Inter Pipeline Fund Announces Transportation Agreement for Canadian Natural Resources Kirby South Oil Sands Project

08 Août 2013 - 8:52PM

Marketwired Canada

Inter Pipeline Fund ("Inter Pipeline") (TSX:IPL.UN) announced today that it has

entered into a long term agreement with Canadian Natural Resources ("CNR") to

transport diluent and bitumen blend for the Kirby South oil sands project.

Approximately $95 million in pipeline and associated facilities have been

constructed to connect the Kirby South production site to the Cold Lake pipeline

system.

Under the terms of the agreement, CNR has contracted for approximately 63,000

barrels per day (b/d) of bitumen blend and 18,000 b/d of diluent transportation

capacity for the Kirby South project beginning in August 2013. Inter Pipeline's

investment is supported by a long term contract which does not involve exposure

to throughput volumes or commodity price fluctuations.

"We are very pleased to be the transportation service provider for the Kirby

South oil sands project," commented David Fesyk, President and CEO of Inter

Pipeline. "This is a highly accretive investment which complements our current

expansion activities in the Cold Lake region. Our long term, integrated

expansion plans are unfolding as we anticipated."

In late March, Inter Pipeline announced that it had executed definitive

transportation agreements for a major $2.6 billion capacity expansion program on

its Cold Lake and Polaris systems in support of three oil sands projects owned

by the FCCL Partnership ("FCCL"), a business venture between Cenovus and

ConocoPhillips.

Project Description

Kirby South is a new large scale in-situ oil extraction project which will

utilize steam assisted gravity drainage technology to recover subsurface

bitumen. The Kirby South production site is located approximately 10 kilometres

("km") south of Conklin, Alberta and is in close proximity to new pipeline

infrastructure being constructed under Inter Pipeline's previously announced

$2.6 billion integrated oil sands development program. Inter Pipeline expects to

capture certain cost synergies through the coordination of construction

activities. In addition, production from the Kirby South project will be shipped

on certain common segments of pipeline where surplus capacity will be available,

making this a very capital-efficient investment.

Transportation of bitumen blend for the Kirby South project will be provided

through a new 20 km, 16-inch diameter pipeline lateral from CNR's production

site to Inter Pipeline's Winefred Junction. This lateral connects to a new

30-inch pipeline constructed to transport bitumen blend from three regional oil

sands projects owned by FCCL. Approximately 20 km of new 10-inch pipeline has

also been constructed from Winefred Junction to the Kirby South site to provide

diluent transportation service.

Construction began in the fall of 2012 and all new facilities are expected to be

in service in August 2013. A map showing the configuration of new facilities

related to the Kirby South project is available on our website at

www.interpipelinefund.com.

Commercial Terms and Economics

The transportation agreement announced today will provide Inter Pipeline with

highly stable, long term cash flow. Under the terms of the contract, CNR will

make fixed annual transportation payments which are not dependent on actual

volumes shipped. All operating costs will also be recovered on a flow through

basis.

Total capital expenditures are expected to be approximately $95 million based on

Inter Pipeline's 85% interest in the Cold Lake Limited Partnership. Inter

Pipeline expects to earn incremental EBITDA of $35 million per year once this

highly accretive project enters commercial service in August 2013. The

investment is expected to provide approximately $0.07 per unit in accretion

relative to cash available for distribution.

Financing

Inter Pipeline's financing plan for the $95 million Kirby South connection has

been developed in tandem with capital funding plans for its $2.6 billion

integrated expansion program on the Cold Lake and Polaris systems. Inter

Pipeline anticipates that combined capital commitments will be met through a

combination of capacity available under its existing committed credit facility,

undistributed cash flow from operations, the periodic issuance of new term debt

and proceeds from existing distribution re-investment programs. In addition,

Inter Pipeline may supplement its capital requirements through the periodic

issuance of comparatively small amounts of underwritten equity.

Inter Pipeline's financial position is supported by investment grade credit

ratings, a strong balance sheet and excellent access to capital markets.

Inter Pipeline Fund

Inter Pipeline is a major petroleum transportation, natural gas liquids

extraction, and bulk liquid storage business based in Calgary, Alberta, Canada.

Structured as a publicly traded limited partnership, Inter Pipeline owns and

operates energy infrastructure assets in western Canada, the United Kingdom,

Denmark, Germany and Ireland. Additional information about Inter Pipeline can be

found at www.interpipelinefund.com.

Inter Pipeline is a member of the S&P/TSX Composite Index. Class A Units trade

on the Toronto Stock Exchange under the symbol IPL.UN.

Eligible Investors

Pursuant to Inter Pipeline's limited partnership agreement dated October 9,

1997, as amended, all unitholders are required to be residents of Canada. A copy

of the limited partnership agreement can be found at www.interpipelinefund.com

by selecting "Corporate Governance". If a unitholder is a non-resident of Canada

("Non-Eligible Unitholder"), he will not be considered to be a member of the

partnership effective as of the date Class A Units were acquired. Inter Pipeline

requires all Non-Eligible Unitholders to dispose of their Class A Units in

accordance with the limited partnership agreement.

In most cases, a unitholder with an address outside of Canada will be a

Non-Eligible Unitholder.

Disclaimer

Certain information contained herein may constitute forward-looking statements

that involve risks and uncertainties. Forward-looking statements in this news

release include, but are not limited to, timing and completion cost estimates

for the Kirby South project and forward EBITDA projections. Readers are

cautioned not to place undue reliance on forward-looking statements. Such

information, although considered reasonable by the General Partner of Inter

Pipeline at the time of preparation, may later prove to be incorrect and actual

results may differ materially from those anticipated in the statements made. For

this purpose, any statements that are not statements of historical fact may be

deemed to be forward-looking statements. Forward-looking statements often

contain terms such as "may", "will", "should", "anticipate", "expects" and

similar expressions. Such risks and uncertainties include, but are not limited

to, risks associated with operations, such as loss of markets, regulatory

matters, environmental risks, industry competition, potential delays and cost

overruns of construction projects including the transportation arrangements with

CNR, Cenovus and ConocoPhillips' FCCL Partnership, and the ability to access

sufficient capital from internal and external sources. You can find a discussion

of those risks and uncertainties in Inter Pipeline's securities filings at

www.sedar.com. The forward-looking statements contained in this news release are

made as of the date of this document, and, except to the extent required by

applicable securities laws and regulations, Inter Pipeline assumes no obligation

to update or revise forward-looking statements made herein or otherwise, whether

as a result of new information, future events, or otherwise. The forward-looking

statements contained in this document are expressly qualified by this cautionary

note.

All dollar values are expressed in Canadian dollars unless otherwise noted.

Non-GAAP Financial Measures

Certain financial measures referred to in this news release, namely, "EBITDA"

and "cash flow" are not measures recognized by GAAP. These non-GAAP financial

measures do not have standardized meanings prescribed by GAAP and therefore may

not be comparable to similar measures presented by other entities. Investors are

cautioned that these non-GAAP financial measures should not be construed as

alternatives to other measures of financial performance calculated in accordance

with GAAP.

FOR FURTHER INFORMATION PLEASE CONTACT:

Inter Pipeline Fund - Investor Relations:

Jeremy Roberge

Vice President, Capital Markets

403-290-6015 or 1-866-716-7473

jroberge@interpipelinefund.com

Inter Pipeline Fund - Media Relations:

Tony Mate

Director, Corporate and Investor Communications

403-290-6166

tmate@interpipelinefund.com

www.interpipelinefund.com

Canadian National Railway (TSX:CNR)

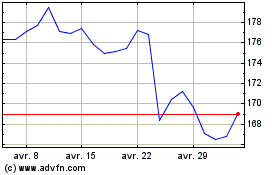

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Canadian National Railway (TSX:CNR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024