By Denise Roland

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 14, 2019).

The world's largest maker of generic drugs is looking for growth

in an unlikely place: high-price biotech medicines.

Teva Pharmaceutical Industries Ltd., which supplies more than

one in 10 drugs taken in the U.S., has struggled in recent years

with slumping generics prices and heavy debt. Forced to cut

thousands of jobs and shut research facilities, the Israeli company

is now turning to biotech drugs to revive its fortunes.

"We figured out a strategy where we'd continue to be leaders in

generics but really focus our R&D on innovative biologics and

biosimilars," Chief Executive Kåre Schultz said in an interview.

"That's what we're working hard on right now."

Teva's results for 2018 underscore the scale of the challenge he

faces. The company on Wednesday reported a 16% slide in annual

revenue to $18.9 billion, with adjusted earnings per share -- which

strips out one-time items -- falling 27% to $2.92. Teva forecast a

further decline in revenue this year, to between $17 billion and

$17.4 billion.

The outlook and weak sales last year for migraine-prevention

treatment Ajovy, one of Teva's newer drugs, sent the company's

shares down 7.7% on the Tel Aviv Stock Exchange.

Biotech, or biologic, drugs are made using living cells in a

process that resembles brewing. They are much more complex than

pill-form medicines and typically command higher prices because

they target specialty diseases like cancer and rheumatological

conditions.

Teva already sells some biologic drugs, but they make up a small

portion of revenue. Mr. Schultz, who became company CEO just over a

year ago, envisions biologics accounting for about half of Teva's

sales.

Teva doesn't have the financial firepower to buy new drug

prospects and has had to cut its research budget. So Mr. Schultz

has halved the size of the company's research pipeline to focus

purely on biologic drugs. It now has 25 drugs in development,

mostly at an early stage.

The 57-year-old industry veteran zeroed in on biologics after

discovering that Teva already had pockets of expertise in the area

but without focus. "The R&D strategy was really all over the

place," said Mr. Schultz, who joined Teva in 2017 from Denmark's

Lundbeck A/S.

In doing so, he is tapping into a broader trend. Between 2006

and 2016, biologics' share of the pharmaceutical market rose from

16% to 25%, according to IQVIA, a health-care data company.

With its push into biologics, Teva is doubling down on what has

been a lucrative sideline for the company: original, branded drugs.

For years, Teva counted on multiple sclerosis drug Copaxone to

boost profits, but sales are now dropping sharply in the face of

competition from cheaper copies.

That sideline started as a lucky break. In 1987, then-CEO Eli

Hurvitz agreed to help out a friend who was working on a new drug

at Israel's Weizmann Institute by bankrolling the clinical trials

needed to win regulatory approval. In return, Teva got the rights

to sell the drug. According to company lore, Mr. Hurvitz carried

around a piece of paper promising to resign if his risky bet on the

multiple sclerosis drug didn't pan out.

Copaxone was launched 10 years later and has since generated

nearly $50 billion for Teva. At its peak in 2013, it accounted for

a fifth of Teva's sales.

Teva continued to develop innovative drugs, but its efforts

didn't yield enough to replace the revenue lost when cheaper copies

of its blockbuster emerged in late 2017.

Copaxone's decline compounded an already dire situation for

Teva. The company was grappling with heavy debts and a price war in

the U.S. generic-drug market, sparked by consolidation among

pharmacy chains and the influx of new competitors. Mr. Schultz's

predecessor, Erez Vigodman, departed in February 2017, and the

company didn't have a permanent chief executive for nearly nine

months.

Weeks after joining the company, Mr. Schultz launched a

cost-cutting plan that involved eliminating about 14,000 positions,

or a quarter of Teva's staff, and shutting up to 25 of the

company's 80 factories and several research centers.

Mr. Schultz says the turnaround is making progress. Cost cuts

are ahead of schedule, debt has been narrowed and revenue is

expected to start edging up in 2020 as the generics business

resumes growth. Some newer branded drugs, like Ajovy and Austedo

for Huntington's and other movement disorders, could also start to

gain momentum.

Despite his focus on biologics, Mr. Schultz wants Teva to remain

a dominant player in generic drugs. He believes the price decline

that has halved the value of the U.S. generics market over the past

five years is bottoming out.

And the company's R&D push may bring it into familiar

territory: Some of the research projects are for biosimilars,

essentially generics for biologic drugs.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

February 14, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

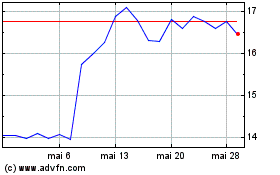

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024