Allied Properties Real Estate Investment Trust Announces First-Quarter Results for 2008

14 Mai 2008 - 10:28PM

Marketwired Canada

Allied Properties REIT (TSX:AP.UN) today announced results for the first quarter

ended March 31, 2008. On a fully diluted, per-unit basis, Distributable Income

("DI"), Funds From Operations ("FFO") and Adjusted Funds From Operations

("AFFO") were up from the comparable quarter by 14.8%, 4.2% and 12.1%,

respectively. The REIT's DI, FFO and AFFO payout ratios for the quarter were

75.0%, 75.6% and 76.5%, respectively.

"By every measure, the first quarter was a good one," said Michael Emory,

President and CEO. "Our financial results were solid, our leasing activity was

strong, we made several strategic acquisitions and our access to mortgage

financing was more than sufficient to meet our needs."

Summary of Financial Results

The financial results for the first quarter are summarized below and compared to

the same quarter in 2007:

(In thousands except for

per unit and % amounts) Q1 2008 Q1 2007 Change % Change

----------------------------------------------------------------------------

----------------------------------------------------------------------------

DI 11,919 7,487 4,432 59.2%

DI per unit (diluted) $0.426 $0.371 $0.055 14.8%

DI pay-out ratio 75.0% 81.6% (6.6%)

FFO 11,834 8,184 3,650 44.6%

FFO per unit (diluted) $0.423 $0.406 $0.017 4.2%

FFO pay-out ratio 75.6% 74.6 1.0%

AFFO 11,698 7,530 4,168 55.4%

AFFO per unit (diluted) $0.418 $0.373 $0.045 12.1%

AFFO pay-out ratio 76.5% 81.1% (4.6%)

----------------------------------------------------------------------------

In the first quarter, the REIT maintained a high level of leased area (97.6% at

quarter-end), increased same-asset net operating income ("NOI") by 0.6% and

completed $50 million in acquisitions, all of which drove per-unit growth in DI,

FFO and AFFO during the quarter. The REIT's debt ratio was 51.3% at the end of

the quarter.

Cautionary Statements

DI, FFO, AFFO and NOI are not financial measures defined by Canadian GAAP.

Please see the REIT's MD&A for a description of these measures and their

reconciliation to net income or cash flow from operations, as presented in the

consolidated financial statements of the REIT for the quarter ended March 31,

2008. These statements, together with accompanying notes and MD&A, have been

filed with SEDAR, www.sedar.com, and are also available on the REIT's web-site,

www.alliedpropertiesreit.com.

Allied Properties REIT is the leading owner and manager of Class I office

properties in Canada, with portfolio assets in the urban areas of Toronto,

Montreal, Winnipeg, Quebec City and Kitchener. The objectives of the REIT are to

provide stable and growing cash distributions to unitholders and to maximize

unitholder value through effective management and accretive portfolio growth.

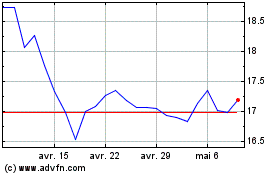

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024