TotalEnergies SE Announces Final Results of Its Tender Offer in Respect of Its €2,500,000,000 Undated Deeply Subordinated Fixed Rate Resettable Notes With a First Call Date on 26 February 2025

20 Novembre 2024 - 12:37PM

Business Wire

(ISIN: XS1195202822)

Regulatory News:

TotalEnergies SE (the “Company”) (Paris:TTE) (LSE:TTE)

(NYSE:TTE) announces the final results of its invitation to holders

of its €2,500,000,000 Undated Non-Call 10 Year Deeply Subordinated

Fixed Rate Resettable Notes with a first call date on 26 February

2025 (ISIN: XS1195202822) issued by the Company on 26 February 2015

(all of which are currently outstanding) and admitted to trading on

Euronext Paris (the “Notes”) to tender their Notes for

purchase by the Company for cash (the “Tender Offer”).

The Tender Offer was announced on 12 November 2024 and was made

on the terms and subject to the conditions contained in the tender

offer memorandum dated 12 November 2024 prepared by the Company, as

updated by the announcement from the Company on 12 November 2024

(together the “Tender Offer Memorandum”), and is subject to

the offer restrictions described in the Tender Offer Memorandum.

Capitalised terms used in this announcement and not otherwise

defined herein shall have the meanings ascribed to them in the

Tender Offer Memorandum.

The Expiration Time for the Tender Offer was 17:00 hours CET on

19 November 2024.

The Company confirms that the issue of the New Notes settled

yesterday, and therefore the Financing Condition has been

satisfied.

As at the Expiration Time, the Company had received and accepted

for purchase valid tenders of €1,418,419,000 in aggregate nominal

amount of the Notes.

The Settlement Date in respect of the Notes accepted for

purchase pursuant to the Tender Offer is expected to be 22 November

2024. Following settlement of the Tender Offer and cancellation of

the relevant Notes accepted for purchase pursuant to the Tender

Offer, €1,081,581,000 in aggregate nominal amount of the Notes will

remain outstanding.

Disclaimer

This announcement does not constitute a prospectus. This

announcement is neither an offer to sell nor a solicitation of an

offer to buy securities. The securities which are the subject of

this publication were not offered to the public.

This announcement does not constitute an invitation to

participate in the Tender Offer in or from any jurisdiction in or

from which, or to or from any person to or from whom, it is

unlawful to make such invitation under applicable securities laws.

The distribution of this announcement in certain jurisdictions may

be restricted by law. Persons into whose possession this

announcement comes are required to inform themselves about, and to

observe, any such restrictions.

United States

The Tender Offer is not being made and will not be made directly

or indirectly in or into, or by use of the mails of, or by any

means or instrumentality (including, without limitation, facsimile

transmission, telex, telephone, email and other forms of electronic

transmission) of interstate or foreign commerce of, or any facility

of a national securities exchange of, the United States or to U.S.

Persons as defined in Regulation S of the U.S. Securities Act of

1933, as amended (the “Securities Act”) (each a “U.S.

Person”) and the Notes may not be tendered in the Tender Offer

by any such use, means, instrumentality or facility from or within

the United States, by persons located or resident in the United

States of America (“U.S. holders” within the meaning of Rule 800(h)

under the Securities Act). Accordingly, copies of the Tender Offer

Memorandum, this announcement and any documents or materials

related to the Tender Offer are not being, and must not be,

directly or indirectly, mailed or otherwise transmitted,

distributed or forwarded (including, without limitation, by

custodians, nominees or trustees) in or into the United States or

to any such person. Any purported Tender Instruction in response to

the Tender Offer resulting directly or indirectly from a violation

of these restrictions will be invalid, and any purported Tender

Instructions made by a person located or resident in the United

States of America or any agent, fiduciary or other intermediary

acting on a non‑discretionary basis for a principal giving

instructions from within the United States will be invalid and will

not be accepted.

For the purposes of the above paragraph, “United States”

means the United States of America, its territories and possessions

(including Puerto Rico, the U.S. Virgin Islands, Guam, American

Samoa, Wake Island and the Northern Mariana Islands), any state of

the United States of America and the District of Columbia.

Each Qualifying Holder of Notes participating in the Tender

Offer will represent that it is not participating in the Tender

Offer from the United States, that it is participating in the

Tender Offer in accordance with Regulation S under the Securities

Act and that it is not a U.S. Person or it is acting on a

non‑discretionary basis for a principal located outside the United

States that is not giving an order to participate in the Tender

Offer from the United States and who is not a U.S. Person.

France

The Tender Offer is being made, directly or indirectly in the

Republic of France to qualified investors (investisseurs qualifiés)

as defined in Article 2(e) of the Prospectus Regulation (as defined

below), as amended, and Article L.411-2 of the French Code

monétaire et financier as amended from time to time. The Tender

Offer Memorandum and any other offering material relating to the

Tender Offer may be distributed in the Republic of France only to

qualified investors. Neither the Tender Offer Memorandum, nor any

other such offering material has been submitted for clearance to

the French Autorité des marchés financiers (the “AMF”).

Please refer to the Tender Offer Memorandum for the other

applicable jurisdictions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241120416174/en/

TotalEnergies SE

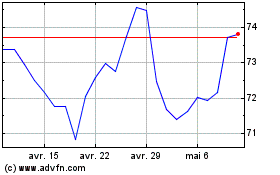

TotalEnergies (NYSE:TTE)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

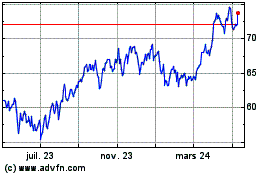

TotalEnergies (NYSE:TTE)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024