Teva Boosts Outlook as Results Top Estimates

29 Octobre 2015 - 2:10PM

Dow Jones News

Teva Pharmaceuticals Industries Ltd. sharply raised its guidance

for the year as third-quarter results came in better than expected,

though overall profit declined sharply on charges.

The company now expects earnings for the year in the range of

$5.40 to $5.45 and revenue of $19.4 billion to $19.6 billion, up

from its previous forecast of $5.15 to $5.40 of earnings and

revenue of $19 billion to $19.4 billion.

Teva recently said it would buy the generics business of

Allergan PLC for about $40 billion, a move that followed a

several-way tug of war among drug makers. The deal is expected to

close in the first quarter of 2016. That deal pushed Teva to drop

its previous pursuit of Mylan NV, which in turn has said it plans

to acquire Perrigo Co.

Overall, Teva reported a profit of $103 million, or 12 cents a

share, down from $876 million, or $1.02 a share, largely due to

restructuring charges. On an adjusted basis, per-share earnings

were $1.35, up from $1.33. Revenue fell 4.6% to $4.82 billion.

Analysts polled by Thomson Reuters had expected earnings of

$1.28 a share on $4.77 billion in revenue.

Shares were inactive premarket.

Write to Anne Steele at Anne.Steele@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 29, 2015 08:55 ET (12:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

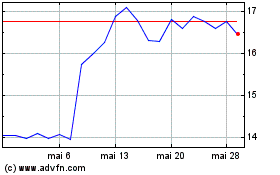

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Sept 2024 à Oct 2024

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Oct 2023 à Oct 2024