UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

Pursuant

to Rule 13a-16 or 15d-16

Under

the Securities Exchange Act of 1934

For

the month of February 2024

Commission

File Number: 001-35829

Vermilion

Energy Inc.

(Exact

name of registrant as specified in its charter)

3500,

520 – 3rd Avenue S.W., Calgary, Alberta T2P 0R3

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Exhibit

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

VERMILION

ENERGY INC.

| |

|

|

| By: |

|

/s/ Lars Glemser |

| Title: |

|

Lars Glemser, VP and Chief Financial Officer |

Date: February 28, 2024

Exhibit 99.1

Vermilion Energy Inc. Acquires Common Shares

of Coelacanth Energy Inc.

CALGARY, AB, Feb. 28, 2024 /CNW/ - Vermilion Energy

Inc. ("Vermilion") (TSX: VET) (NYSE: VET) announces that it has filed an early warning report (the "Early Warning Report")

in respect of its holdings in Coelacanth Energy Inc. ("Coelacanth").

On February 27, 2024, Vermilion acquired ownership

of, or control and direction over, 12,497,000 common shares ("Common Shares") of Coelacanth through a privately negotiated transaction

with a single counterparty at a price of $0.75 per Common Share for a purchase price of $9,372,750 (the "Transaction"), representing

an amount equal to more than 2% of the issued and outstanding Common Shares, thereby triggering the requirement to file an early warning

report.

Prior to the Transaction, Vermilion had ownership

of, or control and direction over, an aggregate of 97,682,604 Common Shares, representing approximately 18.55% of the issued and outstanding

Common Shares (and 104,682,604 Common Shares assuming exercise of 7,000,000 Common Share purchase warrants (the "Warrants")

held by it, representing approximately 19.62% of the issued and outstanding Common Shares on a partially diluted basis). Following the

Transaction, Vermilion now has ownership of, or control and direction over, an aggregate of 110,179,604 Common Shares, representing approximately

20.84% of the issued and outstanding Common Shares (and 117,179,604 Common Shares, assuming exercise of the Warrants, representing approximately

21.88% of the issued and outstanding Common Shares on a partially diluted basis).

The Common Shares were acquired for investment purposes.

Subject to applicable law, Vermilion will continue to review its holdings of Coelacanth's securities, and depending on market conditions,

general economic conditions and industry conditions, Coelacanth's business and financial condition and prospects and/or other relevant

factors, may increase or decrease its investment in the securities of Coelacanth.

This news release is being issued in accordance with

National Instrument 62-103 – The Early Warning System and Related Take-Over Bid and Insider Reporting Issues in connection with

the filing of the Early Warning Report. The Early Warning Report has been filed under Coelacanth's profile on SEDAR+ and can be viewed

at www.sedarplus.ca.

About Vermilion

Vermilion is an international energy producer that

seeks to create value through the acquisition, exploration, development and optimization of producing assets in North America, Europe

and Australia. Our business model emphasizes free cash flow generation and returning capital to investors when economically warranted,

augmented by value-adding acquisitions. Vermilion's operations are focused on the exploitation of light oil and liquids-rich natural

gas conventional and unconventional resource plays in North America and the exploration and development of conventional natural gas and

oil opportunities in Europe and Australia.

Vermilion's priorities are health and safety, the

environment, and profitability, in that order. Nothing is more important to us than the safety of the public and those who work with

us, and the protection of our natural surroundings. We have been recognized by leading ESG rating agencies for our transparency on

and management of key environmental, social and governance issues. In addition, we emphasize strategic community investment in each of

our operating areas.

Vermilion trades on the Toronto Stock Exchange and

the New York Stock Exchange under the symbol VET.

Vermilion's address is 3500, 520 – 3rd

Avenue SW, Calgary, Alberta T2P 0R3

Coelacanth's address is 2110, 530 – 8th Avenue SW, Calgary, Alberta, T2P 3S8

View original content to download multimedia:https://www.prnewswire.com/news-releases/vermilion-energy-inc-acquires-common-shares-of-coelacanth-energy-inc-302073907.html

SOURCE Vermilion Energy Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2024/28/c1395.html

%CIK: 0001293135

For further information: please contact: Dion Hatcher, President;

Lars Glemser, Vice President & CFO; and/or Kyle Preston, Vice President, Investor Relations, TEL (403) 269-4884 | IR TOLL FREE 1-866-895-8101

| investor_relations@vermilionenergy.com | www.vermilionenergy.com

CO: Vermilion Energy Inc.

CNW 08:00e 28-FEB-24

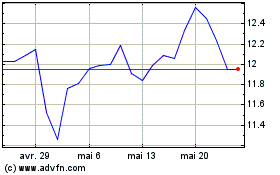

Vermilion Energy (NYSE:VET)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Vermilion Energy (NYSE:VET)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024