Liberty Gold Corp. (TSX: LGD; OTCQX: LGDTF) (“Liberty Gold” or the

“Company”) is pleased to report new exploration drill results from

its Black Pine oxide gold project in southeastern Idaho, together

with a summary of 2022 activities. These results form part of a 324

hole, 67,000 metre (“m”) 2022 reverse circulation (“RC”) and core

drilling program at Black Pine to upgrade and expand the current

mineral resource and discover new oxide gold mineralization.

Project de-risking activities have progressed in parallel with

resource delineation drilling at Black Pine, with the objective of

front-end loading technical work in advance of the mine permitting

phase.

New Drilling Highlights:

- Extended shallow mineralization

along the southern edge of the Discovery Zone:

- 0.60 grams per

tonne gold (“g/t Au”) over 80.8 m from 24.4 m to 105.2 m, including

1.47 g/t Au over 13.7 m in LBP750

- Completed resource

delineation drilling in the F Zone:

- 0.47 g/t Au over

47.2 m from 9.1 m to 56.4 m in LBP744

- Further defined

oxide gold mineralization in the A Basin surficial waste rock

storage area:

- 0.30 g/t Au over

33.5 m from 1.5 m to 35.1 m in LBP675

- Discovered a new,

shallow zone of oxide gold mineralization in the Bobcat target:

- 0.64 g/t Au over

19.8 m from surface in LBP761

- Drilled the South

Rangefront target located approximately 500 m south of the southern

edge of the Rangefront Zone:

- 0.57 g/t Au over

51.8 m in LBP708

2022 De-risking Activities:

- Expansion of

mineralization in the F, E, M, CD and Rangefront zones (see press

releases dated November 8 and November 15, 2022) including areas of

shallow higher-grade mineralization that may serve to consolidate

smaller pits into fewer, larger ones and change the grade profile

of the early years of mining.

- Acquisition of

strategic Idaho State (Section 36) and private mineral rights which

have the potential to provide access for future mine infrastructure

development (see press release dated February 10, 2022).

- Drilled 14

large-diameter (“PQ”) metallurgical core holes, generating

composites from throughout the property for column testing; results

expected over the second half of 2023 (see press release dated

August 2, 2022).

- Permitted a new

Plan of Operations with the Bureau of Land Management (“BLM”) to

explore areas to the east of the current Black Pine deposit

footprint (see press release dated September 12, 2022).

- Submitted a

modification to the existing United States Forest Service (“USFS”)

Plan of Operations to expand the footprint of the Black Pine gold

system (see press release dated November 28, 2022).

- Acquired new

water rights out of the Black Pine Mine bankruptcy, sufficient to

sustain a large, open-pit heap leach mining operation (see press

release dated November 28, 2022).

Jason Attew, President and CEO of

Liberty Gold commented, “By any measure, the 2022

exploration and development programs at Black Pine were a

resounding success. Not only have we encountered oxide gold in

virtually every hole we have received assay results for this year,

but we have increased substantively the footprint of the Black Pine

gold system, expanded areas of near-surface, higher-grade

mineralization, and discovered new oxide gold mineralization in at

least two peripheral targets. We have materially de-risked the

project by securing process water, acquiring private and state

mineral rights, which would allow us to site future mine

infrastructure and have secured Federal permits for expanded

exploration drilling in the coming year. We look

forward to continued success in the new year with the release of

assay result from an estimated 80 pending holes to close out the

2022 drilling campaign, an updated resource estimate and further

growth and advancement of the project.”

For a map and cross sections showing locations

of drill holes in this release click

here:https://libertygold.ca/images/news/2022/December/BlackPine12132022Map_Sections.pdf

For a table showing complete drill results for

all Liberty Gold drilling to date at Black Pine, click

here:https://libertygold.ca/images/news/2022/December/BlackPine12132022AllDrillResults.pdf

Drilling at Black Pine was completed for the

season on December 13, 2022. Current drill results are summarized

below per mineralized zone:

DISCOVERY SOUTH RESOURCE UPGRADE

DRILLING

Two holes tested an area of sparse historic

drilling near the edge of the backfilled original Tallman Pit, the

site of the first open pit mining at Black Pine in the 1950’s.

Results from these holes were better than expected, with above

averaged grades and cyanide solubility at shallow depth.

DISCOVERY SOUTH HIGHLIGHT

TABLE*

|

Hole ID (Az, Dip)(degrees) |

From(m) |

To(m) |

Intercept(m) |

Au(g/t) |

AuCut-Off |

HoleLength(m) |

Target |

Comments |

|

LBP750 (300, -90) |

24.4 |

105.2 |

80.8 |

0.60 |

0.15 |

105.2 |

Discovery South(Tallman Area) |

Resource Expansion |

|

including |

24.4 |

83.8 |

59.4 |

0.67 |

0.20 |

|

and including |

30.5 |

44.2 |

13.7 |

1.47 |

1.00 |

|

and including |

100.6 |

102.1 |

1.5 |

1.59 |

1.00 |

|

LBP754 (300, -50) |

33.5 |

39.6 |

6.1 |

0.24 |

0.15 |

147.8 |

Discovery South(Tallman Area) |

Resource Expansion |

|

and |

80.8 |

111.3 |

30.5 |

0.50 |

|

|

including |

89.9 |

91.4 |

1.5 |

1.05 |

1.00 |

|

including |

94.5 |

96.0 |

1.5 |

1.69 |

*Please refer to the full table at the link

above for complete results. Results are reported as drilled

thicknesses, with true thicknesses approximately 50 to 90% of

drilled thickness. Gold grades are uncapped. Au (g/t) = grams per

tonne of gold.

BOBCAT SHALLOW OXIDE GOLD

DISCOVERY

An area approximately 500 m south of the CD

historic pit with limited shallow historic drilling was explored by

Liberty Gold with 14 drill holes. An area measuring approximately

400 m x 200 m was identified for follow-up drilling with an

additional 13 shallow holes, resulting in identification of an area

of shallow gold mineralization. The zone is still open for

expansion in several directions, with additional drilling planned

for 2023.

BOBCAT ZONE HIGHLIGHT

TABLE*

|

Hole ID (Az, Dip)(degrees) |

From(m) |

To(m) |

Intercept(m) |

Au(g/t) |

AuCut-Off |

HoleLength(m) |

Target |

Comments |

|

LBP635 (0, -45) |

62.5 |

74.7 |

12.2 |

0.31 |

0.15 |

269.7 |

Bobcat |

Reconnaissance |

|

including |

62.5 |

70.1 |

7.6 |

0.41 |

0.20 |

|

and |

88.4 |

103.6 |

15.2 |

0.29 |

0.15 |

|

including |

99.1 |

103.6 |

4.6 |

0.47 |

0.20 |

|

and |

109.7 |

118.9 |

9.1 |

0.64 |

0.15 |

|

including |

109.7 |

117.3 |

7.6 |

0.73 |

0.20 |

|

and including |

112.8 |

114.3 |

1.5 |

1.06 |

1.00 |

|

LBP643 (40, -55) |

155.4 |

166.1 |

10.7 |

0.62 |

0.20 |

281.9 |

Bobcat |

Reconnaissance |

|

LBP648 (90, -50) |

41.1 |

42.7 |

1.5 |

2.22 |

1.00 |

342.9 |

Bobcat |

Reconnaissance |

|

and |

83.8 |

85.3 |

1.5 |

2.20 |

|

LBP653 (45, -45) |

140.2 |

164.6 |

24.4 |

0.37 |

0.15 |

214.9 |

Bobcat |

Reconnaissance |

|

including |

140.2 |

150.9 |

10.7 |

0.54 |

0.20 |

|

and including |

144.8 |

146.3 |

1.5 |

1.17 |

1.00 |

|

including |

155.4 |

163.1 |

7.6 |

0.28 |

0.20 |

|

LBP655 (45, -45) |

22.9 |

30.5 |

7.6 |

0.66 |

0.20 |

227.1 |

Bobcat |

Reconnaissance |

|

and |

61.0 |

85.3 |

24.4 |

0.26 |

0.15 |

|

including |

61.0 |

67.1 |

6.1 |

0.42 |

0.20 |

|

LBP681 (135, -45) |

12.2 |

18.3 |

6.1 |

0.64 |

0.15 |

153.9 |

Bobcat |

Reconnaissance |

|

including |

13.7 |

16.8 |

3.0 |

1.11 |

0.20 |

|

and including |

13.7 |

15.2 |

1.5 |

1.77 |

1.00 |

|

LBP760 (0, -90) |

3.0 |

12.2 |

9.1 |

0.24 |

0.20 |

50.3 |

Bobcat |

Resource Definition |

|

and |

27.4 |

44.2 |

16.8 |

0.26 |

0.15 |

|

including |

27.4 |

42.7 |

15.2 |

0.27 |

0.20 |

|

LBP761 (0, -90) |

0.0 |

19.8 |

19.8 |

0.64 |

0.15 |

50.3 |

Bobcat |

Resource Definition |

|

and |

33.5 |

44.2 |

10.7 |

0.26 |

0.15 |

|

including |

33.5 |

39.6 |

6.1 |

0.33 |

0.20 |

|

LBP764 (35, -45) |

88.4 |

94.5 |

6.1 |

1.29 |

0.20 |

152.4 |

Bobcat |

Resource Definition |

|

including |

89.9 |

93.0 |

3.0 |

2.07 |

1.00 |

*Please refer to the full table at the link

above for complete results. Results are reported as drilled

thicknesses, with true thicknesses approximately 50 to 90% of

drilled thickness. Gold grades are uncapped. Au (g/t) = grams per

tonne of gold.

F ZONE

Drilling in the F Zone for resource expansion

was completed with the addition of five holes in the northern

portion of the zone to close a gap between the F and Discovery

zones and one in the main F Zone area for infill. The drilling

identified shallow surface oxide mineralization in the gap.

F ZONE HIGHLIGHT TABLE*

|

Hole ID (Az, Dip)(degrees) |

From(m) |

To(m) |

Intercept(m) |

Au(g/t) |

AuCut-Off |

HoleLength(m) |

Target |

Comments |

|

LBP725 (280, -45) |

73.2 |

80.8 |

7.6 |

0.39 |

0.15 |

153.9 |

F Zone North |

Resource Expansion |

|

including |

74.7 |

80.8 |

6.1 |

0.45 |

0.20 |

|

and |

89.9 |

103.6 |

13.7 |

1.23 |

|

including |

93.0 |

102.1 |

9.1 |

1.44 |

1.00 |

|

LBP732 (245, -45) |

0.0 |

35.1 |

35.1 |

0.37 |

0.20 |

123.4 |

F Zone North |

Resource Expansion |

|

and |

54.9 |

65.5 |

10.7 |

0.37 |

0.15 |

|

including |

56.4 |

65.5 |

9.1 |

0.40 |

0.20 |

|

LBP744 (190, -45) |

9.1 |

56.4 |

47.2 |

0.47 |

0.15 |

147.8 |

F Zone |

Resource Expansion |

|

including |

9.1 |

45.7 |

36.6 |

0.53 |

0.20 |

|

and including |

12.2 |

16.8 |

4.6 |

1.68 |

1.00 |

*Please refer to the full table at the link

above for complete results. Results are reported as drilled

thicknesses, with true thicknesses approximately 50 to 90% of

drilled thickness. Gold grades are uncapped. Au (g/t) = grams per

tonne of gold.

A BASIN WASTE ROCK STORAGE AREA

The A Basin waste rock storage area was targeted for further

drilling following the identification of oxide gold mineralized

surficial material in previous drilling. Drill holes continued to

intersect shallow gold mineralization in the waste rock storage

area in excess of the expected resource cut-off grade, as well as

in bedrock immediately underlying the waste rock storage.

A BASIN HIGHLIGHT TABLE*

|

Hole ID (Az, Dip)(degrees) |

From(m) |

To(m) |

Intercept(m) |

Au(g/t) |

AuCut-Off |

HoleLength(m) |

Target |

Comments |

|

LBP664 (0, -90) |

0.0 |

10.7 |

10.7 |

0.32 |

0.15 |

202.7 |

A Basin Waste Rock Storage |

Waste Rock |

|

including |

0.0 |

7.6 |

7.6 |

0.37 |

0.20 |

|

and |

73.2 |

96.0 |

22.9 |

0.87 |

Bedrock |

|

including |

83.8 |

89.9 |

6.1 |

1.11 |

1.00 |

|

including |

93.0 |

96.0 |

3.0 |

1.88 |

1.00 |

|

LBP669 (0, -90) |

0.0 |

32.0 |

32.0 |

0.22 |

0.15 |

208.8 |

A Basin Waste Rock Storage |

Waste Rock |

|

including |

7.6 |

22.9 |

15.2 |

0.26 |

0.20 |

|

LBP675 (0, -90) |

1.5 |

35.1 |

33.5 |

0.30 |

0.20 |

56.4 |

A Basin Waste Rock Storage |

Resource DefinitionReduced cyanide solubility |

|

and |

42.7 |

53.3 |

10.7 |

0.23 |

0.15 |

|

LBP676 (120, -50) |

19.8 |

57.9 |

38.1 |

0.22 |

0.15 |

91.4 |

B Pit Backfill |

Waste Rock extends to TD |

|

and |

65.5 |

88.4 |

22.9 |

0.23 |

0.15 |

|

including |

65.5 |

74.7 |

9.1 |

0.26 |

0.20 |

|

LBP748 (0, -90) |

0.0 |

24.4 |

24.4 |

0.23 |

0.15 |

184.4 |

A Basin Waste RockStorage |

Waste Rock |

|

and |

105.2 |

125.0 |

19.8 |

0.62 |

|

Bedrock |

|

including |

109.7 |

111.3 |

1.5 |

1.14 |

1.00 |

|

including |

123.4 |

125.0 |

1.5 |

1.21 |

|

LBP753 (0, -90) |

0.0 |

35.1 |

35.1 |

0.26 |

0.15 |

227.1 |

A Basin Waste Rock Storage |

Resource Definition |

|

including |

13.7 |

30.5 |

16.8 |

0.34 |

0.20 |

|

and |

56.4 |

79.2 |

22.9 |

0.29 |

0.15 |

|

including |

68.6 |

79.2 |

10.7 |

0.44 |

0.20 |

|

and including |

70.1 |

71.6 |

1.5 |

1.02 |

1.00 |

*Please refer to the full table at the link

above for complete results. Results are reported as drilled

thicknesses, with true thicknesses approximately 50 to 90% of

drilled thickness. Gold grades are uncapped. Au (g/t) = grams per

tonne of gold.

RANGEFRONT ZONE EXPANSION

Drilling continues in the Rangefront Zone to

expand the limits of the zone and infill areas with lower drill

density. Drilling will continue throughout the winter months to

ensure the largest possible area is drilled off to Indicated for

inclusion in any subsequent engineering studies.

One reconnaissance hole was drilled 500 m south

of the southern edge of the Rangefront Zone as presently defined

(“South Rangefront”). The hole encountered 0.57 g/t Au over 51.8 m

starting at 440.4 m. While this gold mineralization is deep and

non-oxide, it indicates that the Black Pine gold system is present

in this area. Follow-up drilling to identify shallower zones of

oxide mineralization associated with this discovery is planned for

2023.

RANGEFRONT ZONE HIGHLIGHT TABLE*

|

Hole ID (Az, Dip)(degrees) |

From(m) |

To(m) |

Intercept(m) |

Au(g/t) |

AuCut-Off |

HoleLength(m) |

Target |

Comments |

|

LBP708 (210, -65) |

27.4 |

36.6 |

9.1 |

0.17 |

0.15 |

492.3 |

South Rangefront |

Reconnaissance reduced cyanide solubility below

420 m |

|

and |

420.6 |

423.7 |

3.0 |

0.55 |

|

including |

420.6 |

422.1 |

1.5 |

0.93 |

0.20 |

|

and |

440.4 |

492.3 |

51.8 |

0.57 |

|

including |

458.7 |

461.8 |

3.0 |

1.36 |

1.00 |

|

LBP735 (270, -55) |

15.2 |

32.0 |

16.8 |

0.26 |

0.15 |

269.7 |

Rangefront |

Resource Upgrade |

|

and |

106.7 |

117.3 |

10.7 |

0.20 |

|

and |

123.4 |

135.6 |

12.2 |

0.41 |

|

including |

125.0 |

134.1 |

9.1 |

0.49 |

0.20 |

|

and including |

129.5 |

131.1 |

1.5 |

1.14 |

1.00 |

|

and |

178.3 |

184.4 |

6.1 |

0.68 |

0.20 |

|

including |

181.4 |

182.9 |

1.5 |

1.01 |

1.00 |

|

and |

196.6 |

207.3 |

10.7 |

0.43 |

0.20 |

|

LBP741 (205, -55) |

73.2 |

82.3 |

9.1 |

0.20 |

0.15 |

251.5 |

Rangefront |

Resource Upgrade |

|

and |

112.8 |

144.8 |

32.0 |

0.34 |

0.15 |

|

including |

121.9 |

132.6 |

10.7 |

0.36 |

0.20 |

|

including |

138.7 |

144.8 |

6.1 |

0.79 |

|

and including |

141.7 |

144.8 |

3.0 |

1.38 |

1.00 |

|

and |

147.8 |

178.3 |

30.5 |

0.22 |

0.15 |

|

LBP745 (115, -45) |

65.5 |

93.0 |

27.4 |

0.36 |

0.20 |

182.9 |

Rangefront |

Resource Upgrade |

|

and |

99.1 |

106.7 |

7.6 |

0.26 |

0.15 |

|

and |

170.7 |

182.9 |

12.2 |

0.30 |

|

|

including |

176.8 |

182.9 |

6.1 |

0.43 |

0.20 |

|

LBP746 (30, -65) |

35.1 |

42.7 |

7.6 |

0.28 |

0.15 |

251.5 |

Rangefront |

Resource Upgrade |

|

and |

73.2 |

93.0 |

19.8 |

0.32 |

|

and |

123.4 |

152.4 |

29.0 |

0.19 |

|

and |

184.4 |

210.3 |

25.9 |

0.49 |

0.15 |

|

including |

184.4 |

208.8 |

24.4 |

0.51 |

0.20 |

|

and including |

202.7 |

205.7 |

3.0 |

1.71 |

1.00 |

*Please refer to the full table at the link

above for complete results. Results are reported as drilled

thicknesses, with true thicknesses approximately 50 to 90% of

drilled thickness. Gold grades are uncapped. Au (g/t) = grams per

tonne of gold. The base of the zone is situated at the lowest

structural level of the deposit, such that carbonaceous material is

frequently encountered at the base of the oxide zone, leading to

reduced cyanide solubility at depth.

With the 2022 field program recently completed,

drilling will resume in lower elevation areas on January 6, 2023.

The Black Pine resource model will be updated progressively over

the next months as assays become available and work remains on

track for an updated resource estimate release in the first quarter

2023.

QUALIFIED

PERSON

Moira Smith, Ph.D., P.Geo., Vice-President

Exploration and Geoscience, Liberty Gold, is the Company's

designated Qualified Person for this news release within the

meaning of National Instrument 43-101 Standards of Disclosure for

Mineral Projects ("NI 43-101") and has reviewed and validated that

the information contained in the release is accurate.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and

developing open pit oxide deposits in the Great Basin of the United

States, home to large-scale gold projects that are ideal for

open-pit mining. This region is one of the most prolific

gold-producing regions in the world and stretches across Nevada and

into Idaho and Utah. We know the Great Basin and are driven to

discover and advance big gold deposits that can be mined profitably

in open- pit scenarios. Our flagship projects are Black Pine in

Idaho and Goldstrike in Utah, both past- producing open-pit mines,

where previous operators only scratched the surface.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations Phone:

604-632-4677 or Toll Free 1-877-632-4677 info@libertygold.ca

QUALITY ASSURANCE – QUALITY CONTROL

Drill composites were calculated using a cut-off

of 0.10 g/t Au. Drill intersections are reported as drilled

thicknesses. True widths of the mineralized intervals vary between

30% and 100% of the reported lengths due to varying drill hole

orientations but are typically in the range of 50% to 90% of true

width. Drill samples were assayed by ALS Limited in Reno, Nevada

for gold by Fire Assay of a 30 gram (1 assay ton) charge with an AA

finish, or if over 5.0 g/t were re-assayed and completed with a

gravimetric finish. For these samples, the gravimetric data were

utilized in calculating gold intersections. For any samples

assaying over 0.10 ppm an additional cyanide leach analysis is done

where the sample is treated with a 0.25% NaCN solution and rolled

for an hour. An aliquot of the final leach solution is then

centrifuged and analyzed by Atomic Absorption Spectroscopy. QA/QC

for all drill samples consists of the insertion and continual

monitoring of numerous standards and blanks into the sample stream,

and the collection of duplicate samples at random intervals within

each batch. Selected holes are also analyzed for a 51 multi-element

geochemical suite by ICP-MS. ALS Geochemistry-Reno is ISO

17025:2005 Accredited, with the Elko and Twin Falls prep lab listed

on the scope of accreditation.

All statements in this press release, other than

statements of historical fact, are "forward-looking information"

with respect to Liberty Gold within the meaning of applicable

securities laws, including statements that address potential

quantity and/or grade of minerals. Forward-looking information is

often, but not always, identified by the use of words such as

"seek", "anticipate", "plan", "continue", "planned", "expect",

"project", "predict", "potential", "targeting", "intends",

"believe", "potential", and similar expressions, or describes a

"goal", or variation of such words and phrases or state that

certain actions, events or results "may", "should", "could",

"would", "might" or "will" be taken, occur or be achieved.

Forward-looking information is not a guarantee of future

performance and is based upon a number of estimates and assumptions

of management at the date the statements are made including, among

others, assumptions about future prices of gold, and other metal

prices, currency exchange rates and interest rates, favourable

operating conditions, political stability, obtaining governmental

approvals and financing on time, obtaining renewals for existing

licenses and permits and obtaining required licenses and permits,

labour stability, stability in market conditions, availability of

equipment, timing of assay results, scalability of metallurgical

results, results and accuracy of mineral resources, the

availability of drill rigs, successful resolution of disputes and

anticipated costs and expenditures. Many assumptions are based on

factors and events that are not within the control of Liberty Gold

and there is no assurance they will prove to be correct.

Such forward-looking information, involves known

and unknown risks, which may cause the actual results to be

materially different from any future results expressed or implied

by such forward-looking information, including, risks related to

the interpretation of results and/or the reliance on technical

information provided by third parties as related to the Company’s

mineral property interests; changes in project parameters as plans

continue to be refined; current economic conditions; future prices

of commodities; possible variations in grade or recovery rates; the

costs and timing of the development of new deposits; failure of

equipment or processes to operate as anticipated; the failure of

contracted parties to perform; the timing and success of

exploration activities generally; timing of any preliminary

economic assessments or feasibility assessments; scalability of

metallurgical results, delays in permitting; possible claims

against the Company; labour disputes and other risks of the mining

industry; delays in obtaining governmental approvals, financing or

in the completion of exploration as well as those factors discussed

in the Annual Information Form of the Company dated March 25, 2022

in the section entitled "Risk Factors", under Liberty Gold’s SEDAR

profile at www.sedar.com.

Although Liberty Gold has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking information, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate as actual results and future events could

differ materially from those anticipated in such statements.

Liberty Gold disclaims any intention or obligation to update or

revise any forward-looking information, whether as a result of new

information, future events or otherwise.

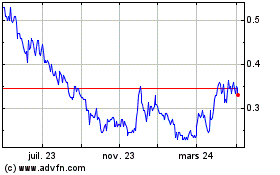

Liberty Gold (TSX:LGD)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

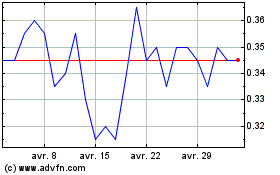

Liberty Gold (TSX:LGD)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024