true0001021162False0001021162tgi:PurchaseRightsMember2024-03-082024-03-0800010211622024-03-082024-03-080001021162us-gaap:CommonStockMember2024-03-082024-03-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 8, 2024

TRIUMPH GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

1-12235 |

|

51-0347963 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

|

555 E Lancaster Avenue, Suite 400 |

|

|

Radnor, Pennsylvania |

|

19087 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (610) 251-1000

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $.001 per share |

|

TGI |

|

New York Stock Exchange |

Purchase Rights |

|

N/A |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On March 8, 2024, Triumph Group, Inc. (the “Company”) issued a press release providing updated guidance regarding financial results for the fiscal year ending March 31, 2024. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The information in this Item 7.01, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Date: March 8, 2024 |

TRIUMPH GROUP, INC. By: /s/ Thomas A. Quigley, III Thomas A. Quigley, III Vice President, Investor Relations, Mergers & Acquisitions and Treasurer |

|

|

|

|

Exhibit 99.1

NEWS RELEASE

|

|

|

|

Contact: Thomas A. Quigley, III VP, Investor Relations, Mergers & Acquisition and Treasurer Phone (610) 251-1000 tquigley@triumphgroup.com |

|

|

|

TRIUMPH UPDATES FINANCIAL GUIDANCE FOR FULL YEAR FISCAL 2024

RADNOR, Pa. – March 8, 2024 – Triumph Group, Inc. (NYSE: TGI) ("TRIUMPH" or the “Company”) announced today that it has updated its financial guidance for its full year fiscal 2024, which ends March 31, 2024, in conjunction with the recent closing on the sale of its former Product Support business and the related expected paydowns of its debt.

The updated cash guidance includes the cash flows from the Product Support business through February 29, 2024, as well as reflects certain cash outflows related to the transaction, including transaction fees and taxes, the timing of interest and accelerated employee related obligations of the divested operations, which are expected to be paid in March 2024, along with modest working capital timing impacts on the continuing operations.

Full Year Fiscal 2024 Guidance

•Reaffirming net sales of $1.17 billion to $1.20 billion

•Reaffirming operating income of $100.0 million to $110.0 million

•Reaffirming adjusted EBITDAP of $157.0 million to $167.0 million

•Updating cash flow used in operations to a range of $(15.8) million to $(5.8) million

•Updating free cash use to a range of $(39.6) million to $(29.6) million

Implied Fourth Quarter Fiscal 2024 Guidance

•Net sales of $336.5 million to $366.5 million, consistent with prior implied guidance

•Operating income of $58.4 million to $68.4 million, consistent with prior implied guidance

•Adjusted EBITDAP of $71.0 million to $81.0 million, consistent with prior implied guidance

•Updating cash flow from operations to a range of $52.5 million to $62.5 million

•Updating free cash flow to a range of $45.0 million to $55.0 million

Balance Sheet Update

•On March 4, 2024, completed the call of $120.0 million of its Senior Secured Notes due 2028 at 103%, plus accrued but unpaid interest for approximately $128.7 million

•On March 5, 2024, settled the asset sale tender of $1.1 million of its Senior Secured Notes due 2028 at par, plus accrued but unpaid interest for approximately $1.2 million

•On March 6, 2024, completed the call of the remaining $435.6 million of Senior Notes due 2025 at par, plus accrued but unpaid interest for approximately $437.6 million

In addition, a presentation including unaudited preliminary quarterly results for continuing operations reflecting Product Support as discontinued operations is posted on the Company’s website at https://www.triumphgroup.com/filings-financial/presentations.

|

|

|

|

|

|

|

Implied fourth quarter |

|

|

|

|

Fiscal 2024 |

|

Fiscal 2024 |

($ in millions) |

|

Guidance |

|

Guidance |

Operating Income |

|

$58.4 - $68.4 |

|

$100.0 - $110.0 |

Adjustments: |

|

|

|

|

Loss on sale of assets and businesses |

|

-- |

|

$12.2 |

Shareholder cooperation expenses |

|

-- |

|

$1.9 |

Legal judgment loss |

|

-- |

|

$1.3 |

Other adjustments |

|

$1.9 |

|

$1.9 |

Depreciation & Amortization |

|

$8.7 |

|

$30.8 |

Amortization of acquired contract liabilities |

|

($1.0) |

|

($2.9) |

Share-based compensation |

|

$3.0 |

|

$11.7 |

Adjusted EBITDAP - non-GAAP* |

|

$71.0 - $81.0 |

|

$157.0 - $167.0 |

* Differences due to rounding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Implied Fourth Quarter Fiscal 2024

Guidance |

|

Fiscal 2024

Guidance |

$ in millions |

|

|

|

|

Cash provided by (used in) operating activities |

|

$ 52.5 - $ 62.5 |

|

$(15.8) - $(5.8) |

Less: |

|

|

|

|

Capital expenditures |

|

$ (7.5) |

|

$ (23.8) |

Free cash flow (use)* |

|

$ 45.0 - $ 55.0 |

|

$(39.6) - $(29.6) |

* Differences due to rounding |

|

|

|

|

|

|

|

|

|

About TRIUMPH

TRIUMPH, headquartered in Radnor, Pennsylvania, designs, develops, manufactures, repairs and overhauls a broad portfolio of aerospace and defense systems and components. The company serves the global aviation industry, including original equipment manufacturers and the full spectrum of military and commercial aircraft operators.

More information about TRIUMPH can be found on the Company’s website at triumphgroup.com.

Forward Looking Statements

Statements in this release which are not historical facts are forward-looking statements under the provisions of the Private Securities Litigation Reform Act of 1995, including statements of expectations of or assumptions about financial and operational performance, revenues, earnings per share, cash flow or use, cost savings, operational efficiencies and organizational restructurings and our evaluation of potential adjustments to reported amounts, as described above. Forward-looking statements may also be identified because they contain words such as “anticipate,” “believe,” “continue,” “could,’’ “estimate,” “expect,” “guidance,” “intend,” “may,” “might,” “plan,” “project,” “seek,” “should,” “target,” “will,” or similar expressions and the negatives of those terms. All forward-looking statements involve risks and uncertainties which could affect the Company’s actual results and could cause its actual results to differ materially from those expressed in any forward-looking statements made by, or on behalf of, the Company. Such risks and uncertainties include, without limitation the inability to increase the Company’s profitability and growth, adequately deleverage its business, strengthen its balance sheet, adequately manage its cash flows and expenses, and win new business; and risks related to the unaudited preliminary pro forma results, which are subject to change. Further information regarding the important factors that could cause actual results to differ from projected results can be found in Triumph Group’s reports filed with the SEC, including our Annual Report on Form 10-K for the fiscal year ended March 31, 2023.

v3.24.0.1

Document and Entity Information

|

Mar. 08, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 08, 2024

|

| Entity Registrant Name |

TRIUMPH GROUP, INC.

|

| Entity Central Index Key |

0001021162

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

51-0347963

|

| Entity File Number |

1-12235

|

| Entity Address, Address Line One |

555 E Lancaster Avenue

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

Radnor

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19087

|

| City Area Code |

(610)

|

| Local Phone Number |

251-1000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $.001 per share

|

| Trading Symbol |

TGI

|

| Security Exchange Name |

NYSE

|

| Purchase Rights [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Purchase Rights

|

| No Trading Symbol Flag |

true

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tgi_PurchaseRightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

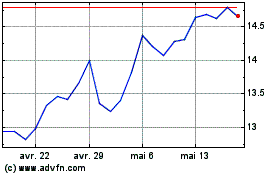

Triumph (NYSE:TGI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Triumph (NYSE:TGI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024