UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-37922

ZTO Express (Cayman) Inc.

Building One, No. 1685

Huazhi Road

Qingpu District

Shanghai, 201708

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Exhibit Index

Exhibit 99.1 – Announcement – Connected Transaction – Acquisition of Properties

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

ZTO Express (Cayman) Inc. |

| |

|

|

|

| |

By |

: |

/s/ Huiping Yan |

| |

Name |

: |

Huiping Yan |

| |

Title |

: |

Chief Financial Officer |

Date: November 29, 2024

Exhibit 99.1

Hong Kong Exchanges and Clearing Limited and

The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its

accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole

or any part of the contents of this announcement.

Under our weighted voting rights structure,

our share capital comprises Class A ordinary shares and Class B ordinary shares. Each Class A ordinary share entitles the holder to exercise

one vote, and each Class B ordinary share entitles the holder to exercise 10 votes, respectively, on all matters that require a shareholder’s

vote. Shareholders and prospective investors should be aware of the potential risks of investing in a company with a weighted voting rights

structure. Our American depositary shares, each representing one of our Class A ordinary shares, are listed on the New York Stock Exchange

in the United States under the symbol ZTO.

ZTO

Express (Cayman) Inc.

中通快遞(開曼)有限公司

(A company controlled

through weighted voting rights and incorporated in the Cayman Islands with limited liability)

(Stock Code: 2057)

CONNECTED TRANSACTION

ACQUISITION OF PROPERTIES

THE ACQUISITION OF PROPERTIES

On November 29, 2024, ZTO Express, a

consolidated affiliated entity of the Company, entered into the Property Purchase Agreement with Zhongkuai Future City, pursuant to which

ZTO Express agreed to purchase, and Zhongkuai Future City agreed to sell, the Properties with a total construction floor area of 22,465.17

square meters at the aggregate consideration of RMB179,720,000.

As part of the Group’s strategic

plan and in order to enhance efficiency and reduce operational expenses, the Group will establish a second headquarter in Tonglu County,

Zhejiang Province, the PRC. Situated at a strategic area of Tonglu County with convenient transportation and comprehensive supporting

facilities, the Properties will be used as the office premises of the Group’s headquarter in Tonglu and the Group’s staff

dormitories.

HONG KONG LISTING RULES IMPLICATIONS

As Zhongkuai Future City is held as

to approximately 57% by Mr. Meisong LAI (an executive Director and controlling shareholder of the Company) as of the date of this announcement,

Zhongkuai Future City is an associate of Mr. Meisong LAI and thus a connected person of the Company. Therefore, the entering into of the

Property Purchase Agreement and the transactions contemplated thereunder constitutes connected transactions of the Company under Chapter

14A of the Hong Kong Listing Rules.

As the highest applicable percentage

ratio calculated pursuant to the Hong Kong Listing Rules in respect of the Property Purchase Agreement and the transactions contemplated

thereunder (on an aggregate basis) is more than 0.1% but less than 5%, the Property Purchase Agreement and the transactions contemplated

thereunder are subject to the reporting and announcement requirements but exempt from the independent Shareholders’ approval requirement

under Chapter 14A of the Hong Kong Listing Rules.

THE ACQUISITION OF PROPERTIES

On November 29, 2024, ZTO Express, a consolidated

affiliated entity of the Company, entered into the Property Purchase Agreement with Zhongkuai Future City, pursuant to which ZTO Express

agreed to purchase, and Zhongkuai Future City agreed to sell, the Properties with a total construction floor area of 22,465.17 square

meters at the aggregate consideration of RMB179,720,000.

PRINCIPAL TERMS OF THE ACQUISITION OF PROPERTIES

The principal terms of the Property Purchase Agreement are set out

below:

| Date |

: |

November 29, 2024 |

| |

|

|

| Parties |

: |

(1) |

Zhongkuai Future City (as the seller); and |

| |

|

|

|

| |

|

(2) |

ZTO Express (as the buyer). |

| |

|

|

|

| Properties to be acquired |

: |

The properties to be acquired (the “Properties”) consist of |

| |

|

|

| |

|

(i) |

floor 13 to floor 19 with an aggregate

construction floor area of 14,137.62 square meters of Tower 1 (“Tower 1 Properties”), and |

| |

|

|

|

| |

|

(ii) |

floor 13 to floor 17 with an aggregate

construction floor area of 8,327.55 square meters of Tower 11 (“Tower 11 Properties”), |

| |

|

|

|

| |

|

of Blue City (藍城),

which is located at No. 586 Tongda Road, Chengnan Subdistrict,

Fuchun Future City, Tonglu County, Hangzhou City, Zhejiang Province,

the PRC. |

| |

|

|

| |

|

The total construction floor

area of the Properties is 22,465.17 square meters. |

| |

|

|

| Consideration and payment terms |

: |

The price of the Properties is RMB8,000 per square meter

(inclusive of tax) and the total consideration for the Properties is

RMB179,720,000 (inclusive of tax), which will be settled as follows: |

| |

|

|

| |

|

(i) |

ZTO Express shall pay 30% of the consideration, namely RMB53,916,000,

to Zhongkuai Future City within 7 working days of the date of the Property Purchase Agreement; and |

| |

|

|

|

| |

|

(ii) |

ZTO Express shall pay the remaining 70% of

the consideration, namely RMB125,804,000, to Zhongkuai Future City before December 31, 2024. |

| |

|

|

|

| Completion |

: |

Zhongkuai Future City shall deliver to ZTO Express all the

Properties before December 31, 2024. |

| |

|

|

| |

|

ZTO Express and Zhongkuai Future City

agreed to jointly apply to the relevant PRC government authorities before January 27, 2025 to complete transaction procedures and real

estate registration in respect of the sale and purchase of the Properties. |

Pursuant to the terms

of the Property Purchase Agreement and the regulatory filing procedures, ZTO Express and Zhongkuai Future City will execute and file

the agreed form of online-pre-sale contracts in relation to the acquisition of the Properties, which is based on the standard form

set by Hangzhou Housing Security and Real Estate Management Bureau

(杭州市住房保障和房產管理局) and shall supersede the

Property Purchase Agreement upon its execution, within reasonable time after the date of the Property Purchase Agreement.

As at the date of the Property Purchase Agreement,

Zhongkuai Future City has obtained the pre-sale permit for the Properties and the construction of Properties has completed. It is expected

that the Properties will be ready for delivery at the date of completion specified in the Property Purchase Agreement.

Basis of consideration

The consideration for

the Properties was determined after arm’s length negotiations between ZTO Express and Zhongkuai Future City based on the

appraised market value of the Properties in the amount of RMB179,720,000 as at the valuation benchmark date of October 12, 2024

according to the valuation report dated October 23, 2024 prepared by Hangzhou Zhongyi Real Estate Valuation and Consulting Co., Ltd.

(杭州中意房地產評估諮詢有限公司), an

independent property valuer qualified in the PRC using the comparison approach with reference to comparable transactions available

in the market and adjustments for the specific conditions of the Properties pursuant to requirements of the relevant real estate

appraisal standards in the PRC.

The consideration will be satisfied by the internal resources of the

Group.

INFORMATION ON RELEVANT PARTIES

The Group

The Company was incorporated under the laws of

Cayman Islands on April 8, 2015. The securities of the Company are dual-primary listed on the NYSE and the Hong Kong Stock Exchange. The

Group is principally engaged in express delivery services in the PRC through a nationwide network partner model.

ZTO Express is a consolidated affiliated entity

of the Company established under the laws of the PRC and principally engaged in express delivery services.

Zhongkuai Future City

Zhongkuai Future City is a company established

under the laws of the PRC and is principally engaged in real estate development and operation. Zhongkuai Future City is the developer

of the Properties. As at the date of this announcement, Zhongkuai Future City is held as to (i) approximately 57% by Mr. Meisong LAI,

an executive Director and controlling shareholder of the Company, (ii) approximately 16% by Mr. Jianfa LAI, a substantial shareholder

of ZTO Express, (iii) approximately 12% by Mr. Jilei WANG, an executive Director of the Company, (iv) approximately 10% by Mr. Jianchang

LAI, a brother-in-law of Mr. Meisong LAI, and (v) approximately 5% by Mr. Zengqun ZHANG, a third party independent of the Company and

its connected persons.

REASONS FOR AND BENEFITS OF THE ACQUISITION OF PROPERTIES

As part of the Group’s strategic plan, the

Group will establish a second headquarter in Tonglu County, Zhejiang Province, the PRC. Tonglu County is known as the “hometown

of private express delivery” in China and has a concentration of personnel working in the express delivery industry. A significant

portion of the Group’s workforce also originates from Tonglu. Establishing a second headquarter in Tonglu and setting up both office

facilities and staff dormitory by acquisition of the Properties will enable the Group to take advantage of the relatively low compensation

level and other operational costs in Tonglu compared to those of first tier cities in China and keep a lower overall operational costs

level by relocating certain existing employees to, and/or hiring future employees in, Tonglu, and to increase the stability of its workforce

by allowing a large number of staff members to work in their hometown, thereby bringing economic benefits to the Group and enhancing the

overall performance and competitiveness of the Group as a whole in the long run. Moreover, as the Company is a leading and fast-growing

express delivery company in China, the acquisition of the Properties and the establishment of a second headquarter in Tonglu County by

the Group are expected to create more local job opportunities, enhance the social image and contribute to the economic and social development

of Tonglu County, which is also consistent with the Group’s commitment to corporate social responsibilities.

In view of the above, the Directors (including

the independent non-executive Directors) consider that the terms of the Property Purchase Agreement have been made on normal commercial

terms, are fair and reasonable, in the ordinary and usual course of business of the Group and in the interests of the Company and its

shareholders as a whole.

HONG KONG LISTING RULES IMPLICATIONS

As Zhongkuai Future City is held as to approximately

57% by Mr. Meisong LAI (an executive Director and controlling shareholder of the Company) as of the date of this announcement, Zhongkuai

Future City is an associate of Mr. Meisong LAI and thus a connected person of the Company. Therefore, the entering into of the Property

Purchase Agreement and the transactions contemplated thereunder constitutes a connected transaction of the Company under Chapter 14A of

the Hong Kong Listing Rules.

As the highest applicable percentage ratio calculated

pursuant to the Hong Kong Listing Rules in respect of the Property Purchase Agreement and the transactions contemplated thereunder (on

an aggregate basis) is more than 0.1% but less than 5%, the Property Purchase Agreement and the transactions contemplated thereunder are

subject to the reporting and announcement requirements but exempt from the independent Shareholders’ approval requirement under

Chapter 14A of the Hong Kong Listing Rules.

Each of Mr. Meisong LAI (as the controlling shareholder

of Zhongkuai Future City) and Mr. Jilei WANG (as equity holder of Zhongkuai Future City), is or may be perceived to have a material interest

in the Property Purchase Agreement, and as a result has abstained from voting on the resolutions of the Board approving the Property Purchase

Agreement. Other than the aforesaid Directors, no other Directors have a material interest in the Property Purchase Agreement or are required

to abstain from voting on the resolutions of the Board approving the transactions under the Property Purchase Agreement.

DEFINITIONS

In this announcement, unless the context otherwise requires, the following

terms shall have the following meanings:

| “associate(s)” |

has the meaning ascribed to it under the Hong Kong Listing Rules |

| |

|

| “Board” |

the board of Directors |

| |

|

| “Class A ordinary shares” |

Class A ordinary shares of the share capital of the Company with a par value of US$0.0001 each, giving a holder of a Class A ordinary share one vote per share on any resolution tabled at the Company’s general meeting |

| |

|

| “Class B ordinary shares” |

Class B ordinary shares of the share capital of the Company with a par value of US$0.0001 each, conferring weighted voting rights in the Company such that a holder of a Class B ordinary share is entitled to 10 votes per share on any resolution tabled at the Company’s general meeting |

| |

|

| “Company” |

ZTO Express (Cayman) Inc., a company incorporated in the Cayman Islands on April 8, 2015 as an exempted company and, where the context requires, its subsidiaries and consolidated affiliated entities from time to time |

| |

|

| “connected person(s)” |

has the meaning ascribed to it under the Hong Kong Listing Rules |

| |

|

| “controlling shareholder” |

has the meaning ascribed to it under the Hong Kong Listing Rules |

| |

|

| “Director(s)” |

the director(s) of the Company |

| |

|

| “Group” |

the Company and its subsidiaries and consolidated affiliated entities from time to time |

| |

|

| “Hong Kong Listing Rules” |

the Rules Governing the Listing of Securities on the Hong Kong Stock Exchange, as amended or supplemented from time to time |

| |

|

| “Hong Kong Stock Exchange” |

The Stock Exchange of Hong Kong Limited |

| |

|

| “NYSE” |

New York Stock Exchange |

| |

|

| “PRC” |

the People’s Republic of China |

| |

|

| “Properties” |

has the meaning ascribed to it in the section headed “Principal Terms of the Acquisition of Properties” in this announcement |

| “Property Purchase Agreement” |

the commodity housing purchase agreement entered into between ZTO Express and Zhongkuai Future City on November 29, 2024 in respect of the sale and purchase of the Properties |

| |

|

| “RMB” |

Renminbi, the lawful currency of China |

| |

|

| “Share(s)” |

the Class A ordinary shares and Class B ordinary shares in the share capital of the Company, as the context so requires |

| |

|

| “Shareholder(s)” |

the holder(s) of the Share(s), where the context requires, ADSs |

| |

|

| “subsidiary(ies)” |

has the meaning ascribed to it under the Hong Kong Listing Rules |

| |

|

| “substantial shareholder” |

has the meaning ascribed to it under the Hong Kong Listing Rules |

| |

|

| “US$” |

United States dollars, the lawful currency of the United States of America |

| |

|

| “Zhongkuai Future City” |

中快(桐廬)未來城產業發展有限公司(Zhongkuai (Tonglu) Future City Industrial Development Co., Ltd.), a company established under the laws of the PRC |

| |

|

| “ZTO Express” |

ZTO Express Co., Ltd., a company established under the laws of the PRC and a consolidated affiliated entity of the Company |

The English names of the PRC entities

referred to in this announcement are translations from their Chinese names and are for identification purposes only.

| |

By order of the

Board |

| |

ZTO Express (Cayman)

Inc. |

| |

Meisong LAI |

| |

Chairman |

Hong Kong, November 29, 2024

As at the date of this announcement,

the board of directors of the Company comprises Mr. Meisong LAI as the chairman and executive director, Mr. Jilei WANG and Mr. Hongqun

HU as executive directors, Mr. Xing LIU and Mr. Xudong CHEN as non-executive directors, Mr. Frank Zhen WEI, Mr. Qin Charles HUANG, Mr.

Herman YU, Mr. Tsun-Ming (Daniel) KAO and Ms. Fang XIE as independent non-executive directors.

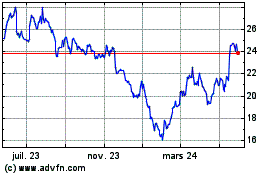

ZTO Express Cayman (NYSE:ZTO)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

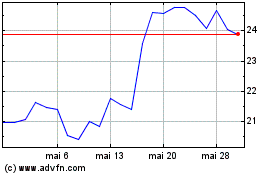

ZTO Express Cayman (NYSE:ZTO)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025