false000140797300014079732023-11-152023-11-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 15, 2023 |

Sonendo, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40988 |

20-5041718 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

26061 Merit Circle, Suite 102 |

|

Laguna Hills, California |

|

92653 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (949) 766-3636 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

SONX |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On November 15, 2023, Sonendo, Inc. (the “Company”) received notice (the “Notice”) from the New York Stock Exchange (the “NYSE”) that the Company was not in compliance with the continued listing standard set forth in Section 802.01B of the NYSE’s Listed Company Manual (“Section 802.01B”) because the Company’s average global market capitalization over a consecutive 30 trading-day period was less than $50 million and, at the same time, its stockholders’ equity was less than $50 million.

As set forth in the notice, as of November 14, 2023, the 30 trading-day average global market capitalization of the Company was approximately $15.5 million and the Company’s last reported stockholders’ equity as of September 30, 2023 was approximately $37.8 million.

The Company has notified the NYSE that it intends to submit a plan to regain compliance within 45 days of the notice received on November 15, 2023 advising the NYSE of definitive action it has, or will take to regain compliance. If the NYSE accepts the Company’s plan, the Company’s common stock, par value $0.001 per share (the “Common Stock”), may continue to be listed and traded on the NYSE during the 18-month cure period, subject to the Company’s pending NYSE appeal and hearing determination.

On November 21, 2023, the Company received an additional notice from the NYSE that the Company was not in compliance with the continued listing standard set forth in Section 802.01B because the Company failed to maintain an average global market capitalization over a consecutive 30-day trading period of at least $15,000,000 under Section 802.01B. Accordingly, the NYSE determined to commence proceedings to delist the Common Stock.

Trading of the Common Stock will be suspended effective at the opening of business Eastern Standard Time on November 22, 2023. The NYSE will apply to the Securities and Exchange Commission (“SEC”) to delist the Common Stock upon completion of all applicable procedures. The Company intends to appeal the NYSE’s determination.

In anticipation of the suspension of trading of the Common Stock on the NYSE, the board of directors of the Company on November 20, 2023 approved the trading of its Common Stock on the OTCQX® Best Market (“OTCQX”), the highest market tier operated by the OTC Markets Group Inc. The Company applied for trading on OTCQX and will commence trading on the OTCQX on November 22, 2023 under the symbol “SONX.” The Company will continue to file the same types of annual and periodic reports and other information it currently files with the SEC.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 17, 2023, Michael Smith, Chief Commercial Officer of the Company, provided notice of his resignation from the Company, effective December 1, 2023, to pursue new opportunities. Mr. Smith’s resignation is not a result of any disagreement with the Company on any matter relating to the Company’s financial reporting, operations, policies or practices. Due to the nature of his employment termination (not a Qualifying Termination as defined in the Company’s Executive Severance Plan), Mr. Smith will not be entitled to receive any severance payments under the Company’s Executive Severance Plan.

“Since joining the Company in June 2021, Michael has been a valuable member of the executive team, and helped create a commercial foundation which will propel the company in the future,” said Sonendo President and CEO Bjarne Bergheim. “We appreciate Michael’s contributions to the Company and wish him the best as he pursues other goals.”

Item 7.01 Regulation FD Disclosure.

On November 21, 2023, the Company issued a press release related to the foregoing mentioned in Item 3.01. Copy of the press release is attached as Exhibit 99.1 to this Current Report and is incorporated by reference to this Item 7.01.

The information in this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is not to be incorporated by reference into any filing by Company under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language contained in such filing, unless otherwise expressly stated in such filing.

Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements (statements which are not historical facts) within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, express or implied forward-looking statements relating to the Company’s ability to successfully appeal the NYSE’s determination; Company’s ability to successfully list on the OTCQX®Best Market and the Company’s anticipated business and financial performance on an on-going basis as well as following the delist of the Common Stock from the NYSE. You are cautioned that such statements are not guarantees of future performance and that our actual results may differ materially from those set forth in the forward-looking statements. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions;

speak only as of the date they are made; and, as a result, are subject to risks and uncertainties that may change at any time. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: logistical issues associated with transferring the trading of the Company’s securities from the NYSE to the OTC; the Company’s ability to satisfy the criteria to trade its securities on OTCQX; and there is no assurance that an active market will be maintained for the Common Stock on the OTCQX. Other factors that could cause the Company’s actual results to differ materially from these forward-looking statements are described in detail in our registration statements, reports and other filings with the Securities and Exchange Commission, including the “Risk Factors” set forth in our Annual Report on Form 10-K, as supplemented by our quarterly reports on Form 10-Q. Such filings are available on our website or at www.sec.gov. We undertake no obligation to publicly update or revise forward-looking statements to reflect subsequent developments, events, or circumstances, except as may be required under applicable securities laws. Readers are cautioned not to put undue reliance on forward-looking statements, and the Company assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Item 9.01 Financial Statements and Exhibits.

The following exhibit is furnished as part of this report:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

SONENDO, INC. |

|

|

|

|

Date: |

November 21, 2023 |

By: |

/s/ Bjarne Bergheim |

|

|

|

Bjarne Bergheim

President and Chief Executive Officer |

Sonendo, Inc. Announces Suspension of NYSE Trading, Will Commence Trading on the OTCQX Effective November 22, 2023

November 21, 2023

LAGUNA HILLS, Calif.--(BUSINESS WIRE)--Sonendo, Inc. (NYSE: SONX) (“Sonendo” or the “Company”), a leading dental technology company and developer of the GentleWave® System, today announced that, on November 15, 2023, it received a notice from the New York Stock Exchange (the “NYSE”) that the Company was no longer in compliance with the NYSE continued listing standards set forth in Section 802.01B of the NYSE’s Listed Company Manual (“Section 802.01B”) due to the Company’s average global market capitalization over a consecutive 30 trading-day period being less than $50 million and its stockholders’ equity being less than $50 million.

As set forth in the notice, as of November 14, 2023, the 30 trading-day average global market capitalization of the Company was approximately $15.5 million and the Company’s last reported stockholders’ equity as of September 30, 2023 was approximately $37.8 million.

The Company has notified the NYSE that it intends to submit a plan to regain compliance within 45 days of the notice received on November 15, 2023 advising the NYSE of definitive action it has or will take to regain compliance. If the NYSE accepts the Company’s plan, the Company’s common stock, par value $0.001 per share (the “Common Stock”), may continue to be listed and traded on the NYSE during the 18-month cure period, subject to the Company’s pending NYSE appeal and hearing determination.

On November 21, 2023, the Company received an additional notice from the NYSE that the NYSE suspended trading of, and commenced proceedings to delist, the Common Stock, effective at the opening of business Eastern Standard Time on November 22, 2023. This suspension is being made because the Company has not complied with Section 802.01B, which requires listed companies to maintain an average global market capitalization over a consecutive 30 trading day period of at least $15 million. The Board of Directors and management of the Company intends to take all advisable actions in order to maintain its listing on the NYSE and will appeal the NYSE’s decision.

In anticipation of the suspension of trading of the Common Stock on NYSE, the Company applied to trade its Common Stock on the OTCQX® Best Market (the “OTCQX”), the highest market tier operated by the OTC Markets Group Inc. and will commence trading on the OTCQX on November 22, 2023 under the symbol “SONX.” For quotes or additional information on the OTCQX, please visit otcmarkets.com.

The transition to the OTCQX will not affect the Company’s business operations. The Company intends to continue to operate in strict compliance with SEC rules and regulations, including filing quarterly financial statements, having independently audited financials, and maintaining an independent Board of Directors, and follow best corporate governance practices of a public company.

“We firmly believe that our current stock price and market capitalization do not reflect the intrinsic value of Sonendo’s underlying business. “We remain steadfast in our commitment to the Company’s fundamentals, the value of our GentleWave technology, and the prospect of leveraging meaningful growth opportunities,” said Bjarne Bergheim, President and Chief Executive Officer of Sonendo. “The change in our listing status on the New York Stock Exchange does not deter our unwavering focus on Sonendo’s core mission, Saving Teeth. Improving Lives.™”

About Sonendo

Sonendo is a commercial-stage medical technology company focused on saving teeth from tooth decay, the most prevalent chronic disease globally. Sonendo develops and manufactures the GentleWave® System, an innovative technology platform designed to treat tooth decay by cleaning and disinfecting the microscopic spaces within teeth without the need to remove tooth structure. The system utilizes a proprietary mechanism of action, which combines procedure fluid optimization, broad-spectrum acoustic energy and advanced fluid dynamics, to debride and disinfect deep regions of the complex root canal system in a less invasive procedure that preserves tooth structure. The clinical benefits of the GentleWave® System when compared to conventional methods of root canal therapy include improved

clinical outcomes, such as superior cleaning that is independent of root canal complexity and tooth anatomy, high and rapid rates of healing and minimal to no post-operative pain. In addition, the GentleWave® System can improve the workflow and economics of dental practices.

Sonendo is also the parent company of TDO® Software, the developer of widely used endodontic practice management software solutions, designed to simplify practice workflow. TDO® Software integrates practice management, imaging, referral reporting and cone beam computed tomography imaging, and offers built-in communication with the GentleWave® System.

For more information on Sonendo, visit www.sonendo.com. For more information on the GentleWave® System, visit www.gentlewave.com/doctor.

Forward-Looking Statements

This press release includes forward-looking statements (statements which are not historical facts) within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, express or implied forward-looking statements relating to the Company’s ability to successfully appeal the NYSE’s determination; Company’s ability to successfully list on the OTCQX® Best Market and the Company’s anticipated business and financial performance on an on-going basis as well as following the delist of the Common Stock from the NYSE. You are cautioned that such statements are not guarantees of future performance and that our actual results may differ materially from those set forth in the forward-looking statements. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions; speak only as of the date they are made; and, as a result, are subject to risks and uncertainties that may change at any time. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: logistical issues associated with transferring the trading of the Company’s securities from the NYSE to the OTC; the Company’s ability to satisfy the criteria to trade its securities on OTCQX; and there is no assurance that an active market will be maintained for the Common Stock on the OTCQX. Other factors that could cause the Company’s actual results to differ materially from these forward-looking statements are described in detail in our registration statements, reports and other filings with the Securities and Exchange Commission, including the “Risk Factors” set forth in our Annual Report on Form 10-K, as supplemented by our quarterly reports on Form 10-Q. Such filings are available on our website or at www.sec.gov. We undertake no obligation to publicly update or revise forward-looking statements to reflect subsequent developments, events, or circumstances, except as may be required under applicable securities laws. Readers are cautioned not to put undue reliance on forward-looking statements, and the Company assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Investor Contact:

Greg Chodaczek

Gilmartin Group

ir@sonendo.com

v3.23.3

Document And Entity Information

|

Nov. 15, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 15, 2023

|

| Entity Registrant Name |

Sonendo, Inc.

|

| Entity Central Index Key |

0001407973

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-40988

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

20-5041718

|

| Entity Address, Address Line One |

26061 Merit Circle, Suite 102

|

| Entity Address, City or Town |

Laguna Hills

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92653

|

| City Area Code |

(949)

|

| Local Phone Number |

766-3636

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

SONX

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

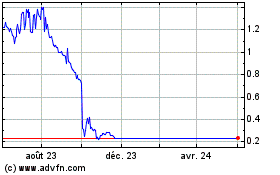

Sonendo (NYSE:SONX)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Sonendo (NYSE:SONX)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024