Maxim Power Corp. ("MAXIM" or the "Corporation") (TSX: MXG)

announced today the release of financial and operating results for

the third quarter and nine months ended September 30, 2023. The

unaudited condensed consolidated interim financial statements,

accompanying notes and Management’s Discussion and Analysis

(“MD&A”) will be available on SEDAR+ and on MAXIM's website on

November 6, 2023. All figures reported herein are Canadian dollars

unless otherwise stated.

FINANCIAL HIGHLIGHTS

| |

Three Months Ended September

30, |

Nine Months EndedSeptember

30, |

|

($ in thousands except per share amounts) |

2023 |

2022 |

2023 |

2022 |

| Revenue |

2,468 |

57,091 |

2,468 |

141,263 |

| Net income

(loss) |

(4,897) |

23,970 |

8,818 |

49,433 |

| Earnings (loss) per

share – basic |

(0.10) |

0.48 |

0.18 |

0.99 |

| Earnings (loss) per

share – diluted |

(0.10) |

0.39 |

0.18 |

0.82 |

| Adjusted

EBITDA (1) |

(1,545) |

39,739 |

19,174 |

74,413 |

| Total generation –

(MWh) |

31,627 |

280,290 |

31,627 |

1,064,693 |

| Total fuel consumption

– (GJ) |

436,985 |

2,943,544 |

459,492 |

11,242,662 |

| Average Alberta market

power price ($ per MWh) |

151.60 |

221.41 |

162.00 |

145.11 |

| Average realized power

price ($ per MWh) |

78.03 |

203.68 |

78.03 |

132.68 |

| Total net

debt (1) |

37,695 |

6,873 |

37,695 |

6,873 |

| Total

assets |

389,432 |

390,014 |

389,432 |

390,014 |

(1) Select financial information was derived from

the consolidated financial statements and is prepared in accordance

with GAAP, except adjusted Earnings before Interest, Income Taxes,

Depreciation and Amortization (“Adjusted EBITDA”), which is a

non-GAAP measure (see Non-GAAP Financial Measures

below). Net debt is included in the notes to the consolidated

financial statements. It is calculated to include: loans and

borrowings (including the convertible loan facility) less

unrestricted cash

OPERATING RESULTS

During the third quarter of 2023, MAXIM recorded

a net loss and negative Adjusted EBITDA(1) of $4.9 million and $1.5

million, respectively, as compared to net income of $24.0 million

and positive Adjusted EBITDA of $39.7 million, respectively, in the

same period of 2022. Net income in the third quarter of 2023

decreased as compared to the same period in 2022 primarily due to

lower generation volumes at Milner 2 (“M2”) as a result of offline

repairs to the air inlet filter house and commissioning work in the

third quarter of 2023, partially offset by the approved business

interruption claims in 2023, less income tax expense in 2023 and

higher unrealized and realized commodity swap losses in 2022. A

significant portion of the decrease to Adjusted EBITDA(1) was due

to the M2 unplanned outage in the third quarter of 2023, partially

offset by the approved business interruption claims (see

Insurance Information Update below).

M2 CCGT EXPANSION

COMMISSIONING

As previously reported, MAXIM has successfully

commissioned the Combined Cycle Gas Turbine (“CCGT”) expansion of

M2. Construction of the heat recovery technology required to expand

M2 into a CCGT facility commenced in 2021 and the project was

originally expected to commission in the fourth quarter of 2022.

Commissioning was delayed due to the non-injury fire on September

30, 2022, which caused damage to M2’s air inlet filter house.

Repairs commenced shortly after and completed in August of 2023 to

allow for the recommencement of commissioning activities. M2 began

generating intermittent electricity to the grid on August 14, 2023,

and achieved CCGT commercial operations on October 24, 2023.

The CCGT expansion of M2 is expected to increase

the maximum generation capacity of the HR Milner (“Milner”) site to

300 MW and has been designed to lower operations and maintenance

costs per MWh. The CCGT expansion of M2 captures waste heat that

would otherwise exhaust into the atmosphere and converts it into

useful low carbon dispatchable electricity for the Alberta power

grid. The estimated final project cost of the CCGT expansion of M2

is currently $164 million, excluding borrowing costs and the net

effect of $20 million of grant proceeds.

This significant milestone completes the coal to

gas energy transformation and repowering project at the Milner site

which saw over $300 million of investment and successfully

converted the legacy 150 MW coal-fired facility into a 300 MW CCGT

facility. The CCGT expansion of M2 is expected to reduce the

intensity of carbon emissions by more than 60% compared to the

legacy coal-fired Milner facility.

INSURANCE INFORMATION

UPDATE

MAXIM reaffirms coverage for the non-injury fire

incident subject to the terms and conditions of the Corporation’s

property insurance policy, including business interruption

provisions. As of the date of this press release, MAXIM has

cumulatively submitted claims for $87.0 million, of which $60.5

million relates to business interruption and $26.5 million relates

to property damage. As of the date of this press release, $63.0

million has been paid by insurance companies in relation to these

claims. MAXIM anticipates receiving a majority of the amounts

claimed and the primary difference in the amounts claimed and

received or recognized is due to timing of the approval by the

insurers. MAXIM has only recognized insurance claims approved by

the insurers and claims pending approval are not recognized in the

interim financial statements.

As previously reported, MAXIM submitted an

additional insurance claim for a delay in start up related to the

non-injury fire incident under its Course of Construction (“COC”)

insurance policy, which includes a provision for Delay in Start Up

(“DSU”) coverage relating to the CCGT expansion of M2. The

Corporation has received a denial of coverage under this policy

from the insurer and is currently evaluating its options in

relation to this claim. No amounts have been recognized by the

Corporation in relation to this claim.

NORMAL COURSE ISSUER BID

UPDATE

MAXIM’s current Normal Course Issuer Bid

(“NCIB”) program allows for the purchase and cancellation of up to

2,526,477 common shares of the Corporation (the “Shares”) with

daily purchase limits of 2,296 Shares from August 31, 2023 to

August 30, 2024. As a result of amendments to the senior credit

facilities, due to the non-injury fire incident, the Corporation

was required to pause purchases under its NCIB until after the CCGT

expansion of M2 achieved substantial completion. Now that the CCGT

expansion of M2 has achieved this milestone, the Corporation

intends to resume the purchase and cancellation of Shares.

NON-GAAP FINANCIAL MEASURES

Management evaluates MAXIM’s performance using a

variety of measures. The non-GAAP measure discussed below should

not be considered as an alternative to or to be more meaningful

than net income of the Corporation, as determined in accordance

with GAAP, when assessing MAXIM’s financial performance or

liquidity.

This measure does not have any standardized

meaning prescribed by GAAP and may not be comparable to similar

measures presented by other companies.

Adjusted EBITDA

Adjusted EBITDA is provided to assist management

and investors in determining the Corporation's approximate

operating cash flows before interest, income taxes, and

depreciation and amortization and certain other non-recurring

income and expenses.

|

|

|

Three months ended |

|

|

Nine months ended |

| |

|

September 30 |

|

|

September 30 |

|

($000's) |

|

2023 |

2022 |

|

2023 |

2022 |

| GAAP

Measures from Condensed Consolidated Statement of Operations |

|

|

|

|

|

|

| |

|

|

|

|

|

|

Net income (loss) |

(4,897) |

23,970 |

|

|

8,818 |

49,433 |

|

Income tax expense (recovery) |

(1,462) |

7,120 |

|

|

2,680 |

12,427 |

|

Finance expense, net |

|

1,292 |

1,779 |

|

|

3,909 |

5,219 |

|

Depreciation and amortization |

|

1,753 |

3,476 |

|

|

5,602 |

7,745 |

| |

(3,314) |

36,345 |

|

|

21,009 |

74,824 |

| Adjustments: |

|

|

|

|

|

|

|

|

Other expense (income) |

|

(5,229) |

(2) |

|

|

(43,757) |

39 |

|

Business interruption insurance claim |

|

5,500 |

- |

|

|

40,022 |

- |

|

Unrealized loss (gain) on commodity swaps |

|

1,324 |

3,248 |

|

|

1,412 |

(841) |

|

Share-based compensation |

|

174 |

148 |

|

|

488 |

391 |

|

Adjusted EBITDA |

(1,545) |

39,739 |

|

|

19,174 |

74,413 |

Adjusted EBITDA is calculated as described above

from its most directly comparable GAAP measure, net income, and

adjusts for specific items that are not reflective of the

Corporation’s underlying operations and excludes other non-cash

items.

Adjusted EBITDA is provided to assist management

and investors in determining the Corporation’s approximate

operating cash flows attributable to shareholders before finance

expense, income taxes, depreciation and amortization, and certain

other non-recurring or non-cash income and expenses. Financing

expense, income taxes, depreciation and amortization are excluded

from the Adjusted EBITDA calculation, as they do not represent cash

expenditures that are directly affected by operations. Management

believes that presentation of this non-GAAP measure provides useful

information to investors and shareholders as it assists in the

evaluation of performance trends. Management uses Adjusted EBITDA

to compare financial results among reporting periods and to

evaluate MAXIM’s operating performance and ability to generate

funds from operating activities.

In calculating Adjusted EBITDA for the third

quarter and first nine months ended September 30, 2023 and

September 30, 2022 management excluded certain non-cash and

non-recurring transactions. In both 2023 and 2022, Adjusted EBITDA

excluded unrealized gains or losses on commodity swaps, share-based

compensation and all items of other income and expense except for

business interruption insurance as it reflects a portion of

earnings that would have been earned if M2 was operational.

About MAXIM

Based in Calgary, Alberta, MAXIM is one of

Canada’s largest truly independent power producers. MAXIM is now

focused entirely on power projects in Alberta. Its core asset – the

300 MW H.R. Milner Plant, M2, in Grande Cache, AB – is a

state-of-the-art combined cycle gas-fired power plant that

commissioned in Q4, 2023. MAXIM continues to explore additional

development options in Alberta including its currently permitted

gas-fired generation projects and the permitting of its wind power

generation project. MAXIM trades on the TSX under the symbol “MXG”.

For more information about MAXIM, visit our website at

www.maximpowercorp.com. For further information please contact:

Bob Emmott, President and COO, (403)

263-3021

Kyle Mitton, CFO and Vice President, Corporate

Development, (403) 263-3021

Forward-looking statements

This press release contains forward-looking

statements and forward-looking information (collectively "forward

looking information") within the meaning of applicable securities

laws relating to MAXIM's plans and other aspects of MAXIM's

anticipated future operations, management focus, objectives,

strategies, financial, operating and production results.

Forward-looking information typically uses words such as

"anticipate", "believe", "project", "expect", "goal", "plan",

"intend", "may", "would", "could" or "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement. Specifically, this press release contains

forward-looking information concerning, among other things,

expected benefits and costs of the CCGT expansion of M2, including

the reduction of carbon emissions by more than 60% and the increase

in generation capacity to 300 MW, current expectation on MAXIM’s

periodic outages resulting in intermittent generation of

electricity (and related revenue) from its Milner operations and

MAXIM's insurance claim related to the same.

Forward-looking information is based on certain

assumptions and analysis made by MAXIM in light of our experience

and MAXIM’s perception of historical trends, current conditions,

expected future developments and other factors MAXIM believes

appropriate under the circumstances. These include, among other

things, assumptions regarding the, insurance coverage, estimated

final project costs, generation capacity following the expansion of

M2 and reduction in carbon emissions.

MAXIM's actual results, performance or

achievement could differ materially from those expressed in, or

implied by, these forward-looking statements and, accordingly, no

assurance can be given that any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of

them do so, what benefits that MAXIM will derive there from. Risk

factors include that MAXIM may not generate full MW capacity from

the CCGT expansion of M2 and that MAXIM may not be covered by

insurance for the air inlet filter house repairs and business

interruption. Readers are cautioned that the foregoing lists of

factors are not exhaustive. Additional information on these and

other factors that could affect MAXIM’s business, operations or

financial results are included in the reports on file with

applicable securities regulatory authorities, including but not

limited to MAXIM’s Annual Information Form for the year ended

December 31, 2022, which may be accessed on MAXIM’s SEDAR+ profile

at www.sedarplus.ca. These forward-looking statements are made as

of the date of this press release and MAXIM disclaims any intent or

obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

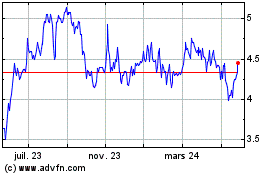

Maxim Power (TSX:MXG)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

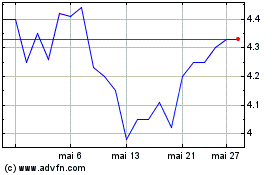

Maxim Power (TSX:MXG)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024