SmallCapPower | April 4, 2017: In Part

3 of our Excel How-to series,

we are going to explore how to analyze the financial strength of

gold companies using the Gold Investor Pro report. If

you missed the opportunity to view the prior sections, click

here: Part 1, Part 2.

Read part 3 of the original report here - https://smallcappower.com/top-stories/gold-stock-investing/

Mining is a capital-intensive business, with significant costs

stemming from the acquisition of properties and royalty fees to

stripping and drilling costs. As a result, gold companies take on

debt in order to finance their exploration, development, and

production endeavors. However, not all debt is treated equal, as

companies vary in their debt structure, revenues, and leverage.

Thus, some companies entail more risk than others, such as

exploration phase stocks that have yet to produce their first gold

pour and revenues. Yet, these same high-risk exploration stocks

have the potential to yield the greatest returns!

In Part 3, we will explore financial ratios such as debt to equity,

debt to EBITDA, and cash burn rates. This will allow us to compare

the financial performance of each company against its industry

peers in our Gold Investor Pro Report to find those stocks that may

be undervalued.

Debt to Equity (D/E)

A widely-used financial ratio to measure the riskiness of a

company’s financial structure is the debt-to-equity ratio. The

calculation reveals the relative proportion of debt and

shareholders’ equity a company employs to finance its assets,

usually as a ratio or percentage. Although debt is widely

considered the cheapest form of financing, a high-debt gold company

may be overwhelmed to service its payment obligations in a bullion

price downturn. Additionally, a high-debt profile also limits a

company from being able to borrow more from lenders and creditors,

which reduces their financial flexibility.

A low debt-to-equity ratio indicates lower risk, and signifies

the company’s ability increase leverage if need be. A higher

debt-to-equity ratio, on the other hand, shows that a company has

been aggressive in financings its growth with debt, and there may

be greater potential for financial distress if earnings do not

exceed the cost of borrowed funds.

To calculate the D/E ratio, divide total liabilities of the

company by its total shareholders’ equity. This has already been

done for you in the ‘Market Data’ Excel sheet (AM-4). Below, we

show you how to filter for the gold companies with the lowest

debt-to-equity ratios. As you can see in Figure

1, Endeavour Mining Corp. (TSX: EDV), Gold Standard Ventures

Corp (TSXV: GSV), Dalradian Resources

Inc. (TSX: DNA), and Lundin Gold

Inc. (TSX: LUG), all have a D/E ratio of 0x, implying

they have no debt.

Figure 1: Using Excel to Filter for Low D/E

Ratios

View the Gold Investor Pro: Top 34 Gold Companies

Analyzed

You can read the original article here.

Debt to EBITDA (D/EBITDA)

The Debt-to-EBITDA ratio calculates how many years of earnings a

company would require to service its current debt obligations. It

is a leverage ratio that measures a company’s ability to pay off

its incurred debt, ignoring factors of interest, taxes,

depreciation, and amortization. For more information regarding

EBITDA, check out our explanation in Part 2 of our Gold Investor Pro How-to

series.

This metric is commonly used by credit rating agencies to assess

a company’s probability of defaulting on issued debt. Hence, a high

D/EBITDA ratio suggests a company may not be able to service its

debt in an appropriate manner and warrants a lower credit rating.

For example, if Company A has $100mm in debt and $10mm in EBITDA,

the D/EBITDA ratio is 10x. If Company B has $60mm in debt and $5mm

in EBITDA, the D/EBITDA ratio is 12x. In this case, Company A would

be less risky as it has a lower D/EBITDA multiple, and may also

have a higher credit rating.

To manually calculate the D/EBITDA ratio, divide total debt

(short-term and long-term) of the company by its EBITDA (net income

+ interest + taxes + depreciation + amortization). Fortunately for

you, this has already been calculated in the ‘Market Data’ Excel

sheet (AK-4). Below, we show you how to filter for the gold

companies with the lowest debt-to-EBITDA ratios. It is worth noting

that companies operating at a loss will have a negative D/EBITDA,

implying an even riskier business. As you can see in Figure

2, Alacer Gold Corp. (TSX: ASR), Dalradian Resources Inc. (TSX: DNA), Lundin Gold Inc.

(TSX: LUG), and a few others all

have a D/EBITDA ratio of 0x.

Figure 2: Using

Excel to Filter for Low D/EBITDA Ratios

View the Gold Investor Pro: Top 34 Gold Companies

Analyzed

You can read the original article here.

Cash Burn Rates

Many gold companies, such as those in the exploration or

development phase, have yet to earn income and thus operate at a

loss. This is because these companies are focused on property

development and, ultimately, proving an economic deposit. As a

result, exploration companies invest heavily in drilling and

exploration campaigns to increase the quality and quantity of their

resource base.

Cash burn rates, or burn rate, refers to how fast a company is

losing money, which is a negative number computed monthly or

quarterly. This is extremely important when a company has limited

sources of funding to cover losses. If a company has a constant

burn rate and a finite amount of cash, it will eventually run out

of money. In accounting terms, cash balance is a balance and burn

rate is a flow. Burn decreases a company’s cash balance—the amount

of money a company has at any given point. ‘Runway’ is the time a

company has until it runs out of money, which is calculated by

dividing the cash balance by the company’s burn rate. For example,

if a company has $500k in cash and cash equivalents (CCE) and will

burn $25k/month, it has a runway of 20 months. After these 20

months, if the company is still in an exploration stage then it

will have to raise additional financing (usually equity) in order

to stay afloat and continue exploring.

As you may have guessed, a higher burn rate generally entails

more risk. To calculate a company’s burn rate, divide its annual

cash flows from operations by 12 for a monthly burn rate, or 4 for

quarterly. Then divide the company’s cash and cash equivalents

(CCE) by its burn rate to find the runway. These calculations are

already included in the ‘Market Data’ Excel sheet, in the column

titled ‘Burn Rate (quarterly) and ‘Runway (quarterly).’ Since our

focus was on producers, most of the companies (besides 5) have

positive operating cash flows; therefore, they don’t have a cash

“burn” rate. This burn is usually only applicable to exploration

and early development-stage companies that have yet to generate

cash from operations.

As you can see in Figure 3, Lundin Gold Inc. (TSX: LUG) has the highest burn rate

at US$14.3mm/quarter. With a cash balance of US$9mm, Lundin Gold

has a runway of 0.6 quarters (US$9/US$14.3) before it would have to

find new financing.

Figure 3: Using Excel to

Calculate and Filter for High Quarterly Burn Rates

Make your own analysis for other top gold stocks such as

Kinross Gold Corp. (TSX: K), Barrick Gold Corp.

(TSX:ABX) and Golden Star

Resources Ltd. (TSXV: GSC) using the free report and

supporting spread sheet.

View the Gold Investor Pro: Top 34 Gold Companies

Analyzed

You can read the original article here.

When analyzing gold companies, no single multiple or

valuation technique will isolate the best stock in which to

invest. Instead, a collaborative approach must be

adopted, where we employ qualitative measures, valuation

calculations, and a financial analysis.

Now that we have gone through all three parts of our ‘Excel

How-to’ series, it is now time to apply the learnings to the

spreadsheets. Take some time to sift through the data to find those

companies with the relative risk and return profiles that match

your investor appetite for risk and reward.

Stay tuned for next week, when we will have one of our

leading research analysts provide his own expert valuation as to

which gold stocks are likely to outperform their industry

peers!

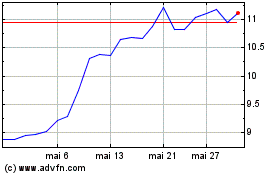

Kinross Gold (TSX:K)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Kinross Gold (TSX:K)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025