Almaden Announces Litigation Financing of up to US$9.5 million; Streamlines Arbitration Management

27 Juin 2024 - 1:00PM

Almaden Minerals Ltd. (“Almaden” or “the Company”; TSX:

AMM; OTCQB: AAUAF) is pleased to announce that further to

its press release of June 17, 2024, it has confirmed non-recourse

litigation funding in the amount of up to US$9.5 million to pursue

its international arbitration proceedings against the United

Mexican States (“Mexico”) under the Comprehensive and Progressive

Agreement for Trans-Pacific Partnership (“CPTPP”). The Company has

also agreed with Almadex Minerals Ltd. (“Almadex”) to an extension

to the maturity of its gold loan, and a litigation management

agreement to help streamline corporate management of the

arbitration process.

- Non-recourse funding secured to

pursue international arbitration proceedings against Mexico;

- Globally leading counterparty

validates quality of legal claims;

- Gold loan maturity pushed out from

March 31, 2026 to March 31, 2030;

- Litigation Management Agreement

streamlines corporate management of the arbitration proceedings to

save money and time.

Litigation Financing

The Company has signed a litigation funding

agreement (“LFA”) with a leading legal finance provider. The

facility is available for immediate draw down for Almaden to pursue

damages against Mexico under the CPTPP resulting from Mexico’s

actions which blocked the development of the Ixtaca project and

ultimately retroactively terminated the Company’s mineral

concessions, causing the loss of the Company’s investments in

Mexico.

The LFA provides funding which is expected to

cover all legal, tribunal and external expert costs of the legal

claims, as well as some corporate operating expenses as may be

required. The funding is repayable in the event that a damages

award is recovered from Mexico, with such repayment being a

contingent entitlement to those damages.

The financing follows extensive due diligence by

the finance provider. The financing size as well as the quality of

the provider is testament to the strength of the Company’s legal

claims against Mexico.

Gold Loan Amendment

The Company is also pleased to report that it

has agreed with Almadex to extend the maturity of the gold loan

(see press release of May 14, 2019) from March 31, 2026 to the

earlier of March 31, 2030 or the receipt by Almaden or its

subsidiary of any amount relating to its legal claims against

Mexico.

In return for this amendment, in addition to its

obligation to repay the gold loan, the Company has agreed to pay

Almadex 2.0% of the gross amount of any damages award that Almaden

may receive as a result of the legal claims, such repayment to be

subordinate to amounts due under the LFA, and any additional legal

and management fees.

Litigation Management

Agreement

Finally, the Company has agreed with Almadex and

its Mexican subsidiary to streamline the management of the

arbitration proceedings by entering into a Litigation Management

Agreement (“LMA”). Under the LMA, Almaden will bear the up-front

costs of the arbitration and provide overall direction to the

arbitration process for itself and its subsidiaries, as well as

Almadex and its subsidiaries, with certain limitations. Almadex

will remain a party to the arbitration and continue in its

cooperation and support of the process. As noted above, Almaden has

already secured litigation funding in the amount anticipated to be

needed to fully prosecute the arbitration proceedings.

Should the arbitration proceedings result in an

award of damages, the pro rata portion of those damages, if any,

which may be attributable to Almadex from the 2.0% NSR royalty it

held on the Ixtaca project will be determined. Almadex’s award will

consist of this pro rata portion, less its pro rata share of the

costs of pursuing the legal claims, including the financing costs

(the “Almadex Award”). Almadex will compensate Almaden in the

amount of 10% of the Almadex Award in exchange for managing the

claim proceedings.

On behalf of the Board of Directors,

“J. Duane Poliquin”____J. Duane

PoliquinChairAlmaden Minerals Ltd.

Safe Harbor Statement

Certain of the statements and information in

this news release constitute “forward-looking statements” within

the meaning of the United States Private Securities Litigation

Reform Act of 1995 and “forward-looking information” within the

meaning of applicable Canadian provincial securities laws. All

statements, other than statements of historical fact, are

forward-looking statements or information. Forward-looking

statements or information in this news release relate to, among

other things, the total potential cost of the legal claims and the

sufficiency of the money available under the LFA to cover these

costs, the ability of the LMA to streamline corporate management of

the legal claims, and the result and damages arising from the

Company’s request for arbitration.

These forward-looking statements and information

reflect the Company’s current views with respect to future events

and are necessarily based upon a number of assumptions that, while

considered reasonable by the Company, are inherently subject to

significant legal, regulatory, business, operational and economic

uncertainties and contingencies, and such uncertainty generally

increases with longer-term forecasts and outlook. These assumptions

include: stability and predictability in Mexico’s response to the

arbitration process under the CPTPP; stability and predictability

in the application of the CPTPP and arbitral decisions thereon; the

ability to continue to finance the arbitration process, and

continued respect for the rule of law in Mexico. The foregoing list

of assumptions is not exhaustive.

The Company cautions the reader that

forward-looking statements and information involve known and

unknown risks, uncertainties and other factors that may cause

actual results and developments to differ materially from those

expressed or implied by such forward-looking statements or

information contained in this news release. Such risks and other

factors include, among others, risks related to: the application of

the CPTPP and arbitral decisions thereon; continued respect for the

rule of law in Mexico; political risk in Mexico; crime and violence

in Mexico; corruption in Mexico; uncertainty as to the outcome of

arbitration; as well as those factors discussed the section

entitled "Risk Factors" in Almaden's Annual Information Form and

Almaden's latest Form 20-F on file with the United States

Securities and Exchange Commission in Washington, D.C. Although the

Company has attempted to identify important factors that could

affect the Company and may cause actual actions, events or results

to differ materially from those described in forward-looking

statements or information, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that our forward-looking

statements or information will prove to be accurate. Accordingly,

readers should not place undue reliance on forward-looking

statements or information. Except as required by law, the Company

does not assume any obligation to release publicly any revisions to

on forward-looking statements or information contained in this news

release to reflect events or circumstances after the date hereof or

to reflect the occurrence of unanticipated events.

Contact Information:

Almaden Minerals Ltd.Tel. 604.689.7644Email:

info@almadenminerals.comhttp://www.almadenminerals.com/

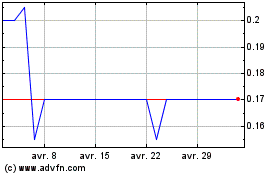

Almaden Minerals (TSX:AMM)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

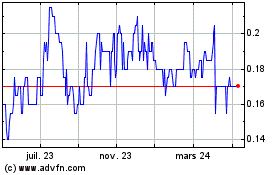

Almaden Minerals (TSX:AMM)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025