Dundee Precious Metals Announces 2013 Fourth Quarter and Annual

Results and 2014 Guidance

TORONTO, ONTARIO--(Marketwired - Feb 13, 2014) - Dundee Precious

Metals Inc. (TSX:DPM)(TSX:DPM.WT.A) -

(All monetary

figures are expressed in U.S. dollars unless otherwise

stated)

Financial and Operating Highlights:

- Record ore and metals production - Mine production of

2.5 million tonnes in 2013 drove increases in gold and copper in

concentrate produced of 10% and 6% over 2012.

- Lower overall mine cash costs - Chelopech cash costs

in the fourth quarter and twelve months of 2013 decreased by 9% and

12% relative to 2012, driven by benefits realized from its

mine/mill expansion and other productivity improvements.

- Smelter curtailment lifted; throughput ramping-up -

Project commissioning issues constrained throughput during 2013.

Second oxygen plant now operational and first quarter 2014

production ramp-up underway. Physical construction of acid plant on

track.

- Near term growth opportunities progressing - Kapan

released its first NI 43-101 compliant underground Mineral Resource

estimate in August 2013. Conceptual study of underground expansion

to be completed in the first quarter of 2014. Krumovgrad local

permitting and approval process is progressing and is expected to

support moving project into construction. Updated project economics

to be released in February 2014.

- Financial results in line with consensus estimates -

Adjusted net earnings of $0.23 per share in 2013. Exited 2013 with

approximately $180 million of cash resources, including the

Company's long-term revolving credit facility.

Dundee Precious Metals Inc. ("DPM" or the "Company") today

reported fourth quarter 2013 net earnings attributable to common

shareholders of $19.2 million ($0.14 per share) compared to $14.7

million ($0.12 per share) for the same period in 2012. Net earnings

attributable to common shareholders for 2013 were $22.5 million

($0.17 per share) compared to $54.4 million ($0.43 per share) in

2012.

Net earnings attributable to common shareholders for the fourth

quarter and twelve months of 2013 were impacted by several items

not reflective of the Company's underlying operating performance,

including gains attributable to DPM's equity settled warrants,

unrealized gains and losses attributable to commodity contracts

related to future production, unrealized losses on Sabina warrants,

and impairment charges on a refurbished oxygen plant and equipment

related to a metals processing facility project no longer expected

to be used at Chelopech. Excluding these items, adjusted net

earnings during the fourth quarter and twelve months of 2013 were

$10.5 million ($0.08 per share) and $30.8 million ($0.23 per

share), respectively, compared to $21.5 million ($0.17 per share)

and $80.9 million ($0.65 per share) for the corresponding periods

in 2012. The year over year declines were driven primarily by lower

metal prices, higher depreciation, and higher operating costs and

lower volumes of concentrate smelted at Tsumeb, partially offset by

higher volumes of payable metals sold, a weaker ZAR relative to the

U.S. dollar and reduced exploration and administrative

expenses.

"In 2013, Chelopech, our flagship asset, achieved record

production and further reduced its cash cost per tonne of ore

processed. However, the sharp decline in metal prices and

production shortfalls at Tsumeb and Kapan offset this strong

performance," said Rick Howes, President and CEO. "We have reached

a major inflection point in the operation of the smelter with the

Namibian government lifting its curtailment on the smelter capacity

in December and the commissioning of the second oxygen plant in

January, allowing ramp up to the 240,000 tonnes per annum rate to

begin this month. We also made significant progress at Kapan in Q4

2013 by raising the production grades, offsetting most of the

shortfall in ore mined as result of the need to build up the

developed and drilled inventories to sustainable levels. This

higher grade trend is expected to continue in 2014 to offset lower

ore mined until we return to normal mine production. We remain

focused on optimizing operational performance, reducing costs at

each of our operations, and preparing for the anticipated

commencement of construction on our Krumovgrad Gold Project."

Adjusted EBITDA

Adjusted EBITDA(1) during the fourth quarter and twelve months

of 2013 was $29.0 million and $102.8 million, respectively,

compared to $37.7 million and $124.6 million in the corresponding

periods in 2012, driven by the same factors affecting adjusted net

earnings(1), with the notable exception of depreciation.

Production and Deliveries

Concentrate production in the fourth quarter of 2013 of 39,233

tonnes was 21% higher than the corresponding period in 2012 due

primarily to higher copper grades at Chelopech and higher zinc

grades and recoveries at Kapan. Concentrate production in 2013 of

144,278 tonnes was 6% higher than the corresponding period in 2012

due primarily to higher volumes of ore mined and processed at

Chelopech, partially offset by lower copper grades at

Chelopech.

Concentrate smelted at Tsumeb during the fourth quarter and

twelve months of 2013 of 38,481 tonnes and 152,457 tonnes,

respectively, was 16% and 4% lower than the corresponding periods

in 2012. Concentrate smelted during the fourth quarter and twelve

months of 2013 was lower than anticipated due primarily to delays

associated with the construction and commissioning of a second

oxygen plant, which has delayed the smelter's increase in

throughput, and unplanned repairs and maintenance. Concentrate

smelted in 2013 was also negatively impacted by disruptions related

to the first quarter commissioning activities related to Project

2012.

During the fourth quarter of 2013, the Technical Committee

representing the Namibian government conducted initial testing to

verify that the modifications made to the off-gas and dust handling

systems were delivering the expected decrease in emissions. The

results of this testing were subsequently confirmed to be

satisfactory and in the latter part of December 2013 the government

formally advised the Company that the smelter could return to full

production, subject to regulatory reporting and emission

requirements, and including a further occupational health survey in

April 2014. The acid plant, which is targeted for completion during

the fourth quarter of 2014, will further reduce the plant's SO2

emissions and complete the Company's major capital programs

directed at modernizing the smelter.

Concentrate sales during the fourth quarter and twelve months of

2013 of 38,353 tonnes and 148,716 tonnes, respectively, were each

9% higher than the corresponding periods in 2012 due primarily to

increased production at Chelopech. Fourth quarter 2013 concentrate

deliveries at Kapan were lower than the comparable period in 2012

due to a significant portion of its copper concentrate deliveries

being deferred until the fourth quarter of 2012 as a result of its

lead content exceeding contractual specification.

Relative to the fourth quarter of 2012, payable gold sold in the

fourth quarter of 2013 increased by 3% to 36,870 ounces, payable

copper sold increased by 10% to 12.1 million pounds, payable silver

sold decreased by 18% to 147,731 ounces and payable zinc sold

decreased by 5% to 2.9 million pounds. Relative to 2012, payable

gold sold in 2013 increased by 14% to 153,274 ounces, payable

copper sold increased by 10% to 46.3 million pounds, payable silver

sold increased by 1% to 552,590 ounces and payable zinc sold

decreased by 5% to 13.5 million pounds. The year over year

increases in payable gold, copper and silver sold were due

primarily to the expansion and improved metal recoveries at

Chelopech, partially offset by lower grades at Chelopech. The

decrease in payable zinc in concentrate sold was due primarily to

lower zinc content in the concentrate delivered.

Cash cost of sales per ounce of gold sold

Consolidated cash cost of sales per ounce of gold sold, net of

by-product credits(1), during the fourth quarter and twelve months

of 2013 was $357 and $329, respectively, compared to $193 and $117

for the corresponding periods in 2012. These increases were due

primarily to lower realized copper and silver prices, partially

offset by higher volumes of payable metals.

Cash provided from operating activities

Cash provided from operating activities during the fourth

quarter and twelve months of 2013 was $40.3 million and $99.5

million, respectively, compared to $27.0 million and $78.3 million

in the corresponding periods in 2012 due primarily to lower working

capital requirements in 2013. Cash provided from operating

activities, before changes in non-cash working capital(1), during

the fourth quarter and twelve months of 2013 was $24.4 million and

$88.2 million, respectively, down $6.3 million and $32.9 million

from the corresponding prior year periods due primarily to the same

factors affecting adjusted EBITDA.

Capital expenditures

Cash outlays for capital expenditures during the fourth quarter

and twelve months of 2013 totalled $47.5 million and $213.0

million, respectively, compared to $51.0 million and $149.0 million

in the corresponding periods in 2012 due primarily to the

construction activity related to the new acid plant at Tsumeb

targeted for completion in the fourth quarter of 2014.

Financial position

As at December 31, 2013, DPM maintained a solid financial

position with minimal debt, representing 10% of total

capitalization, a consolidated cash position, including short-term

investments, of $49.8 million, an investment portfolio valued at

$17.8 million and $130 million of additional liquidity under the

Company's $150 million long-term committed revolving credit

facility. These cash resources, together with the cash flow

currently being generated, are expected to be sufficient to fund

all non-discretionary capital projects through to completion. The

Company's discretionary growth projects, which include the

Krumovgrad Gold Project, a Kapan underground mine expansion and a

holding furnace at Tsumeb, are expected to be staged over time

based on their expected returns, market conditions, and DPM having

sufficient capital resources in place to support any one or more of

these projects.

2014 Guidance

The Company's production and cash cost guidance for 2014 is set

out in the following table:

| 2014 Production & Cash Cost Guidance |

|

Chelopech |

|

Kapan |

|

Tsumeb |

|

Consolidated |

| Ore mined/milled ('000 tonnes) |

1,900 - 2,050 |

|

475 - 525 |

|

- |

|

2,375 - 2,575 |

| Concentrate smelted ('000 tonnes) |

- |

|

- |

|

190 - 220 |

|

190 - 220 |

| Metals contained in concentrate produced(1) |

|

|

|

|

|

|

|

|

|

Gold ('000 ounces) |

126.0 - 138.0 |

|

29.0 - 36.0 |

|

- |

|

155 - 174 |

|

|

Copper (million pounds) |

42.7 - 46.2 |

|

2.8 - 3.8 |

|

- |

|

45.5 - 50.0 |

|

|

Zinc (million pounds) |

- |

|

11.6 - 15.9 |

|

- |

|

11.6 - 15.9 |

|

|

Silver ('000 ounces) |

210 - 230 |

|

468 - 640 |

|

- |

|

678 - 870 |

| Cash cost/tonne of ore processed ($)(2) |

43 - 47 |

|

81 - 91 |

|

- |

|

51 - 56 |

| Cash cost/ounce of gold sold, net of by-product credits

($)(1), (2) |

285 - 430 |

|

485 - 855 |

|

- |

|

335 - 505 |

| All-in-sustaining cost/ounce, net of by-product credits

($)(1), (2), (3) |

- |

|

- |

|

- |

|

710 - 815 |

| Cash cost/tonne of concentrate smelted ($)(2) |

- |

|

- |

|

280 - 350 |

|

280 - 350 |

| Payable gold in pyrite concentrate sold ('000

ounces) |

27 - 33 |

|

- |

|

- |

|

27 - 33 |

|

(1) |

Excludes metals in pyrite concentrate and, where applicable,

the treatment charges, transportation and other selling costs

related to the sale of pyrite concentrate, which is reported

separately. |

|

(2) |

Based on current exchange rates and, where applicable, a copper

price of $3.31 per pound, a silver price of $19.87 per ounce and a

zinc price of $0.90 per pound. |

|

(3) |

Effective 2014, the Company will report its all-in sustaining

cost per ounce of gold, a measure which was recently established by

the World Gold Council, and which attempts to represent the total

sustaining cost of producing gold ounces from current mining

operations. This measure is expected to be used by management and

investors as one of several costs metrics to measure cost

performance. All-in sustaining cost is a non-GAAP measure, has no

standardized meanings under IFRS and may not be comparable to

similar measures presented by other companies. For DPM, all-in

sustaining cost per ounce of gold, net of by-product credits,

represents cash operating costs at Chelopech and Kapan, treatment

charges, penalties, transportation and other selling costs,

sustaining capital expenditures, rehabilitation related accretion

expenses and an allocated portion of the Company's general and

administrative expenses, less by-product revenues in respect of

copper, silver and zinc, divided by the payable gold in copper and

zinc concentrate sold. It does not include depreciation,

exploration, growth capital expenditures, income tax payments and

finance costs. It also excludes the payable gold ounces contained

in the pyrite concentrate sold and the related treatment charges,

transportation and other selling costs. |

For 2014, the majority of Company's growth capital

expenditures(1) will be focused on the construction of an acid

plant at Tsumeb. Other growth capital expenditures include the

pyrite recovery circuit and margin improvement projects at

Chelopech, securing the remaining permits and planning for the

commencement of construction related to the Krumovgrad Gold

Project, and exploration and development work to enhance

underground operations and advance a potential expansion at Kapan.

In aggregate, these expenditures are expected to range between $160

million and $175 million. Sustaining capital expenditures(1) are

expected to range between $37 million and $45 million.

The 2014 guidance provided above may not occur evenly throughout

the year. The estimated metals contained in concentrate produced

and volumes of concentrate smelted may vary from quarter to quarter

depending on the areas being mined, the timing of concentrate

deliveries, planned outages, the timing of the annual maintenance

shutdown at Tsumeb, which is currently scheduled for the third

quarter of 2014, and Kapan returning to full production in the

second quarter of 2014. The production guidance for Tsumeb assumes

that the ramp-up to full production occurs in the first quarter of

2014. Also, the rate of capital expenditures may vary from quarter

to quarter based on the schedule for, and execution of, each

capital project and, where applicable, the receipt of necessary

permits and approvals. Further details can be found in the

Company's MD&A under the section "2014 Guidance".

|

(1) |

Adjusted net earnings, adjusted basic earnings per share,

adjusted earnings before interest, taxes, depreciation and

amortization ("EBITDA"), cash from operating activities, before

changes in non-cash working capital, cash cost per tonne of ore

processed, cash cost per ounce of gold sold, net of by-product

credits, cash cost per tonne of concentrate smelted, and growth and

sustaining capital expenditures are not defined measures under

International Financial Reporting Standards ("IFRS"). Presenting

these measures from period to period helps management and investors

evaluate earnings and cash flow trends more readily in comparison

with results from prior periods. Refer to the "Non-GAAP Financial

Measures" section of the management's discussion and analysis for

the three and twelve months ended December 31, 2013 (the

"MD&A") for further discussion of these items, including

reconciliations to net earnings attributable to common shareholders

and earnings before income taxes. |

Key Financial and Operational Highlights

| $ millions, except where noted |

Three Months |

Twelve Months |

| Ended December 31, |

2013 |

2012 |

2013 |

2012 |

| Revenue |

84.4 |

103.1 |

344.6 |

384.7 |

| Gross profit (1) |

20.0 |

39.2 |

89.8 |

157.0 |

| Earnings before income taxes |

19.7 |

16.2 |

26.9 |

49.7 |

| Net earnings attributable to common shareholders |

19.2 |

14.7 |

22.5 |

54.4 |

| Basic earnings per share ($) |

0.14 |

0.12 |

0.17 |

0.43 |

| Adjusted EBITDA (2) |

29.0 |

37.7 |

102.8 |

124.6 |

| Adjusted net earnings (2) |

10.5 |

21.5 |

30.8 |

80.9 |

| Adjusted basic earnings per share ($) (2) |

0.08 |

0.17 |

0.23 |

0.65 |

| Cash provided from operating activities |

40.3 |

27.0 |

99.5 |

78.3 |

| Cash provided from operating activities, before changes

in non-cash working capital (2) |

24.4 |

30.7 |

88.2 |

121.1 |

|

|

|

|

|

| Concentrate produced (mt) |

39,233 |

32,428 |

144,278 |

135,809 |

| Metals in concentrate produced: |

|

|

|

|

|

Gold

(ounces) |

38,798 |

32,667 |

156,185 |

142,474 |

|

Copper ('000s pounds) |

13,056 |

10,884 |

47,939 |

45,171 |

|

Zinc

('000s pounds) |

3,673 |

2,880 |

15,294 |

15,425 |

|

Silver (ounces) |

174,046 |

143,501 |

671,639 |

665,857 |

| Tsumeb - concentrate smelted (mt) |

38,481 |

45,823 |

152,457 |

159,356 |

| Deliveries of concentrates (mt) |

38,353 |

35,261 |

148,716 |

136,948 |

| Payable metals in concentrate sold: |

|

|

|

|

|

Gold

(ounces) |

36,870 |

35,815 |

153,274 |

134,848 |

|

Copper ('000s pounds) |

12,117 |

10,981 |

46,301 |

42,104 |

|

Zinc

('000s pounds) |

2,928 |

3,082 |

13,545 |

14,204 |

|

Silver (ounces) |

147,731 |

180,155 |

552,590 |

547,193 |

|

|

|

|

|

| Cash cost of sales per ounce of gold sold, net of

by-product credits ($) (2) |

357 |

193 |

329 |

117 |

| Cash cost/tonne of concentrate smelted at Tsumeb($)

(2) |

401 |

347 |

433 |

374 |

|

|

|

(1) |

Gross profit is regarded as an additional GAAP measure and is

presented in the Company's audited consolidated statements of

earnings. Gross profit represents revenue less cost of sales and is

one of several measures used by management and investors to assess

the underlying operating profitability of a business. |

|

(2) |

Adjusted EBITDA; adjusted net earnings; adjusted basic earnings

per share; cash flow provided from operating activities, before

changes in non-cash working capital; cash cost of sales per ounce

of gold sold, net of by-product credits; and cash cost per tonne of

concentrate smelted, are not defined measures under IFRS. Refer to

the MD&A for reconciliations to IFRS measures. |

DPM's audited consolidated financial statements, and MD&A

for the fourth quarter and year ended December 31, 2013, are posted

on the Company's website at www.dundeeprecious.com and have been

filed on SEDAR at www.sedar.com.

The Company will be holding a call to discuss its 2013 fourth

quarter and annual results on February 14, 2014, at 9:00 a.m.

(E.S.T.). Participants are invited to join the live webcast (audio

only) at: www.gowebcasting.com/5192. Alternatively, participants

can access a listen only telephone option at 416-340-2219 or North

America Toll Free at 1-866-226-1798. A

replay of the call will be available at 905-694-9451 or North

America Toll Free at 1-800-408-3053,

passcode 2723701. The audio webcast for this conference call will

also be archived and available on the Company's website at

www.dundeeprecious.com.

Dundee Precious Metals Inc. is a Canadian based, international

gold mining company engaged in the acquisition, exploration,

development, mining and processing of precious metals. The

Company's principal operating assets include the Chelopech

operation, which produces a copper concentrate containing gold and

silver, located east of Sofia, Bulgaria; the Kapan operation, which

produces a copper concentrate and a zinc concentrate, both

containing gold and silver, located in southern Armenia; and the

Tsumeb smelter, a concentrate processing facility located in

Namibia. DPM also holds interests in a number of developing gold

properties located in Bulgaria, Serbia, and northern Canada,

including interests held through its 53.1% owned subsidiary, Avala

Resources Ltd., its 45.5% interest in Dunav Resources Ltd. and its

12.1% interest in Sabina Gold & Silver Corp.

Cautionary Note Regarding Forward-Looking Statements

This press release contains "forward looking statements" that

involve a number of risks and uncertainties. Forward-looking

statements include, but are not limited to, statements with respect

to the future price of gold, copper, zinc and silver, the

estimation of mineral reserves and resources, the realization of

such mineral estimates, the timing and amount of estimated future

production and output, costs of production, capital expenditures,

costs and timing of the development of new deposits, success of

exploration activities, permitting time lines, currency

fluctuations, requirements for additional capital, government

regulation of mining operations, environmental risks, reclamation

expenses, the potential or anticipated outcome of title disputes or

claims and timing and possible outcome of pending litigation.

Often, but not always, forward looking statements can be identified

by the use of words such as "plans", "expects", or "does not

expect", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates", or "does not anticipate", or

"believes", or variations of such words and phrases or that state

that certain actions, events or results "may", "could", "would",

"might" or "will" be taken, occur or be achieved. Forward looking

statements are based on the opinions and estimates of management as

of the date such statements are made and they involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to be

materially different from any other future results, performance or

achievements expressed or implied by the forward looking

statements. Such factors include, among others: the actual results

of current exploration activities; actual results of current

reclamation activities; conclusions of economic evaluations;

changes in project parameters as plans continue to be refined;

future prices of gold, copper, zinc and silver; possible variations

in ore grade or recovery rates; failure of plant, equipment or

processes to operate as anticipated; accidents, labour disputes and

other risks of the mining industry; delays in obtaining

governmental approvals or financing or in the completion of

development or construction activities, uncertainties inherent with

conducting business in foreign jurisdictions where corruption,

civil unrest, political instability and uncertainties with the rule

of law may impact the Company's activities; fluctuations in metal

prices; unanticipated title disputes; claims or litigation;

limitation on insurance coverage; as well as those risk factors

discussed or referred to in the Company's MD&A under the

heading "Risks and Uncertainties" and under the heading "Cautionary

Note Regarding Forward-Looking Statements" which include further

details on material assumptions used to develop such

forward-looking statements and material risk factors that could

cause actual results to differ materially from forward-looking

statements, and other documents (including without limitation the

Company's 2012 AIF) filed from time to time with the securities

regulatory authorities in all provinces and territories of Canada

and available on SEDAR at www.sedar.com. There can be no assurance

that forward looking statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Unless required by securities laws,

the Company undertakes no obligation to update forward looking

statements if circumstances or management's estimates or opinions

should change. Accordingly, readers are cautioned not to place

undue reliance on forward looking statements.

Dundee Precious Metals Inc.Rick HowesPresident and Chief

Executive Officer(416) 365-2836rhowes@dundeeprecious.comDundee

Precious Metals Inc.Hume KyleExecutive Vice President and Chief

Financial Officer(416) 365-5091hkyle@dundeeprecious.comDundee

Precious Metals Inc.Lori Beak, Senior Vice President,Investor &

Regulatory Affairs and Corporate Secretary(416)

365-5165lbeak@dundeeprecious.comwww.dundeeprecious.com

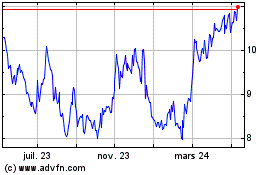

Dundee Precious Metals (TSX:DPM)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

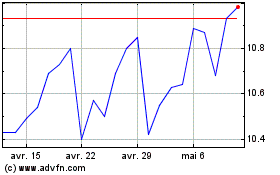

Dundee Precious Metals (TSX:DPM)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025