Teva Begins Trading on the New York Stock Exchange

30 Mai 2012 - 10:45PM

Business Wire

Dr. Phillip Frost, Chairman of the Board of Teva Pharmaceutical

Industries Ltd. (NYSE: TEVA), and Dr. Jeremy Levin, the Company’s

President and CEO, along with a group of employees representing

Teva’s businesses around the world, rang the Opening Bell at the

New York Stock Exchange to celebrate the Company’s transfer to the

NYSE. The Company’s American Depositary Shares began trading this

morning on the NYSE under its existing ticker symbol “TEVA.”

“We are pleased to partner with the NYSE and begin using their

state of the art trading platform and market research,” stated Dr.

Phillip Frost, Chairman of the Board of Directors of Teva. “We are

joining a network of true innovators and leaders listed on the

NYSE.”

“Teva is a global pharmaceutical company and a leader in their

industry with a dedication to their patients,” said Diederik

Zandstra, Head of International Listings, NYSE Euronext. “We are

proud that Teva has chosen to transfer to the NYSE and recognizes

the value of our global community, market structure and technology.

We look forward to our partnership with Teva and its

shareholders."

About Teva

Teva Pharmaceutical Industries Ltd. (NYSE: TEVA) is a leading

global pharmaceutical company, committed to increasing access to

high-quality healthcare by developing, producing and marketing

affordable generic drugs as well as innovative and specialty

pharmaceuticals and active pharmaceutical ingredients.

Headquartered in Israel, Teva is the world's leading generic drug

maker, with a global product portfolio of more than 1,300 molecules

and a direct presence in about 60 countries. Teva's branded

businesses focus on CNS, oncology, pain, respiratory and women's

health therapeutic areas as well as biologics. Teva currently

employs approximately 46,000 people around the world and reached

$18.3 billion in net revenues in 2011.

Teva’s Safe Harbor Statement under the U.S. Private

Securities Litigation Reform Act of 1995:

This release contains forward-looking statements, which express

the current beliefs and expectations of management. Such statements

are based on management’s current beliefs and expectations and

involve a number of known and unknown risks and uncertainties that

could cause our future results, performance or achievements to

differ significantly from the results, performance or achievements

expressed or implied by such forward-looking statements. Important

factors that could cause or contribute to such differences include

risks relating to: our ability to develop and commercialize

additional pharmaceutical products, competition for our innovative

products, especially Copaxone® (including competition from

innovative orally-administered alternatives, as well as from

potential generic equivalents), competition for our generic

products (including from other pharmaceutical companies and as a

result of increased governmental pricing pressures), competition

for our specialty pharmaceutical businesses, our ability to achieve

expected results through our innovative R&D efforts, the

effectiveness of our patents and other protections for innovative

products, decreasing opportunities to obtain U.S. market

exclusivity for significant new generic products, our ability to

identify, consummate and successfully integrate acquisitions

(including the acquisition of Cephalon), the effects of increased

leverage as a result of the acquisition of Cephalon, the extent to

which any manufacturing or quality control problems damage our

reputation for high quality production and require costly

remediation, our potential exposure to product liability claims to

the extent not covered by insurance, increased government scrutiny

in both the U.S. and Europe of our agreements with brand companies,

potential liability for sales of generic products prior to a final

resolution of outstanding patent litigation, including that

relating to the generic version of Protonix®, our exposure to

currency fluctuations and restrictions as well as credit risks, the

effects of reforms in healthcare regulation and pharmaceutical

pricing and reimbursement, any failures to comply with complex

Medicare and Medicaid reporting and payment obligations,

governmental investigations into sales and marketing practices

(particularly for our specialty pharmaceutical products),

uncertainties surrounding the legislative and regulatory pathway

for the registration and approval of biotechnology-based products,

adverse effects of political or economical instability, major

hostilities or acts of terrorism on our significant worldwide

operations, interruptions in our supply chain or problems with our

information technology systems that adversely affect our complex

manufacturing processes, any failure to retain key personnel

(including Cephalon employees) or to attract additional executive

and managerial talent, the impact of continuing consolidation of

our distributors and customers, variations in patent laws that may

adversely affect our ability to manufacture our products in the

most efficient manner, potentially significant impairments of

intangible assets and goodwill, potential increases in tax

liabilities, the termination or expiration of governmental programs

or tax benefits, environmental risks and other factors that are

discussed in our Annual Report on Form 20-F for the year ended

December 31, 2011 and in our other filings with the U.S. Securities

and Exchange Commission.

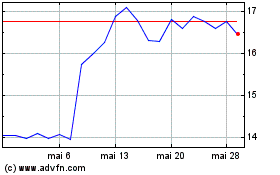

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024