Almaden Minerals Ltd. (“Almaden” or “the Company”; TSX:

AMM; NYSE American: AAU) is providing an update regarding

its Request for Consultations delivered to the United Mexican

States (“Mexico”, see press release dated December 14, 2023), and

its listing on the NYSE American stock exchange (see press release

of October 25, 2023).

Request for Consultations

As previously reported, on December 13, 2023,

Almaden delivered to Mexico a written Request for Consultations in

accordance with Article 9.18 of the Comprehensive and Progressive

Agreement for Trans-Pacific Partnership (“CPTPP”), setting out a

brief description of facts regarding the measures at issue. On

December 29, 2023, Mexico acknowledged receipt of that Request and

stated that it would propose dates for a consultation meeting in

the near future, but never reverted with proposed dates, leaving

the dispute unresolved.

Accordingly, on March 14, 2024, Almaden

delivered to Mexico written notice of its intention to submit a

claim (“Claim”) to arbitration against Mexico (the “Notice”) in

accordance with Article 9.19.3 of the CPTPP. This Notice has been

delivered by Almaden together with Almadex Minerals Ltd., on behalf

of themselves and their Mexican subsidiaries.

Amongst other things, the Notice sets out the

factual background of the dispute as well as the legal basis of the

resulting Claim, the provisions of the CPTPP that Mexico has

breached, and the relief sought. The damages relating to the

Almaden and Almadex Claim will be for no less than US$200 million,

in the aggregate.

The Notice enables the Company to initiate

arbitration should an amicable resolution of the dispute with the

Mexican government not be reached. The filing of the Notice must

precede initiation of arbitration by a minimum of 90 days.

In good faith and in the spirit of cooperation,

Almaden invites Mexico once again to engage in discussions and

negotiations with a view to achieving an amicable resolution of the

dispute. If such consultations with Mexico are unsuccessful,

Almaden may then submit the Claim to arbitration under the CPTPP,

seeking damages for the harm incurred, plus interest, costs, and

any such further relief as a Tribunal may deem appropriate.

NYSE American Continued Listing

Standards

As previously announced, Almaden is not in

compliance with the continued listing standards of the NYSE

American exchange because the Company’s securities have been

selling for a low price per share for a substantial period of time

which NYSE American determines to be a 30-trading-day average price

of less than US$0.20 per share. The Company’s continued

listing on the NYSE American exchange is predicated on it

demonstrating sustained price improvement within a reasonable

period of time which has determined to be no later than April 19,

2024.

Although Almaden has requested consultations

with Mexico under the CPTPP, to date Mexico has not proposed a date

for these consultations. In view of this, and the Company’s wish to

provide predictability to shareholders, the Company has determined

to voluntarily delist from the NYSE American exchange. Almaden

intends to seek a listing on the OTCQB Marketplace in parallel with

its de-listing from the NYSE American exchange to ensure a

continued U.S. trading platform for its U.S. shareholders.

The Company provided notice of the voluntary

delisting to the NYSE American on March 14, 2024 and intends to

file a Form 25 with the Securities and Exchange Commission in a

timely manner to effect the delisting. It is anticipated that the

delisting will become effective at the end of business on or about

April 4, 2024. The Company has made an application to the OTCQB and

expects that its common shares will be quoted on the OTCQB on the

next trading day without interruption.

On Behalf of the Board of Directors,

“J. Duane Poliquin”J. Duane PoliquinChairAlmaden

Minerals Ltd.

Safe Harbor Statement

Certain of the statements and information in

this news release constitute “forward-looking statements” within

the meaning of the United States Private Securities Litigation

Reform Act of 1995 and “forward-looking information” within the

meaning of applicable Canadian provincial securities laws. All

statements, other than statements of historical fact, are

forward-looking statements or information. Forward-looking

statements or information in this news release relate to, among

other things, the timing and nature of any future consultation,

negotiations or settlement between the Company and Mexico, whether

the Company pursues claims before an arbitral tribunal and the

timing, result and damages of such claims before an arbitral

tribunal, and the delisting from the NYSE American exchange,

listing on the OTCQB exchange, and related timing of each.

These forward-looking statements and information

reflect the Company’s current views with respect to future events

and are necessarily based upon a number of assumptions that, while

considered reasonable by the Company, are inherently subject to

significant legal, regulatory, business, operational and economic

uncertainties and contingencies, and such uncertainty generally

increases with longer-term forecasts and outlook. These assumptions

include: stability and predictability in Mexico’s consultation

process under the CPTPP; stability and predictability in the

application of the CPTPP and arbitral decisions thereon; and

continued respect for the rule of law in Mexico. The foregoing list

of assumptions is not exhaustive.

The Company cautions the reader that

forward-looking statements and information involve known and

unknown risks, uncertainties and other factors that may cause

actual results and developments to differ materially from those

expressed or implied by such forward-looking statements or

information contained in this news release. Such risks and other

factors include, among others, risks related to: Mexico’s

consultation process under the CPTPP; the application of the CPTPP

and arbitral decisions thereon; continued respect for the rule of

law in Mexico; political risk in Mexico; crime and violence in

Mexico; corruption in Mexico; environmental risks, including

environmental matters under Mexican laws and regulations; impact of

environmental impact assessment requirements on the Company’s

planned exploration and development activities on the Project;

certainty of mineral title and the outcome of consultation,

litigation and arbitration; community relations; governmental

regulations and the ability to obtain necessary licences and

permits; risks related to mineral properties being subject to prior

unregistered agreements, transfers or claims and other defects in

title; changes in mining, environmental or agrarian laws and

regulations and changes in the application of standards pursuant to

existing laws and regulations which may increase costs of doing

business and restrict operations; as well as those factors

discussed the section entitled "Risk Factors" in Almaden's Annual

Information Form and Almaden's latest Form 20-F on file with the

United States Securities and Exchange Commission in Washington,

D.C. Although the Company has attempted to identify important

factors that could affect the Company and may cause actual actions,

events or results to differ materially from those described in

forward-looking statements or information, there may be other

factors that cause actions, events or results not to be as

anticipated, estimated or intended. There can be no assurance that

our forward-looking statements or information will prove to be

accurate. Accordingly, readers should not place undue reliance on

forward-looking statements or information. Except as required by

law, the Company does not assume any obligation to release publicly

any revisions to on forward-looking statements or information

contained in this news release to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated

events.

Contact Information:

Almaden Minerals Ltd.Tel. 604.689.7644Email:

info@almadenminerals.comhttp://www.almadenminerals.com/

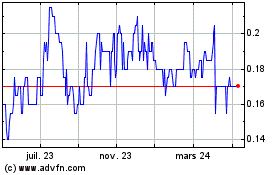

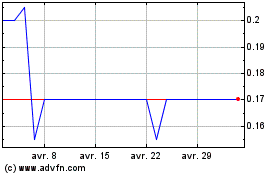

Almaden Minerals (TSX:AMM)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Almaden Minerals (TSX:AMM)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025