State Street Announces Issuance of $2.25 Billion of Senior Debt

25 Novembre 2024 - 10:56PM

Business Wire

- This offering reinforces State Street’s commitment to inclusion

and diversity in the financial services industry

State Street Corporation (“State Street”) (NYSE: STT) announced

today an issuance of $2.25 billion in aggregate principal amount of

senior debt by its principal banking subsidiary, State Street Bank

and Trust Company. The offering, which closed today, was structured

in keeping with State Street’s ongoing inclusion, diversity, and

equity efforts, with Academy Securities, Inc. (“Academy

Securities”) acting as a joint book-running manager and AmeriVet

Securities, Inc., CastleOak Securities L.P., Loop Capital Markets

LLC, and Samuel A. Ramirez & Company, Inc. each acting as

co-managers. All five broker-dealers are owned by underrepresented

groups and, collectively, have underwritten 40% of the securities

in the issuance. The underwriting syndicate also included Morgan

Stanley & Co. LLC, Deutsche Bank Securities Inc., and Goldman

Sachs & Co. LLC, each acting as joint book-running

managers.

“At State Street, we value diverse perspectives. Today’s debt

issuance, achieved in partnership with diverse and veteran-owned

firms, highlights our continued commitment to help create a more

inclusive economy by fueling business growth for these firms,” said

Paul Francisco, chief diversity officer for State Street. “Working

together with all of our stakeholders, our debt issuance initiative

aims to build stronger, more resilient markets and

communities.”

The underwriting syndicate on this debt offering has been

structured in a manner consistent with State Street’s inclusion,

diversity, and equity strategy, reflecting State Street’s ongoing

efforts to amplify its sustainability and impact initiatives.

“Academy Securities is honored to serve as a joint

booking-running manager on today’s benchmark transaction. State

Street is a firm that shares our passion for exceeding clients’

expectations while supporting our nation’s military veteran heroes.

Through our partnership, Academy Securities will be able to help

train additional veterans for a meaningful career in finance while

executing at the highest level,” said Chance Mims, founder and

chief executive officer of Academy Securities.

About State Street Corporation

State Street Corporation (NYSE: STT) is one of the world's

leading providers of financial services to institutional investors

including investment servicing, investment management and

investment research and trading. With $46.8 trillion in assets

under custody and/or administration and $4.7 trillion* in assets

under management as of September 30, 2024, State Street operates

globally in more than 100 geographic markets and employs

approximately 53,000 worldwide. For more information, visit State

Street's website at www.statestreet.com.

* Assets under management as of September 30, 2024 includes

approximately $83 billion of assets with respect to SPDR® products

for which State Street Global Advisors Funds Distributors, LLC

(“SSGA FD”) acts solely as the marketing agent. SSGA FD and State

Street Global Advisors are affiliated.

© 2024 State Street Corporation

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241125588589/en/

Media Contact: Brendan Paul Mobile: +1 401 644 9182

Bpaul2@statestreet.com

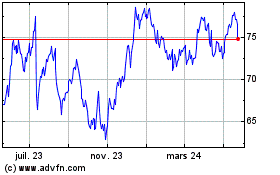

State Street (NYSE:STT)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

State Street (NYSE:STT)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025