Brazil Fast Food Corp. (PINKSHEETS: BOBS) ("Brazil Fast Food", or "the

Company"), one of the largest food service groups in Brazil with 1,192 points of

sale, operating under (i) the Bob's brand, (ii) the Yoggi brand, (iii) KFC and

Pizza Hut São Paulo as franchisee of Yum! Brands, and (iv) Doggis as master

franchisee of Gastronomia & Negocios S.A. (former Grupo de Empresas Doggis

S.A.), today announced financial results for the first quarter ended March 31,

2014.

Q1 2014 Highlights

-- System-wide sales totaled R$ 349.9 million, up 17.6% from Q1 2013

-- Revenue totaled R$ 66.5 million, up 14.2% from Q1 2013

-- Points of sale totaled 1,192 at March 31, 2014 (505 kiosks and 19

temporary points of sale), up from 1,049 at March 31, 2013

-- EBITDA was R$ 8.7 million, down 23.7% from R$ 11.4 million in Q1 2013

-- Operating income was R$ 6.6 million, down 35.2% from R $10.2 million in

Q1 2013

-- Net income was R$ 4.6 million, or R$ 0.56 per basic and diluted share

Note that all numbers are in Brazilian currency.

"We continued to experience a very challenging operating environment in Brazil's

fast food industry during the first quarter of 2014, characterized by escalating

costs for food and labor, muted growth in incomes and consumer spending. The

market environment has also turned increasingly competitive, due to significant

branding efforts of one of our established competitors sponsoring the upcoming

FIFA World Cup. Renewed efforts of established international brands to increase

share in Brazil created fierce competition between incumbents and expanding

international brands in fast food. This has required increased investment in

branding, facilities and promotions, and made it challenging to pass through

these higher costs to our customers. While our revenues continued to expand at

over 14%, our profitability dropped significantly as compared to the first

quarter of 2013, with operating income down 35,2%," said Mr. Ricardo Bomeny, CEO

and CFO of Brazil Fast Food.

"Looking in more detail at our brands, we are very pleased with the performance

of our Bob's franchised stores, where net franchise revenues grew 17% and

operating income grew by 22.2% to R$ 10.1 million with an operating margin of

73%. The number of franchise outlets grew to 1,093, from 972 on March 31, 2013.

Our owned-and-operated Bob's stores grew revenues by 2.8% over Q1 2013, but were

barely profitable for the quarter. We have recently made some changes to our

management structure and incentives for these stores that we believe will help

to restore a reasonable level of profitability.

"We were pleased with the continued expansion of Pizza Hut stores, where we

added 12 new stores and net revenues grew by 30.7% over Q1 2013, although

contribution to operating income is similar to last year. Our KFC stores

continued to struggle in the local market with a slight decline in revenues and

a $1.8 million operating loss for the quarter. We are in active discussions with

Yum! Brands as to how to better adapt the KFC concept, marketing, and menu

offerings to the Brazilian market so as to create a more vibrant future for this

brand," Mr. Bomeny said.

First Quarter 2014 Results

System-wide sales grew 17.6% in the first quarter to R$ 349.9 million, driven by

an increase in the number of franchised points of sale.

Total revenue for the first quarter of 2014 was R$ 66.5 million, an increase of

14.2% as compared to R$ 58.3 million in the first quarter of 2013, due to higher

revenues from franchisees and own-operated restaurants.

Net restaurant sales for company-owned restaurants increased 13.5%

year-over-year to R$ 52.7 million in the first quarter of 2014, driven by higher

sales at Bob's and Pizza Hut.

Net revenue from franchisees increased 16.9% year-over-year to R$ 13.9 million,

driven primarily by an increase in number of franchised retail outlets to 1,093,

as compared to 972 a year ago.

Operating expenses increased 24.7% to R$ 59.9 million in the first quarter of

2014 from R$ 48 million in the first quarter of 2013. As a percentage of

revenue, operating costs increased to 90% of total revenue in the first quarter

of 2014 from 82.4% of total revenue in the first quarter of 2013.

Operating income for the first quarter of 2014 was R$ 6.6 million, a decrease of

35.2% from R$ 10.2 million in the first quarter of 2013. Operating margin in the

first quarter of 2014 declined to 10%, as compared to 17.6% in the first quarter

of 2013.

EBITDA in the first quarter of 2014 was R$ 8.7 million, down by 23.7% as

compared to R$ 11.4 million in the first quarter of 2013. EBITDA margin was 13%,

as compared to 19.5% in the first quarter of 2013. Please refer to Table No. 4

in this press release for a reconciliation of EBITDA to its nearest GAAP

equivalent.

Interest expense was R$ 1.1 million in the first quarter of 2014, as compared to

interest income of R$ 0.1 million in the first quarter of 2013.

Net income in the first quarter of 2014 was R$ 4.6 million, or R$ 0.56 per basic

and diluted share, as compared to R$ 6.7 million, or R$ 0.83 per basic and

diluted share in the first quarter of 2013.

Financial Condition

As of March 31, 2014 the Company had R$ 53.1 million in cash and equivalents, up

from R$ 50.1 million as of March 31, 2013. Working capital was R$ 41.6 million

at March 31, 2014, compared with R$ 41.9 million as of March 31, 2013. Debt

obligations with financial institutions were R$23.5 million as of March 31,

2014, compared with R$23.6 million as of March 31, 2013. Total shareholders'

equity was R$ 85.5 million at March 31, 2014, compared to R$ 80.8 million at

March 31, 2013.

Recent Events

There were no developments during the first quarter of 2014 regarding the

Company's administrative appeal against the penalty charged by the Brazilian

Internal Revenue Service related to the its restructuring in 2006.

Business Outlook

In 2014, the company expects to continue a higher level of investment in

facilities, advertising and promotion in order to support the growth of its

brands in Brazil and respond to international competitors. This will continue to

put pressure in profitability and operating results in the near future.

"Despite the near-term challenges due to the macro-economy and escalating

competition, we strongly believe that we have the right brand assets and

management team in place to drive continued growth. In the first quarter of 2014

we invested $7.8 million in new stores that includes a new multi-brand format

combining Bob's, Doggis and Yoggi in one location, a new standalone Yoggi store

concept called Yoggi Desigual, and expansion of Pizza Huts in high-traffic

locations," Mr. Bomeny said.

"For 2014, to support our expansion and competitive position, we will also be

making a significant investment in branding and promotion activities. Bob's

recently presented its new visual identity, with a different store design and

ambiance, communications, equipment and ingredients, to its franchisees at its

National Convention. We will make a significant investment to refresh our

owned-and-operated stores and will continuously incentivize our franchisees to

do the same. While we expect to see continued margin pressure due to these

activities, our goal is to achieve some improvement in our overall profit

margins from Q1 2014 levels. Our strong balance sheet provides us with the

ability to pursue this expansion strategy without recourse to outside financing.

"Brazil's economy has slowed significantly, with real GDP growth for 2014

expected to be in the range of 2% and inflation north of 6%, primarily due to

rising food and labor prices. This will create difficulties across the

restaurant industry and create near-term financial headwinds for Brazil Fast

Food. But we continue to believe that the opportunity to build a significant

player in the fast food industry is compelling and that we are on the right path

to build long-term value with our unique business," concluded Mr. Bomeny.

About Brazil Fast Food Corp.

Brazil Fast Food Corp., through its holding company in Brazil, BFFC do Brasil

Participações Ltda. ("BFFC do Brasil", formerly 22N Participações Ltda.),

and its subsidiaries, manage one of the largest food service groups in Brazil

and franchise units in Angola and Chile. Our subsidiaries are Venbo Comércio de

Alimentos Ltda. ("Venbo"), LM Comércio de Alimentos Ltda. ("LM"), PCN Comércio

de Alimentos Ltda. ("PCN"), CFK Comércio de Alimentos Ltda. ("CFK", former

Clematis Indústria e Comércio de Alimentos e Participações Ltda.), CFK São

Paulo Comércio de Alimentos Ltda. ("CFK SP"), MPSC Comércio de Alimentos Ltda.

("MPSC"),DGS Comércio de Alimentos Ltda. ("DGS"), CLFL Comércio de Alimentos

Ltda. ("CLFL"), Little Boss Comércio de Alimentos Ltda. ("Little Boss"), Separk

Comércio de Alimentos Ltda. ("Separk"), Schott Comércio de Alimentos Ltda.

("Schott"), FCK Franquias e Participações Ltda. ("FCK", former Suprilog

Logística Ltda.), Yoggi do Brasil Ltda. ("Yoggi"), and Internacional

Restaurantes do Brasil S.A. ("IRB"). IRB has 40% of its capital held by

individuals, including the CEO of IRB.

Safe Harbor Statement

This press release contains forward-looking statements within the meanings of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities and Exchange Act of 1934, as amended, and within the meaning of the

safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Such statements involve known or unknown risks, uncertainties and other factors

that may cause the actual results to differ materially from those expressed or

implied by such forward looking statements. For a discussion of such risks and

uncertainties, which could cause actual results to differ from those contained

in the forward-looking statements, see the disclosures on the Company's website

and in the Company's filings with the Securities and Exchange Commission,

including the risk factors contained in the Company's previous public

disclosures.

-FINANCIAL TABLES FOLLOW-

BRAZIL FAST FOOD CORP. AND SUBSIDIARIES

CONSOLIDATED INCOME STATEMENTS

(in thousands of Brazilian Reais, except share amounts)

Three Months Ended March 31,

----------------------------------

Note 2014 2013

------ ---------------- ----------------

(unaudited)

REVENUES FROM RESTAURANTS AND

FRANCHISEES

Net revenues from own-operated

restaurants 13 R$ 52.681 R$ 46.419

Net revenues from franchisees 13 13.863 11.860

---------------- ----------------

TOTAL REVENUES FROM RESTAURANTS

AND FRANCHISEES 66.544 58.279

---------------- ----------------

Store Costs and Expenses 13 (52.404) (45.511)

Franchise Costs and Expenses 13 (3.751) (3.584)

Administrative Expenses (8.169) (7.552)

Income from supply agreements 5.768 6.446

Other income 583 147

Other Operating Expenses (1.771) (1.012)

Net result of assets sold and

impairment of assets 6 (170) 3.030

---------------- ----------------

OPERATING INCOME 6.630 10.243

---------------- ----------------

Interest Expense (1.054) (83)

---------------- ----------------

NET INCOME BEFORE INCOME TAX 5.576 10.160

---------------- ----------------

Income taxes (1.212) (3.086)

---------------- ----------------

NET INCOME BEFORE NON-CONTROLLING

INTEREST 4.364 7.074

---------------- ----------------

Net loss attributable to non-

controlling interest 226 (328)

---------------- ----------------

NET INCOMEATTRIBUTABLE TO BRAZIL

FAST FOOD CORP. R$ 4.590 R$ 6.746

================ ================

NET INCOME PER COMMON SHARE

BASIC AND DILUTED R$ 0,56 R$ 0,83

================ ================

WEIGHTED AVERAGE COMMON

SHARES OUTSTANDING: BASIC AND

DILUTED 8.129.437 8.129.437

BRAZIL FAST FOOD CORP. AND SUBSIDIARIES

BALANCE SHEETS - ASSETS

(in thousands of Brazilian Reais, except share amounts)

March, 31 December 31,

--------------- ---------------

Note 2014 2013

------------------ --------------- ---------------

(unaudited)

ASSETS

CURRENT ASSETS:

Cash and cash

equivalents 4 R$ 53.097 R$ 50.083

Inventories 2.954 3.090

Accounts receivable

Clients - food sales 10.730 11.051

Franchisees 19.815 20.872

Allowance for

doubtful accounts (164) (163)

Prepaid expenses 2.036 747

Advances to suppliers 2.855 2.962

Bob's Marketing fund

credits 5a - 717

Other current assets 5b and 6 3.433 3.761

--------------- ---------------

TOTAL CURRENT

ASSETS 94.756 93.120

--------------- ---------------

NON-CURRENT ASSETS:

Other receivables and

other assets 5a and 6 14.086 13.118

Deferred tax asset, net 10.644 10.644

Goodwill 3,3 1.121 1.121

Property and equipment,

net 7 49.222 47.240

Intangible assets, net 8 13.486 13.463

--------------- ---------------

TOTAL NON-CURRENT

ASSETS 88.559 85.586

--------------- ---------------

--------------- ---------------

TOTAL ASSETS R$ 183.315 R$ 178.706

=============== ===============

BRAZIL FAST FOOD CORP. AND SUBSIDIARIES

BALANCE SHEETS - LIABILITIES AND EQUITY

(in thousands of Brazilian Reais, except share amounts)

March, 31 December 31,

--------------- ---------------

Note 2014 2013

------ --------------- ---------------

(unaudited)

LIABILITIES AND SHAREHOLDERS' EQUITY

CURRENT LIABILITIES:

Loans and financing 11 R$ 13.050 R$ 12.816

Accounts payable and accrued

expenses 14.338 13.941

Payroll and related accruals 7.262 6.501

Taxes 4.772 7.884

Current portion of deferred income 10 11.056 7.537

Current portion of litigations and

reassessed taxes 9 2.381 2.381

Other current liabilities 294 144

--------------- ---------------

TOTAL CURRENT LIABILITIES 53.153 51.204

--------------- ---------------

Deferred income, less current

portion 10 7.546 8.877

Loans and financing, less current

portion 11 10.418 10.744

Litigations and reassessed taxes,

less

current portion 9 19.983 20.190

Other liabilities 12 2.173 2.170

--------------- ---------------

TOTAL NON-CURRENT LIABILITIES 40.120 41.981

--------------- ---------------

--------------- ---------------

TOTAL LIABILITIES 93.273 93.185

--------------- ---------------

SHAREHOLDERS' EQUITY:

Preferred stock, $.01 par value,

5,000 shares authorized; no

shares issued - -

Common stock, $.0001 par value,

12,500,000 shares authorized; 8,472,927

shares issued for both 2014 and 2013;

and 8,121,937 and 8,129,437 shares

outstanding for both 2014 and 2013 1 1

Additional paid-in capital 61.148 61.148

Treasury Stock (350,990 and

343,490) 14 (2.358) (2.060)

Retained Earnings 28.040 23.450

Accumulated comprehensive loss (1.314) (1.769)

--------------- ---------------

TOTAL SHAREHOLDERS' EQUITY 85.517 80.770

--------------- ---------------

Non-Controlling Interest 4.525 4.751

--------------- ---------------

TOTAL EQUITY 90.042 85.521

--------------- ---------------

--------------- ---------------

TOTAL LIABILITIES AND EQUITY R$ 183.315 R$ 178.706

=============== ===============

BRAZIL FAST FOOD CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands of Brazilian Reais)

Three Months Ended March, 31

--------------------------------

2014 2013

--------------- ---------------

CASH FLOW FROM OPERATING ACTIVITIES: (unaudited)

NET INCOME BEFORE NON-CONTROLLING INTEREST R$ 4.364 R$ 7.074

Adjustments to reconcile net income to cash

provided by (used in) operating

activities:

Depreciation and amortization 2.629 2.076

(Gain) Loss on assets sold, net 170 (3.030)

Deferred income tax - 104

Changes in assets and liabilities:

(Increase) decrease in:

Accounts receivable 1.379 (785)

Inventories 136 (284)

Prepaid expenses, advances to suppliers

and other current assets (137) 573

Other assets (968) 359

(Decrease) increase in:

Accounts payable and accrued expenses 397 3.961

Payroll and related accruals 761 1.223

Taxes (3.112) (1.483)

Deferred income 2.188 1.825

Litigations and reassessed taxes (207) (818)

Other liabilities 153 (697)

--------------- ---------------

CASH FLOWS PROVIDED BY (USED IN)

OPERATING ACTIVITIES 7.753 10.098

--------------- ---------------

CASH FLOW FROM INVESTING ACTIVITIES:

Puechase of Company's share (298) -

Additions to property and equipment, net of

proceed of sales (4.724) 1.039

--------------- ---------------

CASH FLOWS USED IN INVESTING ACTIVITIES (5.022) 1.039

--------------- ---------------

CASH FLOW FROM FINANCING ACTIVITIES:

Net Borrowings (Repayments) under lines of

credit (92) (4.604)

--------------- ---------------

CASH FLOWS PROVIDED BY (USED IN)

FINANCING ACTIVITIES (92) (4.604)

--------------- ---------------

EFFECT OF FOREIGN EXCHANGE RATE 375 19

--------------- ---------------

NET INCREASE IN CASH AND CASH EQUIVALENTS 3.014 6.552

CASH AND CASH EQUIVALENTS AT BEGINNING OF

PERIOD 50.083 32.062

--------------- ---------------

CASH AND CASH EQUIVALENTS AT END OF PERIOD R$ 53.097 R$ 38.614

=============== ===============

BRAZIL FAST FOOD CORP. AND SUBSIDIARIES

RECONCILIATION OF EBITDA TO NET INCOME

Three Months Ended March 31,

--------------------------------

2014 2013

--------------- ---------------

NET INCOME R$ 4.590 R$ 6.746

Interest expenses, Monetary and Foreign

exchange loss 760 (21)

Income taxes 1.212 2.950

Depreciation and amortization 2.128 1.719

--------------- ---------------

EBITDA R$ 8.689 R$ 11.393

--------------- ---------------

* The Company Management reviewed the computation of previously disclosure of

2013 EBITDA in order to include the effect of non-controlling interest.

EBITDA represents earnings before net interest expense, income tax provision,

depreciation and amortization. Our management believes EBITDA is useful to

investors because it is frequently used by securities analysts, investors and

other interested parties in evaluating companies in our industry. In addition,

our management believes that EBITDA is useful in evaluating our operating

performance compared to that of other companies in our industry because the

calculation of EBITDA generally eliminates the effects of financing and income

taxes and the accounting effects of capital spending, which items may vary for

different companies for reasons unrelated to overall operating performance. As a

result, our management uses EBITDA as a measure to evaluate the performance of

our business. However, EBITDA is not a recognized measurement under generally

accepted accounting principles, or GAAP, and when analyzing our operating

performance, investors should use EBITDA in addition to, and not as an

alternative for, income from operations and net income, each as determined in

accordance with GAAP. Not all companies use identical calculations, and our

presentation of EBITDA may not be comparable to similarly titled measures of

other companies. Furthermore, EBITDA is not intended to be a measure of free

cash flow for our management's discretionary use, as it does not consider

certain cash requirements such as a tax and debt service payments.

FOR FURTHER INFORMATION PLEASE CONTACT:

Contact:

Brazil Fast Food Corp.

Ricardo Figueiredo Bomeny

CEO

Phone: +1-55-21-2536-7501 (Brazil)

Email: ir@bffc.com.br

URL: www.bffc.com.br

Crocker Coulson

Phone: +1-323-270-8886

Email: crocker.coulson@gmail.com

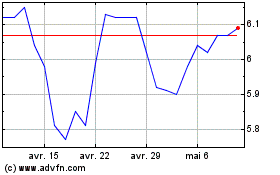

Dividend Growth Split (TSX:DGS)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Dividend Growth Split (TSX:DGS)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024