Urban Edge Properties Announces Fourth Quarter New Leasing Activity and Asset Sales

03 Janvier 2024 - 10:15PM

Business Wire

-- Achieved Same-Property Portfolio Leased

Occupancy of 96%, Highest Since 2018 --

-- Closed on $101 Million of Asset Sales in

December --

Urban Edge Properties (NYSE: UE) (the “Company”) today announced

it achieved record leasing activity for the fourth quarter of 2023,

executing 22 new leases comprising 234,000 square feet, including

the backfill of a 94,000 square foot former Bed Bath and Beyond

with a single national credit tenant at Totowa Commons in Totowa,

NJ. With this activity, Urban Edge has reached same-property

portfolio leased occupancy of 96% as of December 31, 2023, an

increase of 150 basis points compared to September 30, 2023 and 100

basis points compared to December 31, 2022 and the highest level

since 2018. Same-space new leases executed in the fourth quarter

generated an average rent spread of 38% on a cash basis.

Urban Edge also announced today that it has completed the sales

of Freeport Commons in Freeport, NY and a self-storage facility in

North Bergen, NJ in separate transactions for a combined $101

million, representing a blended 5.8% cap rate on forward NOI.

Freeport Commons was secured by a $43 million mortgage loan that

was repaid at closing, generating net proceeds from both sales to

the Company of approximately $56 million. The sale of Freeport

Commons completes the 1031 exchange associated with the $309

million acquisition of Shoppers World and Gateway Center on October

23, 2023. The Company is also currently under contract to sell an

additional non-core industrial asset for approximately $30

million.

“2023 was a transformational year for Urban Edge highlighted by

record leasing volumes, significant capital recycling that provided

accretive earnings growth, and sizable refinancing activity that

has further enhanced our strong balance sheet,” said Jeff Olson,

Chairman and CEO. “We continue to execute our business plan and

remain on track to achieve our targeted FFO as adjusted of $1.35

per share in 2025.”

ABOUT URBAN EDGE PROPERTIES

Urban Edge Properties is a NYSE listed real estate investment

trust focused on owning, managing, acquiring, developing, and

redeveloping retail real estate in urban communities, primarily in

the Washington, D.C. to Boston corridor. Urban Edge owns 76

properties totaling 17.1 million square feet of gross leasable

area.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240103067145/en/

For additional information: Mark

Langer, EVP and Chief Financial Officer 212-956-2556

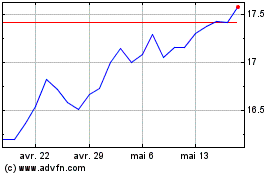

Urban Edge Properties (NYSE:UE)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Urban Edge Properties (NYSE:UE)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025