0001489096false00014890962023-11-142023-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 14, 2023

THERMON GROUP HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 001-35159 | 27-2228185 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification Number) |

| | | | | | | | | | | |

| 7171 Southwest Parkway | | |

| Building 300, | Suite 200 | | |

| Austin | TX | | 78735 |

| (Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number, including area code: (512) 690-0600

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | | | | | | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange

on which registered | |

| Common Stock, $0.001 par value per share | | THR | | New York Stock Exchange | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On November 14, 2023, in connection with the previously announced investor day, Thermon Group Holdings, Inc. (NYSE: THR) (the “Company”) issued a press release with further details regarding the investor day. A copy of the Company's press release regarding this investor day is being furnished as Exhibit 99.1 to this Current Report on Form 8-K. The presentation, entitled “Investor Day Presentation,” will be posted ahead of the event and may be found on the Company’s investor relations website at: https://ir.thermon.com.

The information in this Current Report on Form 8-K is being “furnished” pursuant to Item 7.01 and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and is not incorporated by reference into any Company filing, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Cautionary Note on Forward-Looking Statements

For more information regarding the forward-looking statements included in this Current Report on Form 8-K (including Exhibit 99.1 attached hereto), see the section titled, "Forward-Looking Statements," included in Exhibit 99.1.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits. |

| | | | | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted in Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| November 14, 2023 | THERMON GROUP HOLDINGS, INC. |

| | By: | /s/ | Ryan Tarkington |

| | | | Ryan Tarkington |

| | | | SVP, General Counsel & Corporate Secretary |

Thermon to Host 2023 Investor Day

Highlights Strategy to Create Long-term Shareholder Value

Increases Fiscal 2026 Financial Targets

AUSTIN, TX / ACCESSWIRE / November 14, 2023 -- Thermon Group Holdings, Inc. (NYSE:THR) ("Thermon"), a global leader in industrial process heating solutions, will host its inaugural investor day in New York City today, Tuesday, November 14, 2023 starting at 9:00 a.m. EST. The event will be available via a live webcast on the investor relations section of the Company’s website at http://ir.thermon.com and by replay shortly after the event. Presentation materials will also be posted ahead of the event.

Bruce Thames, President and CEO, and Kevin Fox, CFO, will be joined by other members of the executive management team to present an in-depth review of the Company's overall business and strategy, financial performance and outlook, how Thermon is enabling the energy transition, innovation and new product development, and the Company’s focus on operational excellence.

“We are thrilled to host our first investor day, which will give the investment community deeper insight into our strategy to create long-term value for our shareholders,” said Bruce Thames. “Our mission critical solutions and leading market positions enable us to drive revenue growth and expand our margins, backed by investments in innovation and new product development. We benefit from enhanced productivity through the implementation of the new Thermon Business System and attachment to secular trends that provide meaningful tailwinds for growth. We are also excited to share our long-term strategy, future financial targets, and our plans to accomplish them.”

Fiscal Year 2026 Financial Targets

During the investor day, Thermon will update its financial goals for its fiscal year ending on March 31, 2026 (the “FY2026 Financial Goals”) as follows:

a.Total Revenue: $600 million - $700 million

b.Non-Oil & Gas Revenue: ~70%

c.Adjusted EBITDA Margin: ~24%

Thermon will provide a comprehensive overview of the key initiatives that support the achievement of the FY2026 Financial Goals, along with the underlying assumptions, during its investor day.

About Thermon

Through its global network, Thermon provides safe, reliable and mission critical industrial process heating solutions. Thermon specializes in providing complete flow assurance, process heating, temperature maintenance, freeze protection and environmental monitoring solutions. Thermon is headquartered in Austin, Texas. For more information, please visit www.thermon.com.

Non-GAAP Financial Measures

Disclosure in this release of “Adjusted EBITDA margin”, which is a “non-GAAP financial measure” as defined under the rules of the Securities and Exchange Commission, is intended as a supplemental measure of our financial performance that is not required by, or presented in accordance with, U.S. generally accepted accounting principles (“GAAP”). “Adjusted EBITDA margin” represents Adjusted EBITDA as a percentage of total revenue. “Adjusted EBITDA” represents net income before interest expense (net of interest income), income tax expense, depreciation and amortization expense, stock-based compensation expense, acquisition costs, costs associated with restructuring and other income/(charges), and costs associated with impairments and other charges.

We believe this non-GAAP financial measure is meaningful to our investors to enhance their understanding of our financial performance and are frequently used by securities analysts, investors and other interested parties to compare our performance with the performance of other companies that report Adjusted EBITDA margin. This non-GAAP measure should be considered in addition to, and not a substitute for, net income margin and other measures of financial performance reported in accordance with GAAP. Our calculation of Adjusted EBITDA margin may not be comparable to similarly titled measures reported by other companies.

We are unable to reconcile our target fiscal 2026 Adjusted EBITDA margin to the most directly comparable projected GAAP financial measure because certain information necessary to calculate such measures on a GAAP basis is unavailable or dependent on the timing of future events outside of our control. Therefore, because of the uncertainty and variability of the nature of and the amount of any potential applicable future adjustments, which could be significant, we are unable to provide a reconciliation for target fiscal 2026 Adjusted EBITDA margin without unreasonable effort.

Forward-Looking Statements

This release includes forward-looking statements within the meaning of the U.S. federal securities laws in addition to historical information. These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, statements regarding our industry, business strategy, plans, goals and expectations concerning our market position, future operations, margins, profitability, capital expenditures, liquidity and capital resources and other financial and operating information such as our execution of our strategic initiatives, and our ability to achieve the FY26 Financial Goals. When used herein, the words "anticipate," "assume," "believe," "budget," "continue," "contemplate," "could," "should" "estimate," "expect," "intend," "may," "plan," "possible," "potential," "predict," "project," "will," "would," "future," and similar terms and phrases are intended to identify forward-looking statements in this release. Forward-looking statements reflect our current expectations regarding future events, results or outcomes. These expectations may or may not be realized. Some of these expectations may be based upon assumptions, data or judgments that prove to be incorrect. In addition, our business and operations involve numerous risks and uncertainties, many of which are beyond our control, which could result in our expectations not being realized or otherwise materially affect our financial condition, results of operations and cash flows.

Actual events, results and outcomes may differ materially from our expectations due to a variety of factors. Although it is not possible to identify all of these factors, they include, among others, (i) the outbreak of a global pandemic, including the current pandemic (COVID-19 and its variants); (ii) general economic conditions and cyclicality in the markets we serve; (iii) future growth of energy, chemical processing and power generation capital investments; (iv) our ability to operate successfully in foreign countries; (v) our ability to successfully develop and improve our products and successfully implement new technologies; (vi) competition from various other sources providing similar heat tracing and process heating products and services, or alternative technologies, to customers; (vii) our ability to deliver existing orders within our backlog; (viii) our ability to bid and win new contracts; (ix) the imposition of certain operating and financial restrictions contained in our debt agreements; (x) our revenue mix; (xi) our ability to grow through strategic acquisitions; (xii) our ability to manage risk through insurance against potential liabilities (xiii) changes in relevant currency exchange rates; (xiv) tax liabilities and changes to tax policy; (xv) impairment of goodwill and other intangible assets; (xvi) our ability to attract and retain qualified management and employees, particularly in our overseas markets; (xvii) our ability to protect our trade secrets; (xviii) our ability to protect our intellectual property; (xix) our ability to protect data and thwart potential cyber-attacks; (xx) a material disruption at any of our manufacturing facilities; (xxi) our dependence on subcontractors and third-party suppliers; (xxii) our ability to profit on fixed-price contracts; (xxiii) the credit risk associated to our extension of credit to customers; (xxiv) our ability to achieve our operational initiatives; (xxv) unforeseen difficulties with expansions, relocations, or consolidations of existing facilities; (xxvi) potential liability related to our products as well as the delivery of products and services; (xxvii) our ability to comply with foreign anti-corruption laws; (xxviii) export control regulations or sanctions; (xxix) changes in government administrative policy; (xxx) the current geopolitical instability in Russia and Ukraine and related sanctions by the U.S. and Canadian governments and European Union; (xxxi) environmental and health and safety laws and regulations as well as environmental liabilities; and (xxxii) climate change and related regulation of greenhouse gases, and (xxxiii) those factors listed under

Item 1A “Risk Factors” included in our Annual Report on Form 10-K for the fiscal year ended March 31, 2023 filed with the Securities and Exchange Commission (the “SEC”) on May 25, 2023 and in any subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K or other filings that we have filed or may file with the SEC. Any one of these factors or a combination of these factors could materially affect our future results of operations and could influence whether any forward-looking statements contained in this release ultimately prove to be accurate.

Our forward-looking statements are not guarantees of future performance, and actual results and future performance may differ materially from those suggested in any forward-looking statements. We do not intend to update these statements unless we are required to do so under applicable securities laws.

CONTACT:

Kevin Fox, Chief Financial Officer

Ivonne Salem, Vice President, FP&A and Investor Relations (512) 690-0600

Investor.Relations@thermon.com

v3.23.3

Cover Page Cover Page

|

Nov. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 14, 2023

|

| Entity Registrant Name |

THERMON GROUP HOLDINGS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35159

|

| Entity Tax Identification Number |

27-2228185

|

| Entity Address, Address Line One |

7171 Southwest Parkway

|

| Entity Address, Address Line Two |

Building 300,

|

| Entity Address, Address Line Three |

Suite 200

|

| Entity Address, City or Town |

Austin

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78735

|

| City Area Code |

512

|

| Local Phone Number |

690-0600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

THR

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001489096

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

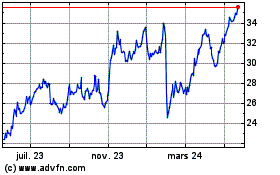

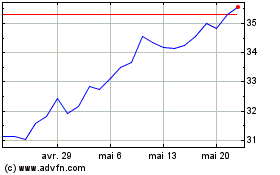

Thermon (NYSE:THR)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Thermon (NYSE:THR)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024