Teva Pharmaceutical Industries Ltd. (NYSE: TEVA) provides its

current outlook for non-GAAP financial performance for the full

year ending December 31, 2014.

In an effort to enhance investor understanding of the business

performance of the company, and to provide more clarity and

transparency regarding its projections for 2014, given the

significant uncertainty concerning possible generic competition to

Copaxone® in the U.S., the Company is providing two alternative

scenarios for its current non-GAAP financial outlook for the

year:

- the "Generic Copaxone" scenario

assumes the launch of at least two AP-rated generic competitors to

Copaxone® in the U.S. on June 1, 2014; and

- the "Exclusive Copaxone"

scenario assumes no generic competition to Copaxone® in the U.S.

during 2014.

Both scenarios assume the launch of Copaxone® 40mg

three-times-a-week in early 2014 and exclusive sales of the generic

version of Pulmicort® in the U.S. throughout 2014. The outlook

provided is organic, and neither alternative includes the potential

impact of any business development activities.

Below is a table summarizing the non-GAAP financial outlook for

the two scenarios:

Generic Exclusive Copaxone

Copaxone Net Revenues ($ b) 19.3-20.3 19.8-20.8 GP (%)

57%-59% 58%-60% R&D ($ b) 1.3-1.45 1.3-1.45 S&M ($ b)

4.0-4.1 4.0-4.1 G&A ($ b) 1.2 1.2 OP ($ b) 4.8-5.1 5.35-5.65

Finance Expenses ($ m) 310-350 310-350 Tax (%) 20%-21%

19%-20% Number of Shares (m) 840-850 840-850

EPS ($)

4.20-4.50 4.80-5.10 Cash Flow from Operations

($ b)

2.7

3.0

Teva estimates that each month of delay in the launch of generic

competitors to Copaxone® in the U.S. will contribute on average

approximately $78 million to net revenues and $0.08 to non-GAAP

diluted earnings per share.

“2014 will be a pivotal year for Teva and a year of major

transitions across the company", stated Eyal Desheh, Acting

President and CEO of Teva. "We will continue to make

significant progress in implementing our strategy. We will focus

our efforts on our generics business and core R&D programs,

including high-value complex generics, promising specialty

medicines and New Therapeutic Entities. In our specialty business,

we anticipate six important launches and the potential submission

of ten additional medicines for approval. At the same time, we are

focused on increasing our organizational effectiveness through our

cost reduction program to ensure Teva’s leadership position, growth

and sustainable profitability.”

Detailed financial outlook:

Generic Exclusive

Copaxone Copaxone U.S. $ in billions Generics

inc. API 9.8 - 10.5 9.8 - 10.5 Specialty: 7.3 - 7.7 7.8 - 8.2 OTC

& Other*: 2.0 - 2.2 2.0 - 2.2 Total Net Revenues 19.3 - 20.3

19.8 - 20.8

*Including OTC, distribution & other

- Net Revenues by

Geographies:

Generic Exclusive

Copaxone Copaxone U.S. $ in billions United

States 9.5-9.9 10.0-10.4 Europe*: 5.7-6.2 5.7-6.2 Rest of the

World: 3.8-4.2 3.8-4.2 Total Net Revenues 19.3 - 20.3 19.8 - 20.8

*All members of the European Union, Switzerland, Norway and

certain South Eastern Europe countries

- Generics (including API) Net

Revenues:

U.S. $ in billions United States 4.1 - 4.5 Europe*:

3.1 - 3.5 Rest of the World: 2.3 - 2.6 Total Generics Net Revenues

9.8 - 10.5

*All members of the European Union, Switzerland, Norway and

certain South Eastern Europe countries

- Key Specialty Medicines Net

Revenues:*All members of the European Union, Switzerland,

Norway and certain South Eastern Europe countries

Generic Exclusive Copaxone

Copaxone U.S. $ in millions Copaxone®

3,100-3,200 3,600-3,700 Treanda® 750 ProAir® 510 Azilect® 390 Qvar®

380 Nuvigil® 350

- Other net revenues of $2.0-$2.2

billion, which include net revenues from Teva's share in PGT

Healthcare, our joint venture with Procter & Gamble, of

$1.0-1.1 billion, and approximately $0.2 billion of OTC contract

manufacturing in the U.S.Overall in-market revenues of PGT

Healthcare will be approximately $1.7 billion. This amount

represents sales of the combined OTC portfolios of Teva and P&G

outside of North America.

Other Generic

Exclusive OTC & Generics

Specialty Copaxone Copaxone

Other Total Revenues ($ b) 9.8-10.5 4.2-4.5 3.1-3.2

3.6-3.7 2.0-2.2 GP (%) 41%-44% 83%-85% 88%-91% 88%-91% 32%-34%

R&D ($ b) 0.45-0.50 0.8-0.9 0.1 0.1 - Total S&M ($ b)

1.7-1.8 1.4 0.6-0.7 0.6-0.7 0.3 OP before G&A ($ b) 2.0-2.3

1.15-1.55 2.0-2.1 2.55-2.65 0.35-0.5 % of Teva Total OP before

G&A* 33% 21% - 39% 7%

* Mid-range compared to "Exclusive Copaxone" scenario

(approximate)

Non-GAAP gross profit margin excludes amortization of intangible

assets of approximately $1.1 billion.

Non-GAAP selling & marketing expenses exclude amortization

of intangible assets.

Non-GAAP total expenses are exclusive of approximately $900

million of restructuring expenses due to cost reduction

programs

- Figures for Cash flow from

operations are after deduction of payments of approximately $2

billion in 2014 for legal settlements and payments related to our

cost reduction program.

Note: items not expressed in

this press release in the form of ranges are approximate and may

vary +/-5%.

These estimates reflect management`s current expectations for

Teva's performance in 2014. Actual results may vary, whether as a

result of FX differences, market conditions or other factors. In

addition, the non-GAAP figures exclude the amortization of

purchased intangible assets, costs related to certain regulatory

actions, inventory step-up, legal settlements and reserves,

impairments and related tax effects. The non-GAAP data presented by

Teva are the results used by Teva's management and board of

directors to evaluate the operational performance of the company,

to compare against the company's work plans and budgets, and

ultimately to evaluate the performance of management. Teva provides

such non-GAAP data to investors as supplemental data and not in

substitution or replacement for GAAP results, because management

believes such data provides useful information to investors.

Conference Call

Teva will host a conference call and live webcast to discuss its

2014 business outlook on Tuesday, December 10, 2013,

at 8:00 a.m. Eastern Daylight Time. The call will be webcast

and can be accessed through the Company's website

at www.tevapharm.com, or by dialing 1-800-510-9691 (U.S.

and Canada) or 1-617-614-3453 (International). The conference

ID is 15601679. Following the conclusion of the call, a replay will

be available within 24 hours at the Company's website

at www.tevapharm.com. A replay will also be available

until December 17, 2013, at 11:59 p.m. ET, by calling

1-888-286-8010 (U.S. and Canada) or 1-617-801-6888

(International). The Conference ID is 73093491#.

About Teva

Teva Pharmaceutical Industries Ltd. (NYSE: TEVA) is a leading

global pharmaceutical company, committed to increasing access to

high-quality healthcare by developing, producing and marketing

affordable generic drugs as well as innovative and specialty

pharmaceuticals and active pharmaceutical ingredients.

Headquartered in Israel, Teva is the world's leading generic drug

maker, with a global product portfolio of more than 1,000 molecules

and a direct presence in about 60 countries. Teva's branded

businesses focus on CNS, oncology, pain, respiratory and women's

health therapeutic areas as well as biologics. Teva currently

employs approximately 46,000 people around the world and reached

$20.3 billion in net revenues in 2012.

Teva's Safe Harbor Statement under the U. S. Private

Securities Litigation Reform Act of 1995:This document contains

forward-looking statements, which express the current beliefs and

expectations of management. Such statements involve a number of

known and unknown risks and uncertainties that could cause our

future results, performance or achievements to differ significantly

from the results, performance or achievements expressed or implied

by such forward-looking statements. Important factors that could

cause or contribute to such differences include risks relating to:

the ability to reduce operating expenses to the extent and during

the timeframe intended by our cost restructuring program; our

ability to develop and commercialize additional pharmaceutical

products, including our ability to develop, manufacture, market and

sell biopharmaceutical products, competition for our innovative

medicines, especially COPAXONE® (including competition from

innovative orally-administered alternatives, as well as from

potential purported generic equivalents), competition for our

generic products (including from other pharmaceutical companies and

as a result of increased governmental pricing pressures),

competition for our specialty pharmaceutical businesses, our

ability to achieve expected results through our specialty,

including innovative, R&D efforts, the effectiveness of our

patents and other protections for innovative products, decreasing

opportunities to obtain U.S. market exclusivity for significant new

generic products, our ability to identify, consummate and

successfully integrate acquisitions and license products,

uncertainties relating to the replacement of and transition to a

new President & Chief Executive Officer, the effects of

increased leverage as a result of recent acquisitions, the extent

to which any manufacturing or quality control problems damage our

reputation for high quality production and require costly

remediation, our potential exposure to product liability claims to

the extent not covered by insurance, increased government scrutiny

in both the U.S. and Europe of our settlement agreements with brand

companies and liabilities arising from class action litigation and

other third-party claims relating to such agreements, potential

liability for sales of generic medicines prior to a final

resolution of outstanding patent litigation, our exposure to

currency fluctuations and restrictions as well as credit risks, the

effects of reforms in healthcare regulation and pharmaceutical

pricing and reimbursement, any failures to comply with complex

Medicare and Medicaid reporting and payment obligations,

governmental investigations into sales and marketing practices,

particularly for our specialty medicines (and our ongoing FCPA

investigations and related matters), uncertainties surrounding the

legislative and regulatory pathways for the registration and

approval of biotechnology-based medicines, adverse effects of

political or economical instability, corruption, major hostilities

or acts of terrorism on our significant worldwide operations,

interruptions in our supply chain or problems with our information

technology systems that adversely affect our complex manufacturing

processes, any failure to retain key personnel or to attract

additional executive and managerial talent, the impact of

continuing consolidation of our distributors and customers,

variations in patent laws that may adversely affect our ability to

manufacture our products in the most efficient manner, potentially

significant impairments of intangible assets and goodwill,

potential increases in tax liabilities resulting from challenges to

our intercompany arrangements, the termination or expiration of

governmental programs or tax benefits, environmental risks and

other factors that are discussed in our Annual Report on Form 20-F

for the year ended December 31, 2012 and in our other filings with

the U.S. Securities and Exchange Commission. Forward-looking

statements speak only as of the date on which they are made and the

Company undertakes no obligation to update or revise any forward

looking statement, whether as a result of new information, future

events or otherwise.

Teva Pharmaceutical Industries Ltd.IR:Kevin C. Mannix,

215-591-8912United StatesorRan Meir, 215-591-3033United

StatesorTomer Amitai, 972 (3) 926-7656IsraelorPRIris Beck

Codner, 972 (3) 926-7246IsraelorDenise Bradley,

215-591-8974United States

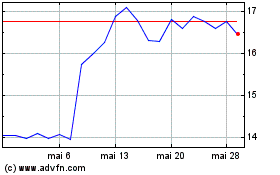

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024