Dundee Corporation (TSX: DC.A) (the “Corporation”

or “Dundee”) today announced its financial results for the three

and nine months ended September 30, 2023. All currency amounts in

this press release are in Canadian dollars, except as otherwise

indicated.

THIRD QUARTER 2023 RESULTS

- Reported a net loss from portfolio

investments for the third quarter of 2023 of $24.7 million (2022 –

income of $20.0 million). The key driver of performance during the

quarter was the market depreciation in Reunion Gold Corporation and

Centaurus Metals Limited by $12.8 million and $4.6 million,

respectively. Broad-based market weakness for mining stocks

accounted for the remaining decrease. For the nine months ended

September 30, 2023, the Corporation reported a net loss from

portfolio investments of $22.2 million (2022 – income of $13.7

million).

- Reported consolidated general and

administrative expenses for the current quarter of $4.6 million

(2022 – $6.5 million), representing a 29% year-over-year decline as

Dundee sustains momentum with cost-cutting initiatives. Corporate

head office general and administrative expenses fell to $3.1

million in the third quarter of 2023, declining 28% from $4.3

million incurred from the same period of the prior year.

- Reported share of loss from equity

accounted investments for the third quarter of 2023 of $0.6 million

(2022 – income of $1.0 million). For the nine months ended

September 30, 2023, Dundee reported a share of loss from equity

accounted investments of $4.1 million (2022 – income of $3.3

million).

- Reported a net loss attributable to

owners of the Corporation for the third quarter of 2023 of $26.5

million (2022 – earnings of $4.6 million), or a loss of $0.31 per

share (2022 – earnings of $0.04 per share, before the effect of any

dilutive securities).

- For the nine months ended September

30, 2023, the Corporation reported a net loss attributable to

owners of the Corporation of $36.0 million (2022 – $8.9 million),

or a loss of $0.43 per share (2022 – $0.13 per share).

Jonathan Goodman, President and Chief Executive

Officer of Dundee Corporation, commented:

“Dundee navigated a turbulent market environment

for junior mining in the third quarter. The reacceleration of

inflation, the specter of global growth cooling because of

tightening monetary measures, growing concerns over unmanageable

global fiscal deficits as well, as spiraling geopolitical

conflicts, all contributed to a material decline in the appetite

for risk, posing a significant headwind for our investment

portfolio in the third quarter. In the latest flight to safety, the

price of gold has reached over $2,000 per ounce, which strengthens

our conviction that the market is underestimating the value of

companies engaged in the discovery and development of high-quality

precious metals resources. We remain focused on investing in the

long-term and working with our investee companies as advisors and

partners to maximize asset value and realize their full

potential.”

“Meanwhile, Dundee continued to make progress on

the factors within its control, namely around cost reduction. In

addition to enabling our existing portfolio companies to move

forward with their strategic plans, during the quarter, Dundee took

steps to further de-risk the company by terminating its joint

venture arrangement in Borborema, Inc. in exchange for a net

smelter royalty on the sale of any product from Borborema, up to

2,000,000 ounces of gold. The royalty gives Dundee a direct line of

sight on anticipated future cash flows.”

Mr. Goodman concluded: “The entire team at

Dundee continues to work diligently to implement and execute on our

strategy across all fronts. I am encouraged by our ability to

sustain and grow our momentum in the second half of 2023, and we

are excited by the opportunity set ahead of us. Our team remains

committed to growing the core business, streamlining operations,

divesting our remaining non-core businesses and investments, and

positioning Dundee to deliver long-term, sustainable value for our

stakeholders, shareholders and partners. I would like to thank the

entire team for their hard work in navigating a time of continued

evolution.”

SEGMENTED FINANCIAL RESULTS

Mining Investments

In the third quarter of 2023, the Corporation

reported a net loss from the mining investments segment of $23.3

million (2022 – earnings of $17.5 million). Performance from the

mining investments portfolio contributed $25.6 million (2022 –

income of $17.7 million) to the net loss in this segment. The share

of income from equity accounted mining investments during the

current quarter of 2023 was $3,000 (2022 – loss of $0.2 million).

In addition, the Corporation recognized a $2.3 million gain in the

third quarter of 2023 related to the termination of the

Corporation’s 20% equity interest in the Borborema gold project

joint venture in exchange for a net smelter royalty as non-monetary

consideration.

During the first nine months of 2023, the

Corporation reported a net loss from the mining investments segment

of $22.4 million (2022 – earnings of $11.0 million). Performance

from the mining investment portfolio attributable a $22.7 million

loss (2022 – income of $11.3 million) to the net loss in this

segment. The share of loss from equity accounted mining investments

during the first nine months of 2023 was $1.9 million (2022 – loss

of $0.2 million).

Mining Services

During the three months ended September 30,

2023, the mining services segment, comprised of the Corporation’s

78% owned subsidiary, Dundee Sustainable Technologies (“DST”),

reported a pre-tax loss of $0.6 million (2022 – $0.9 million). The

current quarter included a $0.9 million gain on the sale of a

non-strategic operation and assets located at its Thetford Mines

technical facilities, and a $0.4 million gain on debt valuation

related to its convertible debenture. Also, DST invested $75,000

into Enim Technologies Inc., a Québec-based company focused on the

treatment of electronic waste material, in return for a 25% equity

interest.

During the first nine months of 2023, DST

incurred a pre-tax loss of $3.1 million (2022 – $2.5 million).

Corporate and others

The Corporation reported a pre-tax loss from the

corporate and others segment, including non-core subsidiaries, of

$3.5 million (2022 – $0.7 million) during the three months ended

September 30, 2023. During this period, the Corporation reported

head office general and administrative expenses of $3.1 million,

which decreased by 28% from the $4.3 million expense incurred from

the same period of the prior year. During the first nine months of

2023, the corporate and others segment reported a pre-tax loss of

$11.7 million (2022 – $7.7 million).

The fair value of portfolio investments in the

corporate and others segment increased by $0.9 million during the

three months ended September 30, 2023 (2022 – $2.3 million). The

increase was mainly attributable to the investment in TauRx

Pharmaceuticals Ltd., primarily on account of period-over-period

fluctuations in foreign exchange. The fair value of portfolio

investments in the corporate and others segment increased by $0.5

million during the first nine months of 2023 (2022 – $2.4

million).

Other subsidiaries and equity accounted

investments contributed $1.1 million and $0.6 million,

respectively, to this segment’s total pre-tax loss during the third

quarter of 2023 (2022 – loss of $1.1 million and income of $1.3

million, respectively). During the first nine months of 2023, other

subsidiaries and equity accounted investments contributed $3.1

million and $2.1 million, respectively, to this segment’s total

pre-tax loss (2022 – loss of $4.5 million and income of $3.5

million, respectively).

SHAREHOLDERS’ EQUITY ON A PER SHARE BASIS

|

|

|

Carrying Value |

|

|

|

Carrying Value |

|

|

|

|

September 30, 2023 |

|

|

|

December 31, 2022 |

|

|

Mining Investments |

|

|

|

|

|

|

|

|

Portfolio investments |

$ |

146,826 |

|

|

$ |

168,598 |

|

|

Equity accounted investments |

|

8,378 |

|

|

|

26,506 |

|

|

Royalty |

|

18,921 |

|

|

|

- |

|

|

|

|

174,125 |

|

|

|

195,104 |

|

|

Mining Services |

|

|

|

|

|

|

|

|

Subsidiaries |

|

3,051 |

|

|

|

3,081 |

|

|

Equity accounted investment |

|

75 |

|

|

|

- |

|

|

|

|

3,126 |

|

|

|

3,081 |

|

|

Corporate and Others |

|

|

|

|

|

|

|

|

Corporate |

|

28,732 |

|

|

|

36,333 |

|

|

Portfolio investments ‒ other |

|

67,956 |

|

|

|

67,455 |

|

|

Equity accounted investments ‒ other |

|

27,899 |

|

|

|

28,557 |

|

|

Real estate joint ventures |

|

3,354 |

|

|

|

6,796 |

|

|

Subsidiaries |

|

7,410 |

|

|

|

16,814 |

|

|

|

|

135,351 |

|

|

|

155,955 |

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY |

$ |

312,602 |

|

|

$ |

354,140 |

|

|

Less: Shareholders' equity attributable to holders of: |

|

|

|

|

|

|

|

|

Preference Shares, series 2 |

|

(27,667 |

) |

|

|

(27,667 |

) |

|

Preference Shares, series 3 |

|

(40,976 |

) |

|

|

(50,423 |

) |

|

SHAREHOLDERS' EQUITY ATTRIBUTABLE TO CLASS A SUBORDINATE

SHARES |

|

|

|

|

|

|

|

|

AND CLASS B SHARES OF THE CORPORATION |

$ |

243,959 |

|

|

$ |

276,050 |

|

|

|

|

|

|

|

|

|

|

|

Number of shares of the Corporation issued and outstanding: |

|

|

|

|

|

|

|

|

Class A Subordinate Shares |

|

85,474,363 |

|

|

|

84,968,090 |

|

|

Class B Shares |

|

3,114,491 |

|

|

|

3,114,491 |

|

|

Total number of shares issued and outstanding |

|

88,588,854 |

|

|

|

88,082,581 |

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY ON A PER SHARE BASIS |

$ |

2.75 |

|

|

$ |

3.13 |

|

* Shareholders' Equity on a per share basis is

calculated as total shareholders' equity per the financial

statements, less the carrying amount of preference shares series 2

and series 3, and divided by the total number of Class A and Class

B shares issued and outstanding

The Corporation’s unaudited interim consolidated

financial statements as at and for the three and nine months ended

September 30, 2023 and 2022, along with the accompanying

management’s discussion and analysis, have been filed on the System

for Electronic Document Analysis and Retrieval (“SEDAR”) and may be

viewed by interested parties under the Corporation’s profile at

www.sedarplus.ca or the Corporation’s website at

www.dundeecorporation.com.

BOARD OF DIRECTORS CHANGES

Dundee is also announcing today the retirement

of Murray Sinclair as a member of the board of directors and the

appointment of Bruce McLeod as a new independent member of the

board of directors of the Corporation.

Mr. McLeod is a Mining Engineer with over 30

years of experience in all areas of the mining industry. Most

recently, he was the President and CEO of Sabina Gold & Silver

Corp. until Sabina was acquired by B2Gold Corp. in April 2023 for

C$1.2B. Mr. McLeod also served as a director of Kaminak Gold Corp.,

which was acquired by Goldcorp Inc. for $520 million in 2016. Prior

to that, he served in a senior capacity with a number of operating

and development mining ventures, including, President and CEO of

Mercator Minerals Ltd.; President, CEO and director of Creston Moly

Corp.; and founder of both Sherwood Copper Corp. and Stornoway

Diamond Corp. He also served on the board of directors of Palmarejo

Silver and Gold Corp. (acquired by Coeur D'Alene Mines for $1.2

billion) and Ariane Gold (acquired by Cambior Inc.) and has been

involved in numerous projects at various stages of development

while with the Northair Group. Mr. McLeod was the co‐recipient of

AME BC's E.A. Scholz award for excellence in mine development in

2009 and primarily focuses on project development, strategic

planning, and financing activities. Jonathan Goodman,

President and Chief Executive Officer of Dundee Corporation,

commented:

“On behalf of myself and the entire board we

would like to sincerely thank Murray for his invaluable

contributions as a member of the board of directors for the last 11

years. We are also very excited to welcome Bruce to our board.

Bruce is an experienced mining engineer and executive with a deep

knowledge of capital markets.”

ABOUT DUNDEE CORPORATION:

Dundee Corporation is a public Canadian

independent holding company, listed on the Toronto Stock Exchange

under the symbol “DC.A”. Through its operating subsidiaries, Dundee

Corporation is an active investor focused on delivering

long-term, sustainable value as a trusted partner in the mining

sector with more than 30 years of experience making accretive

mining investments.

FORWARD-LOOKING STATEMENTS:

This press release may contain forward-looking

information within the meaning of applicable securities

legislation, which reflects Dundee Corporation’s current

expectations regarding future events. Forward-looking information

is based on a number of assumptions and is subject to a number of

risks and uncertainties, many of which are beyond Dundee

Corporation’s control, which could cause actual results and events

to differ materially from those that are disclosed in or implied by

such forward-looking information. Such risks and uncertainties

include, but are not limited to, the factors discussed under “Risk

Factors” in the Annual Information Form of Dundee Corporation and

subsequent filings made with securities commissions in Canada.

Dundee Corporation does not undertake any obligation to update such

forward-looking information, whether as a result of new

information, future events or otherwise, except as expressly

required by applicable law.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Investor and Media RelationsT: (416) 864-3584E:

ir@dundeecorporation.com

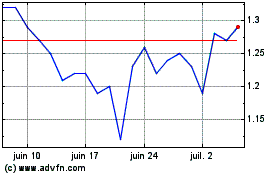

Dundee (TSX:DC.A)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Dundee (TSX:DC.A)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024