goeasy Ltd. (TSX: GSY), (“

goeasy” or the

“

Company”), a leading full-service provider of

goods and alternative financial services, today reported results

for the second quarter ended June 30, 2021 and announced a

commitment from National Bank Financial Markets to increase its

existing revolving securitization warehouse facility (the

“

Securitization Facility”) from $200 million to

$600 million, including a new 3-year term extension, improved

eligibility criteria and a 110 basis point reduction in the

interest rate payable on advances from 1-month Canadian Dollar

Offered Rate (“

CDOR”) plus 295 bps to CDOR plus

185

bps.

Second

Quarter Results

During the quarter, the Company experienced an

increased level of demand within its direct-to-consumer lending

channels, aided by strong growth in its point-of-sale finance

channel. Increased originations and loan growth, complemented by

improved credit performance and the April 30, 2021 closing of the

previously announced acquisition of LendCare Holdings Inc.

(“LendCare”), led to record financial results.

The Company generated a record $379 million in

total loan originations in the second quarter, up 122% compared to

the $171 million produced in the second quarter of 2020, and a

sequential increase of 39% from the $272 million in loan

originations in the first quarter of 2021. In addition to the

approximately $445 million gross consumer loan portfolio acquired

through the acquisition of LendCare, the increase in loan

origination volume led to organic growth in the loan portfolio of

an additional $74 million during the quarter, resulting in a total

gross consumer loan receivable portfolio of $1.80 billion, up 58%

from $1.13 billion as at June 30, 2020. The growth in consumer

loans led to an increase in revenue, which was a record $202

million in the quarter, up 34% over the same period in 2020.

During the quarter, the Company also continued

to experience strong credit and payment performance. When combined

with the amalgamation of the structurally lower credit risk of the

LendCare portfolio, the net charge off rate for the second quarter

was 8.2%, compared to 10.0% in the second quarter of 2020. As a

result of the continued improvement in underlying credit quality,

the improving economic recovery, and the amalgamation of LendCare,

the Company reduced its overall allowance for future credit losses

to 7.90% from 9.88% in the prior quarter.

Operating income for the second quarter of 2021

was $56.1 million, up 4% from $54.0 million in the second quarter

of 2020, while the operating margin for the second quarter was

27.7%, down from 35.8% in the prior year. After adjusting for items

related to the acquisition of LendCare and an unrealized fair value

loss on investments recorded in the quarter, the Company reported

record adjusted operating income of $79.9 million, up $25.9 million

or 48% over the second quarter of 2020. Adjusted operating margin

for the second quarter was 39.5%, up from 35.8% in the prior

year.

Net income in the second quarter was $19.5

million, compared to $32.5 million in the same period of 2020,

which resulted in diluted earnings per share of $1.16, compared to

$2.11 in the second quarter of 2020. After adjusting for

non-recurring and unusual items on an after-tax basis, including

$8.6 million of transaction and integration costs related to the

acquisition of LendCare, $1.6 million in amortization of acquired

intangible assets, a $10.5 million day one IFRS loss provision

related to the acquired LendCare loan portfolio and a $3.5 million

unrealized fair value loss on investments recorded in the second

quarter of 2021, adjusted net income was a record $43.7 million, up

50% from $29.1 million in 2020, resulting in adjusted diluted

earnings per share of $2.61, up 38% from $1.89 in the second

quarter of 2020.

Return on equity during the quarter was 12.0%,

compared to 37.0% in the second quarter of 2020. After adjusting

for the non-recurring and unusual items previously noted, adjusted

return on equity was 26.9% in the quarter, compared to adjusted

return on equity of 33.1% in the same period of 2020.

“The second quarter was highlighted by a

significant increase in loan originations, continued strength in

the credit performance of our portfolio, and the expansion of our

point-of-sale lending channel through the acquisition of LendCare,”

said Jason Mullins, goeasy’s President and Chief Executive Officer,

“As we have now entered a period of accelerated growth, revenues

lifted 34%, while adjusted diluted earnings per share rose 38%. To

support our future growth, we were also pleased to announce a $400

million increase to our securitization facility, supplemented by a

material pricing reduction to a variable coupon rate of

approximately 2.3%,” Mr. Mullins concluded, “I’d like to extend my

sincere appreciation to the entire goeasy team for successfully

navigating through another period of pandemic related disruption

and for the excellent job integrating our new colleagues at

LendCare into the Company.”

Other Key Second Quarter

Highlights

easyfinancial (including the acquired

LendCare portfolio)

- Revenue of $165 million, up

43%

- 33% of the loan portfolio secured,

up from 11.1%

- 65% of net loan advances in the

quarter were issued to new customers, up from 49%

- 38% of applications were acquired

online, consistent with 39%

- 34% of new customers acquired

through point-of-sale, up from 23%

- Average loan book per branch

improved to $3.8 million, an increase of 5%

- Weighted average interest yield of

33.7%, down from 38.7%

- Record operating income of $74.9

million, up 25%

- Operating margin of 45.4%, down

from 51.9% due to the higher rate of growth

easyhome

- Record revenue of $37.5 million, up

7%

- Same store revenue growth of

7.9%

- Consumer loan portfolio within

easyhome stores increased to $56.9 million, up 41%

- Revenue from consumer lending

increased to $7.3 million, up 43%

- Record operating income of $9.3

million, up 24%

- Record operating margin of 24.9%,

up from 21.4%

Overall

- 45th consecutive quarter of same

store sales growth

- 80th consecutive quarter of

positive net income

- 2021 marks the 17th consecutive

year of paying dividends and the 7th consecutive year of a dividend

increase

- Total same store revenue growth of

20.2%

- Adjusted return on equity of 26.9%

in the quarter and adjusted return on tangible common equity of

38.5%

- Fully drawn weighted average cost

of borrowing reduced to 4.8%, down from 5.1%

- Net external debt to net

capitalization of 64% on June 30, 2021, down from 70% in the prior

year and below the Company’s target leverage ratio of 70%

Six Months Results

For the first six months of 2021, goeasy

produced revenues of $373 million, up 17% compared with $318

million in the same period of 2020. Operating income for the period

was $120.0 million compared with $98.2 million in the first six

months of 2020, an increase of $21.8 million or 22%. Net income for

the first six months of 2021 was $131 million and diluted earnings

per share was $8.10 compared with $54.5 million or $3.51 per share,

increases of 141% and 131%, respectively. Excluding the effects of

the adjusting items related to the acquisition of LendCare and

unrealized fair value gains on investments, adjusted net income for

the first six months of 2021 was $80.4 million and adjusted diluted

earnings per share was $4.95, increases of 57% and 51%,

respectively, while adjusted return on equity was 27.7%.

Balance Sheet and Liquidity

Total assets were $2.45 billion as of June 30,

2021, an increase of 81% from $1.35 billion as of June 30, 2020,

driven by growth in the consumer loan portfolio, including the $445

million gross consumer loan portfolio acquired through the

acquisition of LendCare, the intangible assets and goodwill arising

from the LendCare acquisition, and the return on the Company’s

investment in Affirm Holdings Inc. (“Affirm”).

During the second quarter of 2021, the Company

recognized a $3.5 million after-tax unrealized fair value loss on

its investments, which was mainly related to the unhedged

contingent shares of its investment in Affirm. Year to date, the

Company has recorded total unrealized fair value gains related to

its investment in Affirm and the total return swap (the “TRS”),

which was put in place to substantively hedge the market exposure

related to the non-contingent portion of the equity held in Affirm,

of $83.5 million.

During the quarter, the Company also invested an

additional $4.0 million to increase its minority equity interest in

Brim Financial Inc. (“Brim”), a Canadian fintech platform company

and globally certified credit card issuer, bringing the Company’s

total investment in Brim to $10.5 million as at June 30, 2021. The

investment in Brim aligns with the Company’s strategic vision of

broadening its digital platform and near-prime product range.

The Company also announced today that it has

obtained a commitment to increase its existing revolving

securitization warehouse facility to $600 million, from its current

$200 million capacity. The Securitization Facility, originally

established in December 2020, will continue to be structured and

underwritten by National Bank Financial Markets under a new

three-year agreement, which incorporates favourable key

modifications, including improvements to eligibility criteria and

advance rates. The interest on advances will be payable at the rate

of 1-month Canadian Dollar Offered Rate plus 185 bps, an

improvement of 110 bps over the previous rate. Based on the current

1-month CDOR rate of 0.42% as of August 4, 2021, the interest rate

would be 2.27%. The Company will continue utilizing an interest

rate swap agreement to generate fixed rate payments on the amounts

drawn and mitigate the impact of interest rate volatility. Proceeds

from the Securitization Facility will be used for general corporate

purposes, primarily funding growth of the Company’s consumer loan

portfolio, originated by both its easyfinancial Services Inc. and

LendCare subsidiaries.

Cash provided by operating activities before the

net growth in gross consumer loans receivable in the quarter was

$48.3 million. Based on the cash on hand at the end of the quarter

and the borrowing capacity under the Company’s revolving credit

facilities, including the aforementioned expansion of the

Securitization Facility, goeasy has approximately $870 million in

total funding capacity, which it estimates is sufficient to fund

its organic growth through the fourth quarter of 2023. At

quarter-end, the Company’s fully drawn weighted average cost of

borrowing reduced to 4.8%, down from 5.1% in the prior year, with

incremental draws on its senior secured revolving credit facility

bearing a rate of approximately 3.5% and incremental draws on its

amended Securitization Facility bearing a rate of approximately

2.3%.

As of June 30, 2021, the Company also estimates

that once its existing and available sources of capital are fully

utilized, it could continue to grow the loan portfolio by

approximately $200 million per year solely from internal cash

flows. The Company also estimates that if it were to run-off its

consumer loan and consumer leasing portfolios, the value of the

total cash repayments paid to the Company over the remaining life

of its contracts would be approximately $2.9 billion. If, during

such a run-off scenario, all excess cash flows were applied

directly to debt, the Company estimates it would extinguish all

external debt within 18 months.

Future Outlook

The Company has provided a new 3-year forecast

for the years 2021 through 2023. The Company continues to pursue a

long-term strategy that includes expanding its product range,

developing its channels of distribution and leveraging risk-based

pricing, which increase the average loan size and extends the life

of its customer relationships. As such, the total yield earned on

its consumer loan portfolio will gradually decline, while net

charge-off rates moderate and operating margins expand. The

forecasts outlined below contemplate the Company’s expected

domestic organic growth plan and do not include the impact of any

future mergers or acquisitions, or the associated gains or losses

associated with its investments.

“With the economic recovery underway, the launch

of our new auto loan product and the rapid expansion of our

point-of-sale platform, we expect the growth of our portfolio to

accelerate as we capture a larger share of the $200 billion

non-prime consumer credit market,” said Mr. Mullins, “Our updated

three-year forecast reflects growing our consumer loan book to

nearly $3 billion by the end of 2023, while gradually reducing the

cost of borrowing for our consumers, improving the underlying

credit performance and expanding our margins through operating

leverage. We remain focused on our goal of becoming the largest and

best-performing non-prime consumer lender in Canada, while

continuing to deliver market leading returns for our

shareholders.”

|

|

Forecasts for 2021 |

Forecasts for 2022 |

Forecasts for 2023 |

|

Gross Loan Receivable Portfolio at Year End |

$1.95 billion –$2.05 billion |

$2.35 billion –$2.55 billion |

$2.8 billion –$3.0 billion |

|

New easyfinancial locations |

20 - 25 |

15 - 20 |

10 - 15 |

|

easyfinancial Total Revenue Yield |

40% - 42% |

36% - 38% |

35% - 37% |

|

Total Revenue Growth |

24% - 27% |

17% - 20% |

12% - 15% |

|

Net charge-off Rate (Average Receivables) |

8.5% - 10.5% |

8.5% - 10.5% |

8.0% - 10.0% |

|

Adjusted Total Company Operating Margin |

35%+ |

36%+ |

37%+ |

|

Adjusted Return on Equity |

22%+ |

22%+ |

22%+ |

|

Cash provided by Operating Activities before Net Growth in Gross

Consumer Loans Receivable |

$190 million –$230 million |

$270 million –$310 million |

$310 million –$350 million |

|

Net Debt to Net Capitalization |

64% - 66% |

64% - 66% |

63% - 65% |

Dividend

The Board of Directors has approved a quarterly

dividend of $0.66 per share payable on October 8,

2021 to the holders of common shares of record as at the close

of business on September 24, 2021.

Forward-Looking Statements

All figures reported above with respect to

outlook are targets established by the Company and are subject to

change as plans and business conditions vary. Accordingly,

investors are cautioned not to place undue reliance on the

foregoing guidance. Actual results may differ materially.

This press release includes forward-looking

statements about goeasy, including, but not limited to, its

business operations, strategy, expected financial performance and

condition, the estimated number of new locations to be opened,

targets for growth of the consumer loans receivable portfolio,

annual revenue growth targets, strategic initiatives, new product

offerings and new delivery channels, anticipated cost savings,

planned capital expenditures, anticipated capital requirements,

liquidity of the Company, plans and references to future operations

and results and critical accounting estimates. In certain cases,

forward-looking statements are statements that are predictive in

nature, depend upon or refer to future events or conditions, and/or

can be identified by the use of words such as ‘expects’,

‘anticipates’, ‘intends’, ‘plans’, ‘believes’, ‘budgeted’,

‘estimates’, ‘forecasts’, ‘targets’ or negative versions thereof

and similar expressions, and/or state that certain actions, events

or results ‘may’, ‘could’, ‘would’, ‘might’ or ‘will’ be taken,

occur or be achieved.

Forward-looking statements are based on certain

factors and assumptions, including expected growth, results of

operations and business prospects and are inherently subject to,

among other things, risks, uncertainties and assumptions about the

Company’s operations, economic factors and the industry generally,

as well as those factors referred to in the Company’s most recent

Annual Information Form and Management Discussion and Analysis, as

available on www.sedar.com, in the section entitled “Risk Factors”.

There can be no assurance that forward-looking statements will

prove to be accurate, as actual results and future events could

differ materially from those expressed or implied by

forward-looking statements made by the Company, due to, but not

limited to, important factors such as the Company’s ability to

enter into new lease and/or financing agreements, collect on

existing lease and/or financing agreements, open new locations on

favourable terms, purchase products which appeal to customers at a

competitive rate, respond to changes in legislation, react to

uncertainties related to regulatory action, raise capital under

favourable terms, manage the impact of litigation (including

shareholder litigation), control costs at all levels of the

organization and maintain and enhance the system of internal

controls. The Company cautions that the foregoing list is not

exhaustive.

The reader is cautioned to consider these, and

other factors carefully and not to place undue reliance on

forward-looking statements, which may not be appropriate for other

purposes. The Company is under no obligation (and expressly

disclaims any such obligation) to update or alter the

forward-looking statements whether as a result of new information,

future events or otherwise, unless required by law.

About goeasy

goeasy Ltd., a Canadian company, headquartered

in Mississauga, Ontario, provides non-prime leasing and

lending services through its easyhome, easyfinancial and LendCare

brands. Supported by more than 2,200 employees, the Company offers

a wide variety of financial products and services including

unsecured and secured instalment loans. Customers can transact

seamlessly through an omni-channel model that includes an online

and mobile platform, over 400 locations across Canada, and

point-of-sale financing offered in the retail, power sports,

automotive, home improvement and healthcare verticals, through more

than 4,000 merchants across Canada. Throughout the Company’s

history, it has acquired and organically served over 1 million

Canadians and originated over $6.7 billion in loans, with one

in three easyfinancial customers graduating to prime credit and 60%

increasing their credit score within 12 months of borrowing.

Accredited by the Better Business Bureau, goeasy

is the proud recipient of several awards including Waterstone

Canada’s Most Admired Corporate Cultures, Glassdoor Top CEO Award,

Achievers Top 50 Most Engaged Workplaces in North America,

Greater Toronto Top Employers Award, the Digital Finance

Institute’s Canada’s Top 50 FinTech Companies, ranking on the TSX30

and placing on the Report on Business ranking of Canada’s Top

Growing Companies. The company and its employees believe strongly

in giving back to the communities in which it operates and has

raised over $3.8 million to support its long-standing

partnerships with BGC Canada, Habitat for Humanity and many other

local charities.

goeasy Ltd.’s. common shares are listed on the

TSX under the trading symbol “GSY”. goeasy is rated BB- with a

stable trend from S&P and Ba3 with a stable trend from Moody’s.

Visit www.goeasy.com.

For further information contact:

Jason MullinsPresident & Chief Executive

Officer(905) 272-2788

Farhan Ali KhanSenior Vice President, Corporate

Development & Investor Relations(905) 272-2788

|

goeasy Ltd. |

|

|

|

|

| |

|

|

|

|

|

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL

POSITION |

|

|

|

(Unaudited) |

|

|

|

|

| (expressed

in thousands of Canadian dollars) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As

At |

As

At |

|

| |

|

June 30, |

December

31, |

|

|

|

|

2021 |

2020 |

|

| |

|

|

|

|

|

ASSETS |

|

|

|

|

|

Cash |

|

140,192 |

93,053 |

|

|

|

Amounts receivable |

|

17,112 |

9,779 |

|

|

|

Prepaid expenses |

|

8,477 |

13,005 |

|

|

|

Consumer loans receivable, net |

|

1,682,151 |

1,152,378 |

|

|

|

Investments |

|

95,138 |

56,040 |

|

|

|

Lease assets |

|

45,921 |

49,384 |

|

|

|

Property and equipment, net |

|

34,467 |

31,322 |

|

|

|

Deferred tax assets, net |

|

- |

4,066 |

|

|

|

Derivative financial assets |

|

32,953 |

- |

|

|

|

Intangible assets, net |

|

162,379 |

25,244 |

|

|

|

Right-of-use assets, net |

|

52,656 |

46,335 |

|

|

|

Goodwill |

|

179,835 |

21,310 |

|

|

|

TOTAL ASSETS |

|

2,451,281 |

1,501,916 |

|

|

| |

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

Liabilities |

|

|

|

|

|

Revolving credit facility |

|

14,039 |

198,339 |

|

|

|

Accounts payable and accrued liabilities |

|

53,081 |

46,065 |

|

|

|

Income taxes payable |

|

7,927 |

13,897 |

|

|

|

Dividends payable |

|

10,887 |

6,661 |

|

|

|

Unearned revenue |

|

9,389 |

10,622 |

|

|

|

Accrued interest |

|

7,860 |

2,598 |

|

|

|

Deferred tax liabilities, net |

|

43,922 |

- |

|

|

|

Derivative financial liabilities |

|

48,027 |

36,910 |

|

|

|

Lease liabilities |

|

60,600 |

53,902 |

|

|

|

Revolving securitization warehouse facility |

|

198,731 |

- |

|

|

|

Secured borrowing |

|

186,714 |

- |

|

|

|

Notes payable |

|

1,061,313 |

689,410 |

|

|

|

TOTAL LIABILITIES |

|

1,702,490 |

1,058,404 |

|

|

| |

|

|

|

|

|

Shareholders' equity |

|

|

|

|

|

Share capital |

|

369,617 |

181,753 |

|

|

|

Contributed surplus |

|

18,401 |

19,732 |

|

|

|

Accumulated other comprehensive income (loss) |

|

2,757 |

(5,280 |

) |

|

|

Retained earnings |

|

358,016 |

247,307 |

|

|

|

TOTAL SHAREHOLDERS' EQUITY |

|

748,791 |

443,512 |

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

|

2,451,281 |

1,501,916 |

|

|

| |

|

|

|

|

|

goeasy Ltd. |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF

INCOME |

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

| (expressed

in thousands of Canadian dollars except earnings per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

Three Months Ended |

Six Months Ended |

|

| |

|

June

30, |

June 30, |

June 30, |

June 30, |

|

|

|

|

2021 |

2020 |

2021 |

2020 |

|

| |

|

|

|

|

|

|

|

REVENUE |

|

|

|

|

|

|

|

Interest income |

|

128,483 |

|

100,866 |

233,977 |

200,966 |

|

|

Lease revenue |

|

28,348 |

|

28,002 |

56,785 |

55,816 |

|

|

Commissions earned |

|

42,435 |

|

19,348 |

75,772 |

54,626 |

|

|

Charges and fees |

|

3,090 |

|

2,461 |

5,996 |

6,471 |

|

|

|

|

202,356 |

|

150,677 |

372,530 |

317,879 |

|

| |

|

|

|

|

|

|

|

EXPENSES BEFORE DEPRECIATION AND AMORTIZATION |

|

|

|

|

|

|

|

Salaries and benefits |

|

43,804 |

|

34,124 |

79,210 |

65,826 |

|

|

Stock-based compensation |

|

1,901 |

|

1,771 |

3,987 |

3,869 |

|

|

Advertising and promotion |

|

7,172 |

|

4,504 |

13,064 |

10,818 |

|

|

Bad debts |

|

48,873 |

|

24,666 |

78,147 |

73,284 |

|

|

Occupancy |

|

5,753 |

|

5,805 |

11,277 |

11,487 |

|

|

Technology costs |

|

4,017 |

|

3,313 |

7,821 |

6,682 |

|

|

Other expenses |

|

15,409 |

|

6,459 |

22,504 |

15,754 |

|

|

|

|

126,929 |

|

80,642 |

216,010 |

187,720 |

|

| |

|

|

|

|

|

|

|

DEPRECIATION AND AMORTIZATION |

|

|

|

|

|

|

|

Depreciation of lease assets |

|

8,843 |

|

9,065 |

18,086 |

18,089 |

|

|

Depreciation of right-of-use assets |

|

4,422 |

|

3,944 |

8,766 |

7,941 |

|

|

Depreciation of property and equipment |

|

1,938 |

|

1,425 |

3,766 |

3,037 |

|

|

Amortization of intangible assets |

|

4,134 |

|

1,607 |

5,880 |

2,879 |

|

|

|

|

19,337 |

|

16,041 |

36,498 |

31,946 |

|

| |

|

|

|

|

|

|

|

TOTAL OPERATING EXPENSES |

|

146,266 |

|

96,683 |

252,508 |

219,666 |

|

| |

|

|

|

|

|

|

|

OPERATING INCOME |

|

56,090 |

|

53,994 |

120,022 |

98,213 |

|

| |

|

|

|

|

|

|

|

OTHER INCOME |

|

(4,086 |

) |

4,000 |

83,286 |

4,000 |

|

| |

|

|

|

|

|

|

|

FINANCE COSTS |

|

|

|

|

|

|

|

Interest expense and amortization of deferred financing

charges |

|

20,066 |

|

13,405 |

33,561 |

27,081 |

|

|

Interest expense on lease liabilities |

|

756 |

|

667 |

1,497 |

1,335 |

|

|

|

|

20,822 |

|

14,072 |

35,058 |

28,416 |

|

| |

|

|

|

|

|

|

|

INCOME BEFORE INCOME TAXES |

|

31,182 |

|

43,922 |

168,250 |

73,797 |

|

| |

|

|

|

|

|

|

|

INCOME TAX EXPENSE |

|

|

|

|

|

|

|

Current |

|

15,811 |

|

6,001 |

32,808 |

13,298 |

|

|

Deferred |

|

(4,096 |

) |

5,379 |

4,000 |

5,978 |

|

|

|

|

11,715 |

|

11,380 |

36,808 |

19,276 |

|

| |

|

|

|

|

|

|

|

NET INCOME |

|

19,467 |

|

32,542 |

131,442 |

54,521 |

|

| |

|

|

|

|

|

|

|

BASIC EARNINGS PER SHARE |

|

1.20 |

|

2.25 |

8.39 |

3.74 |

|

|

DILUTED EARNINGS PER SHARE |

|

1.16 |

|

2.11 |

8.10 |

3.51 |

|

| |

|

|

|

|

|

|

|

Segmented Reporting |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2021 |

|

|

($ in 000's except earnings per share) |

|

easyfinancial1 |

easyhome |

Corporate |

Total |

|

| |

|

|

|

|

|

|

|

|

Revenue |

|

|

|

|

|

|

|

|

Interest income |

|

123,036 |

5,447 |

- |

|

128,483 |

|

|

| |

Lease

revenue |

|

- |

28,348 |

- |

|

28,348 |

|

|

| |

Commissions

earned |

|

39,665 |

2,770 |

- |

|

42,435 |

|

|

| |

Charges and

fees |

|

2,187 |

903 |

- |

|

3,090 |

|

|

|

|

|

|

164,888 |

37,468 |

- |

|

202,356 |

|

|

| |

|

|

|

|

|

|

|

|

Total operating expenses before depreciation and amortization |

|

83,291 |

17,066 |

26,572 |

|

126,929 |

|

|

| |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

|

|

|

|

| |

Depreciation

and amortization of lease assets, property and equipment and

intangible assets |

|

4,458 |

9,165 |

1,292 |

|

14,915 |

|

|

| |

Depreciation

of right-of-use assets |

|

2,288 |

1,918 |

216 |

|

4,422 |

|

|

|

|

|

|

6,746 |

11,083 |

1,508 |

|

19,337 |

|

|

|

|

|

|

|

|

|

|

|

|

Segment operating income (loss) |

|

74,851 |

9,319 |

(28,080 |

) |

56,090 |

|

|

| |

|

|

|

|

|

|

|

|

Other income |

|

|

|

|

(4,086 |

) |

|

| |

|

|

|

|

|

|

|

|

Finance costs |

|

|

|

|

|

|

| |

Interest

expense and amortization of deferred financing charges |

|

|

|

|

20,066 |

|

|

| |

Interest

expense on lease liabilities |

|

|

|

|

756 |

|

|

|

|

|

|

|

|

|

20,822 |

|

|

| |

|

|

|

|

|

|

|

|

Income before income taxes |

|

|

|

|

31,182 |

|

|

| |

|

|

|

|

|

|

|

|

Income taxes |

|

|

|

|

11,715 |

|

|

| |

|

|

|

|

|

|

|

|

Net Income |

|

|

|

|

19,467 |

|

|

| |

|

|

|

|

|

|

|

|

Diluted earnings per share |

|

|

|

|

1.16 |

|

|

|

1 LendCare’s financial results are reported under the easyfinancial

reporting segment. |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2020 |

|

|

($ in 000's except earnings per share) |

|

easyfinancial |

easyhome |

Corporate |

Total |

|

| |

|

|

|

|

|

|

|

|

Revenue |

|

|

|

|

|

|

| |

Interest

income |

|

96,846 |

4,020 |

- |

|

100,866 |

|

|

| |

Lease

revenue |

|

- |

28,002 |

- |

|

28,002 |

|

|

| |

Commissions

earned |

|

17,346 |

2,002 |

- |

|

19,348 |

|

|

| |

Charges and

fees |

|

1,545 |

916 |

- |

|

2,461 |

|

|

|

|

|

|

115,737 |

34,940 |

- |

|

150,677 |

|

|

|

Total operating expenses before depreciation and amortization |

|

51,999 |

16,181 |

12,462 |

|

80,642 |

|

|

| |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

|

|

|

|

| |

Depreciation

and amortization of lease assets, property and equipment and

intangible assets |

|

1,770 |

9,441 |

886 |

|

12,097 |

|

|

| |

Depreciation

of right-of-use-assets |

|

1,865 |

1,827 |

252 |

|

3,944 |

|

|

|

|

|

|

3,635 |

11,268 |

1,138 |

|

16,041 |

|

|

| |

|

|

|

|

|

|

|

|

Segment operating income (loss) |

|

60,103 |

7,491 |

(13,600 |

) |

53,994 |

|

|

| |

|

|

|

|

|

|

|

|

Other income |

|

|

|

|

4,000 |

|

|

| |

|

|

|

|

|

|

|

|

Finance costs |

|

|

|

|

|

|

| |

Interest

expense and amortization of deferred financing charges |

|

|

|

|

13,405 |

|

|

| |

Interest

expense on lease liabilities |

|

|

|

|

667 |

|

|

|

|

|

|

|

|

|

14,072 |

|

|

| |

|

|

|

|

|

|

|

|

Income before income taxes |

|

|

|

|

43,922 |

|

|

| |

|

|

|

|

|

|

|

|

Income taxes |

|

|

|

|

11,380 |

|

|

| |

|

|

|

|

|

|

|

|

Net Income |

|

|

|

|

32,542 |

|

|

| |

|

|

|

|

|

|

|

|

Diluted earnings per share |

|

|

|

|

2.11 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, 2021 |

|

|

($ in 000's except earnings per share) |

|

easyfinancial1 |

easyhome |

Corporate |

Total |

|

| |

|

|

|

|

|

|

|

|

Revenue |

|

|

|

|

|

|

| |

Interest

income |

|

223,540 |

10,437 |

- |

|

233,977 |

|

|

| |

Lease

revenue |

|

- |

56,785 |

- |

|

56,785 |

|

|

| |

Commissions

earned |

|

70,575 |

5,197 |

- |

|

75,772 |

|

|

| |

Charges and

fees |

|

4,102 |

1,894 |

- |

|

5,996 |

|

|

|

|

|

|

298,217 |

74,313 |

- |

|

372,530 |

|

|

| |

|

|

|

|

|

|

|

|

Total operating expenses before depreciation and amortization |

|

140,617 |

33,391 |

42,002 |

|

216,010 |

|

|

| |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

|

|

|

|

| |

Depreciation

and amortization of lease assets, property and equipment and

intangible assets |

|

6,543 |

18,740 |

2,449 |

|

27,732 |

|

|

| |

Depreciation

of right-of-use assets |

|

4,509 |

3,826 |

431 |

|

8,766 |

|

|

|

|

|

|

11,052 |

22,566 |

2,880 |

|

36,498 |

|

|

| |

|

|

|

|

|

|

|

|

Segment operating income (loss) |

|

146,548 |

18,356 |

(44,882 |

) |

120,022 |

|

|

| |

|

|

|

|

|

|

|

|

Other income |

|

|

|

|

83,286 |

|

|

| |

|

|

|

|

|

|

|

|

Finance costs |

|

|

|

|

|

|

| |

Interest

expense and amortization of deferred financing charges |

|

|

|

|

33,561 |

|

|

| |

Interest expense on lease liabilities |

|

|

|

|

1,497 |

|

|

|

|

|

|

|

|

|

35,058 |

|

|

| |

|

|

|

|

|

|

|

|

Income before income taxes |

|

|

|

|

168,250 |

|

|

| |

|

|

|

|

|

|

|

|

Income taxes |

|

|

|

|

36,808 |

|

|

| |

|

|

|

|

|

|

|

|

Net Income |

|

|

|

|

131,442 |

|

|

| |

|

|

|

|

|

|

|

|

Diluted earnings per share |

|

|

|

|

8.10 |

|

|

|

1 LendCare’s financial results are reported under the easyfinancial

reporting segment. |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, 2020 |

|

|

($ in 000's except earnings per share) |

|

easyfinancial |

easyhome |

Corporate |

Total |

|

| |

|

|

|

|

|

|

|

|

Revenue |

|

|

|

|

|

|

| |

Interest

income |

|

192,940 |

8,026 |

- |

|

200,966 |

|

|

| |

Lease

revenue |

|

- |

55,816 |

- |

|

55,816 |

|

|

| |

Commissions

earned |

|

50,311 |

4,315 |

- |

|

54,626 |

|

|

| |

Charges and

fees |

|

4,274 |

2,197 |

- |

|

6,471 |

|

|

|

|

|

|

247,525 |

70,354 |

- |

|

317,879 |

|

|

| |

|

|

|

|

|

|

|

|

Total operating expenses before depreciation and

amortization |

|

128,755 |

33,220 |

25,745 |

|

187,720 |

|

|

| |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

|

|

|

|

| |

Depreciation

and amortization of lease assets, property and equipment and

intangible assets |

|

3,470 |

18,852 |

1,683 |

|

24,005 |

|

|

| |

Depreciation

of right-of-use-assets |

|

3,714 |

3,771 |

456 |

|

7,941 |

|

|

|

|

|

|

7,184 |

22,623 |

2,139 |

|

31,946 |

|

|

| |

|

|

|

|

|

|

|

|

Segment operating income (loss) |

|

111,586 |

14,511 |

(27,884 |

) |

98,213 |

|

|

| |

|

|

|

|

|

|

|

|

Other income |

|

|

|

|

4,000 |

|

|

| |

|

|

|

|

|

|

|

|

Finance costs |

|

|

|

|

|

|

| |

Interest

expense and amortization of deferred financing charges |

|

|

|

|

27,081 |

|

|

|

|

Interest expense on lease liabilities |

|

|

|

|

1,335 |

|

|

| |

|

|

|

|

|

28,416 |

|

|

| |

|

|

|

|

|

|

|

|

Income before income taxes |

|

|

|

|

73,797 |

|

|

| |

|

|

|

|

|

|

|

|

Income taxes |

|

|

|

|

19,276 |

|

|

| |

|

|

|

|

|

|

|

|

Net Income |

|

|

|

|

54,521 |

|

|

| |

|

|

|

|

|

|

|

|

Diluted earnings per share |

|

|

|

|

3.51 |

|

|

| |

|

|

|

|

|

|

|

|

Summary of Financial Results and Key Performance

Indicators |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

($ in 000’s except earnings per share and

percentages) |

Three Months Ended |

Variance |

Variance |

|

|

|

June 30, 2021 |

June 30, 2020 |

$ / bps |

% change |

|

|

|

Summary Financial Results |

|

|

|

|

|

|

|

Revenue |

202,356 |

|

150,677 |

|

51,679 |

|

34.3 |

% |

|

|

|

Operating expenses before depreciation and amortization2 |

126,929 |

|

80,642 |

|

46,287 |

|

57.4 |

% |

|

|

|

EBITDA1 |

62,498 |

|

64,970 |

|

(2,472 |

) |

(3.8 |

%) |

|

|

|

EBITDA margin1 |

30.9 |

% |

43.1 |

% |

(1,220

bps) |

|

(28.3 |

%) |

|

|

|

Depreciation and amortization expense2 |

19,337 |

|

16,041 |

|

3,296 |

|

20.5 |

% |

|

|

|

Operating income |

56,090 |

|

53,994 |

|

2,096 |

|

3.9 |

% |

|

|

|

Operating margin1 |

27.7 |

% |

35.8 |

% |

(810

bps) |

|

(22.6 |

%) |

|

|

|

Other income2,3 |

(4,086 |

) |

4,000 |

|

(8,086 |

) |

(202.2 |

%) |

|

|

|

Finance costs2 |

20,822 |

|

14,072 |

|

6,750 |

|

48.0 |

% |

|

|

|

Effective income tax rate |

37.6 |

% |

25.9 |

% |

1,170

bps |

|

45.2 |

% |

|

|

|

Net income |

19,467 |

|

32,542 |

|

(13,075 |

) |

(40.2 |

%) |

|

|

|

Diluted earnings per share |

1.16 |

|

2.11 |

|

(0.95 |

) |

(45.0 |

%) |

|

|

|

Return on equity |

12.0 |

% |

37.0 |

% |

(2,500

bps) |

|

(67.6 |

%) |

|

|

|

Return on tangible common equity |

17.1 |

% |

42.0 |

% |

(2,490

bps) |

|

(59.3 |

%) |

|

|

|

|

|

|

|

|

|

|

|

Adjusted Financial

Results1,2,3 |

|

|

|

|

|

|

|

Adjusted operating income |

79,870 |

|

53,994 |

|

25,876 |

|

47.9 |

% |

|

|

|

Adjusted operating margin |

39.5 |

% |

35.8 |

% |

370

bps |

|

10.3 |

% |

|

|

|

Adjusted net income |

43,687 |

|

29,072 |

|

14,615 |

|

50.3 |

% |

|

|

|

Adjusted diluted earnings per share |

2.61 |

|

1.89 |

|

0.72 |

|

38.1 |

% |

|

|

|

Adjusted return on equity |

26.9 |

% |

33.1 |

% |

(620

bps) |

|

(18.7 |

%) |

|

|

|

Adjusted return on tangible common equity |

38.5 |

% |

37.6 |

% |

90 bps |

|

2.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

Key Performance Indicators1 |

|

|

|

|

|

Same store revenue growth (overall) |

20.2 |

% |

1.1 |

% |

1,910

bps |

|

1,736.4 |

% |

|

|

|

Same store revenue growth (easyhome) |

7.9 |

% |

2.1 |

% |

580

bps |

|

276.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

Segment Financials |

|

|

|

|

|

|

|

easyfinancial revenue |

164,888 |

|

115,737 |

|

49,151 |

|

42.5 |

% |

|

|

|

easyfinancial operating margin |

45.4 |

% |

51.9 |

% |

(650

bps) |

|

(12.5 |

%) |

|

|

|

easyhome revenue |

37,468 |

|

34,940 |

|

2,528 |

|

7.2 |

% |

|

|

|

easyhome operating margin |

24.9 |

% |

21.4 |

% |

350

bps |

|

16.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

Portfolio Indicators |

|

|

|

|

|

|

|

Gross consumer loans receivable |

1,795,844 |

|

1,134,482 |

|

661,362 |

|

58.3 |

% |

|

|

|

Growth in consumer loans receivable4 |

518,553 |

|

(31,573 |

) |

550,126 |

|

1,742.4 |

% |

|

|

|

Gross loan originations |

379,082 |

|

170,842 |

|

208,240 |

|

121.9 |

% |

|

|

|

Total yield on consumer loans (including ancillary products) |

42.8 |

% |

42.6 |

% |

20 bps |

|

0.5 |

% |

|

|

|

Net charge offs as a percentage of average gross consumer loans

receivable |

8.2 |

% |

10.0 |

% |

(180

bps) |

|

(18.0 |

%) |

|

|

|

Cash provided by operating activities before net growth in gross

consumer loans receivable |

48,246 |

|

52,114 |

|

(3,868 |

) |

(7.4 |

%) |

|

|

|

Potential monthly lease revenue |

8,322 |

|

8,204 |

|

118 |

|

1.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

1 See description in sections “Portfolio Analysis” and “Key

Performance Indicators and Non-IFRS Measures” in June 30, 2021

Management’s Discussion and Analysis. 2 During the second quarter

of 2021, the Company had a total of $29.6 million before-tax ($24.2

million after-tax) of adjusting items which include: Adjusting

items related to the LendCare Acquisition • Transaction costs of

$8.4 million before-tax ($8.0 million after-tax) which include

advisory and consulting costs, legal costs, and other direct

transaction costs related to the Acquisition of LendCare reported

under Operating expenses before depreciation and amortization

amounting to $6.7 million which are non tax-deductible and loan

commitment fees related to the Acquisition of LendCare reported

under Finance costs amounting to $1.7 million before-tax ($1.3

million after-tax); • Integration costs related to advisory and

consulting costs, employee incentives, representation and warranty

insurance cost, and other integration costs related to the

Acquisition of LendCare reported under Operating expenses before

depreciation and amortization amounting to $0.6 million before-tax

($0.5 million after-tax); • Bad debt expense related to the day one

loan loss provision on the acquired loan portfolio from LendCare

amounting to $14.3 million before-tax ($10.5 million after-tax);

and • Amortization of $131 million intangible asset related to the

Acquisition of LendCare with an estimated useful life of ten years

amounting to $2.2 million before-tax ($1.6 million after-tax).

Adjusting item related to other income • Unrealized fair value loss

mainly on investments in Affirm and TRS amounting to $4.1 million

before-tax ($3.5 million after-tax). 3 During the second quarter of

2020, the Company’s adjusting items include: • Unrealized fair

value gain on investment in PayBright amounting to $4.0 million

before-tax ($3.5 million after-tax). 4 Growth in consumer loan

receivable during the period includes gross loan purchased through

the LendCare Acquisition amounting to $444.5 million. |

|

|

| |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

($ in 000’s except earnings per share and

percentages) |

Six Months Ended |

Variance |

Variance |

|

|

|

June 30, 2021 |

June 30, 2020 |

$ / bps |

% change |

|

|

|

Summary Financial Results |

|

|

|

|

|

Revenue |

372,530 |

|

317,879 |

|

54,651 |

|

17.2 |

% |

|

|

|

Operating expenses before depreciation and amortization2 |

216,010 |

|

187,720 |

|

28,290 |

|

15.1 |

% |

|

|

|

EBITDA1 |

221,720 |

|

116,070 |

|

105,650 |

|

91.0 |

% |

|

|

|

EBITDA margin1 |

59.5 |

% |

36.5 |

% |

2,300 bps |

63.0 |

% |

|

|

|

Depreciation and amortization expense2 |

36,498 |

|

31,946 |

|

4,552 |

|

14.2 |

% |

|

|

|

Operating income |

120,022 |

|

98,213 |

|

21,809 |

|

22.2 |

% |

|

|

|

Operating margin1 |

32.2 |

% |

30.9 |

% |

130 bps |

4.2 |

% |

|

|

|

Other income2,3 |

83,286 |

|

4,000 |

|

79,286 |

|

1,982.2 |

% |

|

|

|

Finance costs2 |

35,058 |

|

28,416 |

|

6,642 |

|

23.4 |

% |

|

|

|

Effective income tax rate |

21.9 |

% |

26.1 |

% |

(420 bps) |

(16.1 |

%) |

|

|

|

Net income |

131,442 |

|

54,521 |

|

76,921 |

|

141.1 |

% |

|

|

|

Diluted earnings per share |

8.10 |

|

3.51 |

|

4.59 |

|

130.8 |

% |

|

|

|

Return on equity |

45.3 |

% |

31.6 |

% |

1,370 bps |

43.4 |

% |

|

|

|

Return on tangible common equity |

60.4 |

% |

35.8 |

% |

2,460 bps |

68.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

Adjusted Financial

Results1,2,3 |

|

|

|

|

|

|

|

Adjusted operating income |

144,481 |

|

98,213 |

|

46,268 |

|

47.1 |

% |

|

|

|

Adjusted operating margin |

38.8 |

% |

30.9 |

% |

790 bps |

25.6 |

% |

|

|

|

Adjusted net income |

80,366 |

|

51,051 |

|

29,315 |

|

57.4 |

% |

|

|

|

Adjusted diluted earnings per share |

4.95 |

|

3.29 |

|

1.66 |

|

50.5 |

% |

|

|

|

Adjusted return on equity |

27.7 |

% |

29.6 |

% |

(190 bps) |

(6.4 |

%) |

|

|

|

Adjusted return on tangible common equity |

36.9 |

% |

33.6 |

% |

330 bps |

9.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

Key Performance Indicators1 |

|

|

|

|

|

Same store revenue growth (overall) |

10.4 |

% |

10.0 |

% |

40 bps |

4.0 |

% |

|

|

|

Same store revenue growth (easyhome) |

6.4 |

% |

3.3 |

% |

310 bps |

93.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

Segment Financials |

|

|

|

|

|

|

|

easyfinancial revenue |

298,217 |

|

247,525 |

|

50,692 |

|

20.5 |

% |

|

|

|

easyfinancial operating margin |

49.1 |

% |

45.1 |

% |

400 bps |

8.9 |

% |

|

|

|

easyhome revenue |

74,313 |

|

70,354 |

|

3,959 |

|

5.6 |

% |

|

|

|

easyhome operating margin |

24.7 |

% |

20.6 |

% |

410 bps |

19.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

Portfolio Indicators |

|

|

|

|

|

|

|

Gross consumer loans receivable |

1,795,844 |

|

1,134,482 |

|

661,362 |

|

58.3 |

% |

|

|

|

Growth in consumer loans receivable4 |

549,004 |

|

23,849 |

|

525,155 |

|

2,202.0 |

% |

|

|

|

Gross loan originations |

651,433 |

|

412,445 |

|

238,988 |

|

57.9 |

% |

|

|

|

Total yield on consumer loans (including ancillary products) |

43.4 |

% |

45.2 |

% |

(180 bps) |

(4.0 |

%) |

|

|

|

Net charge-offs as a percentage of average gross consumer loans

receivable |

8.6 |

% |

11.6 |

% |

(300 bps) |

(25.9 |

%) |

|

|

|

Cash provided by operating activities before net growth in gross

consumer loans receivable |

111,412 |

|

106,061 |

|

5,351 |

|

5.0 |

% |

|

|

|

Potential monthly lease revenue |

8,322 |

|

8,204 |

|

118 |

|

1.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

1 See description in sections “Portfolio Analysis” and “Key

Performance Indicators and Non-IFRS Measures” in June 30, 2021

Management’s Discussion and Analysis. 2 During the six-month period

ended June 30, 2021, the Company had a total of -$57.1 million

before-tax (-$51.1 million after-tax) adjusting items which

include: Adjusting items related to the LendCare Acquisition •

Transaction costs of $9.1 million before-tax ($8.7 million

after-tax) which include advisory and consulting costs, legal

costs, and other direct transaction costs related to the

Acquisition of LendCare reported under Operating expenses before

depreciation and amortization amounting to $7.4 million which are

non tax-deductible and loan commitment fees related to the

Acquisition of LendCare reported under Finance costs amounting to

$1.7 million before-tax ($1.3 million after-tax); • Integration

costs related to advisory and consulting costs, employee

incentives, representation and warranty insurance cost, and other

integration costs related to the Acquisition of LendCare reported

under Operating expenses before depreciation and amortization

amounting to $0.6 million before-tax ($0.5 million after-tax); •

Bad debt expense related to the day one loan loss provision on the

acquired loan portfolio from LendCare amounting to $14.3 million

before-tax ($10.5 million after-tax); and • Amortization of $131

million intangible asset related to the Acquisition of LendCare

with an estimated useful life of ten years amounting to $2.2

million before-tax ($1.6 million after-tax). Adjusting item related

to other income • Unrealized fair value gain mainly on investments

in Affirm and TRS amounting to $83.3 million before-tax ($72.3

million after-tax). 3 During the six-month period ended June 30,

2020, the Company’s adjusting items include: • Unrealized fair

value gain on investment in PayBright amounting to $4.0 million

before-tax ($3.5 million after-tax). 4 Growth in consumer loan

receivable during the period includes gross loan purchased through

the LendCare Acquisition amounting to $444.5 million. |

|

|

| |

|

| |

|

|

|

|

|

|

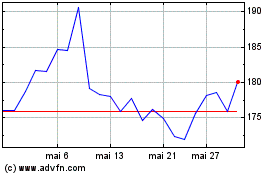

Goeasy (TSX:GSY)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Goeasy (TSX:GSY)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024