any remaining 2024 Notes in accordance with the terms of the indenture governing the 2024 Notes. This announcement does not constitute an offer to purchase the 2024 Notes or a notice of satisfaction and discharge with respect to the 2024 Notes. Net proceeds from the sale of the Notes, after initial purchasers’ discounts and commissions and SEE’s estimated fees and expenses, are expected to be approximately $421 million. The Issuers expect the offering to close on November 20, 2023, subject to customary closing conditions.

The Notes and related guarantees will be offered only to qualified institutional buyers under Rule 144A of the Securities Act of 1933, as amended (the “Securities Act”), and to non-U.S. persons in transactions outside the United States under Regulation S of the Securities Act. The Notes have not been registered under the Securities Act, and, unless so registered, may not be offered or sold in the United States absent registration or an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and other applicable securities laws.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the Notes, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

###

About SEE

SEE (NYSE: SEE) is in business to protect, to solve critical packaging challenges, and to make our world better than we find it. Our automated packaging solutions promote a safer, more resilient, and less wasteful global food, fluids and liquids supply chain, enable e-commerce, and protect goods in transit from damage.

The company, under its former trade name, Sealed Air, announced its new SEE corporate brand and logo in May 2023.

Our globally recognized solution brands include CRYOVAC® food packaging, LIQUIBOX® fluids and liquids systems, SEALED AIR® protective packaging, AUTOBAG® automated packaging systems, BUBBLE WRAP® packaging, SEE Automation™ and prismiq™ digital packaging and printing.

Our partnership with customers creates value through sustainable, automated, and digital packaging solutions, leveraging our industry-leading expertise in materials, automation systems, engineering and technology.

SEE has approximately 17,300 employees (including Liquibox employees) who serve customers in 120 countries/territories.

Website Information

We routinely post important information for investors on our website in the Investors section. We use this website as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investors section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. The information contained on, or that may be accessed through, our website is not incorporated by reference into, and is not a part of, this document.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 concerning our business, consolidated financial condition, results of operations and cash flows. Forward-looking statements are subject to risks and uncertainties, many of which are outside our control, which could cause actual results to differ materially from these statements. Therefore, you should not rely on any of these forward-looking statements. Forward-looking statements can be identified by such words as “anticipate,” “believe,” “plan,” “assume,” “could,” “should,” “estimate,” “expect,” “intend,” “potential,” “seek,” “predict,” “may,” “will” and similar references to future periods. All statements other than statements of historical facts included in this press release regarding our strategies, prospects, financial condition, operations, costs, plans and objectives are forward-looking statements.

Examples of forward-looking statements include, among others, statements we make regarding expected future operating results, expectations regarding the results of restructuring and other programs, expectations regarding future impacts resulting from the Liquibox acquisition, anticipated levels of capital expenditures and expectations of the effect on our financial condition of claims, litigation, environmental costs, contingent liabilities and governmental and regulatory investigations and proceedings.

The following are important factors that we believe could cause actual results to differ materially from those in our forward-looking statements: global economic and political conditions, including recessionary and inflationary pressures, currency translation and devaluation effects, changes in raw material pricing and availability, competitive conditions, the success of new product offerings, failure to realize synergies and other financial benefits from the acquisition of Liquibox within the expected time frames, greater than expected costs or difficulties related to the integration of Liquibox, consumer preferences, the effects of animal and food-related health issues, the effects of epidemics or pandemics, including the Coronavirus Disease 2019, negative impacts related to the ongoing conflict between Russia and Ukraine and related sanctions, export restrictions and other counteractions thereto, uncertainties relating to existing or potential increased hostilities in the Middle East, changes in energy costs, environmental matters, the success of our restructuring activities, the success of our merger, acquisition and equity investment strategies, the success of our financial growth, profitability, cash generation and manufacturing strategies and our cost reduction and productivity efforts, changes in our credit ratings, the tax benefit associated with the Settlement agreement (as defined in our 2022 Annual Report on Form 10-K), regulatory actions and legal matters and the other information referenced in the “Risk Factors” section appearing in our most recent Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, and as revised and updated by our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Any forward-looking statement made by us is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking

statements, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Company Contacts

Investor Relations

Brian Sullivan

brian.c.sullivan@sealedair.com

704.503.8841

Louise Lagache

Louise.lagache@sealedair.com

Media

Christina Griffin

christina.griffin@sealedair.com

704.430.5742

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

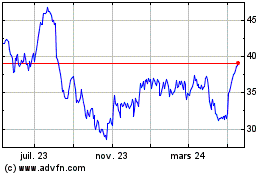

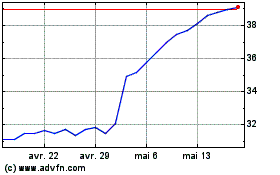

Sealed Air (NYSE:SEE)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Sealed Air (NYSE:SEE)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024