AT&T Shares Rise as Cell Carrier Lifts Free Cash Flow Outlook

19 Octobre 2023 - 2:22PM

Dow Jones News

By Will Feuer

AT&T's core cellphone business kept growing in the third

quarter, lifting revenue and spurring the company to raise its

full-year outlook for free cash flow.

Shares, down about 22% so far this year, rose almost 4% to

$14.85 in premarket trading.

In the third quarter, the Dallas company added 468,000 postpaid

phone connections, the cell carrier's main profit engine. Wall

Street analysts surveyed by FactSet expected the company to add

about 403,000 of those kinds of subscribers.

The cell carrier's quarterly earnings were dented by severance

and restructuring charges. The company has been consolidating

offices as part of a plan to cut costs across the company.

AT&T is the first telecommunications heavyweight to report

third-quarter results. Verizon and T-Mobile are set to offer their

own updates next week.

Here is how AT&T did in the third quarter:

Revenue: Third-quarter revenue rose 1% to $30.4 billion, above

the $30.21 billion that Wall Street analysts expected, according to

FactSet.

Adjusted profit: Stripping out one-time items, adjusted earnings

were 64 cents a share vs. 62 cents a share expected.

Free cash flow: AT&T posted third-quarter free cash flow of

$5.2 billion, up from $3.8 billion a year ago.

Outlook: AT&T says it is on track to hit roughly $16.5

billion in free cash flow this year, above the company's prior

outlook of at least $16 billion.

Write to Will Feuer at will.feuer@wsj.com

(END) Dow Jones Newswires

October 19, 2023 08:07 ET (12:07 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

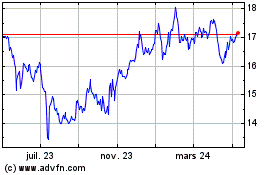

AT&T (NYSE:T)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

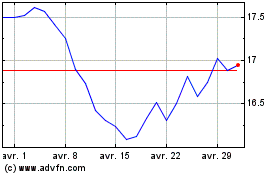

AT&T (NYSE:T)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024