VOC Energy Trust Announces Trust Quarterly Distribution and Joint Venture

19 Janvier 2017 - 10:15PM

Business Wire

VOC Energy Trust (NYSE:VOC) announced the Trust distribution of

net profits for the fourth quarterly payment period ended December

31, 2016 and provided an update on certain operational matters,

including VOC Brazos Energy Partners, L.P.’s (“VOC Brazos”)

entrance into a joint venture with Hawkwood Energy East Texas LLC

(“Hawkwood Energy”).

Unitholders of record on January 30, 2017 will receive a

distribution amounting to $1,360,000 or $0.08 per unit, payable

February 14, 2017.

Volumes, average sales prices and net profits for the payment

period were:

Sales volumes: Oil (Bbl) 135,640 Natural gas (Mcf)

87,594 Total (BOE) 150,239

Average sales prices:

Oil (per Bbl) $ 43.01 Natural gas (per Mcf) $ 2.57 Gross proceeds:

Oil sales $ 5,833,941 Natural gas sales 224,888 Total

gross proceeds $ 6,058,829 Costs: Lease operating expenses $

2,994,238 Production and property taxes 691,321 Development

expenses 473,215 Total costs $ 4,158,774 Net

proceeds $ 1,900,055 Percentage applicable to Trust’s Net Profits

Interest 80 % Net profits interest $ 1,520,044 Increase in

cash reserve held by VOC Brazos Energy Partners, L.P. 0

Total cash proceeds available for the Trust $ 1,520,044

Provision for estimated Trust expenses (160,044 ) Net cash

proceeds available for distribution $ 1,360,000

VOC Brazos has reported to the Trustee that it has entered into

a joint venture with Hawkwood Energy to develop the lower EagleBine

interval, also referred to as the Lower Woodbine Organic Shale

(“LWOS”), within the south half of the Kurten Woodbine Unit (the

“Contract Area”). Activity pursuant to the terms of the joint

venture would recommence the horizontal LWOS drilling development

program that VOC Brazos previously reported to the Trustee in

December 2014.

Under the terms of the joint venture agreement between VOC

Brazos and Hawkwood Energy, Hawkwood Energy may carry VOC Brazos

for its share of drilling and completion costs for up to four LWOS

wells (the “Earning Wells”), with the first Earning Well to be spud

by December 31, 2017 and the fourth Earning Well to be spud by

January 1, 2019. In exchange, Hawkwood Energy would earn a working

interest representing 50% of VOC Brazos’ interest in each Earning

Well and up to a 50% interest in VOC Brazos’ acreage in the

Contract Area. Hawkwood Energy also would have the right to propose

and drill up to eight LWOS wells per year in the Contract Area

after the Earning Wells are completed.

VOC Brazos is evaluating the potential economic benefits

associated with development of the LWOS and pad drilling in the

upper EagleBine interval. If these activities are pursued, with the

exception of the Earning Wells in which Hawkwood Energy would carry

VOC Brazos for its share of drilling and completion costs, such

activities would result in increased development costs burdening

the net profits interest of the Trust relative to historical

development costs. As a result of such increased development costs,

cash available for distributions by the Trust would be temporarily

reduced until anticipated production from the various development

efforts in the Kurten Woodbine Unit can be brought on-line. To

address these emerging opportunities, VOC Brazos will continue to

evaluate the appropriate strategy and capital plan to fund

development for the Trust.

This press release contains forward-looking statements. Although

VOC Brazos has advised the Trust that VOC Brazos believes that the

expectations contained in this press release are reasonable, no

assurances can be given that such expectations will prove to be

correct. The announced distributable amount is based on the amount

of cash received or expected to be received by the Trustee from the

underlying properties on or prior to the record date with respect

to the quarter ended December 31, 2016. Any differences in actual

cash receipts by the Trust could affect this distributable amount.

Other important factors that could cause these statements to differ

materially include the actual results of drilling operations, risks

inherent in drilling and production of oil and gas properties, the

ability of commodity purchasers to make payment, and other risk

factors described in the Trust’s Form 10-K for the year ended

December 31, 2015 filed with the Securities and Exchange

Commission. Statements made in this press release are qualified by

the cautionary statements made in these risk factors. The Trust

does not intend, and assumes no obligation, to update any of the

statements included in this press release.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170119006036/en/

VOC Energy TrustThe Bank of New York Mellon Trust Company,

N.A., as TrusteeMike Ulrich, 512-236-6599

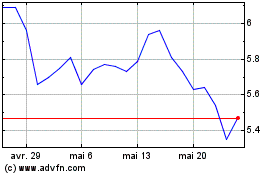

Voc Energy (NYSE:VOC)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Voc Energy (NYSE:VOC)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025