Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

26 Décembre 2023 - 12:04PM

Edgar (US Regulatory)

UNITED STATES SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission file number 001-34919

SUMITOMO MITSUI FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

1-2, Marunouchi 1-chome, Chiyoda-ku, Tokyo 100-0005, Japan

(Address of principal executive offices)

|

|

|

|

|

|

|

|

|

|

|

| Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: |

|

|

Form 20-F |

☒ |

|

or |

|

|

Form 40-F |

☐ |

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE INTO THE PROSPECTUS FORMING A PART OF

SUMITOMO MITSUI FINANCIAL GROUP, INC.’S REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-273003) AND TO BE A PART OF SUCH PROSPECTUS FROM THE DATE ON WHICH THIS REPORT IS FURNISHED, TO THE

EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

| Sumitomo Mitsui Financial Group, Inc. |

|

|

| By: |

|

/s/ Jun Okahashi |

|

|

Name: Jun Okahashi |

|

|

Title: General Manager, Financial Accounting Dept. |

Date: December 25, 2023

Sumitomo Mitsui Financial Group, Inc.

Notice Regarding Submission of Interim Report on Form 6-K

to the U.S. Securities and Exchange Commission

TOKYO, December 25, 2023 --- Sumitomo Mitsui Financial Group, Inc. (the “Company,” President and Group Chief

Executive Officer: Toru Nakashima) hereby announces that, on December 22, 2023 (Eastern Standard Time), the Company submitted an interim report on Form 6-K to the U.S. Securities and Exchange Commission (“SEC”).

A copy of the interim report on Form 6-K can be viewed and obtained at the Company’s website at

https://www.smfg.co.jp/english/investor/financial/disclosure.html or on EDGAR, the SEC’s Electronic Data Gathering, Analysis, and Retrieval system.

Attachment:

(Reference) Consolidated

Financial Statements (IFRS) (Unaudited)

|

|

|

| |

|

| This document contains a summary

of the Company’s consolidated interim financial information under International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board that was disclosed in its interim report on Form 6-K

submitted to the U.S. Securities and Exchange Commission on December 22, 2023. This document does not contain all of the information in the interim report on Form 6-K that may be important to you. You should read the entire interim report on Form

6-K carefully to obtain a comprehensive understanding of the Company’s business and financial data under IFRS and related issues.

This document contains “forward-looking statements” (as defined in the U.S. Private Securities Litigation Reform Act of 1995),

regarding the intent, belief or current expectations of the Company and its management with respect to the Company’s future financial condition and results of operations. In many cases but not all, these statements contain words such as

“anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “probability,” “risk,” “project,” “should,” “seek,”

“target,” “will” and similar expressions. Such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ from those expressed in or implied by such

forward-looking statements contained or deemed to be contained herein. The risks and uncertainties which may affect future performance include: deterioration of Japanese and global economic conditions and financial markets; declines in the value of

the Company’s securities portfolio; incurrence of significant credit-related costs; the Company’s ability to successfully implement its business strategy through its subsidiaries, affiliates and alliance partners; and exposure to new risks

as the Company expands the scope of its business. Given these and other risks and uncertainties, you should not place undue reliance on forward-looking statements, which speak only as of the date of this document. The Company undertakes no

obligation to update or revise any forward-looking statements. Please refer to the Company’s most recent disclosure documents such as its annual report on Form 20-F and other documents submitted to the U.S. Securities and Exchange Commission,

as well as its earnings press releases, for a more detailed description of the risks and uncertainties that may affect its financial conditions, its operating results, and investors’ decisions. |

|

|

– 1 –

(Reference) Consolidated Financial Statements (IFRS) (Unaudited)

Consolidated Statements of Financial Position (Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

At March 31, |

|

|

At September 30, |

|

| |

|

2023 |

|

|

2023 |

|

| Assets: |

|

|

|

|

|

|

|

|

| Cash and deposits with banks |

|

¥ |

76,465,511 |

|

|

¥ |

78,237,000 |

|

| Call loans and bills bought |

|

|

5,684,812 |

|

|

|

6,088,010 |

|

| Reverse repurchase agreements and cash collateral on securities borrowed |

|

|

11,024,084 |

|

|

|

13,402,684 |

|

| Trading assets |

|

|

4,585,915 |

|

|

|

5,310,998 |

|

| Derivative financial instruments |

|

|

8,649,947 |

|

|

|

13,015,294 |

|

| Financial assets at fair value through profit or loss |

|

|

1,488,239 |

|

|

|

1,900,462 |

|

| Investment securities |

|

|

27,595,598 |

|

|

|

34,082,730 |

|

| Loans and advances |

|

|

111,891,134 |

|

|

|

116,285,384 |

|

| Investments in associates and joint ventures |

|

|

1,141,250 |

|

|

|

1,384,292 |

|

| Property, plant and equipment |

|

|

1,832,241 |

|

|

|

1,877,012 |

|

| Intangible assets |

|

|

905,028 |

|

|

|

973,871 |

|

| Other assets |

|

|

6,167,202 |

|

|

|

8,929,755 |

|

| Current tax assets |

|

|

190,267 |

|

|

|

71,559 |

|

| Deferred tax assets |

|

|

65,810 |

|

|

|

81,596 |

|

| Total assets |

|

¥ |

257,687,038 |

|

|

¥ |

281,640,647 |

|

| Liabilities: |

|

|

|

|

|

|

|

|

| Deposits |

|

¥ |

172,927,810 |

|

|

¥ |

178,121,198 |

|

| Call money and bills sold |

|

|

2,569,056 |

|

|

|

2,161,558 |

|

| Repurchase agreements and cash collateral on securities lent |

|

|

17,786,026 |

|

|

|

23,604,811 |

|

| Trading liabilities |

|

|

3,291,089 |

|

|

|

4,187,152 |

|

| Derivative financial instruments |

|

|

10,496,855 |

|

|

|

15,298,715 |

|

| Financial liabilities designated at fair value through profit or loss |

|

|

414,106 |

|

|

|

421,392 |

|

| Borrowings |

|

|

15,371,801 |

|

|

|

16,060,190 |

|

| Debt securities in issue |

|

|

11,984,994 |

|

|

|

13,725,816 |

|

| Provisions |

|

|

247,344 |

|

|

|

225,396 |

|

| Other liabilities |

|

|

8,703,413 |

|

|

|

12,273,302 |

|

| Current tax liabilities |

|

|

41,649 |

|

|

|

46,800 |

|

| Deferred tax liabilities |

|

|

315,930 |

|

|

|

449,682 |

|

| Total liabilities |

|

|

244,150,073 |

|

|

|

266,576,012 |

|

| Equity: |

|

|

|

|

|

|

|

|

| Capital stock |

|

|

2,342,537 |

|

|

|

2,344,038 |

|

| Capital surplus |

|

|

645,774 |

|

|

|

635,915 |

|

| Retained earnings |

|

|

7,199,479 |

|

|

|

7,563,151 |

|

| Treasury stock |

|

|

(151,799 |

) |

|

|

(17,722 |

) |

| Equity excluding other reserves |

|

|

10,035,991 |

|

|

|

10,525,382 |

|

| Other reserves |

|

|

2,629,000 |

|

|

|

3,288,687 |

|

| Equity attributable to shareholders of Sumitomo Mitsui Financial Group, Inc. |

|

|

12,664,991 |

|

|

|

13,814,069 |

|

| Non-controlling interests |

|

|

106,172 |

|

|

|

123,871 |

|

| Equity attributable to other equity instruments holders |

|

|

765,802 |

|

|

|

1,126,695 |

|

| Total equity |

|

|

13,536,965 |

|

|

|

15,064,635 |

|

| Total equity and liabilities |

|

¥ |

257,687,038 |

|

|

¥ |

281,640,647 |

|

– 2 –

Consolidated Income Statements (Unaudited)

(In millions, except per share data)

|

|

|

|

|

|

|

|

|

| |

|

For the six months ended

September 30, |

|

| |

|

2022 |

|

|

2023 |

|

| Interest income |

|

¥ |

1,424,087 |

|

|

¥ |

2,776,392 |

|

| Interest expense |

|

|

573,910 |

|

|

|

1,887,450 |

|

| Net interest income |

|

|

850,177 |

|

|

|

888,942 |

|

|

|

|

| Fee and commission income |

|

|

607,546 |

|

|

|

690,715 |

|

| Fee and commission expense |

|

|

112,737 |

|

|

|

119,089 |

|

| Net fee and commission income |

|

|

494,809 |

|

|

|

571,626 |

|

|

|

|

| Net trading income |

|

|

565,037 |

|

|

|

487,524 |

|

| Net income from financial assets and liabilities at fair value through profit or

loss |

|

|

171,708 |

|

|

|

79,984 |

|

| Net investment income (loss) |

|

|

(4,915 |

) |

|

|

61,733 |

|

| Other income |

|

|

85,818 |

|

|

|

57,734 |

|

| Total operating income |

|

|

2,162,634 |

|

|

|

2,147,543 |

|

|

|

|

| Impairment charges on financial assets |

|

|

88,025 |

|

|

|

130,253 |

|

| Net operating income |

|

|

2,074,609 |

|

|

|

2,017,290 |

|

|

|

|

| General and administrative expenses |

|

|

948,612 |

|

|

|

1,072,003 |

|

| Other expenses |

|

|

162,686 |

|

|

|

129,601 |

|

| Operating expenses |

|

|

1,111,298 |

|

|

|

1,201,604 |

|

|

|

|

| Share of post-tax profit of associates and

joint ventures |

|

|

61,241 |

|

|

|

55,286 |

|

| Profit before tax |

|

|

1,024,552 |

|

|

|

870,972 |

|

|

|

|

| Income tax expense |

|

|

247,158 |

|

|

|

208,185 |

|

| Net profit |

|

¥ |

777,394 |

|

|

¥ |

662,787 |

|

|

|

|

| Profit attributable to: |

|

|

|

|

|

|

|

|

| Shareholders of Sumitomo Mitsui Financial Group, Inc. |

|

¥ |

762,185 |

|

|

¥ |

651,127 |

|

| Non-controlling interests |

|

|

9,603 |

|

|

|

5,891 |

|

| Other equity instruments holders |

|

|

5,606 |

|

|

|

5,769 |

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

| Basic |

|

¥ |

555.91 |

|

|

¥ |

487.79 |

|

| Diluted |

|

|

555.72 |

|

|

|

487.65 |

|

– 3 –

Consolidated Statements of Comprehensive Income (Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

For the six months ended

September 30, |

|

| |

|

2022 |

|

|

2023 |

|

| Net profit |

|

¥ |

777,394 |

|

|

¥ |

662,787 |

|

|

|

|

| Other comprehensive income: |

|

|

|

|

|

|

|

|

| Items that will not be reclassified to profit or loss: |

|

|

|

|

|

|

|

|

| Remeasurements of defined benefit plans: |

|

|

|

|

|

|

|

|

| Gains (losses) arising during the period, before tax |

|

|

15,329 |

|

|

|

(6,886) |

|

| Equity instruments at fair value through other comprehensive income: |

|

|

|

|

|

|

|

|

| Gains (losses) arising during the period, before tax |

|

|

(219,566 |

) |

|

|

760,840 |

|

| Own credit on financial liabilities designated at fair value through profit or loss: |

|

|

|

|

|

|

|

|

| Gains (losses) arising during the period, before tax |

|

|

1,035 |

|

|

|

(7,589) |

|

| Share of other comprehensive income (loss) of associates and joint ventures |

|

|

12,073 |

|

|

|

1,790 |

|

| Income tax relating to items that will not be reclassified |

|

|

62,244 |

|

|

|

(223,425) |

|

| Total items that will not be reclassified to profit or loss, net of tax |

|

|

(128,885 |

) |

|

|

524,730 |

|

|

|

|

| Items that may be reclassified subsequently to profit or loss: |

|

|

|

|

|

|

|

|

| Debt instruments at fair value through other comprehensive income: |

|

|

|

|

|

|

|

|

| Gains (losses) arising during the period, before tax |

|

|

(652,810 |

) |

|

|

(484,785) |

|

| Reclassification adjustments for (gains) losses included in net profit, before tax |

|

|

157,216 |

|

|

|

45,420 |

|

| Exchange differences on translating foreign operations: |

|

|

|

|

|

|

|

|

| Gains (losses) arising during the period, before tax |

|

|

655,317 |

|

|

|

487,098 |

|

| Reclassification adjustments for (gains) losses included in net profit, before tax |

|

|

193 |

|

|

|

— |

|

| Share of other comprehensive income (loss) of associates and joint ventures |

|

|

38,125 |

|

|

|

33,910 |

|

| Income tax relating to items that may be reclassified |

|

|

147,427 |

|

|

|

132,461 |

|

| Total items that may be reclassified subsequently to profit or loss, net of tax |

|

|

345,468 |

|

|

|

214,104 |

|

|

|

|

| Other comprehensive income, net of tax |

|

|

216,583 |

|

|

|

738,834 |

|

| Total comprehensive income |

|

¥ |

993,977 |

|

|

¥ |

1,401,621 |

|

|

|

|

| Total comprehensive income attributable to: |

|

|

|

|

|

|

|

|

|

|

|

| Shareholders of Sumitomo Mitsui Financial Group, Inc. |

|

¥ |

976,191 |

|

|

¥ |

1,386,696 |

|

| Non-controlling interests |

|

|

12,180 |

|

|

|

9,156 |

|

| Other equity instruments holders |

|

|

5,606 |

|

|

|

5,769 |

|

– 4 –

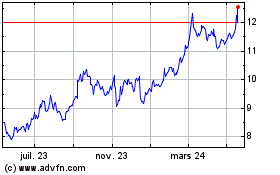

Sumitomo Mitsui Financial (NYSE:SMFG)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

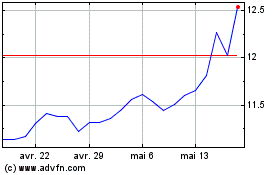

Sumitomo Mitsui Financial (NYSE:SMFG)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024