Almaden Files Request for Arbitration Against Mexico with International Centre for Settlement of Investment Disputes

17 Juin 2024 - 1:00PM

Almaden Minerals Ltd. (together with its Mexican

Subsidiary, Minera Gorrión S.A. de C.V., “Almaden” or “the

Company”; TSX: AMM; OTCQB: AAUAF) announces that it has

commenced international arbitration proceedings against the United

Mexican States (“Mexico”) under the Comprehensive and Progressive

Agreement for Trans-Pacific Partnership (“CPTPP”).

The Company’s international arbitration claim

against Mexico will be prosecuted pursuant to the established and

enforceable legal framework of the International Centre for

Settlement of Investment Disputes (“ICSID”). Almaden alleges

that Mexico has breached its obligations under the CPTPP through

actions which blocked the development of the Ixtaca project and

ultimately retroactively terminated the Company’s mineral

concessions, causing the loss of the Company’s investments in

Mexico.

Almaden initiated the six-month consultation

period required under the CPTPP on December 13, 2023. Mexico agreed

to hold one consultation meeting, which took place on May 30, 2024,

but it did not result in an amicable resolution of the Company’s

investment dispute. The Company filed notice of its intention to

submit a claim to arbitration against Mexico under the CPTPP on

March 14, 2024, triggering a 90-day notice period prior to filing.

With this notice period now over, the Company has filed its Request

for Arbitration with ICSID.

Duane Poliquin, Chair of Almaden, stated “This

is clearly not a desirable outcome for our tremendous discovery

back in 2010. With the announcement of the feasibility study in

2018, the Ixtaca project was poised to become a significant success

for shareholders, local communities, and Mexico. The Company

followed best international standards and practices, including

through adoption of dry stack filtered tailings, ore-sorting, and

water management plans that could have improved water availability

for local communities. Our human rights due diligence was second to

none and kept pace with the technical evolution of the project,

culminating in a Human Rights Impact Assessment completed to the

highest international standards. We are problem solvers and sought

to resolve each challenge presented by Mexico, up until the point

the Mexican government cancelled our concessions. This leaves us

with no alternative but to pursue international arbitration. We

regret this outcome for shareholders, who may still see some

benefit from the discovery as we pursue this arbitration. However I

lament most heavily this outcome for local people, whom we have

worked very closely with over the past two decades, and who have

become our friends. They now stand to gain nothing from the Ixtaca

project which was developed and designed with their

assistance.”

About the Ixtaca Project and the

Company’s Damages Claim

The Company discovered the Ixtaca project in

2010, and ultimately completed a feasibility study on the project,

filing the technical report in 2019. Highlights of the project

included the following:

-

Average annual production of 108,500 ounces gold and 7.06 million

ounces silver (203,000 gold equivalent ounces, or 15.2 million

silver equivalent ounces) over first 6 years;

-

After-tax IRR of 42% and after-tax payback period of 1.9

years;

- Conventional

open pit mining with a proven and probable mineral reserve of 1.39

million ounces of gold and 85.2 million ounces of silver;

- All-in

Sustaining Costs (“AISC”), including operating costs, sustaining

capital, expansion capital, private and public royalties, refining

and transport of $850 per gold equivalent ounce, or $11.30 per

silver equivalent ounce;

- Dry stack

filtered tailings facility, and co disposal with waste rock with no

tailings dam;

- A fresh water

storage dam for mine and community use, enhancing community access

to a fresh water reservoir beyond closure;

- Testing showed

the host limestone “waste” rock and flotation tailings were

neutralising and had low potential for metal leaching. Both

products could have had commercial uses such as aggregate and

cement feed;

- Had the project

proceeded, economic contributions were estimated to include

approximately 600 direct jobs during the peak of construction and

420 jobs throughout the 11 year mine life. Assuming base case metal

prices, the project could have generated approximately US$130

million in Federal taxes, US$50 million in State taxes and US$30

million in Municipal taxes and provide updated infrastructure to a

marginalised region.(All values shown are in $US; Base case uses

$1275/oz gold and $17/oz silver prices. Gold and silver equivalency

calculations assumed 75:1 ratio. Proven mineral reserves were

comprised of 31.6 million tonnes grading 0.70 g/t gold and 43.5 g/t

silver. Probable mineral reserves were comprised of 41.4 million

tonnes grading 0.51 g/t gold and 30.7 g/t silver. The cut-off grade

used for ore/waste determination was NSR>=$14/t. Associated

metallurgical recoveries (gold and silver, respectively) were

estimated as 90% and 90% for limestone, 50% and 90% for volcanic,

50% and 90% for black shale).

As part of the CPTPP requirements, although

still at an early stage in the arbitration process, the Company

must submit an initial and preliminary estimate of damages claimed.

As noted in the Company’s press release of March 14, 2024, Almaden

is pursuing this arbitration together with Almadex Minerals Ltd.,

on behalf of themselves and their Mexican subsidiaries, and based

on a preliminary estimate will be seeking damages of no less than

US$200 million, in the aggregate.

As the arbitration proceeds, the Company expects

to appoint a quantum expert who will prepare a professional damages

assessment for review by the arbitration tribunal. The Company will

update shareholders as this process evolves.

The Company has engaged international

arbitration counsel at Boies Schiller Flexner to act on its

behalf.

On behalf of the Board of Directors,

“J. Duane Poliquin”J. Duane PoliquinChairAlmaden

Minerals Ltd.

Safe Harbor Statement

Certain of the statements and information in

this news release constitute “forward-looking statements” within

the meaning of the United States Private Securities Litigation

Reform Act of 1995 and “forward-looking information” within the

meaning of applicable Canadian provincial securities laws. All

statements, other than statements of historical fact, are

forward-looking statements or information. Forward-looking

statements or information in this news release relate to, among

other things, the appointment of a quantum expert and the result

and damages arising from the Company’s request for arbitration.

These forward-looking statements and information

reflect the Company’s current views with respect to future events

and are necessarily based upon a number of assumptions that, while

considered reasonable by the Company, are inherently subject to

significant legal, regulatory, business, operational and economic

uncertainties and contingencies, and such uncertainty generally

increases with longer-term forecasts and outlook. These assumptions

include: stability and predictability in Mexico’s response to the

arbitration process under the CPTPP; stability and predictability

in the application of the CPTPP and arbitral decisions thereon; the

ability to finance the arbitration process, and continued respect

for the rule of law in Mexico. The foregoing list of assumptions is

not exhaustive.

The Company cautions the reader that

forward-looking statements and information involve known and

unknown risks, uncertainties and other factors that may cause

actual results and developments to differ materially from those

expressed or implied by such forward-looking statements or

information contained in this news release. Such risks and other

factors include, among others, risks related to: the application of

the CPTPP and arbitral decisions thereon; continued respect for the

rule of law in Mexico; political risk in Mexico; crime and violence

in Mexico; corruption in Mexico; treatment of environmental matters

and indigenous consultation under Mexican laws and regulations;

impact of environmental impact assessment requirements on the

Company’s planned exploration and development activities on the

Ixtaca project; uncertainty as to the outcome of arbitration;

community relations; governmental regulations; risks related to

mineral properties being subject to prior unregistered agreements,

transfers or claims and other defects in title; changes in mining,

environmental or agrarian laws and regulations and changes in the

application of standards pursuant to existing laws and regulations;

as well as those factors discussed the section entitled "Risk

Factors" in Almaden's Annual Information Form and Almaden's latest

Form 20-F on file with the United States Securities and Exchange

Commission in Washington, D.C. Although the Company has attempted

to identify important factors that could affect the Company and may

cause actual actions, events or results to differ materially from

those described in forward-looking statements or information, there

may be other factors that cause actions, events or results not to

be as anticipated, estimated or intended. There can be no assurance

that our forward-looking statements or information will prove to be

accurate. Accordingly, readers should not place undue reliance on

forward-looking statements or information. Except as required by

law, the Company does not assume any obligation to release publicly

any revisions to on forward-looking statements or information

contained in this news release to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated

events.

Contact Information:

Almaden Minerals Ltd.Tel. 604.689.7644Email:

info@almadenminerals.comhttp://www.almadenminerals.com/

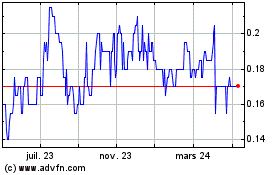

Almaden Minerals (TSX:AMM)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

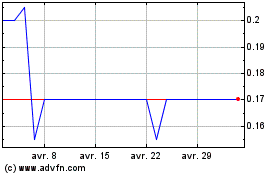

Almaden Minerals (TSX:AMM)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024