CN (TSX: CNR) (NYSE: CNI) today reported its financial and

operating results for the third quarter ended September 30, 2023.

"Our 'Make the Plan, Run the Plan, Sell the

Plan' approach continued to perform well, delivering strong

customer service despite weak consumer demand as well as external

challenges. As volumes continue to improve, we are well positioned

to deliver incremental operating leverage. We remain confident in

our ability to accelerate sustainable, profitable growth in 2024

through 2026.” – Tracy Robinson, President and Chief Executive

Officer, CN

Financial results

highlights

- Revenues of C$3,987 million for the

third quarter of 2023, a decrease of C$526 million, or 12%, and

C$12,357 million for the first nine months of 2023, a decrease of

C$208 million, or 2%.

- Operating income of C$1,517 million

for the third quarter of 2023, a decrease of C$415 million, or 21%

and C$4,779 million for the first nine months of 2023, a decrease

of C$149 million, or 3%.

- Operating ratio, defined as

operating expenses as a percentage of revenues, of 62.0% for the

third quarter of 2023, an increase of 4.8-points and 61.3% for the

first nine months of 2023, an increase 0.5-points or an increase of

0.7-points on an adjusted basis. (1)

- Diluted earnings per share (EPS) of

C$1.69 for the third quarter of 2023, a decrease of 21% and C$5.27

for the first nine months of 2023, a decrease of 1% or a decrease

of 2% on an adjusted basis. (1)

- Free cash flow was C$581 million

for the third quarter of 2023, a decrease of C$775 million, or 57%

and C$2,274 million for the first nine months of 2023, a decrease

of C$650 million, or 22%. (1)

Operating performance

- Injury frequency rate of 1.07 (per

200,000 person hours) for the third quarter of 2023, a

deterioration of 6% and 1.02 (per 200,000 person hours) for the

first nine months of 2023, an improvement of 11%. (3)

- Accident rate of 1.86 (per million

train miles) for the third quarter of 2023, a deterioration of 10%

and 1.76 (per million train miles) for the first nine months of

2023, an improvement of 16%. (3)

- Through dwell of 7.1 (entire

railroad, hours) for the third quarter of 2023, a deterioration of

1% and 7.0 (entire railroad hours) for the first nine months of

2023, an improvement of 10%.

- Car velocity of 209 (car miles per

day) for the third quarter of 2023, a deterioration of 1% and 212

(car miles per day) for the first nine months of 2023, an

improvement of 10%.

- Through network train speed of 19.7

(mph) for the third quarter of 2023, a deterioration of 2% and 19.9

(mph) for the first nine months of 2023, an improvement of 7%.

- Fuel efficiency of 0.832 (US

gallons of locomotive fuel consumed per 1,000 gross ton miles

(GTMs)) for the third quarter of 2023, an improvement of 1% and

0.874 (US gallons of locomotive fuel consumed per 1,000 gross ton

miles (GTMs)) for the first nine months of 2023, less efficient by

2%.

- Train length of 7,927 (feet) for

the third quarter of 2023, a decrease of 3% and 7,870 (feet) for

the first nine months of 2023, a decrease of 5%.

- Revenue ton miles (RTMs) of 55,640

(millions) for the third quarter of 2023, a decrease of 5% and

171,478 (millions) for the first nine months of 2023, a decrease of

2%.

Outlooks

and shareholder distributions CN continues to

expect flat to slightly negative year-over-year growth in adjusted

diluted EPS in 2023. CN reiterates its longer-term financial

perspective and continues to target compounded annual diluted EPS

growth in the range of 10%-15% over the 2024-2026 period driven by

growing volumes more than the economy, pricing above rail inflation

and incrementally improving efficiency, all of which assumes a

supportive economy. (2)

In January 2023, CN announced the Board's

approval for a new normal course issuer bid permitting CN to

purchase for cancellation, over a 12-month period, up to 32 million

common shares. The Board has now approved an additional C$500

million, increasing the budget from approximately C$4.0 billion to

approximately C$4.5 billion.

Third quarter

2023 revenues, traffic volumes and

expenses Revenues for the third quarter of 2023 were

C$3,987 million compared to C$4,513 million for the same period in

2022. The decrease of C$526 million, or 12%, was mainly due to

lower fuel surcharge revenues as a result of lower fuel prices,

lower volumes of intermodal, crude oil and forest products,

primarily as a result of lower demand for freight services to move

consumer goods and the negative impact of the pacific coast dock

workers strike, unfavorable crude oil price spreads and weaker

market conditions for lumber and panels as well as lower ancillary

services including container storage; partly offset by freight rate

increases, higher volumes of Canadian grain and potash and the

positive translation impact of a weaker Canadian dollar.

Operating expenses for the third quarter of 2023

were C$2,470 million compared to C$2,581 million for the same

period in 2022. The decrease of C$111 million, or 4%, was mainly

due to lower fuel prices; partly offset by the negative translation

impact of a weaker Canadian dollar.

(1) Non-GAAP Measures CN

reports its financial results in accordance with United States

generally accepted accounting principles (GAAP). CN uses non-GAAP

measures in this news release that do not have any standardized

meaning prescribed by GAAP, including adjusted net income, adjusted

earnings per share (EPS), adjusted operating income and adjusted

operating ratio (referred to as adjusted performance measures) and

free cash flow. These non-GAAP measures may not be comparable to

similar measures presented by other companies. For further details

of these non-GAAP measures, including a reconciliation to the most

directly comparable GAAP financial measures, refer to the attached

supplementary schedule, Non-GAAP Measures.

CN's full-year adjusted diluted EPS outlook (2)

excludes certain adjustments, which are expected to be comparable

to adjustments made in prior years. However, management cannot

individually quantify on a forward-looking basis the impact of

these adjustments on its adjusted diluted EPS because these items,

which could be significant, are difficult to predict and may be

highly variable. As a result, CN does not provide a corresponding

GAAP measure for, or reconciliation to, its adjusted diluted EPS

outlook.

(2) Forward-Looking Statements

Certain statements included in this news release constitute

"forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and under

Canadian securities laws, including statements based on

management’s assessment and assumptions and publicly available

information with respect to CN. By their nature, forward-looking

statements involve risks, uncertainties and assumptions. CN

cautions that its assumptions may not materialize and that current

economic conditions render such assumptions, although reasonable at

the time they were made, subject to greater uncertainty.

Forward-looking statements may be identified by the use of

terminology such as "believes," "expects," "anticipates,"

"assumes," "outlook," "plans," "targets", or other similar

words.

2023 key

assumptions CN has made a number of economic and market

assumptions in preparing its 2023 outlook. The Company now assumes

flat North American industrial production in 2023 (compared to the

July 25, 2023 assumption of negative North American industrial

production in 2023). The Company continues to assume that the

2023/2024 grain crop in Canada will be below its three-year average

(also below when excluding the significantly lower 2021/2022 crop

year) and the U.S. grain crop will be above its three-year average.

CN continues to assume pricing above rail inflation upon contract

renewals. CN also continues to assume that in 2023, the value of

the Canadian dollar in U.S. currency will be approximately $0.75,

and now assumes the average price of crude oil (West Texas

Intermediate) will be approximately US$80 per barrel (compared to

the July 25, 2023 assumption of being approximately US$75 per

barrel). Additionally, CN continues to assume that in 2023 there

will be no further significant impact from Canadian wildfires.

2024-2026 key assumptions CN

has made a number of economic and market assumptions in preparing

its three-year financial perspective. CN assumes that the North

American industrial production will increase by at least two

percent CAGR over the next three years. CN assumes continued

pricing above rail inflation. CN assumes that the value of the

Canadian dollar in U.S. currency will be approximately $0.75 and

that the average price of crude oil (West Texas Intermediate) will

be approximately US$80 per barrel during this period.

Forward-looking statements are not guarantees of

future performance and involve risks, uncertainties and other

factors which may cause actual results, performance or achievements

of CN to be materially different from the outlook or any future

results, performance or achievements implied by such statements.

Accordingly, readers are advised not to place undue reliance on

forward-looking statements. Important risk factors that could

affect the forward-looking statements in this news release include,

but are not limited to, general economic and business conditions,

including factors impacting global supply chains such as pandemics

and geopolitical conflicts and tensions; industry competition;

inflation, currency and interest rate fluctuations; changes in fuel

prices; legislative and/or regulatory developments; compliance with

environmental laws and regulations; actions by regulators;

increases in maintenance and operating costs; security threats;

reliance on technology and related cybersecurity risk; trade

restrictions or other changes to international trade arrangements;

transportation of hazardous materials; various events which could

disrupt operations, including illegal blockades of rail networks,

and natural events such as severe weather, droughts, fires, floods

and earthquakes; climate change; labor negotiations and

disruptions; environmental claims; uncertainties of investigations,

proceedings or other types of claims and litigation; risks and

liabilities arising from derailments; timing and completion of

capital programs; the availability of and cost competitiveness of

renewable fuels and the development of new locomotive propulsion

technology; and other risks detailed from time to time in reports

filed by CN with securities regulators in Canada and the United

States. Reference should also be made to Management’s Discussion

and Analysis (MD&A) in CN’s annual and interim reports, Annual

Information Form and Form 40-F, filed with Canadian and U.S.

securities regulators and available on CN’s website, for a

description of major risk factors relating to CN.

Forward-looking statements reflect information

as of the date on which they are made. CN assumes no obligation to

update or revise forward-looking statements to reflect future

events, changes in circumstances, or changes in beliefs, unless

required by applicable securities laws. In the event CN does update

any forward-looking statement, no inference should be made that CN

will make additional updates with respect to that statement,

related matters, or any other forward-looking statement.

Information contained on, or accessible through, our website is not

part of this news release.

(3) Based on Federal Railroad

Administration (FRA) reporting criteria.

This earnings news release, as well as

additional information, including the Financial Statements, Notes

thereto and MD&A, is contained in CN’s Quarterly Review

available on the Company's website at

www.cn.ca/financial-results and on SEDAR+ at

www.sedarplus.com as well as on the U.S. Securities and

Exchange Commission's website at www.sec.gov through

EDGAR.

About CN CN is a world-class

transportation leader and trade-enabler. Essential to the economy,

to the customers, and to the communities it serves, CN safely

transports more than 300 million tons of natural resources,

manufactured products, and finished goods throughout North America

every year. CN's network connects Canada’s Eastern and Western

coasts with the U.S. South through a 18,600-mile rail network. CN

and its affiliates have been contributing to community prosperity

and sustainable trade since 1919. CN is committed to programs

supporting social responsibility and environmental stewardship.

|

Contacts: |

|

|

Media |

Investment Community |

| Jonathan

Abecassis |

Stacy

Alderson |

|

Director |

Assistant

Vice-President |

| Public

Affairs and Media Relations |

Investor

Relations |

| (438)

455-3692 |

(514)

399-0052 |

|

media@cn.ca |

investor.relations@cn.ca |

| |

|

| |

|

SELECTED RAILROAD STATISTICS –

UNAUDITED

| |

|

Three months ended September 30 |

Nine months

ended September 30 |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

Financial measures |

|

|

|

|

|

|

|

|

|

| Key

financial performance indicators (1) |

|

|

|

|

|

|

|

|

|

| Total

revenues ($ millions) |

|

3,987 |

|

4,513 |

|

12,357 |

|

12,565 |

|

| Freight

revenues ($ millions) |

|

3,820 |

|

4,366 |

|

11,933 |

|

12,169 |

|

| Operating

income ($ millions) |

|

1,517 |

|

1,932 |

|

4,779 |

|

4,928 |

|

| Adjusted

operating income ($ millions) (2)(3) |

|

1,517 |

|

1,932 |

|

4,779 |

|

4,950 |

|

| Net income

($ millions) |

|

1,108 |

|

1,455 |

|

3,495 |

|

3,698 |

|

| Adjusted net

income ($ millions) (2)(3) |

|

1,108 |

|

1,455 |

|

3,495 |

|

3,714 |

|

| Diluted

earnings per share ($) |

|

1.69 |

|

2.13 |

|

5.27 |

|

5.34 |

|

| Adjusted

diluted earnings per share ($) (2)(3) |

|

1.69 |

|

2.13 |

|

5.27 |

|

5.37 |

|

| Free cash

flow ($ millions) (2)(4) |

|

581 |

|

1,356 |

|

2,274 |

|

2,924 |

|

| Gross

property additions ($ millions) |

|

934 |

|

744 |

|

2,270 |

|

1,830 |

|

| Share

repurchases ($ millions) |

|

1,196 |

|

1,178 |

|

3,438 |

|

3,644 |

|

| Dividends

per share ($) |

|

0.7900 |

|

0.7325 |

|

2.3700 |

|

2.1975 |

|

|

Financial ratio |

|

|

|

|

|

|

|

|

|

| Operating

ratio (%) (5) |

|

62.0 |

|

57.2 |

|

61.3 |

|

60.8 |

|

|

Adjusted operating ratio (%) (2)(3) |

|

62.0 |

|

57.2 |

|

61.3 |

|

60.6 |

|

|

Operational measures (6) |

|

|

|

|

|

|

|

|

|

|

Statistical operating data |

|

|

|

|

|

|

|

|

|

| Gross ton

miles (GTMs) (millions) |

|

108,221 |

|

115,585 |

|

333,356 |

|

347,393 |

|

| Revenue ton

miles (RTMs) (millions) |

|

55,640 |

|

58,540 |

|

171,478 |

|

175,645 |

|

| Carloads

(thousands) |

|

1,326 |

|

1,469 |

|

4,048 |

|

4,289 |

|

| Route miles

(includes Canada and the U.S.) |

|

18,600 |

|

18,600 |

|

18,600 |

|

18,600 |

|

| Employees

(end of period) |

|

25,101 |

|

23,828 |

|

25,101 |

|

23,828 |

|

|

Employees (average for the period) |

|

25,168 |

|

23,729 |

|

24,859 |

|

23,195 |

|

|

Key operating measures |

|

|

|

|

|

|

|

|

|

| Freight

revenue per RTM (cents) |

|

6.87 |

|

7.46 |

|

6.96 |

|

6.93 |

|

| Freight

revenue per carload ($) |

|

2,881 |

|

2,972 |

|

2,948 |

|

2,837 |

|

| GTMs per

average number of employees (thousands) |

|

4,300 |

|

4,871 |

|

13,410 |

|

14,977 |

|

| Operating

expenses per GTM (cents) |

|

2.28 |

|

2.23 |

|

2.27 |

|

2.20 |

|

| Labor and

fringe benefits expense per GTM (cents) |

|

0.71 |

|

0.67 |

|

0.70 |

|

0.63 |

|

| Diesel fuel

consumed (US gallons in millions) |

|

90.0 |

|

96.9 |

|

291.5 |

|

299.2 |

|

| Average fuel

price ($ per US gallon) |

|

4.66 |

|

5.70 |

|

4.56 |

|

5.31 |

|

| Fuel

efficiency (US gallons of locomotive fuel consumed per 1,000

GTMs) |

|

0.832 |

|

0.838 |

|

0.874 |

|

0.861 |

|

| Train weight

(tons) |

|

9,246 |

|

9,202 |

|

9,146 |

|

9,385 |

|

| Train length

(feet) |

|

7,927 |

|

8,140 |

|

7,870 |

|

8,259 |

|

| Car velocity

(car miles per day) |

|

209 |

|

212 |

|

212 |

|

193 |

|

| Through

dwell (entire railroad, hours) |

|

7.1 |

|

7.0 |

|

7.0 |

|

7.8 |

|

| Through

network train speed (miles per hour) |

|

19.7 |

|

20.1 |

|

19.9 |

|

18.6 |

|

|

Locomotive utilization (trailing GTMs per total horsepower) |

|

189 |

|

202 |

|

191 |

|

197 |

|

|

Safety indicators (7) |

|

|

|

|

|

|

|

|

|

| Injury

frequency rate (per 200,000 person hours) |

|

1.07 |

|

1.01 |

|

1.02 |

|

1.15 |

|

|

Accident rate (per million train miles) |

|

1.86 |

|

1.69 |

|

1.76 |

|

2.10 |

|

|

(1) |

|

Amounts expressed in Canadian dollars and prepared in accordance

with United States generally accepted accounting principles (GAAP),

unless otherwise noted. |

|

(2) |

|

These non-GAAP measures do not have any standardized meaning

prescribed by GAAP and therefore, may not be comparable to similar

measures presented by other companies. |

|

(3) |

|

See the supplementary schedule entitled Non-GAAP Measures –

Adjusted performance measures for an explanation of these

non-GAAP measures. |

|

(4) |

|

See the supplementary schedule entitled Non-GAAP Measures –

Free cash flow for an explanation of this non-GAAP

measure. |

|

(5) |

|

Operating ratio is defined as operating expenses as a percentage of

revenues. |

|

(6) |

|

Statistical operating data, key operating measures and safety

indicators are unaudited and based on estimated data available at

such time and are subject to change as more complete information

becomes available. Definitions of gross ton miles, revenue ton

miles, freight revenue per RTM, fuel efficiency, train weight,

train length, car velocity, through dwell and through network train

speed are included within the Company’s Management’s Discussion and

Analysis. Definitions of all other indicators are provided on CN's

website, www.cn.ca/glossary. |

|

(7) |

|

Based on Federal Railroad Administration (FRA) reporting

criteria. |

SUPPLEMENTARY INFORMATION – UNAUDITED

| |

|

Three months ended September 30 |

Nine months ended September 30 |

|

|

|

2023 |

|

2022 |

|

% Change Fav(Unfav) |

% Change atconstantcurrency (1)Fav (Unfav) |

2023 |

|

2022 |

|

% Change Fav(Unfav) |

% Change atconstantcurrency (1)Fav (Unfav) |

|

Revenues ($ millions) (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Petroleum and chemicals |

|

758 |

|

850 |

|

(11 |

%) |

(12 |

%) |

2,334 |

|

2,435 |

|

(4 |

%) |

(7 |

%) |

|

Metals and minerals |

|

515 |

|

539 |

|

(4 |

%) |

(6 |

%) |

1,541 |

|

1,411 |

|

9 |

% |

5 |

% |

|

Forest products |

|

466 |

|

550 |

|

(15 |

%) |

(17 |

%) |

1,457 |

|

1,489 |

|

(2 |

%) |

(6 |

%) |

|

Coal |

|

242 |

|

258 |

|

(6 |

%) |

(7 |

%) |

768 |

|

702 |

|

9 |

% |

8 |

% |

|

Grain and fertilizers |

|

722 |

|

621 |

|

16 |

% |

15 |

% |

2,271 |

|

1,829 |

|

24 |

% |

21 |

% |

|

Intermodal |

|

880 |

|

1,340 |

|

(34 |

%) |

(35 |

%) |

2,875 |

|

3,722 |

|

(23 |

%) |

(24 |

%) |

|

Automotive |

|

237 |

|

208 |

|

14 |

% |

12 |

% |

687 |

|

581 |

|

18 |

% |

14 |

% |

|

Total freight revenues |

|

3,820 |

|

4,366 |

|

(13 |

%) |

(14 |

%) |

11,933 |

|

12,169 |

|

(2 |

%) |

(5 |

%) |

|

Other revenues |

|

167 |

|

147 |

|

14 |

% |

12 |

% |

424 |

|

396 |

|

7 |

% |

4 |

% |

|

Total revenues |

|

3,987 |

|

4,513 |

|

(12 |

%) |

(13 |

%) |

12,357 |

|

12,565 |

|

(2 |

%) |

(4 |

%) |

|

Revenue ton miles (RTMs) (millions) (3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Petroleum and chemicals |

|

10,470 |

|

11,715 |

|

(11 |

%) |

(11 |

%) |

31,915 |

|

35,604 |

|

(10 |

%) |

(10 |

%) |

|

Metals and minerals |

|

7,630 |

|

7,441 |

|

3 |

% |

3 |

% |

21,458 |

|

20,853 |

|

3 |

% |

3 |

% |

|

Forest products |

|

5,719 |

|

6,614 |

|

(14 |

%) |

(14 |

%) |

17,529 |

|

19,083 |

|

(8 |

%) |

(8 |

%) |

|

Coal |

|

5,421 |

|

5,769 |

|

(6 |

%) |

(6 |

%) |

17,234 |

|

17,264 |

|

— |

% |

— |

% |

|

Grain and fertilizers |

|

14,528 |

|

11,944 |

|

22 |

% |

22 |

% |

45,138 |

|

37,748 |

|

20 |

% |

20 |

% |

|

Intermodal |

|

11,048 |

|

14,340 |

|

(23 |

%) |

(23 |

%) |

35,918 |

|

42,966 |

|

(16 |

%) |

(16 |

%) |

|

Automotive |

|

824 |

|

717 |

|

15 |

% |

15 |

% |

2,286 |

|

2,127 |

|

7 |

% |

7 |

% |

|

Total RTMs |

|

55,640 |

|

58,540 |

|

(5 |

%) |

(5 |

%) |

171,478 |

|

175,645 |

|

(2 |

%) |

(2 |

%) |

|

Freight revenue / RTM (cents) (2)(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Petroleum and chemicals |

|

7.24 |

|

7.26 |

|

— |

% |

(2 |

%) |

7.31 |

|

6.84 |

|

7 |

% |

4 |

% |

|

Metals and minerals |

|

6.75 |

|

7.24 |

|

(7 |

%) |

(9 |

%) |

7.18 |

|

6.77 |

|

6 |

% |

2 |

% |

|

Forest products |

|

8.15 |

|

8.32 |

|

(2 |

%) |

(4 |

%) |

8.31 |

|

7.80 |

|

7 |

% |

3 |

% |

|

Coal |

|

4.46 |

|

4.47 |

|

— |

% |

(1 |

%) |

4.46 |

|

4.07 |

|

10 |

% |

8 |

% |

|

Grain and fertilizers |

|

4.97 |

|

5.20 |

|

(4 |

%) |

(6 |

%) |

5.03 |

|

4.85 |

|

4 |

% |

1 |

% |

|

Intermodal |

|

7.97 |

|

9.34 |

|

(15 |

%) |

(15 |

%) |

8.00 |

|

8.66 |

|

(8 |

%) |

(9 |

%) |

|

Automotive |

|

28.76 |

|

29.01 |

|

(1 |

%) |

(3 |

%) |

30.05 |

|

27.32 |

|

10 |

% |

6 |

% |

|

Total freight revenue / RTM |

|

6.87 |

|

7.46 |

|

(8 |

%) |

(9 |

%) |

6.96 |

|

6.93 |

|

— |

% |

(2 |

%) |

|

Carloads (thousands) (3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Petroleum and chemicals |

|

156 |

|

161 |

|

(3 |

%) |

(3 |

%) |

468 |

|

482 |

|

(3 |

%) |

(3 |

%) |

|

Metals and minerals |

|

264 |

|

264 |

|

— |

% |

— |

% |

749 |

|

709 |

|

6 |

% |

6 |

% |

|

Forest products |

|

76 |

|

86 |

|

(12 |

%) |

(12 |

%) |

234 |

|

250 |

|

(6 |

%) |

(6 |

%) |

|

Coal |

|

124 |

|

130 |

|

(5 |

%) |

(5 |

%) |

386 |

|

377 |

|

2 |

% |

2 |

% |

|

Grain and fertilizers |

|

153 |

|

135 |

|

13 |

% |

13 |

% |

483 |

|

422 |

|

14 |

% |

14 |

% |

|

Intermodal |

|

494 |

|

641 |

|

(23 |

%) |

(23 |

%) |

1,556 |

|

1,894 |

|

(18 |

%) |

(18 |

%) |

|

Automotive |

|

59 |

|

52 |

|

13 |

% |

13 |

% |

172 |

|

155 |

|

11 |

% |

11 |

% |

|

Total carloads |

|

1,326 |

|

1,469 |

|

(10 |

%) |

(10 |

%) |

4,048 |

|

4,289 |

|

(6 |

%) |

(6 |

%) |

|

Freight revenue / carload ($) (2)(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Petroleum and chemicals |

|

4,859 |

|

5,280 |

|

(8 |

%) |

(10 |

%) |

4,987 |

|

5,052 |

|

(1 |

%) |

(4 |

%) |

|

Metals and minerals |

|

1,951 |

|

2,042 |

|

(4 |

%) |

(7 |

%) |

2,057 |

|

1,990 |

|

3 |

% |

(1 |

%) |

|

Forest products |

|

6,132 |

|

6,395 |

|

(4 |

%) |

(6 |

%) |

6,226 |

|

5,956 |

|

5 |

% |

1 |

% |

|

Coal |

|

1,952 |

|

1,985 |

|

(2 |

%) |

(3 |

%) |

1,990 |

|

1,862 |

|

7 |

% |

5 |

% |

|

Grain and fertilizers |

|

4,719 |

|

4,600 |

|

3 |

% |

1 |

% |

4,702 |

|

4,334 |

|

8 |

% |

6 |

% |

|

Intermodal |

|

1,781 |

|

2,090 |

|

(15 |

%) |

(15 |

%) |

1,848 |

|

1,965 |

|

(6 |

%) |

(7 |

%) |

|

Automotive |

|

4,017 |

|

4,000 |

|

— |

% |

(2 |

%) |

3,994 |

|

3,748 |

|

7 |

% |

3 |

% |

|

Total freight revenue / carload |

|

2,881 |

|

2,972 |

|

(3 |

%) |

(5 |

%) |

2,948 |

|

2,837 |

|

4 |

% |

1 |

% |

|

(1) |

|

This non-GAAP measure does not have any standardized meaning

prescribed by GAAP and therefore, may not be comparable to similar

measures presented by other companies. See the supplementary

schedule entitled Non-GAAP Measures – Constant currency for an

explanation of this non-GAAP measure. |

|

(2) |

|

Amounts expressed in Canadian dollars. |

|

(3) |

|

Statistical operating data and related key operating measures are

unaudited and based on estimated data available at such time and

are subject to change as more complete information becomes

available. |

NON-GAAP MEASURES – UNAUDITED

In this supplementary schedule, the "Company" or

"CN" refers to Canadian National Railway Company, together with its

wholly-owned subsidiaries. Financial information included in this

schedule is expressed in Canadian dollars, unless otherwise

noted.

CN reports its financial results in accordance

with United States generally accepted accounting principles (GAAP).

The Company also uses non-GAAP measures that do not have any

standardized meaning prescribed by GAAP, including adjusted

performance measures, free cash flow, constant currency and

adjusted debt-to-adjusted EBITDA multiple. These non-GAAP measures

may not be comparable to similar measures presented by other

companies. From management's perspective, these non-GAAP measures

are useful measures of performance and provide investors with

supplementary information to assess the Company's results of

operations and liquidity. These non-GAAP measures should not be

considered in isolation or as a substitute for financial measures

prepared in accordance with GAAP.

Adjusted performance

measures

Adjusted net income, adjusted earnings per

share, adjusted operating income, adjusted operating expenses and

adjusted operating ratio are non-GAAP measures that are used to set

performance goals and to measure CN's performance. Management

believes that these adjusted performance measures provide

additional insight to management and investors into the Company's

operations and underlying business trends as well as facilitate

period-to-period comparisons, as they exclude certain significant

items that are not reflective of CN's underlying business

operations and could distort the analysis of trends in business

performance. These items may include:

- operating expense adjustments:

workforce reduction program, depreciation expense on the deployment

of replacement system, advisory fees related to shareholder

matters, losses and recoveries from assets held for sale, business

acquisition-related costs;

- non-operating expense adjustments:

business acquisition-related financing fees, merger termination

income, gains and losses on disposal of property; and

- the effect of tax law changes and

rate enactments.

These non-GAAP measures do not have any

standardized meaning prescribed by GAAP and therefore, may not be

comparable to similar measures presented by other companies.

For the three and nine months ended September

30, 2023, the Company's net income was $1,108 million, or $1.69 per

diluted share, and $3,495 million, or $5.27 per diluted share,

respectively. There were no adjustments in the third quarter and

the first nine months of 2023.

For the three and nine months ended September

30, 2022, the Company's adjusted net income was $1,455 million, or

$2.13 per diluted share, and $3,714 million, or $5.37 per diluted

share, respectively. The adjusted figures for the nine months ended

September 30, 2022 exclude advisory fees related to shareholder

matters of $22 million, or $16 million after-tax ($0.03 per diluted

share) recorded in Casualty and other within the Consolidated

Statements of Income.

Adjusted net income is defined as Net income in

accordance with GAAP adjusted for certain significant items.

Adjusted diluted earnings per share is defined as adjusted net

income divided by the weighted-average diluted shares outstanding.

The following table provides a reconciliation of Net income and

Earnings per share in accordance with GAAP, as reported for the

three and nine months ended September 30, 2023 and 2022, to the

non-GAAP adjusted performance measures presented herein:

| |

|

Three months ended September 30 |

Nine months ended September 30 |

|

In millions, except per share data |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Net income |

|

$ |

1,108 |

|

$ |

1,455 |

|

$ |

3,495 |

|

$ |

3,698 |

|

|

Adjustments: |

|

|

|

|

|

|

Advisory fees related to shareholder matters |

|

|

— |

|

|

— |

|

|

— |

|

|

22 |

|

|

Tax effect of adjustments (1) |

|

|

— |

|

|

— |

|

|

— |

|

|

(6 |

) |

|

Total adjustments |

|

|

— |

|

|

— |

|

|

— |

|

|

16 |

|

|

Adjusted net income |

|

$ |

1,108 |

|

$ |

1,455 |

|

$ |

3,495 |

|

$ |

3,714 |

|

|

Diluted earnings per share |

|

$ |

1.69 |

|

$ |

2.13 |

|

$ |

5.27 |

|

$ |

5.34 |

|

|

Impact of adjustments, per share |

|

|

— |

|

|

— |

|

|

— |

|

|

0.03 |

|

|

Adjusted diluted earnings per share |

|

$ |

1.69 |

|

$ |

2.13 |

|

$ |

5.27 |

|

$ |

5.37 |

|

|

(1) |

|

The tax impact of adjustments is based on the nature of the item

for tax purposes and related tax rates in the applicable

jurisdiction. |

Adjusted operating income is defined as

Operating income in accordance with GAAP adjusted for certain

significant operating expense items. Adjusted operating expenses is

defined as Operating expenses in accordance with GAAP adjusted for

certain significant operating expense items. Adjusted operating

ratio is defined as adjusted operating expenses as a percentage of

revenues. The following table provides a reconciliation of

Operating income, Operating expenses and operating ratio, as

reported for the three and nine months ended September 30, 2023 and

2022, to the non-GAAP adjusted performance measures presented

herein:

| |

Three months endedSeptember 30 |

Nine months endedSeptember 30 |

|

In millions, except percentages |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Operating income |

$ |

1,517 |

|

$ |

1,932 |

|

$ |

4,779 |

|

$ |

4,928 |

|

|

Adjustment: |

|

|

|

|

|

|

|

Advisory fees related to shareholder matters |

|

— |

|

|

— |

|

|

— |

|

|

22 |

|

|

Total adjustment |

|

— |

|

|

— |

|

|

— |

|

|

22 |

|

|

Adjusted operating income |

$ |

1,517 |

|

$ |

1,932 |

|

$ |

4,779 |

|

$ |

4,950 |

|

|

|

|

|

|

|

|

|

| Operating

expenses |

$ |

2,470 |

|

$ |

2,581 |

|

$ |

7,578 |

|

$ |

7,637 |

|

|

Total adjustment |

|

— |

|

|

— |

|

|

— |

|

|

(22 |

) |

|

Adjusted operating expenses |

$ |

2,470 |

|

$ |

2,581 |

|

$ |

7,578 |

|

$ |

7,615 |

|

|

|

|

|

|

|

|

|

| Operating

ratio |

|

62.0 |

% |

|

57.2 |

% |

|

61.3 |

% |

|

60.8 |

% |

|

Impact of adjustment |

|

— |

% |

|

— |

% |

|

— |

% |

|

(0.2 |

)% |

|

Adjusted operating ratio |

|

62.0 |

% |

|

57.2 |

% |

|

61.3 |

% |

|

60.6 |

% |

Free cash flow

Free cash flow is a useful measure of liquidity

as it demonstrates the Company's ability to generate cash for debt

obligations and for discretionary uses such as payment of

dividends, share repurchases, and strategic opportunities. The

Company defines its free cash flow measure as the difference

between net cash provided by operating activities and net cash used

in investing activities, adjusted for the impact of (i) business

acquisitions and (ii) merger transaction-related payments, cash

receipts and cash income taxes, which are items that are not

indicative of operating trends. Free cash flow does not have any

standardized meaning prescribed by GAAP and therefore, may not be

comparable to similar measures presented by other companies.

The following table provides a reconciliation of

Net cash provided by operating activities in accordance with GAAP,

as reported for the three and nine months ended September 30, 2023

and 2022, to the non-GAAP free cash flow presented herein:

| |

|

Three months ended September 30 |

Nine months ended September 30 |

|

In millions |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Net cash provided by operating activities |

|

$ |

1,512 |

|

$ |

2,112 |

|

$ |

4,552 |

|

$ |

4,395 |

|

|

Net cash used in investing activities |

|

|

(931 |

) |

|

(756 |

) |

|

(2,278 |

) |

|

(1,573 |

) |

|

Net cash provided before financing activities |

|

|

581 |

|

|

1,356 |

|

|

2,274 |

|

|

2,822 |

|

|

Adjustment: |

|

|

|

|

|

|

Cash income taxes for merger transaction-related payments and cash

receipts (1) |

|

|

— |

|

|

— |

|

|

— |

|

|

102 |

|

|

Free cash flow |

|

$ |

581 |

|

$ |

1,356 |

|

$ |

2,274 |

|

$ |

2,924 |

|

|

(1) |

|

Relates to income tax payments of $102 million for KCS merger

transaction-related payments and cash receipts. See Note 4 –

Acquisition to the Company's 2022 Annual Consolidated Financial

Statements for additional information. |

Constant currency

Financial results at constant currency allow

results to be viewed without the impact of fluctuations in foreign

currency exchange rates, thereby facilitating period-to-period

comparisons in the analysis of trends in business performance.

Measures at constant currency are considered non-GAAP measures and

do not have any standardized meaning prescribed by GAAP and

therefore, may not be comparable to similar measures presented by

other companies. Financial results at constant currency are

obtained by translating the current period results denominated in

US dollars at the weighted average foreign exchange rates used to

translate transactions denominated in US dollars of the comparable

period of the prior year.

The average foreign exchange rates were $1.34

and $1.35 per US$1.00 for the three and nine months ended September

30, 2023, respectively, and $1.31 and $1.28 per US$1.00 for the

three and nine months ended September 30, 2022, respectively. On a

constant currency basis, the Company's net income for the three and

nine months ended September 30, 2023 would have been lower by

$18 million ($0.03 per diluted share) and $94 million ($0.14

per diluted share), respectively.

The following table provides a reconciliation of

the impact of constant currency and related percentage change at

constant currency on the financial results, as reported for the

three and nine months ended September 30, 2023:

| |

|

Three months

ended September 30 |

Nine months ended September 30 |

|

In millions, except per share data |

|

|

2023 |

|

Constantcurrencyimpact |

|

2022 |

|

% Changeat constantcurrency Fav(Unfav) |

|

2023 |

|

Constantcurrencyimpact |

|

2022 |

|

% Changeat constantcurrencyFav(Unfav) |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

Petroleum and chemicals |

|

$ |

758 |

|

$ |

(14 |

) |

$ |

850 |

|

(12 |

%) |

$ |

2,334 |

|

$ |

(70 |

) |

$ |

2,435 |

|

(7 |

%) |

|

Metals and minerals |

|

|

515 |

|

|

(11 |

) |

|

539 |

|

(6 |

%) |

|

1,541 |

|

|

(58 |

) |

|

1,411 |

|

5 |

% |

|

Forest products |

|

|

466 |

|

|

(10 |

) |

|

550 |

|

(17 |

%) |

|

1,457 |

|

|

(53 |

) |

|

1,489 |

|

(6 |

%) |

|

Coal |

|

|

242 |

|

|

(2 |

) |

|

258 |

|

(7 |

%) |

|

768 |

|

|

(13 |

) |

|

702 |

|

8 |

% |

|

Grain and fertilizers |

|

|

722 |

|

|

(9 |

) |

|

621 |

|

15 |

% |

|

2,271 |

|

|

(55 |

) |

|

1,829 |

|

21 |

% |

|

Intermodal |

|

|

880 |

|

|

(7 |

) |

|

1,340 |

|

(35 |

%) |

|

2,875 |

|

|

(45 |

) |

|

3,722 |

|

(24 |

%) |

|

Automotive |

|

|

237 |

|

|

(5 |

) |

|

208 |

|

12 |

% |

|

687 |

|

|

(24 |

) |

|

581 |

|

14 |

% |

|

Total freight revenues |

|

|

3,820 |

|

|

(58 |

) |

|

4,366 |

|

(14 |

%) |

|

11,933 |

|

|

(318 |

) |

|

12,169 |

|

(5 |

%) |

|

Other revenues |

|

|

167 |

|

|

(3 |

) |

|

147 |

|

12 |

% |

|

424 |

|

|

(12 |

) |

|

396 |

|

4 |

% |

|

Total revenues |

|

|

3,987 |

|

|

(61 |

) |

|

4,513 |

|

(13 |

%) |

|

12,357 |

|

|

(330 |

) |

|

12,565 |

|

(4 |

%) |

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

Labor and fringe benefits |

|

|

773 |

|

|

(6 |

) |

|

770 |

|

— |

% |

|

2,332 |

|

|

(39 |

) |

|

2,204 |

|

(4 |

%) |

|

Purchased services and material |

|

|

534 |

|

|

(5 |

) |

|

520 |

|

(2 |

%) |

|

1,698 |

|

|

(28 |

) |

|

1,615 |

|

(3 |

%) |

|

Fuel |

|

|

486 |

|

|

(13 |

) |

|

649 |

|

27 |

% |

|

1,528 |

|

|

(68 |

) |

|

1,846 |

|

21 |

% |

|

Depreciation and amortization |

|

|

457 |

|

|

(5 |

) |

|

435 |

|

(4 |

%) |

|

1,354 |

|

|

(25 |

) |

|

1,278 |

|

(4 |

%) |

|

Equipment rents |

|

|

89 |

|

|

(2 |

) |

|

72 |

|

(21 |

%) |

|

262 |

|

|

(10 |

) |

|

254 |

|

1 |

% |

|

Casualty and other |

|

|

131 |

|

|

(2 |

) |

|

135 |

|

4 |

% |

|

404 |

|

|

(13 |

) |

|

440 |

|

11 |

% |

|

Total operating expenses |

|

|

2,470 |

|

|

(33 |

) |

|

2,581 |

|

6 |

% |

|

7,578 |

|

|

(183 |

) |

|

7,637 |

|

3 |

% |

|

Operating income |

|

|

1,517 |

|

|

(28 |

) |

|

1,932 |

|

(23 |

%) |

|

4,779 |

|

|

(147 |

) |

|

4,928 |

|

(6 |

%) |

| Interest

expense |

|

|

(185 |

) |

|

4 |

|

|

(141 |

) |

(28 |

%) |

|

(523 |

) |

|

22 |

|

|

(395 |

) |

(27 |

%) |

| Other

components of net periodic benefit income |

|

|

121 |

|

|

— |

|

|

125 |

|

(3 |

%) |

|

360 |

|

|

— |

|

|

374 |

|

(4 |

%) |

|

Other income (loss) |

|

|

(2 |

) |

|

— |

|

|

(1 |

) |

(100 |

%) |

|

— |

|

|

— |

|

|

(25 |

) |

100 |

% |

|

Income before income taxes |

|

|

1,451 |

|

|

(24 |

) |

|

1,915 |

|

(25 |

%) |

|

4,616 |

|

|

(125 |

) |

|

4,882 |

|

(8 |

%) |

|

Income tax expense |

|

|

(343 |

) |

|

6 |

|

|

(460 |

) |

27 |

% |

|

(1,121 |

) |

|

31 |

|

|

(1,184 |

) |

8 |

% |

|

Net income |

|

$ |

1,108 |

|

$ |

(18 |

) |

$ |

1,455 |

|

(25 |

%) |

$ |

3,495 |

|

$ |

(94 |

) |

$ |

3,698 |

|

(8 |

%) |

|

Diluted earnings per share |

|

$ |

1.69 |

|

$ |

(0.03 |

) |

$ |

2.13 |

|

(22 |

%) |

$ |

5.27 |

|

$ |

(0.14 |

) |

$ |

5.34 |

|

(4 |

%) |

Adjusted debt-to-adjusted EBITDA

multiple

Management believes that the adjusted

debt-to-adjusted EBITDA multiple is a useful credit measure because

it reflects the Company's ability to service its debt and other

long-term obligations. The Company calculates the adjusted

debt-to-adjusted EBITDA multiple as adjusted debt divided by the

last twelve months of adjusted EBITDA. Adjusted debt is defined as

the sum of Long-term debt and Current portion of long-term debt as

reported on the Company’s Consolidated Balance Sheets as well as

Operating lease liabilities, including current portion and pension

plans in deficiency recognized on the Company's Consolidated

Balance Sheets due to the debt-like nature of their contractual and

financial obligations. Adjusted EBITDA is calculated as Net income

excluding Interest expense, Income tax expense, Depreciation and

amortization, operating lease cost, Other components of net

periodic benefit income, Other income (loss), and other significant

items that are not reflective of CN's underlying business

operations and which could distort the analysis of trends in

business performance. Adjusted debt and adjusted EBITDA are

non-GAAP measures used to compute the Adjusted debt-to-adjusted

EBITDA multiple. These measures do not have any standardized

meaning prescribed by GAAP and therefore, may not be comparable to

similar measures presented by other companies.

The following table provides a reconciliation of

debt and Net income in accordance with GAAP, reported as at and for

the twelve months ended September 30, 2023 and 2022, to the

adjusted measures presented herein, which have been used to

calculate the non-GAAP adjusted debt-to-adjusted EBITDA

multiple:

|

In millions, unless otherwise indicated |

As at and for the twelve months ended September 30, |

|

|

2023 |

|

|

2022 |

|

|

Debt |

$ |

18,382 |

|

$ |

15,392 |

|

|

Adjustments: |

|

|

|

Operating lease liabilities, including current portion (1) |

|

429 |

|

|

484 |

|

|

Pension plans in deficiency (2) |

|

351 |

|

|

444 |

|

|

Adjusted debt |

$ |

19,162 |

|

$ |

16,320 |

|

|

Net income |

$ |

4,915 |

|

$ |

4,899 |

|

|

Interest expense |

|

676 |

|

|

520 |

|

|

Income tax expense |

|

1,582 |

|

|

1,557 |

|

|

Depreciation and amortization |

|

1,805 |

|

|

1,661 |

|

|

Operating lease cost (3) |

|

147 |

|

|

138 |

|

|

Other components of net periodic benefit income |

|

(484 |

) |

|

(486 |

) |

|

Other loss |

|

2 |

|

|

4 |

|

|

Adjustment: |

|

|

|

Advisory fees related to shareholder matters (4) |

|

— |

|

|

35 |

|

|

Adjusted EBITDA |

$ |

8,643 |

|

$ |

8,328 |

|

|

Adjusted debt-to-adjusted EBITDA multiple

(times) |

|

2.22 |

|

|

1.96 |

|

|

(1) |

|

Represents the present value of operating lease payments. |

|

(2) |

|

Represents the total funded deficit of all defined benefit pension

plans with a projected benefit obligation in excess of plan

assets. |

|

(3) |

|

Represents the operating lease costs recorded in Purchased services

and material and Equipment rents within the Consolidated Statements

of Income. |

|

(4) |

|

Relates to advisory fees related to shareholder matters recorded in

Casualty and other within the Consolidated Statements of Income.

See the section entitled Adjusted performance measures of the

Company's 2022 Annual MD&A for additional information. |

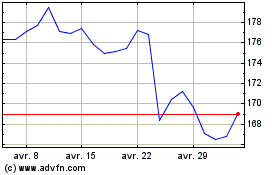

Canadian National Railway (TSX:CNR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Canadian National Railway (TSX:CNR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024