trueFalse00010211620001021162tgi:PurchaseRightsMember2024-03-012024-03-0100010211622024-03-012024-03-010001021162us-gaap:CommonStockMember2024-03-012024-03-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 1, 2024

TRIUMPH GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

1-12235 |

|

51-0347963 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

|

555 E Lancaster Avenue, Suite 400 |

|

|

Radnor, Pennsylvania |

|

19087 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (610) 251-1000

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $.001 per share |

|

TGI |

|

New York Stock Exchange |

Purchase Rights |

|

N/A |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.01 Completion of Acquisition or Disposition of Assets.

The closing of the transactions (the “Transaction”) under the Security and Asset Purchase Agreement, dated December 21, 2023 (the “Agreement”), by and between Triumph Group, Inc., a Delaware corporation (the “Company”), Triumph Aftermarket Services Group, LLC, a Delaware limited liability company, Triumph Group Acquisition Corp., a Delaware corporation, Triumph Group Acquisition Holdings, Inc., a Delaware corporation, and The Triumph Group Operations, Inc., a Delaware corporation (collectively, the “Sellers”), and AAR Corp., a Delaware corporation (“Buyer”), occurred on March 1, 2024. In connection therewith, the Sellers sold the Product Support business to Buyer for $725 million in cash, subject to customary adjustments set forth in the Agreement.

The foregoing description of the Agreement and the transactions contemplated thereby does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Agreement, a copy of which was attached as Exhibit 2.1 to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on December 22, 2023, and the terms of which are incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

On March 1, 2024, the Company issued a press release announcing the closing of the Transaction. A copy of this press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The information in this Item 7.01, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into any filing of the registrant under the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference to such filing.

Item 9.01 Financial Statements and Exhibits.

(b) Pro Forma Financial Information.

Unaudited pro forma consolidated financial information of Triumph Group, Inc., giving effect to the Transaction, is attached hereto as Exhibit 99.2.

(d) Exhibits.

|

|

|

Exhibit No. |

|

Description |

2.1 |

|

Securities and Asset Purchase Agreement, dated as of December 21, 2023, by and among Triumph Group, Inc., Triumph Aftermarket Services Group, LLC, Triumph Group Acquisition Corp., Triumph Group Acquisition Holdings, Inc., The Triumph Group Operations, Inc. and AAR CORP. (incorporated by reference to Exhibit 2.1 to the Form 8-K filed by Triumph Group, Inc. on December 22, 2023).* |

99.1 |

|

Press Release dated March 1, 2024, issued by Triumph Group, Inc., regarding the Transaction |

99.2 |

|

Triumph's Unaudited Pro Forma Condensed Consolidated Financial Statements. |

104.1 |

|

Cover page interactive data file (embedded within the Inline XBRL document). |

|

|

|

* Schedules (as similar attachments) have been omitted from this filing pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule will be furnished to the Securities and Exchange Commission upon request.

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Date: March 7, 2024 |

TRIUMPH GROUP, INC. By: /s/ Jennifer H. Allen______________________ Jennifer H. Allen Chief Administrative Officer and Senior Vice President, General Counsel and Secretary |

|

|

|

|

Exhibit 99.1

NEWS RELEASE

|

|

|

|

Contact: Thomas A. Quigley, III VP, Investor Relations, Mergers & Acquisition and Treasurer Phone (610) 251-1000 tquigley@triumphgroup.com |

|

|

|

TRIUMPH COMPLETES SALE OF PRODUCT SUPPORT BUSINESS TO AAR

RADNOR, Pa. – March 1, 2024 – Triumph Group, Inc. (NYSE: TGI) ("TRIUMPH" or the “Company”) announced today that it has completed the sale of its Product Support business to AAR CORP. (NYSE: AIR). The transaction is valued at $725 million, and the net after-tax proceeds are expected to be approximately $700 million, which will primarily be used for debt reduction.

The Product Support business is an industry leader in the Maintenance, Repair and Overhaul (MRO) of structures and airframe and engine accessories, servicing both the commercial and military aftermarkets across five primary locations.

“We are pleased to complete this transformative divestiture which delivers immediate and substantial value to TRIUMPH and our stakeholders. This transaction enables TRIUMPH to greatly accelerate our deleveraging progress while placing our third-party Product Support business with a market-leading MRO company that has a proven track record of customer support” said Dan Crowley, TRIUMPH’s chairman, president, and chief executive officer. “By strengthening our balance sheet and focusing on our OEM component, spares and IP-based aftermarket business, TRIUMPH will further improve its capacity to win and expects to profitably grow in the expanding markets we serve.”

Upon completion of the transaction, TRIUMPH will advance in aerospace and its adjacent markets as a value-added and IP-based business. The Systems & Support segment will consist of three pure play engineered systems components and aftermarket companies focused on Actuation Products and Services, Systems Electronics and Controls, and Geared Solutions. Together with the Interiors segment, TRIUMPH now has 21 sites and approximately 4,500 employees, and over 60% of the Company’s products and services will be based on TRIUMPH intellectual property and 90% supplied on a sole-sourced basis.

About TRIUMPH

TRIUMPH, headquartered in Radnor, Pennsylvania, designs, develops, manufactures, repairs and overhauls a broad portfolio of aerospace and defense systems and components. The company serves the global aviation industry, including original equipment manufacturers and the full spectrum of military and commercial aircraft operators.

More information about TRIUMPH can be found on the Company’s website at triumphgroup.com.

Forward Looking Statements

Statements in this release which are not historical facts are forward-looking statements under the provisions of the Private Securities Litigation Reform Act of 1995, including statements of expectations of or assumptions about financial and operational performance, revenues, earnings per share, cash flow or use, cost savings, operational efficiencies and organizational restructurings and our evaluation of potential adjustments to reported amounts, as described above. Forward-looking statements may also be identified because they contain words such as “anticipate,” “believe,” “continue,” “could,’’ “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “project,” “seek,” “should,” “target,” “will,” or similar expressions and the negatives of those terms. All forward-looking statements involve risks and uncertainties which could affect the Company’s actual results and could cause its actual results to differ materially from those expressed in any forward-looking statements made by, or on behalf of, the Company. Such risks and uncertainties include, without limitation the inability to increase the Company’s profitability and growth, adequately deleverage its business, strengthen its balance sheet and win new business. Further information regarding the important factors that could cause actual results to differ from projected results can be found in Triumph Group’s reports filed with the SEC, including our Annual Report on Form 10-K for the fiscal year ended March 31, 2023.

Exhibit 99.2

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Overview

On March 1, 2024, Triumph Group, Inc. ("Triumph" or the “Company”) completed its previously announced sale of its maintenance, repair, and overhaul operations located in Wellington, Kansas; Grand Prairie, Texas; San Antonio, Texas; Hot Springs, Arkansas; and Chonburi, Thailand (“Product Support” or "TPS") to AAR CORP. (“AAR”) (the "TPS Divestiture"), pursuant to a securities and asset purchase agreement entered into on December 21, 2023, (as amended or supplemented through the date hereof) (the “Divestiture Agreement”), for a purchase price of $725 million in cash, subject to transaction adjustments in accordance with the Divestiture Agreement. For purposes of the unaudited pro forma condensed balance sheet, the cash proceeds received by the Company at closing, which are net of estimated closing adjustments and transaction cost funding, have been reflected as approximately $701 million. The divestiture of Product Support represents a strategic shift and therefore, beginning with the Company's quarterly report on Form-10-Q for the period ended December 31, 2023, Product Support was reflected as discontinued operations, including prior periods.

On February 6, 2024, Triumph issued (i) a notice of conditional redemption in respect of up to all $435.6 million of its outstanding 7.750% Senior Notes due 2025 (the “2025 Notes”) to be redeemed on March 6, 2024 (the "2025 Notes Redemption) and (ii) a notice of conditional redemption in respect of $120.0 million of its 9.000% Senior Secured First Lien Notes due 2028 (the “First Lien Notes”) to be redeemed on March 4, 2024 (the "First Lien Notes Redemption") (together, the "Senior Notes Redemptions"). The Senior Notes Redemptions were conditioned upon the consummation of the TPS Divestiture and therefore, on March 1, 2024, the Company concluded that the redemptions described on its February 6, 2024, Form 8-K were probable and the disclosure of related pro forma financial information would be material to investors.

Unaudited Pro Forma Financial Information

The following unaudited pro forma consolidated financial statements of Triumph were derived from its historical consolidated financial statements and are being presented to give effect to the TPS Divestiture and the Senior Notes Redemptions (together, the "Transactions"). The unaudited pro forma condensed consolidated balance sheet as of December 31, 2023, gives effect to the Transactions as if they had occurred on that date. As the TPS Divestiture was reflected as a component of discontinued operations within the condensed consolidated statement of operations in Triumph's Quarterly Report on Form 10-Q for December 31, 2023, the unaudited pro forma consolidated statements of operations for the nine months ended December 31, 2023, only reflects pro forma transaction adjustments for the Senior Notes Redemptions.

The unaudited pro forma consolidated statements of operations for the years ended March 31, 2023, 2022 and 2021 give effect to the pro forma discontinued operations presentation of the TPS Divestiture as if the TPS Divestiture had occurred on April 1, 2020, and in accordance with Financial Accounting Standards Board Accounting Standards Codification 205, “Presentation of Financial Statements” (“ASC 205”) for those historical periods.

The unaudited pro forma consolidated statements of operations for the year ended March 31, 2023, give effect to the pro forma Senior Notes Redemptions as if they had occurred on April 1, 2022, after adjusting for the effects of the TPS Divestiture as disclosed further in Note 2 below.

The unaudited pro forma consolidated financial statements should be read in conjunction with: (i) the accompanying notes to the unaudited pro forma condensed consolidated financial statements, (ii) Triumph's audited consolidated financial statements, the accompanying notes and Management’s Discussion and Analysis of Financial Condition and Results of Operations included in the Company's Annual Report on Form 10-K for the year ended March 31, 2023; and (iii) Triumph's unaudited condensed consolidated financial statements, the accompanying notes and Management’s Discussion and Analysis of Financial Condition and Results of Operations included in the Company's Quarterly Report on Form 10-Q for the quarterly period ended December 31, 2023.

The unaudited pro forma consolidated financial statements, prepared in accordance with Securities and Exchange Commission (“SEC”) Regulation S-X Article 11, Pro Forma Financial Information, have been prepared based upon the best available information and management estimates and are subject to assumptions and adjustments described in the accompanying notes to these financial statements, are for informational purposes only, and are not intended to be a complete presentation of the Company's operating results or financial position had the TPS Divestiture occurred as of and for the periods indicated, nor do they purport to project the results of operations or financial position for any future period or as of any future date. Accordingly, such information should not be relied upon as an indicator of future performance, financial condition or liquidity.

TRIUMPH GROUP, INC.

Unaudited Pro Forma Condensed Consolidated Balance Sheets

as of December 31, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands) |

|

As Reported |

|

|

TPS Divestiture |

|

|

|

Senior Notes Redemptions |

|

|

|

Total Pro Forma |

|

ASSETS |

|

|

|

|

Note 1 |

|

|

|

Note 2 |

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

162,899 |

|

|

$ |

701,214 |

|

(a) |

|

$ |

(575,202 |

) |

(c) |

|

$ |

288,911 |

|

Trade and other receivables, net |

|

|

127,494 |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

127,494 |

|

Contract assets |

|

|

89,406 |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

89,406 |

|

Inventory, net |

|

|

352,188 |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

352,188 |

|

Prepaid expenses and other current assets |

|

|

16,578 |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

16,578 |

|

Assets held for sale - current |

|

|

180,642 |

|

|

|

(180,642 |

) |

(a) |

|

|

— |

|

|

|

|

— |

|

Total current assets |

|

|

929,207 |

|

|

|

520,572 |

|

|

|

|

(575,202 |

) |

|

|

|

874,577 |

|

Property and equipment, net |

|

|

141,583 |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

141,583 |

|

Goodwill |

|

|

511,571 |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

511,571 |

|

Intangible assets, net |

|

|

67,308 |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

67,308 |

|

Other, net |

|

|

26,913 |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

26,913 |

|

Total assets |

|

$ |

1,676,582 |

|

|

$ |

520,572 |

|

|

|

$ |

(575,202 |

) |

|

|

$ |

1,621,952 |

|

LIABILITIES AND STOCKHOLDERS' DEFICIT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current portion of long-term debt |

|

$ |

3,342 |

|

|

$ |

(141 |

) |

(b) |

|

|

— |

|

|

|

|

3,201 |

|

Accounts payable |

|

|

133,550 |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

133,550 |

|

Contract liabilities |

|

|

40,182 |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

40,182 |

|

Accrued expenses |

|

|

140,092 |

|

|

|

(6,835 |

) |

(b) |

|

|

(15,981 |

) |

(c) |

|

|

117,276 |

|

Liabilities related to assets held for sale - current |

|

|

32,216 |

|

|

|

(32,216 |

) |

(a) |

|

|

— |

|

|

|

|

— |

|

Total current liabilities |

|

|

349,382 |

|

|

|

(39,192 |

) |

|

|

|

(15,981 |

) |

|

|

|

294,209 |

|

Long-term debt, less current portion |

|

|

1,627,810 |

|

|

|

(193 |

) |

(b) |

|

|

(555,621 |

) |

(c) |

|

|

1,071,996 |

|

Accrued pension and other postretirement benefits |

|

|

301,661 |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

301,661 |

|

Deferred income taxes |

|

|

7,356 |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

7,356 |

|

Other noncurrent liabilities |

|

|

60,653 |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

60,653 |

|

Stockholders' deficit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock |

|

|

77 |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

77 |

|

Capital in excess of par value |

|

|

1,107,241 |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

1,107,241 |

|

Treasury stock, at cost |

|

|

(5 |

) |

|

|

— |

|

|

|

|

— |

|

|

|

|

(5 |

) |

Accumulated other comprehensive loss |

|

|

(534,676 |

) |

|

|

— |

|

|

|

|

— |

|

|

|

|

(534,676 |

) |

Accumulated deficit |

|

|

(1,242,917 |

) |

|

|

559,957 |

|

(a) |

|

|

(3,600 |

) |

(c) |

|

|

(686,560 |

) |

Total stockholders' deficit |

|

|

(670,280 |

) |

|

|

559,957 |

|

|

|

|

(3,600 |

) |

|

|

|

(113,923 |

) |

Total liabilities and stockholders' deficit |

|

$ |

1,676,582 |

|

|

$ |

520,572 |

|

|

|

$ |

(575,202 |

) |

|

|

$ |

1,621,952 |

|

TRIUMPH GROUP, INC.

Unaudited Pro Forma Condensed Consolidated Statement of Operations

for the Nine Months Ended December 31, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands, except per share amounts) |

As Reported |

|

|

Senior Notes Redemptions |

|

|

|

Total

Pro Forma |

|

Net sales |

$ |

833,456 |

|

|

$ |

— |

|

|

|

$ |

833,456 |

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

Cost of sales (exclusive of depreciation shown separately below) |

|

618,742 |

|

|

|

— |

|

|

|

|

618,742 |

|

Selling, general and administrative |

|

135,479 |

|

|

|

— |

|

|

|

|

135,479 |

|

Depreciation and amortization |

|

22,062 |

|

|

|

— |

|

|

|

|

22,062 |

|

Legal judgment loss |

|

1,338 |

|

|

|

— |

|

|

|

|

1,338 |

|

Restructuring |

|

1,985 |

|

|

|

— |

|

|

|

|

1,985 |

|

Loss on sale of assets and businesses |

|

12,208 |

|

|

|

— |

|

|

|

|

12,208 |

|

|

|

791,814 |

|

|

|

— |

|

|

|

|

791,814 |

|

Operating income |

|

41,642 |

|

|

|

— |

|

|

|

|

41,642 |

|

Non-service defined benefit income |

|

(2,460 |

) |

|

|

— |

|

|

|

|

(2,460 |

) |

Debt modification and extinguishment (gain) loss |

|

(5,125 |

) |

|

|

9,691 |

|

(d) |

|

|

4,566 |

|

Warrant remeasurement gain, net |

|

(8,545 |

) |

|

|

— |

|

|

|

|

(8,545 |

) |

Interest expense and other, net |

|

94,354 |

|

|

|

(15,488 |

) |

(d) |

|

|

78,866 |

|

Loss from continuing operations before income taxes |

|

(36,582 |

) |

|

|

5,797 |

|

|

|

|

(30,785 |

) |

Income tax expense |

|

3,348 |

|

|

|

— |

|

(g) |

|

|

3,348 |

|

Net loss |

$ |

(39,930 |

) |

|

$ |

5,797 |

|

|

|

$ |

(34,133 |

) |

Loss per share - continuing operations—basic |

$ |

(0.55 |

) |

|

|

|

|

|

$ |

(0.47 |

) |

Weighted average common shares outstanding—basic |

|

73,200 |

|

|

|

|

|

|

|

73,200 |

|

Loss per share - continuing operations—diluted |

$ |

(0.55 |

) |

|

|

|

|

|

$ |

(0.47 |

) |

Weighted average common shares outstanding—diluted |

|

73,200 |

|

|

|

|

|

|

|

73,200 |

|

TRIUMPH GROUP, INC.

Unaudited Pro Forma Condensed Consolidated Statement of Operations

for the Year Ended March 31, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands, except per share amounts) |

As Reported |

|

|

(a)

TPS Divestiture |

|

|

Senior Notes Redemptions |

|

|

|

Total

Pro Forma |

|

|

|

|

|

Note 1 |

|

|

Note 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

$ |

1,379,128 |

|

|

$ |

(248,566 |

) |

|

|

— |

|

|

|

$ |

1,130,562 |

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales (exclusive of depreciation shown separately below) |

|

991,599 |

|

|

|

(181,717 |

) |

|

|

— |

|

|

|

|

809,882 |

|

Selling, general and administrative |

|

210,430 |

|

|

|

(19,342 |

) |

|

|

— |

|

|

|

|

191,088 |

|

Depreciation and amortization |

|

35,581 |

|

|

|

(3,322 |

) |

|

|

— |

|

|

|

|

32,259 |

|

Restructuring |

|

4,949 |

|

|

|

(1,777 |

) |

|

|

— |

|

|

|

|

3,172 |

|

Gain on sale of assets and businesses |

|

(101,523 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

(101,523 |

) |

|

|

1,141,036 |

|

|

|

(206,158 |

) |

|

|

— |

|

|

|

|

934,878 |

|

Operating income |

|

238,092 |

|

|

|

(42,408 |

) |

|

|

— |

|

|

|

|

195,684 |

|

Non-service defined benefit income |

|

(19,664 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

(19,664 |

) |

Debt modification and extinguishment loss |

|

33,044 |

|

|

|

— |

|

|

|

7,337 |

|

(e) |

|

|

40,381 |

|

Warrant remeasurement gain, net |

|

(8,683 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

(8,683 |

) |

Interest expense and other, net |

|

137,714 |

|

|

|

(22,504 |

) |

|

|

(23,059 |

) |

(e) |

|

|

92,151 |

|

Income from continuing operations before income taxes |

|

95,681 |

|

|

|

(19,904 |

) |

|

|

15,722 |

|

|

|

|

91,499 |

|

Income tax expense |

|

6,088 |

|

|

|

(2,442 |

) |

|

|

— |

|

(g) |

|

|

3,646 |

|

Net income |

$ |

89,593 |

|

|

$ |

(17,462 |

) |

|

$ |

15,722 |

|

|

|

$ |

87,853 |

|

Earnings per share - continuing operations—basic |

$ |

1.38 |

|

|

|

|

|

|

|

|

|

$ |

1.35 |

|

Weighted average common shares outstanding—basic |

|

65,021 |

|

|

|

|

|

|

|

|

|

|

65,021 |

|

Earnings per share - continuing operations—diluted |

$ |

1.20 |

|

|

|

|

|

|

|

|

(f) |

$ |

1.17 |

|

Weighted average common shares outstanding—diluted |

|

71,721 |

|

|

|

|

|

|

|

|

|

|

71,721 |

|

TRIUMPH GROUP, INC.

Unaudited Pro Forma Condensed Consolidated Statement of Operations

for the Year Ended March 31, 2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands, except per share amounts) |

As Reported |

|

|

(a)

TPS Divestiture |

|

|

Total

Pro Forma |

|

Net sales |

$ |

1,459,942 |

|

|

$ |

(197,238 |

) |

|

$ |

1,262,704 |

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

Cost of sales (exclusive of depreciation shown separately below) |

|

1,073,063 |

|

|

|

(144,426 |

) |

|

|

928,637 |

|

Selling, general and administrative |

|

202,070 |

|

|

|

(17,815 |

) |

|

|

184,255 |

|

Depreciation and amortization |

|

49,635 |

|

|

|

(4,126 |

) |

|

|

45,509 |

|

Impairment of long-lived assets |

|

2,308 |

|

|

|

— |

|

|

|

2,308 |

|

Restructuring |

|

19,295 |

|

|

|

(74 |

) |

|

|

19,221 |

|

Loss on sale of assets and businesses |

|

9,294 |

|

|

|

— |

|

|

|

9,294 |

|

|

|

1,355,665 |

|

|

|

(166,441 |

) |

|

|

1,189,224 |

|

Operating income |

|

104,277 |

|

|

|

(30,797 |

) |

|

|

73,480 |

|

Non-service defined benefit income |

|

(5,373 |

) |

|

|

— |

|

|

|

(5,373 |

) |

Debt modification and extinguishment loss |

|

11,624 |

|

|

|

— |

|

|

|

11,624 |

|

Interest expense and other, net |

|

135,861 |

|

|

|

(22,781 |

) |

|

|

113,080 |

|

Loss from continuing operations before income taxes |

|

(37,835 |

) |

|

|

(8,016 |

) |

|

|

(45,851 |

) |

Income tax expense |

|

4,923 |

|

|

|

(110 |

) |

|

|

4,813 |

|

Net loss |

$ |

(42,758 |

) |

|

$ |

(7,906 |

) |

|

$ |

(50,664 |

) |

Loss per share - continuing operations—basic |

$ |

(0.66 |

) |

|

|

|

|

$ |

(0.79 |

) |

Weighted average common shares outstanding—basic |

|

64,538 |

|

|

|

|

|

|

64,538 |

|

Loss per share - continuing operations—diluted |

$ |

(0.66 |

) |

|

|

|

|

$ |

(0.79 |

) |

Weighted average common shares outstanding—diluted |

|

64,538 |

|

|

|

|

|

|

64,538 |

|

TRIUMPH GROUP, INC.

Unaudited Pro Forma Condensed Consolidated Statement of Operations

for the Year Ended March 31, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands, except per share amounts) |

As Reported |

|

|

(a)

TPS Divestiture |

|

|

Total

Pro Forma |

|

Net sales |

$ |

1,869,719 |

|

|

$ |

(171,278 |

) |

|

$ |

1,698,441 |

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

Cost of sales (exclusive of depreciation shown separately below) |

|

1,476,266 |

|

|

|

(153,896 |

) |

|

|

1,322,370 |

|

Selling, general and administrative |

|

215,962 |

|

|

|

(18,787 |

) |

|

|

197,175 |

|

Depreciation and amortization |

|

93,334 |

|

|

|

(4,633 |

) |

|

|

88,701 |

|

Impairment of long-lived assets |

|

252,382 |

|

|

|

— |

|

|

|

252,382 |

|

Restructuring |

|

53,224 |

|

|

|

— |

|

|

|

53,224 |

|

Loss on sale of assets and businesses |

|

104,702 |

|

|

|

— |

|

|

|

104,702 |

|

|

|

2,195,870 |

|

|

|

(177,316 |

) |

|

|

2,018,554 |

|

Operating loss |

|

(326,151 |

) |

|

|

6,038 |

|

|

|

(320,113 |

) |

Non-service defined benefit income |

|

(49,519 |

) |

|

|

— |

|

|

|

(49,519 |

) |

Interest expense and other, net |

|

171,397 |

|

|

|

(26,226 |

) |

|

|

145,171 |

|

Loss from continuing operations before income taxes |

|

(448,029 |

) |

|

|

32,264 |

|

|

|

(415,765 |

) |

Income tax expense |

|

2,881 |

|

|

|

108 |

|

|

|

2,989 |

|

Net loss |

$ |

(450,910 |

) |

|

$ |

32,156 |

|

|

$ |

(418,754 |

) |

Loss per share - continuing operations—basic |

$ |

(8.55 |

) |

|

|

|

|

$ |

(7.94 |

) |

Weighted average common shares outstanding—basic |

|

52,739 |

|

|

|

|

|

|

52,739 |

|

Loss per share - continuing operations—diluted |

$ |

(8.55 |

) |

|

|

|

|

$ |

(7.94 |

) |

Weighted average common shares outstanding—diluted |

|

52,739 |

|

|

|

|

|

|

52,739 |

|

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

The following items resulted in adjustments in the unaudited pro forma condensed consolidated financial statements.

Transaction Accounting Adjustments:

Note 1

(a)Reflects the removal of the Product Support business, including the associated assets, liabilities, equity and results of operations for the periods presented consistent with the principles under ASC 205-20, Discontinued Operations and the Company's related accounting policies as disclosed in the Company's Quarterly Report on Form 10-Q for December 31, 2023. The cash and cash equivalents represent the cash consideration received at closing from the TPS Divestiture, net of estimated closing adjustments and transaction cost funding. This amount is preliminary and may change in the future as the closing adjustments are finalized.

(b)Reflects the use of a portion of the cash consideration to settle certain transaction costs and finance lease obligations accrued as of December 31, 2023.

Note 2

(c)Reflects the use of approximately $575.2 million in cash to redeem approximately $555.6 million in principal as disclosed above, plus accrued interest of approximately $16.0 million and a premium on redemption of the First Lien Notes of approximately $3.6 million.

(d)Reflects approximately $9.7 million in debt extinguishment losses and approximately $15.5 million in reduced interest expense that would have been avoided had the Senior Notes Redemption occurred on April 1, 2023. The $15.5 million of reduced interest expense is in addition to approximately $17.9 million in reduced interest expense that was allocated to discontinued operations in the Company's condensed consolidated statement of operations included on Form 10-Q for the nine months ended December 31, 2023.

(e)The First Lien Notes were issued on March 14, 2023, including approximately $20.0 million in deferred debt issuance costs. The Company concluded that presenting pro forma adjustments for the First Lien Notes redemption would not provide investors with clear, understandable information about the effect of the Transactions because of the timing of the First Lien Notes issuance. Instead, the Company considered that, had the TPS Divestiture occurred on April 1, 2022, under the terms of the indenture of its then outstanding 8.875% Senior Secured First Lien Notes due June 1, 2024 (the "2024 First Lien Notes"), approximately $213.2 million of the sale proceeds would have been required to repay the 2024 First Lien Notes at a premium of 106.656% (the "2024 First Lien Notes Redemption"). As a result, only $342.5 million would remain available under the Senior Notes Redemptions described above to redeem the 2025 Notes (the "Residual 2025 Notes Redemption"). The effect of the assumptions made above results in the pro forma adjustments reflecting approximately $4.7 million in incremental loss on extinguishment principally on the increase in the premium of 2024 First Lien Notes redemptions of 106.656% as compared with the 104.438% premium that was recognized in the year ended March 31, 2023, when the 2024 First Lien Notes were redeemed in March 2023, and approximately $23.1 million in reduced interest expense had the 2024 First Lien Notes Redemption and the Residual 2025 Notes Redemption occurred on April 1, 2022. The $23.1 million of reduced interest expense is in addition to approximately $21.6 million in reduced interest expense that was allocated to discontinued operations as a result of the application of ASC 205-20, Discontinued operations and the Company's related accounting policies as described in Note 1 (a) above.

(f)As disclosed in the Company's Annual Report on Form 10-K for the Year Ended March 31, 2023, the calculation of diluted earnings per share reflects the effect of all potentially dilutive securities (principally outstanding warrants and outstanding restricted stock units). The warrants outstanding in the year ended March 31, 2023, permitted the tendering of certain of the Company's long-term debt in payment of the exercise price. In computing diluted earnings per share, the Company applies the if-converted method to the warrants and such warrants are assumed to be exercised and the debt redeemed unless tendering cash would be more advantageous to the warrant holder. Interest (net of tax) on any Designated Notes assumed to be tendered is added back as an adjustment to the numerator. The numerator also is adjusted for any nondiscretionary adjustments based on income (net of tax) including, for example, warrant remeasurement gains recognized in the period. If cash exercise is more advantageous, the Company applies the treasury stock method to the warrants when calculating diluted EPS. In the year ended March 31, 2023, net income was reduced by approximately $3.6 million as a result of warrants related adjustments under the if-converted method. There were no warrants outstanding in the years ended March 31, 2022 and 2021.

(g)Income tax adjustments have not been computed on the basis of statutory rates. Adjustments have been computed based on the Company's tax profile, including net operating losses, tax holidays, and estimates of effective tax rate. The Company believes that this method presents a tax adjustment that more closely

reflects the effects of the Transactions.

v3.24.0.1

Document and Entity Information

|

Mar. 01, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 01, 2024

|

| Entity Registrant Name |

TRIUMPH GROUP, INC.

|

| Entity Central Index Key |

0001021162

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

51-0347963

|

| Entity File Number |

1-12235

|

| Entity Address, Address Line One |

555 E Lancaster Avenue

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

Radnor

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19087

|

| City Area Code |

(610)

|

| Local Phone Number |

251-1000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $.001 per share

|

| Trading Symbol |

TGI

|

| Security Exchange Name |

NYSE

|

| Purchase Rights [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Purchase Rights

|

| No Trading Symbol Flag |

true

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tgi_PurchaseRightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

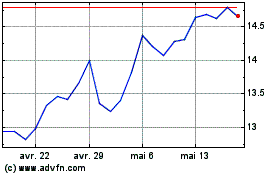

Triumph (NYSE:TGI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Triumph (NYSE:TGI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024