Form SCHEDULE 13G/A - Statement of Beneficial Ownership by Certain Investors: [Amend]

31 Janvier 2025 - 7:53PM

Edgar (US Regulatory)

EXHIBIT 1

All Class B Common Stock shares beneficially

owned by Timothy P. Horne are held individually by or in trusts for the benefit of Timothy P. Horne, Daniel W. Horne, Deborah Horne, Tiffany

Horne Noonan, Kiera R. Noonan, Tessa R. Noonan, Liv R. Noonan and Peter W. Horne, and any voting trust certificates representing such

shares, are subject to an Amended and Restated Stock Restriction Agreement (the “Agreement”). Upon any proposed voluntary

transfer or transfer by operation of law of Class B Common Stock or voting trust certificates representing such shares by any of

the above stockholders, or upon the death of such a stockholder holding such shares or voting trust certificates, the other parties to

the Agreement have a pro rata right of first refusal to purchase such shares (including a second opportunity to elect to purchase any

shares not purchased under the first right of refusal).

The purchase price per share is the 15-day average

trading price of the Issuer’s Class A Common Stock while publicly traded, except in the case of certain involuntary transfers,

in which case the purchase price is book value.

This summary is qualified in its entirety by reference

to the text of the Agreement which is incorporated herein by reference to Exhibit 2 to the Issuer’s Current Report on Form 8-K

dated October 31, 1991, and to the text of Amendment No. 1 to the Agreement which is incorporated herein by reference to Exhibit 10.21

to the Issuer’s Annual Report on Form 10-K dated September 16, 1997.

EXHIBIT 2

The

950,000 shares of Class B Common Stock held by a revocable trust for the benefit of Timothy P. Horne, 1,666,970 shares of Class B Common

Stock held by a trust for the benefit of Daniel W. Horne, 1,666,970 shares of Class B Common Stock held by a trust for the benefit of

Deborah Horne, 1,495,010 shares of Class B Common Stock held by a trust for the benefit of Peter W. Horne, 21,600 shares of Class

B Common Stock held for the benefit of Tiffany Horne Noonan under an irrevocable trust for which Timothy P. Horne serves as trustee, 113,924

shares of Class B Common Stock held by a trust for the benefit of Tiffany Horne Noonan for which Walter J. Flowers serves as the sole

trustee, 6,447 shares of Class B Common Stock held by a trust for the benefit of Kiera R. Noonan, for which Joseph T. Noonan and Walter

J. Flowers serve as co-trustees, 6,447 shares of Class B Common Stock held by a trust for the benefit of Tessa R. Noonan, for which Joseph

T. Noonan and Walter J. Flowers serve as co-trustees, and 5,922 shares of Class B Common Stock held by a trust for the benefit of Liv

R. Noonan, for which Joseph T. Noonan and Walter J. Flowers serve as co-trustees (5,933,290 shares of Class B Common Stock in the aggregate)

are subject to the terms of The George B. Horne Voting Trust Agreement-1997 (the “1997 Voting Trust”). Under the terms of

the 1997 Voting Trust, the trustee (currently Timothy P. Horne) has sole power to vote all shares subject to the 1997 Voting Trust.

Under

the terms of the 1997 Voting Trust, in the event Timothy P. Horne ceases to serve as trustee of the 1997 Voting Trust, then Joseph T.

Noonan and Walter J. Flowers (each, a “Successor Trustee” and collectively, the “Successor Trustees”), shall thereupon

become co-trustees of the 1997 Voting Trust if such individuals are willing and able to succeed. At any time, Timothy P. Horne, if then

living and not subject to incapacity, may designate up to two additional persons, one to be designated as the primary designee (the “Primary

Designee”) and the other as the secondary designee (“Secondary Designee”), to serve in the stead of any Successor Trustee

who shall be unable or unwilling to serve as a trustee of the 1997 Voting Trust. Such designations are revocable by Timothy P. Horne at

any time prior to the time at which such designees become a trustee. If any of the Successor Trustees is unable or unwilling or

shall otherwise fail to serve as a trustee of the 1997 Voting Trust, or after becoming a co-trustee shall cease to serve as such for any

reason, then a third person shall become a co-trustee with the remaining two trustees, in accordance with the following line of succession:

first, any individual designated as the Primary Designee, next, any individual designated as the Secondary Designee, and then, an individual

appointed by the holders of a majority in interest of the voting trust certificates then outstanding. In the event that the Successor

Trustees shall not concur on matters not specifically contemplated by the terms of the 1997 Voting Trust, the vote of a majority of the

Successor Trustees shall be determinative. No trustee or Successor Trustee shall possess the Determination Power unless it is specifically

conferred upon such trustee pursuant to the provisions of the 1997 Voting Trust.

The 1997 Voting Trust was extended effective as

of November 26, 2024 by unanimous agreement of the holders of all of the outstanding trust certificates issued under the 1997 Voting Trust

agreement for an additional period of four years and will expire on August 26, 2030. The 1997 Voting Trust may be amended by vote of the

holders of a majority of the voting trust certificates then outstanding and by the number of trustees authorized to take action at the

relevant time. Shares may not be removed from the 1997 Voting Trust during its term without the consent of the trustees.

This summary is qualified in its entirety by reference

to the 1997 Voting Trust which is incorporated herein by reference to Exhibit 9.2 of the Issuer's Annual Report on Form 10-K dated September

28, 1999 filed with the Securities and Exchange Commission.

EXHIBIT 3

AGREEMENT REGARDING JOINT FILING

Pursuant to Rule 13d-1(k)(1) under the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), the undersigned hereby agree to file jointly on behalf of each of them the statement on Schedule

13G to which this Agreement is attached, and any amendments thereto, pursuant to Regulation 13D-G under the Exchange Act.

It is understood and agreed that each of the parties hereto is responsible

for the timely filing of the statement on Schedule 13G to which this Agreement is attached, and any amendments thereto, and for the completeness

and accuracy of the information concerning such party contained therein; provided that such party is not responsible for the completeness

or accuracy of information concerning any other party unless such party knows or has reason to believe that such information is inaccurate.

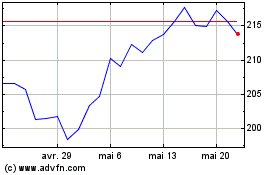

Watts Water Technologies (NYSE:WTS)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Watts Water Technologies (NYSE:WTS)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025