UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2024.

Commission File Number 001-38755

Suzano S.A.

(Exact name of registrant as specified in its charter)

SUZANO INC.

(Translation of Registrant’s Name into English)

Av. Professor Magalhaes Neto, 1,752

10th Floor, Rooms 1010 and 1011

Salvador, Brazil 41 810-012

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F

x Form 40-F

¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

OPINION OF THE FISCAL COUNCIL

Dear Shareholders,

The members of the Fiscal Council of Suzano S.A.

(“Company”), at a meeting that began on February 26, 2024 and ended on February 28, 2024, in exercise of its legal

and statutory functions, examined the Management Report and the Individual and Consolidated financial statements of the Company and their

respective Explanatory Notes, all related to the year ended December 31, 2023, accompanied by the report by PricewaterhouseCoopers

Auditores Independentes Ltda., issued without qualifications, and having found these documents in accordance with the applicable legal

requirements, opined in favor of their approval by the General Meeting.

São Paulo, February 28, 2024.

Rubens Barletta

Member

Luiz Augusto Marques Paes

Member

Eraldo Soares Peçanha

Member

SUMMARIZED ANNUAL REPORT OF THE STATUTORY AUDIT

COMMITTEE (“CAE”)

About the Committee

The CAE of Suzano S.A. (“Company”)

is a statutory body set up in permanent operation established in April 2019, according to the best practices of corporate governance.

According to its Internal Regulations and the

Company's Bylaws, the CAE will function on a permanent basis, will report to the Board of Directors and will be composed of at least 3

(three) and at most 5 (five) members, elected by the Company’s Board of Directors of the, and: (i) at least one of the CAE

members must also be an independent member of the Board; (ii) at least one of the members of the CAE has proven financial literacy

("financial literacy"), as established in these Bylaws and in the applicable legislation (especially in Section 10A of

the "Securities Exchange Act of 1934" and respective rules) and in the rules issued by Organs regulatory bodies of the

capital markets and stock exchanges on which the Company's securities are listed; (iii) all members meet the requirements set forth

in Article 147 of Law No. 6,404/76.

Currently,

the CAE is composed of 4 (four) members with a 2 (two) year term, the

last election being held on May 4, 2022, that is, all members have a term valid until the first meeting of the Board of Directors

to be held after the Company’s General Meeting that deliberates on the accounts for the fiscal year to end on December 31,

2023. The majority of members is independent. Among the CAE members, Ms. Ana Paula Pessoa, acts as coordinator and also a member

of the Company's Board of Directors, together with Mr. Paulo Rogerio Caffarelli, also member of the Board of Directors, Mr. Carlos

Biedermann, as financial specialist and Mr. Marcelo Moses de Oliveira Lyrio.

In accordance with its Internal Regulations, the

CAE is responsible, among other functions, to review, supervise and ensure (i) the quality and integrity of the Company's quarterly

financial information, interim financial statements and financial statements (ii) compliance with legal and regulatory requirements

(iii) evaluate, together with the independent auditors, the critical accounting policies and practices adopted by the Company (iv) evaluate

and recommend to the Board of Directors the Company’s Authority Policy and (v) the performance, independence and quality of

the work of the independent audit companies and the internal audit and (vi) quality and effectiveness of the internal control system

and risk management. CAE's assessments are based on information received from management, independent auditors, internal auditors, those

responsible for risk management and internal controls, managers of the complaint and ombudsman channels and in their own analysis resulting

from direct observation.

PricewaterhouseCoopers Auditores Independentes

Ltda. is the company responsible for auditing the financial statements in accordance with standards issued by the Federal Accounting Council

(“CFC”) and certain specific requirements of the Brazilian Securities Exchange Commission (“CVM”). The independent

auditors are also responsible for the special review of the quarterly reports (“ITRs”) filed with the CVM. The independent

auditors' report reflects the results of their verifications and presents their opinion regarding the reliability of the financial statements

for the year in relation to the accounting principles arising from the CFC in accordance with the standards issued by the International

Accounting Standard Board (“IASB”), CVM rules and Brazilian corporate law. For the year ended December 31, 2023,

the independent auditors issued a report said on February 28, 2024, without qualifications.

The internal audit work is performed by its own

team. CAE is responsible for recommending acceptance or rejection of the annual internal audit plan, which is subsequently approved by

the Board of Directors, that implementation is monitored and guided by the Internal Audit Officer, directly linked to the Board of Directors

and is also responsible for reviewing the structure organizational and qualifications of the members of the Internal Audit, and results

achieved in the development of their functions. Furthermore, CAE develops its activities widely and independent manner, observing, mainly,

the coverage of areas, processes and activities that present the most sensitive risks to the operation and the most significant impacts

in the implementation of the Company's strategy.

Issues discussed by the CAE

The CAE met 10 (ten) times, 7 (seven) ordinarily

and 3 (three) extraordinarily from February 2023 to February 2024. Among the activities performed during the year, it highlights

the following:

| (i) | individual meetings with Internal Audit and External Audit to monitor the main issues related to the work

of the current year, maintaining independence and reinforcing the transparency of the process; |

| (ii) | individual agendas with the CEO and CFO and other administrators for alignment and monitoring of strategic

issues for the committee; |

| (iii) | approval and monitoring of the Annual Work Program of Internal Audit and its implementation; |

| (iv) | knowledge and monitoring of the points of attention and the resulting recommendations of the Internal

Audit and Independent Audit, as well as follow up on the remedial measures taken by Management; |

| (v) | monitoring of the internal control system as to its effectiveness and improvement processes, monitoring

of fraud risks based on the manifestations and meetings with the Internal Auditors and the Independent Auditors, with the Internal Controls,

Compliance and Ombudsman area; |

| (vi) | analysis of the Internal Controls certification process (Sarbanes-Oxley SOX) with Administrators and Independent

Auditors; |

| (vii) | analysis, approval and monitoring of the Annual Work Program of the Independent Auditors and its timely

implementation; |

| (viii) | monitoring the process of preparing and reviewing Company’s financial statements, the Management

Report and the Earnings Release, through meetings with the Management and the Independent Auditors to discuss the ITRs and the financial

statements for the year ended December 31, 2023; |

| (ix) | monitoring the Company's Compliance program and mitigating actions; |

| (x) | monitoring of the methodology adopted for risk management and the results obtained, according to the work

presented and developed by the specialized area and by all managers responsible for the risks under their management. |

Deep dive of the main risks monitored

by the company with monitoring of the degree of risk and delivery of mitigation plans, in order to ensure the disclosure and monitoring

of risks relevant to the Company;

| (xi) | monitoring the evolution of cybersecurity program during 2023; |

| (xii) | monitoring of the main indicators of the company's financial policies and of the indicators of achievement

of the main ESG goals linked to financial contracts; |

| (xiii) | analysis of judicial provisions and contingencies as well as monitoring of legal topics such as Tax Reform,

incentivized exhaustion and Brazilian Federal Revenue inspections; |

| (xiv) | review and recommendation for approval by the Board of Directors of corporate policies, such as Risk Management

Policy, Related Parties, Anti-Corruption Policy, Code of Ethics; |

| (xv) | monitoring of the reporting chancel for complaints open to shareholders, employees, issuers, suppliers

and the general public, with Ombudsman's responsibility for receiving and investigating complaints or suspected violations of the Code

of Ethics, respecting confidentiality and independence of the process and at the same ensuring the appropriate levels of transparency; |

| (xvi) | meetings with the current Independent Auditors of the Company, PricewaterhouseCoopers Auditores Independentes

Ltda. at several times, to discuss the ITRs submitted for its review and learned about of the audit report, containing the opinion on

the financial statements for the year ended December 31, 2023, being satisfied with the information and clarifications provided;

and |

| (xvii) | attention to transactions with related parties to their recommendation for approval by the Board of Directors,

to the criteria used to assess the fair value of biological assets and the criteria adopted in other accounting estimates in order to

ensure the quality and transparency of information. |

The above issues were submitted to the appreciation

and or approval of other management bodies, including the Board of Directors, according to the Company's bylaws and internal regulations.

Conclusion

The members of the Company's CAE, in the exercise

of their legal attributions and responsibilities, as well as those provided for in the Committee's Internal Rules, proceeded to the examination

and analysis of the financial statements, accompanied by the audit report containing an opinion without qualifications from the independent

auditors, the Management's annual report and the proposed allocation of the result, all related to the year ended December 31, 2023.

Considering the information provided by the Company's Management and the audit examination conducted by PricewaterhouseCoopers Auditores

Independentes Ltda, recommend, unanimously, the approval by the Company's Board of Directors of the documents mentioned above.

São Paulo, February 28, 2024.

Ana Paula Pessoa

Coordinator

Carlos Biedermann

Financial Expert

Marcelo Moses de Oliveira Lyrio

Member

Paulo Rogerio Caffarelli

Member

OPINION OF THE STATUTORY AUDIT COMMITTEE

In the exercising of its legal and statutory attributions

and in compliance with the provisions of item VIII of Article No. 27 of CVM Instruction 80/22, Suzano’s Statutory Audit

Committee has examined the parent company and consolidated financial statements for the year ending December 31, 2023, the Management

Report and the report issued without qualifications by PricewaterhouseCoopers Auditores Independentes Ltda.

There were no instances of significant divergences

between the Company’s Management, the independent auditors and the Audit Committee with respect to the Company’s financial

statements.

Based on the examined documents and the clarifications

rendered, the undersigned members of the Statutory Audit Committee are of the opinion that the financial statements in all material respects

are fairly presented and should be approved.

São Paulo, February 28, 2024.

Ana Paula Pessoa

Coordinator

Carlos Biedermann

Financial Expert

Marcelo Moses de Oliveira Lyrio

Member

Paulo Rogerio Caffarelli

Member

OPINION OF THE EXECUTIVE BOARD ON THE CONSOLIDATED

FINANCIAL STATEMENTS AND INDEPENDENT AUDITOR’S REPORT

In compliance with the provisions of Sections

V and VI of Article No. 27 of CVM Instruction No. 80/22, the executive board of Suzano S.A. states that they have:

| (i) | Reviewed, discussed and agreed with the Company's consolidated financial statements for the year ended

December 31, 2023; and |

| (ii) | Reviewed, discussed and agreed with the opinions expressed in the report by PricewaterhouseCoopers Auditores

Independentes on the Company's consolidated financial statements for the year ended December 31, 2023. |

São Paulo, February 28, 2024.

Walter Schalka

Chief Executive Officer

Marcelo Feriozzi Bacci

Executive Officer - Finance and Investor Relations

Aires Galhardo

Executive Officer - Pulp Operation

Carlos Aníbal de Almeida Jr.

Executive Officer - Forestry and Procurement

Christian Orglmeister

Executive Officer - New Businesses, Strategy, IT

and Digital

Fernando de Lellis Garcia Bertolucci

Executive Officer – Sustainability, Research

and Innovation

Leonardo Barreto de Araújo Grimaldi

Executive Officer - Commercial Pulp and Logistics

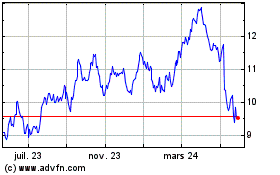

Suzano (NYSE:SUZ)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

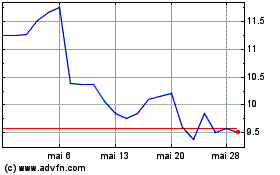

Suzano (NYSE:SUZ)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024