Firan Technology Group Corporation (“FTG”) Announces Full Year and Fourth Quarter 2024 Financial Results

19 Février 2025 - 2:33PM

Firan Technology Group Corporation (TSX: FTG) (OTCQX: FTGFF) today

announced financial results for the full year and fourth quarter of

2024.

Full Year Financial Highlights:

- Bookings: Total

bookings reached $184.5 million, marking a 25% increase over

2023.

- Backlog: The

year-end backlog stood at $122.4 million, a 26% rise from the

previous year.

- Revenue: Full year

revenues increased by 20% to $162.1 million.

- Adjusted EBITDA:

Achieved $25.8 million, up from $19.4 million in 2023.

- Adjusted Net

Earnings: Increased by 47% to $10.3 million.

- Net Debt:

Maintained a strong balance sheet with net debt of $0.7 million

after $14.7 million in investments.

- Working Capital: As of November 30, 2024,

FTG's net working capital was $49.9 million, compared to $41.1

million at year-end 2023, reflecting higher accounts receivable and

cash due to organic growth.

Fourth Quarter Financial Highlights:

- Sales: Reached

$45.2 million, a 13.1% increase over Q4 2023.

- Adjusted EBITDA:

Recorded at $7.6 million, up from $6.0 million in Q4 2023.

- Adjusted Net Earnings: Rose by 67% to $3.9

million.

Business Highlights:

During 2024, the Corporation invested in existing sites and grew

the business organically. FTG is strategically deploying its

capital in ways that will drive increased shareholder returns for

the future in both the near term and long term. Specifically, FTG

accomplished many goals in 2024 that continue to improve the

Corporation and position it for the future, including:

- Integration

Progress: Continued successful integration of 2023

acquisitions, with improvements in throughput, pricing, and cost

savings at Circuits Minnetonka and Circuits Haverhill.

- Contract Wins: Secured a $17.0 million

contract to supply cockpit interface assemblies for COMAC's C919

aircraft, with production spanning from late 2024 to Q3 2026.

Subsequent Events:

- FLYHT Acquisition:

Subsequent to year-end, FTG acquired FLYHT Aerospace Solutions

Ltd., enhancing FTG’s presence in the commercial aerospace

aftermarket and expanding its product offerings on Airbus aircraft.

This acquisition aligns with FTG's strategic priorities, and plans

include ramping up sales of FLYHT’s product lines and insourcing

manufacturing to other FTG sites.

- De Havilland

Contract: Also subsequent to year-end, FTG announced that

De Havilland Aircraft of Canada Ltd. has selected FTG to provide

updated cockpit control assemblies for the new De Havilland

Canadair 515 (DHC-515) aerial firefighting aircraft.

- New Facility:

Announced plans to open an Aerospace facility in Hyderabad, India,

to support strategic growth and expand market presence.

- Banking Agreement: Completed a new three-year

banking agreement with BMO Corporate Finance, providing improved

flexibility and reduced costs to support growth and corporate

development objectives.

Financial Tables:

Table 1: Key Financial Metrics (Full Year)

|

Metric |

FY 2024 |

FY 2023 |

% Change |

|

Sales |

$162,096,000 |

$135,200,000 |

19.9% |

|

Gross Margin |

$44,176,000 |

$39,285,000 |

12.5% |

|

Gross Margin (%) |

27.3% |

29.1% |

-180 bps |

|

Net Earnings to FTG Equity Holders |

$10,815,000 |

$11,621,000 |

-6.9% |

|

Adjusted Net Earnings (1) |

$10,306,000 |

$7,012,000 |

47.0% |

|

Earnings Per Share (Basic) |

$0.45 |

$0.49 |

-8.2% |

|

Earnings Per Share (Diluted) |

$0.45 |

$0.48 |

-6.3% |

|

Adjusted Earnings Per Share (Basic) (1) |

$0.43 |

$0.29 |

48.3% |

|

Adjusted Earnings Per Share (Diluted) (1) |

$0.43 |

$0.29 |

48.3% |

|

(1) |

Adjusted Net Earnings is not a measure recognized under

International Financial Reporting Standards (“IFRS”). Management

believes that this measure is important to many of the

Corporation’s shareholders, creditors and other stakeholders. The

Corporation’s method of calculating Adjusted Net Earnings may

differ from other corporations and accordingly may not be

comparable to measures used by other corporations. |

Table 2: Key Financial Metrics (Quarterly)

|

Metric |

Q4 2024 |

Q4 2023 |

% Change |

|

Sales |

$45,244,000 |

$39,991,000 |

13.1% |

|

Gross Margin |

$12,816,000 |

$10,739,000 |

19.3% |

|

Gross Margin (%) |

28.3% |

26.9% |

140 bps |

|

Net Earnings to FTG Equity Holders |

$4,448,000 |

$3,826,000 |

16.3% |

|

Adjusted Net Earnings (1) |

$3,939,000 |

$2,360,000 |

66.9% |

|

Earnings Per Share (Basic) |

$0.18 |

$0.16 |

12.5% |

|

Earnings Per Share (Diluted) |

$0.18 |

$0.16 |

12.5% |

|

Adjusted Earnings Per Share (Basic) (1) |

$0.16 |

$0.10 |

60.0% |

|

Adjusted Earnings Per Share (Diluted) (1) |

$0.16 |

$0.10 |

60.0% |

|

(1) |

Adjusted Net Earnings is not a measure recognized under

International Financial Reporting Standards (“IFRS”). Management

believes that this measure is important to many of the

Corporation’s shareholders, creditors and other stakeholders. The

Corporation’s method of calculating Adjusted Net Earnings may

differ from other corporations and accordingly may not be

comparable to measures used by other corporations. |

Table 3: EBITDA

|

Metric |

Q4 2024 |

Q4 2023 |

FY 2024 |

FY 2023 |

% Change (Q4) |

% Change (FY) |

|

Net Earnings to Equity Holders |

$4,448,000 |

$3,826,000 |

$10,815,000 |

$11,621,000 |

|

|

|

Add: Interest, Accretion |

$529,000 |

$512,000 |

$2,210,000 |

$1,283,000 |

|

|

|

Add: Income Taxes |

$836,000 |

($468,000 |

$4,093,000 |

$2,225,000 |

|

|

|

Add: Depreciation and Amortization |

$2,060,000 |

$1,950,000 |

$8,345,000 |

$6,888,000 |

|

|

|

EBITDA (2) |

$7,873,000 |

$5,820,000 |

$25,463,000 |

$22,017,000 |

35.3% |

15.7% |

|

Adjustments |

|

|

|

|

|

|

|

Stock Based Compensation |

$106,000 |

$197,000 |

$739,000 |

$512,000 |

|

|

|

Government Assistance |

- |

- |

- |

($3,758,000) |

|

|

|

Acquisition and Divestiture Expenses |

$317,000 |

- |

$317,000 |

$615,000 |

|

|

|

India Startup Costs |

$110,000 |

- |

$110,000 |

- |

|

|

|

Change in Fair Value of Contingent Consideration |

($829,000) |

- |

($829,000) |

- |

|

|

|

Adjusted EBITDA (2) |

$7,577,000 |

$6,017,000 |

$25,800,000 |

$19,386,000 |

25.9% |

33.1% |

|

Adjusted EBITDA Margin (2) |

16.7% |

15.0% |

15.9% |

14.3% |

|

|

|

(2) |

EBITDA and Adjusted EBITDA are not measures recognized under

International Financial Reporting Standards (“IFRS”). Management

believes that these measures are important to many of the

Corporation’s shareholders, creditors and other stakeholders. The

Corporation’s method of calculating EBITDA and Adjusted EBITDA may

differ from other corporations and accordingly may not be

comparable to measures used by other corporations |

CEO Commentary:

"We are thrilled with FTG’s performance in 2024, which reflects

our strategic focus on growth and operational excellence," said

Bradley C. Bourne, President and CEO of FTG. "Our investments in

technology and acquisitions have positioned us well for future

success, and we are excited about the opportunities ahead,

including our expansion into the Indian market."

About Firan Technology Group Corporation:

FTG is an aerospace and defence electronics product and

subsystem supplier to customers around the globe. FTG has two

operating units:

- FTG Circuits: A

manufacturer of high technology, high reliability printed circuit

boards. Our customers are leaders in the aviation, defence, and

high technology industries. FTG Circuits has operations in Toronto,

Ontario, Chatsworth, California, Fredericksburg, Virginia,

Minnetonka, Minnesota, Haverhill, Massachusetts, and a joint

venture in Tianjin, China.

- FTG Aerospace: Designs, certifies,

manufactures, and provides in-service support for illuminated

cockpit products and electronic assemblies for original equipment

manufacturers and operators of aerospace and defence equipment. FTG

Aerospace has operations in Toronto, Ontario, Calgary, Alberta,

Chatsworth, California, and Tianjin, China.

The Corporation's shares are traded on the Toronto Stock

Exchange under the symbol FTG, and on the OTCQX Exchange under the

symbol FTGFF.

Conference Call Details:

FTG will host a live conference call on Wednesday, February 19,

2025, at 4:00 p.m. (Eastern) to discuss the full year and fourth

quarter 2024 financial results. To participate in the call, please

dial 1-289-514-5100 or 1-800-717-1738 and use Conference ID 06303.

The Chairperson is Mr. Brad Bourne. A replay of the call will be

available until March 18, 2025, and can be accessed by dialing

1-289-819-1325 or 1-888-660-6264, Playback Passcode# 06303. The

replay will also be available on the FTG website at

www.ftgcorp.com.

Forward-Looking Statements:

This news release contains certain forward-looking statements.

These forward-looking statements are related to, but not limited

to, FTG’s operations, anticipated financial performance, business

prospects and strategies. Forward-looking information typically

contains words such as “anticipate”, “believe”, “expect”, “plan” or

similar words suggesting future outcomes. Such statements are based

on the current expectations of management of the Corporation and

inherently involve numerous risks and uncertainties, known and

unknown, including economic factors and the Corporation’s industry,

generally. The preceding list is not exhaustive of all possible

factors. Such forward-looking statements are not guarantees of

future performance and actual events and results could differ

materially from those expressed or implied by forward-looking

statements made by the Corporation. The reader is cautioned to

consider these and other factors carefully when making decisions

with respect to the Corporation and not place undue reliance on

forward-looking statements. Other than as may be required by law,

FTG disclaims any intention or obligation to update or revise any

such forward-looking statements, whether as a result of new

information, future events or otherwise.

For further information please contact:

- Bradley C. Bourne, President and CEOFiran

Technology Group CorporationTel: (416) 299-4000

x314bradbourne@ftgcorp.com

- Jamie Crichton, Vice President and CFOFiran

Technology Group CorporationTel: (416) 299-4000

x264jamiecrichton@ftgcorp.com

Additional information can be found at the Corporation’s website

www.ftgcorp.com.

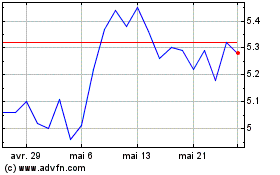

Firan Technology (TSX:FTG)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Firan Technology (TSX:FTG)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025