W&T Offshore, Inc. (NYSE: WTI) (“W&T Offshore” or the

“Company”) today announced the closing, on January 28, 2025, of its

previously announced offering of $350 million in aggregate

principal amount of 10.750% Senior Second Lien Notes due 2029 (the

“Notes”) at par in a private offering that is exempt from

registration under the Securities Act of 1933, as amended (the

“Securities Act”), and receipt of proceeds from a

previously-announced insurance settlement. In conjunction with the

issuance of the Notes, the Company entered into a credit agreement

with certain lenders and other parties which provides the Company a

revolving credit facility of $50 million.

- Closed $350

million of Notes;

- Lowered the

interest rate from the previous 11.750% Senior Second Lien Notes

due 2026 (the “2026 Senior Second Lien Notes”) by one hundred basis

points;

- Repaid $114.2

million outstanding under the term loan provided by Munich Re Risk

Financing, Inc., as lender (the “MRE Term Loan”);

- Entered into a

new credit agreement for a $50 million revolving credit facility

through July 2028 that is undrawn and replaces the previous credit

facility provided by Calculus Lending, LLC; and

- Received in

cash $58.2 million of the previously announced $58.5 million

insurance settlement related to the Mobile Bay 78-1 well, with the

remainder expected shortly, which further bolsters W&T’s

balance sheet.

Tracy W. Krohn, Chairman and Chief Executive

Officer, commented, “We have begun 2025 with several positive

events that improve W&T’s financial position. Over the past

month, we have strengthened the balance sheet by closing the new

senior second lien notes offering, entering into a new revolving

credit facility and collecting our insurance settlement. I would

like to thank our banks for running such a smooth process. The new

senior second lien notes, which received improved credit ratings

from S&P and Moody’s, had a broad distribution. This included

international investors and was significantly oversubscribed,

further demonstrating the investment community’s confidence in

W&T’s underlying asset base. We are likewise pleased to now

have access to the bank revolver market again. With pathways in

place to bring additional fields back online and our successful

actions to enhance our balance sheet, we are well-positioned for

success moving forward.”

The Company has used a portion of the proceeds

from the Notes offering, along with cash on hand to, (i) purchase

for cash pursuant to a tender offer, such of the Company’s

outstanding 2026 Senior Second Lien Notes that were validly

tendered pursuant to the terms thereof (the “Tender Offer”), (ii)

repay outstanding amounts under the MRE Term Loan, (iii) fund the

full redemption amount for an August 1, 2025 redemption of the

remaining 2026 Senior Second Lien Notes not validly tendered and

accepted for purchase in the Tender Offer and (iv) pay premiums,

fees and expenses related to the offering of Notes, the Tender

Offer, the redemption of the remaining 2026 Senior Second Lien

Notes, the satisfaction and discharge of the indenture governing

the 2026 Senior Second Lien Notes and the repayment of the MRE Term

Loan. On the closing date of the offering of the Notes, the Company

completed all actions necessary to satisfy and discharge the

indenture governing the 2026 Senior Second Lien Notes.

On January 28, 2025, in conjunction with the

issuance of the Notes, the Company entered into a credit agreement

(the “Credit Agreement”), by and among the Company, as borrower,

Texas Capital Bank, as Administrative Agent, lender and L/C Issuer,

TCBI Securities, Inc., doing business as Texas Capital Securities,

as Lead Arranger and Bookrunner, the other lenders named therein

and other parties thereto which provides the Company a revolving

credit and letter of credit facility (the “Credit Facility”), with

initial lending commitments of $50 million with a letter of credit

sublimit of $10 million. The Credit Facility matures on July 28,

2028.

The Credit Facility is guaranteed by each of the

Company’s wholly owned direct and indirect subsidiaries (the

“Guarantors”) and is secured by a first-priority lien on

substantially all of the natural gas and oil properties and

personal property assets of the Company and the Guarantors, other

than the Company’s membership interest in its Unrestricted

Subsidiaries (as defined in the Credit Agreement) and minority

ownership in certain joint venture entities. Certain future-formed

or acquired majority-owned domestic subsidiaries of the Company may

also be required to guarantee the Credit Facility and grant a

security interest in substantially all of their natural gas and oil

properties and personal property assets to secure the obligations

under the Credit Facility.

This press release is being issued for

informational purposes only and does not constitute an offer to

purchase or a solicitation of an offer to sell the 2026 Senior

Second Lien Notes, and it does not constitute a notice of

redemption of the 2026 Senior Second Lien Notes.

The Notes and the related guarantees have not

been and will not be registered under the Securities Act or any

other securities laws, and the Notes and the related guarantees may

not be offered or sold except pursuant to an exemption from, or in

a transaction not subject to, the registration requirements of the

Securities Act and any other applicable securities laws. The Notes

and the related guarantees are being offered only to persons

reasonably believed to be qualified institutional buyers in the

United States under Rule 144A and to non-U.S. investors outside the

United States pursuant to Regulation S.

This press release is being issued for

informational purposes only and does not constitute an offer to

sell, a solicitation of an offer to buy, or a sale of the Notes,

the related guarantees, or any other securities, nor does it

constitute an offer to sell, a solicitation of an offer to buy or a

sale in any jurisdiction in which such offer, solicitation or sale

is unlawful.

ABOUT W&T OFFSHORE

W&T Offshore, Inc. is an independent oil and

natural gas producer with operations offshore in the Gulf of Mexico

and has grown through acquisitions, exploration and development. As

of September 30, 2024, the Company had working interests in 53

fields in federal and state waters (which include 46 fields in

federal waters and 7 in state waters). The Company has under lease

approximately 673,100 gross acres (515,400 net acres) spanning

across the outer continental shelf off the coasts of Louisiana,

Texas, Mississippi and Alabama, with approximately 514,000 gross

acres on the conventional shelf, approximately 153,500 gross acres

in the deepwater and 5,600 gross acres in Alabama state waters. A

majority of the Company’s daily production is derived from wells it

operates.

FORWARD-LOOKING AND CAUTIONARY

STATEMENTS

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. All statements other than statements of

historical facts included in this release regarding the Company’s

financial position, operating and financial performance, and

potential to return fields back to production are forward-looking

statements. When used in this release, forward-looking statements

are generally accompanied by terms or phrases such as “estimate,”

“project,” “predict,” “believe,” “expect,” “continue,”

“anticipate,” “target,” “could,” “plan,” “intend,” “seek,” “goal,”

“will,” “should,” “may” or other words and similar expressions that

convey the uncertainty of future events or outcomes, although not

all forward-looking statements contain such identifying words.

Items contemplating or making assumptions about actual or potential

future production and sales, prices, market size, and trends or

operating results also constitute such forward-looking

statements.

These forward-looking statements are based on

the Company’s current expectations and assumptions about future

events and speak only as of the date of this release. While

management considers these expectations and assumptions to be

reasonable, they are inherently subject to significant business,

economic, competitive, regulatory and other risks, contingencies

and uncertainties, most of which are difficult to predict and many

of which are beyond the Company’s control. Accordingly, you are

cautioned not to place undue reliance on these forward-looking

statements, as results actually achieved may differ materially from

expected results described in these statements. The Company does

not undertake, and specifically disclaims, any obligation to update

any forward-looking statements to reflect events or circumstances

occurring after the date of such statements, unless required by

law.

Forward-looking statements are subject to risks

and uncertainties that could cause actual results to differ

materially including, among other things, the regulatory

environment, including availability or timing of, and conditions

imposed on, obtaining and/or maintaining permits and approvals,

including those necessary for drilling and/or development projects;

the impact of current, pending and/or future laws and regulations,

and of legislative and regulatory changes and other government

activities, including those related to permitting, drilling,

completion, well stimulation, operation, maintenance or abandonment

of wells or facilities, managing energy, water, land, greenhouse

gases or other emissions, protection of health, safety and the

environment, or transportation, marketing and sale of the Company’s

products; inflation levels; global economic trends, geopolitical

risks and general economic and industry conditions, such as the

global supply chain disruptions and the government interventions

into the financial markets and economy in response to inflation

levels and world health events; volatility of oil, NGL and natural

gas prices; the global energy future, including the factors and

trends that are expected to shape it, such as concerns about

climate change and other air quality issues, the transition to a

low-emission economy and the expected role of different energy

sources; supply of and demand for oil, natural gas and NGLs,

including due to the actions of foreign producers, importantly

including OPEC and other major oil producing companies (“OPEC+”)

and change in OPEC+’s production levels; disruptions to, capacity

constraints in, or other limitations on the pipeline systems that

deliver the Company’s oil and natural gas and other processing and

transportation considerations; inability to generate sufficient

cash flow from operations or to obtain adequate financing to fund

capital expenditures, meet the Company’s working capital

requirements or fund planned investments; price fluctuations and

availability of natural gas and electricity; the Company’s ability

to use derivative instruments to manage commodity price risk; the

Company’s ability to meet the Company’s planned drilling schedule,

including due to the Company’s ability to obtain permits on a

timely basis or at all, and to successfully drill wells that

produce oil and natural gas in commercially viable quantities;

uncertainties associated with estimating proved reserves and

related future cash flows; the Company’s ability to replace the

Company’s reserves through exploration and development activities;

drilling and production results, lower–than–expected production,

reserves or resources from development projects or

higher–than–expected decline rates; the Company’s ability to obtain

timely and available drilling and completion equipment and crew

availability and access to necessary resources for drilling,

completing and operating wells; changes in tax laws; effects of

competition; uncertainties and liabilities associated with acquired

and divested assets; the Company’s ability to make acquisitions and

successfully integrate any acquired businesses; asset impairments

from commodity price declines; large or multiple customer defaults

on contractual obligations, including defaults resulting from

actual or potential insolvencies; geographical concentration of the

Company’s operations; the creditworthiness and performance of the

Company’s counterparties with respect to its hedges; impact of

derivatives legislation affecting the Company’s ability to hedge;

failure of risk management and ineffectiveness of internal

controls; catastrophic events, including tropical storms,

hurricanes, earthquakes, pandemics and other world health events;

environmental risks and liabilities under U.S. federal, state,

tribal and local laws and regulations (including remedial actions);

potential liability resulting from pending or future litigation;

the Company’s ability to recruit and/or retain key members of the

Company’s senior management and key technical employees;

information technology failures or cyberattacks; and governmental

actions and political conditions, as well as the actions by other

third parties that are beyond the Company’s control, and other

factors discussed in W&T Offshore’s most recent Annual Report

on Form 10-K and subsequent Quarterly Reports on Form 10-Q found at

www.sec.gov or at the Company’s website at www.wtoffshore.com under

the Investor Relations section.

CONTACT:

Al PetrieInvestor Relations

Coordinatorinvestorrelations@wtoffshore.com713-297-8024

Sameer ParasnisExecutive Vice President and

Chief Financial Officersparasnis@wtoffshore.com713-513-8654

Source: W&T Offshore, Inc.

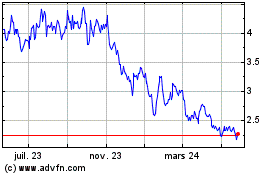

W and T Offshore (NYSE:WTI)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

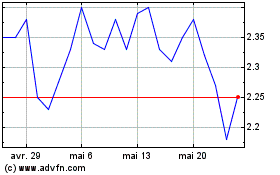

W and T Offshore (NYSE:WTI)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025