Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

29 Février 2024 - 12:14PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2024.

Commission File Number 001-38755

Suzano S.A.

(Exact name of registrant as specified in its charter)

SUZANO INC.

(Translation of Registrant’s Name into English)

Av. Professor Magalhaes Neto, 1,752

10th Floor, Rooms 1010 and 1011

Salvador, Brazil 41 810-012

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☑ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Enclosures:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 29, 2024

| | | | | | | | |

| | SUZANO S.A. |

| | |

| By: | /s/ Marcelo Feriozzi Bacci |

| Name: | Marcelo Feriozzi Bacci |

| Title: | Chief Financial and Investor Relations Officer |

SUZANO S.A.

Publicly-Held Company

Corporate Taxpayer ID (CNPJ/MF): 16.404.287/0001-55

Company Registry (NIRE): 29.3.0001633-1

MATERIAL FACT

São Paulo, February 29th, 2024 – Suzano S.A. (“Company” or “Suzano”) (B3: SUZB3 / NYSE: SUZ), in compliance with CVM Instruction 44 of August 23, 2021, and CVM Instruction 480 of December 7, 2009 (“CVM Instruction 480/09”), as amended, in line with corporate governance best practices, hereby announces the updated estimates of long-term operational expenditure in its pulp business.

1. Long-term estimates of operational expenditure in Suzano’s pulp business.

The long-term outlook for the operating performance of the Company’s pulp business expected for 2027 considers the following factors in relation to the estimate disclosed previously: (i) monetary update estimated for 2024 and the variation in inflation indices (IPCA, INPC and IGPM) observed in 2023 in relation to the forecast; (ii) exchange rate variation; and (iii) updates related to operational costs and management initiatives aimed at higher structural competitiveness.

In view of the above, Suzano maintains its estimated total operational disbursement practically stable at R$1,753 per ton in 2027. This estimate takes into account the following operating disbursements: pulp production cash cost (including scheduled downtimes) of R$685/t; logistics, selling and administrative expenses of R$584/t; and maintenance capex of R$484/t.

The above estimates reflect actual amounts and do not consider expectations or assumptions regarding inflation or exchange variation for 2025 onwards. The estimates also assume the Company operating at full capacity, including the Cerrado Project.

2. Period projected and period of validity of estimates of total operational expenditure in Suzano’s pulp business

The period projected covers the evolution in the operating performance of the Company’s pulp business over the next four years, and the above amounts are expected to be achieved in 2027.

3. Update of Reference Form

The Company also clarifies that item 3 of the Reference Form will be duly updated within the deadline set in CVM Instruction 480/09.

By disclosing the information contained in this Material Fact notice, the Company reaffirms its commitment to transparency with its shareholders, investors and the market and will keep them adequately informed of any significant change in the estimated long-term operational performance announced.

The estimates shown here merely reflect the current estimates or expectations of the Company's management, are subject to risks and uncertainties, and in no way constitute a promise of performance. These estimates represent forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. The terms "anticipates", "believes", "expects", "foresees", "intends", "plans", "projects", "aims", "shall" and other similar terms are aimed identifying such forecasts, which evidently involve risks or uncertainties that may or not be foreseen by the Company. Information on business prospects, projections and financial targets constitutes mere forecasts based on management's current expectations regarding the future of the Company and its subsidiaries. These expectations depend on market conditions and on the economic scenario in Brazil and the countries where the Company operates and the sectors in which it operates. Any change in the perception or the factors described above may cause actual results to differ from the estimates presented here.

São Paulo, February 29, 2024.

Marcelo Feriozzi Bacci

Chief Financial and Investor Relations Officer

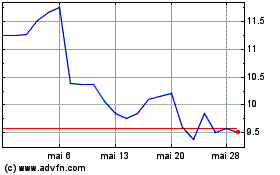

Suzano (NYSE:SUZ)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

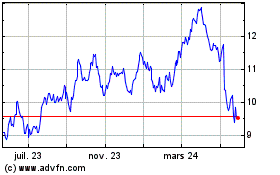

Suzano (NYSE:SUZ)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024