W&T Offshore, Inc. (NYSE: WTI) (“W&T” or the “Company”)

announced today the initial results of its previously announced

cash tender offer (the “Tender Offer”) relating to any and all of

its outstanding 11.750% senior second lien notes due 2026 (the

“2026 Senior Second Lien Notes”) pursuant to its Offer to Purchase

and Consent Solicitation dated January 13, 2025 (the “Offer to

Purchase”). In conjunction with the Tender Offer, the Company also

solicited consents (the “Consent Solicitation”) from the holders of

the 2026 Senior Second Lien Notes for the adoption of proposed

amendments (the “Proposed Amendments”), which, among other

things, eliminated substantially all of the restrictive

covenants, as well as various events of default and related

provisions contained in the indenture governing the 2026 Senior

Second Lien Notes (the “Indenture”).

As of 5:00 p.m. (New York City time) on January

27, 2025, the Company had received the requisite tenders and

consents to the Proposed Amendments. The Proposed Amendments became

effective on January 27, 2025 upon execution of a supplemental

indenture to the indenture governing the 2026 Senior Second Lien

Notes.

On January 28, 2025 (the “Early Settlement

Date”), the Company accepted and purchased $269,741,000 aggregate

principal amount of the outstanding 2026 Senior Second Lien Notes

(or approximately 98.09% of the outstanding principal amount of

2026 Senior Second Lien Notes) for a purchase price equal to

$1,036.25, plus accrued and unpaid interest, for each $1,000

principal amount of the 2026 Senior Second Lien Notes purchased.

After giving effect to the purchase of 2026 Senior Second Lien

Notes on the Early Settlement Date, an aggregate $5,259,000

principal amount of the 2026 Senior Second Lien Notes will remain

outstanding.

W&T’s tender offer for the 2026 Senior

Second Lien Notes will expire at 5:00 p.m. (New York City time) on

February 11, 2025, unless the Tender Offer is extended by the

Company in its sole discretion (the “Expiration Time”). Holders of

the 2026 Senior Second Lien Notes who validly tender their 2026

Senior Second Lien Notes on or prior to the Expiration Time, and

whose 2026 Senior Second Lien Notes are accepted for purchase, will

receive consideration of $1,006.25 per $1,000 principal amount of

the 2026 Senior Second Lien Notes tendered. In addition, the

Company will pay accrued and unpaid interest on the principal

amount of 2026 Senior Second Lien Notes accepted for purchase from

the most recent interest payment date on the 2026 Senior Second

Lien Notes to, but not including, February 13, 2025, the final

settlement date.

Also on January 28, 2025, the Company mailed a

notice of redemption to each remaining holder of 2026 Senior Second

Lien Notes. The notice of redemption calls for the redemption of

any 2026 Senior Second Lien Notes that remain outstanding on August

1, 2025. Such redemption is being made in accordance with the

“optional redemption” provision of the Indenture, at a redemption

price equal to 100.000% of the aggregate principal amount of the

2026 Senior Second Lien Notes, plus accrued and unpaid interest up

to, but excluding, the date of redemption.

Because the withdrawal deadline of 5:00 p.m.

(New York City time) on January 27, 2025 has passed, previously

tendered 2026 Senior Second Lien Notes may no longer be withdrawn,

and holders who tender 2026 Senior Second Lien Notes after the

withdrawal deadline will not have withdrawal rights.

W&T engaged Morgan Stanley & Co. LLC to

act as dealer manager for the Tender Offer and as solicitation

agent for the Consent Solicitation and can be contacted at (212)

761-1057 (collect) or (800) 624-1808 (toll-free) with questions

regarding the Tender Offer and Consent Solicitation.

Copies of the Offer to Purchase are available to

holders of 2026 Second Senior Lien Notes from D.F. King & Co.,

Inc., the information agent and tender agent for the Tender Offer

and the Consent Solicitation. Requests for copies of the Offer to

Purchase should be directed to D.F. King at (866) 620-2535 (toll

free), (212) 269-5550 (banks and brokers) or

wtoffshore@dfking.com

Neither the Offer to Purchase nor any related

documents have been filed with the U.S. Securities and Exchange

Commission (“SEC”), nor have any such documents been filed with or

reviewed by any federal or state securities commission or

regulatory authority of any country. No authority has passed upon

the accuracy or adequacy of the Offer to Purchase or any related

documents, and it is unlawful and may be a criminal offense to make

any representation to the contrary.

The Tender Offer and the Consent Solicitation

were made solely on the terms and conditions set forth in the Offer

to Purchase. Under no circumstances shall this press release

constitute an offer to buy or the solicitation of an offer to sell

the 2026 Second Senior Lien Notes or any other securities of the

Company or any of its subsidiaries. The Tender Offer and the

Consent Solicitation are not being made to, nor will the Company

accept tenders of 2026 Second Senior Lien Notes or deliveries of

consents from, holders in any jurisdiction in which the Tender

Offer and the Consent Solicitation or the acceptance thereof would

not be in compliance with the securities of blue sky laws of such

jurisdiction. This press release also is not a solicitation of

consents to the Proposed Amendments to the indenture governing the

2026 Second Senior Lien Notes. No recommendation is made as to

whether holders should tender their 2026 Second Senior Lien Notes

or deliver their consents with respect to the 2026 Second Senior

Lien Notes. Holders should carefully read the Offer to Purchase

because it contains important information, including the terms and

conditions of the Tender Offer and the Consent Solicitation.

About W&T Offshore

W&T Offshore, Inc. is an independent oil and

natural gas producer, active in the exploration, development and

acquisition of oil and natural gas properties in the Gulf of

Mexico. As of September 30, 2024, the Company had working

interests in 53 producing offshore fields in federal and state

waters (which include 46 fields in federal waters and seven in

state waters). The Company has under lease approximately 673,100

gross acres (515,400 net acres) spanning across the outer

continental shelf off the coasts of Louisiana, Texas, Mississippi

and Alabama, with approximately 514,000 gross acres on the

conventional shelf, approximately 153,500 gross acres in the

deepwater and 5,600 gross acres in Alabama state waters. A majority

of the Company’s daily production is derived from wells it

operates. For more information on W&T, please visit the

Company’s website at www.wtoffshore.com.

Forward-Looking and Cautionary

Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. All statements other than statements of

historical facts included in this release regarding the Company’s

financial position, operating and financial performance, timing and

completion of the Tender Offer and Consent Solicitation are

forward-looking statements. When used in this release,

forward-looking statements are generally accompanied by terms or

phrases such as “estimate,” “project,” “predict,” “believe,”

“expect,” “continue,” “anticipate,” “target,” “could,” “plan,”

“intend,” “seek,” “goal,” “will,” “should,” “may” or other words

and similar expressions that convey the uncertainty of future

events or outcomes, although not all forward-looking statements

contain such identifying words. Items contemplating or making

assumptions about actual or potential future production and sales,

prices, market size, and trends or operating results also

constitute such forward-looking statements.

These forward-looking statements are based on

the Company’s current expectations and assumptions about future

events and speak only as of the date of this release. While

management considers these expectations and assumptions to be

reasonable, they are inherently subject to significant business,

economic, competitive, regulatory and other risks, contingencies

and uncertainties, most of which are difficult to predict and many

of which are beyond the Company’s control. Accordingly, you are

cautioned not to place undue reliance on these forward-looking

statements, as results actually achieved may differ materially from

expected results described in these statements. The Company does

not undertake, and specifically disclaims, any obligation to update

any forward-looking statements to reflect events or circumstances

occurring after the date of such statements, unless required by

law.

Forward-looking statements are subject to risks

and uncertainties that could cause actual results to differ

materially including, among other things, the regulatory

environment, including availability or timing of, and conditions

imposed on, obtaining and/or maintaining permits and approvals,

including those necessary for drilling and/or development projects;

the impact of current, pending and/or future laws and regulations,

and of legislative and regulatory changes and other government

activities, including those related to permitting, drilling,

completion, well stimulation, operation, maintenance or abandonment

of wells or facilities, managing energy, water, land, greenhouse

gases or other emissions, protection of health, safety and the

environment, or transportation, marketing and sale of the Company’s

products; inflation levels; global economic trends, geopolitical

risks and general economic and industry conditions, such as the

global supply chain disruptions and the government interventions

into the financial markets and economy in response to inflation

levels and world health events; volatility of oil, NGL and natural

gas prices; the global energy future, including the factors and

trends that are expected to shape it, such as concerns about

climate change and other air quality issues, the transition to a

low-emission economy and the expected role of different energy

sources; supply of and demand for oil, natural gas and NGLs,

including due to the actions of foreign producers, importantly

including OPEC and other major oil producing companies (“OPEC+”)

and change in OPEC+’s production levels; disruptions to, capacity

constraints in, or other limitations on the pipeline systems that

deliver the Company’s oil and natural gas and other processing and

transportation considerations; inability to generate sufficient

cash flow from operations or to obtain adequate financing to fund

capital expenditures, meet the Company’s working capital

requirements or fund planned investments; price fluctuations and

availability of natural gas and electricity; the Company’s ability

to use derivative instruments to manage commodity price risk; the

Company’s ability to meet the Company’s planned drilling schedule,

including due to the Company’s ability to obtain permits on a

timely basis or at all, and to successfully drill wells that

produce oil and natural gas in commercially viable quantities;

uncertainties associated with estimating proved reserves and

related future cash flows; the Company’s ability to replace the

Company’s reserves through exploration and development activities;

drilling and production results, lower–than–expected production,

reserves or resources from development projects or

higher–than–expected decline rates; the Company’s ability to obtain

timely and available drilling and completion equipment and crew

availability and access to necessary resources for drilling,

completing and operating wells; changes in tax laws; effects of

competition; uncertainties and liabilities associated with acquired

and divested assets; the Company’s ability to make acquisitions and

successfully integrate any acquired businesses; asset impairments

from commodity price declines; large or multiple customer defaults

on contractual obligations, including defaults resulting from

actual or potential insolvencies; geographical concentration of the

Company’s operations; the creditworthiness and performance of the

Company’s counterparties with respect to its hedges; impact of

derivatives legislation affecting the Company’s ability to hedge;

failure of risk management and ineffectiveness of internal

controls; catastrophic events, including tropical storms,

hurricanes, earthquakes, pandemics and other world health events;

environmental risks and liabilities under U.S. federal, state,

tribal and local laws and regulations (including remedial actions);

potential liability resulting from pending or future litigation;

the Company’s ability to recruit and/or retain key members of the

Company’s senior management and key technical employees;

information technology failures or cyberattacks; and governmental

actions and political conditions, as well as the actions by other

third parties that are beyond the Company’s control, and other

factors discussed in W&T Offshore’s most recent Annual Report

on Form 10-K and subsequent Quarterly Reports on Form 10-Q found at

www.sec.gov or at the Company’s website at www.wtoffshore.com under

the Investor Relations section.

Disclaimer

This press release must be read in conjunction with the Offer to

Purchase. This announcement and the Offer to Purchase contain

important information which must be read carefully before any

decision is made with respect to the Tender Offer and the Consent

Solicitation. If any holder of 2026 Senior Second Lien Notes is in

any doubt as to the actions it should take, it is recommended to

seek its own legal, tax, accounting and financial advice, including

as to any tax consequences, immediately from its stockbroker, bank

manager, attorney, accountant or other independent financial or

legal adviser. Any individual or company whose 2026 Senior Second

Lien Notes are held on its behalf by a broker, dealer, bank,

custodian, trust company or other nominee or intermediary must

contact such entity if it wishes to participate in the Offer to

Purchase. None of the Company, the dealer manager and solicitation

agent, the information agent and tender agent and any person who

controls, or is a director, officer, employee or agent of such

persons, or any affiliate of such persons, makes any recommendation

as to whether holders of 2026 Senior Second Lien Notes should

participate in the Tender Offer.

|

|

|

|

|

CONTACT: |

Al Petrie |

Sameer Parasnis |

| |

Investor Relations

Coordinator |

Executive VP and CFO |

| |

investorrelations@wtoffshore.com |

sparasnis@wtoffshore.com |

| |

713-297-8024 |

713-513-8654 |

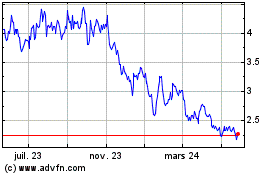

W and T Offshore (NYSE:WTI)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

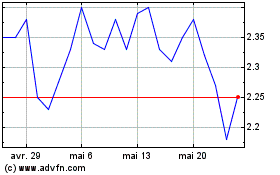

W and T Offshore (NYSE:WTI)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025