Oncolytics Biotech® Reports 2018 Third Quarter Financial Results and Provides Corporate Update

12 Novembre 2018 - 1:00PM

- Checkpoint combination studies support

progression into registration pathway for metastatic breast cancer

and potential expansion of indications -

Oncolytics Biotech® Inc. (Nasdaq: ONCY) (TSX: ONC), currently

developing pelareorep, an intravenously delivered immuno-oncolytic

virus, today announced financial results and operational highlights

for the quarter ended September 30, 2018. All dollar amounts

are Canadian unless otherwise noted.

“The clinical progress and mechanistic

understandings achieved with pelareorep thus far in 2018 lay the

ground work for a transformational 2019. We continue to

advance towards a registration study in metastatic breast cancer as

we prepare to initiate our AWARE-1 window of opportunity clinical

study with pelareorep and Roche’s checkpoint inhibitor, Tecentriq,

in breast cancer patients,” said Dr. Matt Coffey, President and CEO

of Oncolytics Biotech. “Although we originally believed that

pelareorep acts foremost as a lytic agent directly killing tumor

cells, we have learned pelareorep replicates efficiently in cancer

cells to produce double stranded RNA and trigger an immune response

to the tumor by stimulating and recruiting NK cells and T cells to

target the tumor. This quarter we presented additional data

confirming pelareorep stimulates expression of PD-L1 on tumor

cells, thereby transforming those tumor cells into targets for the

highly valued immuno-oncology checkpoint inhibitors. This

expanded focus on innate and adaptive immune response better allows

us to prepare for our planned studies in metastatic breast cancer,

to validate recently identified therapeutic biomarkers for

pelareorep, and to efficiently explore the potential for pelareorep

to extend the effectiveness of checkpoint inhibitors into

additional patient populations.”

Selected highlights

since July 1, 2018

Clinical Updates

- Established plans with pelareorep to advance the phase 3

metastatic breast cancer program and for expansion into combination

trials with checkpoint inhibitors to enlist pelareorep’s

immune effects and to seek validation of key therapeutic and

prognostic biomarkers.

- Clinical trials announced in 2018 include: °

AWARE-1 window of opportunity (WOO) study with pelareorep in

combination with Roche’s Tecentriq® in breast cancer.

° Pelareorep plus Merck’s anti-PD-1 checkpoint inhibitor

Keytruda® in pancreatic cancer. ° Pelareorep plus

Bristol-Myers Squibb’s anti-PD-1 checkpoint inhibitor Opdivo® in

multiple myeloma. ° Pelareorep plus Merck’s

anti-PD-1 checkpoint inhibitor Keytruda in multiple myeloma.

- Announced a Master Clinical Supply Agreement with F.

Hoffmann-La Roche Ltd (Roche) to supply Tecentriq for use in the

company’s clinical development program.

- Presented positive phase 2 clinical trial results for

pelareorep in the treatment of patients with KRAS mutant metastatic

colorectal cancer at the European Society for Medical Oncology

(ESMO) 2018 Congress. Thirty-six patients received treatment with

FOLFIRI/B (irinotecan, fluorouracil, leucovorin, plus bevacizumab)

and pelareorep. The six patients receiving treatment with the

recommended study dose had progression free survival of 65.6 weeks

and an overall survival of 107.5 weeks. Study results exceeded

expectations when compared to analogous historical data.

- Announced a publication demonstrating that intravenously

delivered oncolytic viruses, including pelareorep, effectively

target tumors even in the presence of neutralizing antibodies. A

publication in Cancer Immunology Research showed that pelareorep, a

systemically delivered oncolytic reovirus, can destroy tumor cells

via a monocyte-mediated process even after the virions have been

exposed to antibodies designed to neutralize the reovirus.

Corporate Updates

- Entered into a common stock purchase agreement for up to

US$26.0 million with Lincoln Park Capital Fund, LLC.

- Announced a US$30.0 million At-the-Market facility with

Canaccord Genuity.

Anticipated Milestones

- Initiate a phase 2 study with

pelareorep in combination with Merck’s Keytruda in advanced

pancreatic cancer in Q4 2018*.

- Initiate a phase 1 study with

pelareorep in combination with Bristol-Myers Squibb’s Opdivo in

multiple myeloma in Q4 2018*.

- Initiate AWARE-1, a phase 1b WOO

study with pelareorep in the neoadjuvant breast cancer setting in

Q1 2019.

- Initiate a phase 1b study with

pelareorep in combination with Merck’s Keytruda in multiple myeloma

in Q1 2019*.

- Data from AWARE-1 study with

pelareorep in breast cancer

mid-2019.

- Initiate registration study with

pelareorep in mBC – guidance to be provided after AWARE-1 data is

available.

- Preliminary data from MUK eleven

study with pelareorep in multiple myeloma mid-2019*.

* Guidance provided by principle

investigator

Financial

- At September 30, 2018, the company

reported $16.2 million in cash and cash equivalents.

- As at November 8, 2018, the company

had an unlimited number of authorized common shares with 17,059,123

common shares issued and outstanding, 16,443,500 warrants

exercisable into 1,730,894 common shares with a $9.025 strike price

and 1,093,407 options and share units.

- Operating expense for the third

quarter of 2018 was $1.5 million compared to $1.3 million for the

prior year period. R&D expense in the third quarter 2018 was

$1.9 compared to $1.7 million for the third quarter of 2017.

- The net loss for the third quarter

of 2018 was $3.3 million or $0.20 per share compared to a net loss

of $3.0 million or $0.20 per share for the period one year ago, on

a consolidated basis.

Webcast and Conference

CallOncolytics management will host a conference

call for Analysts and Institutional Investors at 8:30 a.m. ET

today, Monday, November 12, 2018. The live call may be accessed by

dialing (888) 231-8191 for callers in North America. Overseas

callers should contact investor relations for the toll-free dial

information for their country. A replay of this call will be

available approximately two hours after the call is ended at

855-859-2056, using the replay code 6463668 and will be available

for six months.

A live audio webcast of the call will be

accessible on the Investor Relations page of Oncolytics' website

at www.oncolyticsbiotech.com and will be archived for six

months.

| |

| |

| ONCOLYTICS BIOTECH INC.INTERIM

CONSOLIDATED STATEMENTS OF FINANCIAL

POSITION(unaudited) |

| |

| As

at |

September 30, 2018 $ |

December 31, 2017 $ |

|

Assets |

|

|

| Current

assets |

|

|

| Cash and cash

equivalents |

16,214,347 |

|

11,836,119 |

|

| Contract

receivable |

— |

|

4,767,100 |

|

| Other receivables |

56,895 |

|

37,726 |

|

| Prepaid expenses |

1,450,030 |

|

1,176,063 |

|

|

Total current assets |

17,721,272 |

|

17,817,008 |

|

| Non-current

assets |

|

|

| Property

and equipment |

428,588 |

|

333,441 |

|

|

Total non-current assets |

428,588 |

|

333,441 |

|

|

|

|

|

|

Total assets |

18,149,860 |

|

18,150,449 |

|

| Liabilities And

Shareholders’ Equity |

|

|

| Current

Liabilities |

|

|

| Accounts payable and

accrued liabilities |

2,239,514 |

|

3,684,023 |

|

| Contract liability |

927,400 |

|

1,545,645 |

|

| Other

liabilities |

76,529 |

|

— |

|

|

Total current liabilities |

3,243,443 |

|

5,229,668 |

|

| Non-current

liabilities |

|

|

| Contract liability |

5,802,887 |

|

4,636,935 |

|

| Other liabilities |

54,128 |

|

— |

|

|

Total non-current liabilities |

5,857,015 |

|

4,636,935 |

|

|

|

|

|

|

Total liabilities |

9,100,458 |

|

9,866,603 |

|

| Shareholders’

equity |

|

|

| Share capital

Authorized: unlimited Issued: September 30, 2018 –

16,915,325 December 31, 2017 – 141,805,722

pre-consolidation December 31, 2017 – 14,926,840

post-consolidation |

283,742,409 |

|

271,710,138 |

|

| Warrants |

3,617,570 |

|

3,617,900 |

|

| Contributed

surplus |

27,894,420 |

|

27,028,238 |

|

| Accumulated other

comprehensive income |

459,142 |

|

373,730 |

|

|

Accumulated deficit |

(306,664,139 |

) |

(294,446,160 |

) |

|

Total shareholders’ equity |

9,049,402 |

|

8,283,846 |

|

|

Total liabilities and equity |

18,149,860 |

|

18,150,449 |

|

| |

| |

| ONCOLYTICS BIOTECH INC.INTERIM

CONSOLIDATED STATEMENTS OF LOSS AND COMPREHENSIVE

LOSS(unaudited) |

| |

|

|

Three MonthPeriodEndingSeptember30, 2018

$ |

Three MonthPeriodEndingSeptember30, 2017

$ |

Nine MonthPeriodEndingSeptember30, 2018

$ |

Nine MonthPeriodEndingSeptember30, 2017

$ |

| |

|

|

|

|

|

Expenses |

|

|

|

|

| Research and

development |

1,929,405 |

|

1,726,726 |

|

6,909,713 |

|

6,913,470 |

|

|

Operating |

1,468,262 |

|

1,309,607 |

|

4,869,617 |

|

4,054,450 |

|

| Loss before the

following |

(3,397,667 |

) |

(3,036,333 |

) |

(11,779,330 |

) |

(10,967,920 |

) |

|

Interest |

61,880 |

|

31,759 |

|

109,308 |

|

96,637 |

|

| Loss before

income taxes |

(3,335,787 |

) |

(3,004,574 |

) |

(11,670,022 |

) |

(10,871,283 |

) |

|

Income tax (expense) recovery |

(79 |

) |

168 |

|

(547,957 |

) |

16 |

|

| Net

loss |

(3,335,866 |

) |

(3,004,406 |

) |

(12,217,979 |

) |

(10,871,267 |

) |

| Other

comprehensive (loss) income items that may be reclassified to net

loss |

|

|

|

|

|

Translation adjustment |

(49,238 |

) |

(126,846 |

) |

85,412 |

|

(192,334 |

) |

|

Net comprehensive loss |

(3,385,104 |

) |

(3,131,252 |

) |

(12,132,567 |

) |

(11,063,601 |

) |

|

Basic and diluted loss per common share |

(0.20 |

) |

(0.20 |

) |

(0.78 |

) |

(0.80 |

) |

|

Weighted average number of shares (basic and

diluted) |

16,540,612 |

|

14,685,871 |

|

15,646,117 |

|

13,625,411 |

|

| |

|

|

| ONCOLYTICS BIOTECH

INC.INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN

EQUITY(unaudited) |

|

|

| |

Share Capital$ |

Warrants$ |

ContributedSurplus$ |

AccumulatedOtherComprehensiveIncome$ |

AccumulatedDeficit$ |

Total$ |

| As at December 31,

2016 |

262,321,825 |

|

— |

|

26,643,044 |

|

554,060 |

|

(278,829,309 |

) |

10,689,620 |

|

| Net loss and other

comprehensive loss |

— |

|

— |

|

— |

|

(192,334 |

) |

(10,871,267 |

) |

(11,063,601 |

) |

| Issued pursuant to "At

the Market" agreement |

1,479,065 |

|

— |

|

— |

|

— |

|

— |

|

1,479,065 |

|

| Issued pursuant to

public offering |

7,893,600 |

|

3,617,900 |

|

— |

|

— |

|

— |

|

11,511,500 |

|

| Issued pursuant to

stock option plan |

536,949 |

|

— |

|

(193,509 |

) |

— |

|

— |

|

343,440 |

|

| Share based

compensation |

— |

|

— |

|

438,044 |

|

— |

|

— |

|

438,044 |

|

| Share issue costs |

(1,331,770 |

) |

— |

|

— |

|

— |

|

— |

|

(1,331,770 |

) |

|

As at September 30, 2017 |

270,899,669 |

|

3,617,900 |

|

26,887,579 |

|

361,726 |

|

(289,700,576 |

) |

12,066,298 |

|

| |

|

|

|

|

|

|

| As at December 31,

2017 |

271,710,138 |

|

3,617,900 |

|

27,028,238 |

|

373,730 |

|

(294,446,160 |

) |

8,283,846 |

|

| Net loss and other

comprehensive income |

— |

|

— |

|

— |

|

85,412 |

|

(12,217,979 |

) |

(12,132,567 |

) |

| Issued pursuant to "At

the Market" agreement |

553,650 |

|

— |

|

— |

|

— |

|

— |

|

553,650 |

|

| Issued pursuant to

public offering |

11,606,882 |

|

— |

|

— |

|

— |

|

— |

|

11,606,882 |

|

| Issued pursuant to

Common Stock Purchase Agreement |

1,906,152 |

|

— |

|

— |

|

— |

|

— |

|

1,906,152 |

|

| Issued pursuant to

stock option plan |

178,322 |

|

— |

|

(66,635 |

) |

— |

|

— |

|

111,687 |

|

| Issued pursuant to

warrant agreement |

1,747 |

|

(330 |

) |

— |

|

— |

|

— |

|

1,417 |

|

| Share based

compensation |

— |

|

— |

|

932,817 |

|

— |

|

— |

|

932,817 |

|

| Share issue costs |

(2,214,482 |

) |

— |

|

— |

|

— |

|

— |

|

(2,214,482 |

) |

|

As at September 30, 2018 |

283,742,409 |

|

3,617,570 |

|

27,894,420 |

|

459,142 |

|

(306,664,139 |

) |

9,049,402 |

|

|

|

| |

| ONCOLYTICS BIOTECH INC.INTERIM

CONSOLIDATED STATEMENTS OF CASH

FLOWS(unaudited) |

| |

|

|

Three MonthPeriodEndingSeptember30, 2018

$ |

Three MonthPeriodEndingSeptember30, 2017

$ |

Nine MonthPeriodEndingSeptember30, 2018

$ |

Nine MonthPeriodEndingSeptember30, 2017

$ |

| |

|

|

|

|

| Operating

Activities |

|

|

|

|

| Net loss for the

period |

(3,335,866 |

) |

(3,004,406 |

) |

(12,217,979 |

) |

(10,871,267 |

) |

| Depreciation - property

and equipment |

26,698 |

|

20,591 |

|

67,682 |

|

70,315 |

|

| Share based

compensation |

236,607 |

|

148,447 |

|

932,817 |

|

438,044 |

|

| Unrealized foreign

exchange loss (gain) |

82,643 |

|

(6,414 |

) |

(19,702 |

) |

(119,058 |

) |

| Onerous lease

contract |

67,588 |

|

— |

|

67,588 |

|

— |

|

| Amortization - lease

incentive liability |

12,494 |

|

— |

|

12,494 |

|

— |

|

| Net

change in non-cash working capital |

(596,779 |

) |

(331,590 |

) |

3,630,991 |

|

(1,186,142 |

) |

|

Cash used in operating activities |

(3,506,615 |

) |

(3,173,372 |

) |

(7,526,109 |

) |

(11,668,108 |

) |

| Investing

Activities |

|

|

|

|

| Acquisition of property

and equipment |

(40,094 |

) |

(9,451 |

) |

(120,156 |

) |

(95,337 |

) |

| Redemption of

short-term investments |

— |

|

— |

|

— |

|

2,088,800 |

|

|

Cash (used in) provided by investing

activities |

(40,094 |

) |

(9,451 |

) |

(120,156 |

) |

1,993,463 |

|

| Financing

Activities |

|

|

|

|

| Proceeds from "At the

Market" equity distribution agreement |

— |

|

733,171 |

|

520,315 |

|

1,292,698 |

|

| Proceeds from public

offering |

— |

|

— |

|

10,188,526 |

|

10,366,098 |

|

| Proceeds from Common

Stock Purchase Agreement |

1,143,361 |

|

— |

|

1,143,361 |

|

— |

|

| Proceeds from exercise

of options |

87,777 |

|

48,090 |

|

111,687 |

|

343,440 |

|

| Proceeds

from exercise of warrants |

— |

|

— |

|

1,417 |

|

— |

|

|

Cash provided by financing activities |

1,231,138 |

|

781,261 |

|

11,965,306 |

|

12,002,236 |

|

| (Decrease)

increase in cash |

(2,315,571 |

) |

(2,401,562 |

) |

4,319,041 |

|

2,327,591 |

|

| Cash and cash

equivalents, beginning of period |

18,741,347 |

|

16,676,298 |

|

11,836,119 |

|

12,034,282 |

|

| Impact of

foreign exchange on cash and cash equivalents |

(211,429 |

) |

(241,092 |

) |

59,187 |

|

(328,229 |

) |

|

Cash and cash equivalents, end of period |

16,214,347 |

|

14,033,644 |

|

16,214,347 |

|

14,033,644 |

|

| |

To view the Company's Fiscal 2018 Third Quarter

Consolidated Financial Statements, related Notes to the

Consolidated Financial Statements, and Management's Discussion and

Analysis, please see the Company's filings, which will be available

at www.sedar.com, www.sec.gov and on Oncolytics' website

at http://www.oncolyticsbiotech.com/investor-centre/financials/.

About PelareorepPelareorep is a

non-pathogenic, proprietary isolate of the unmodified reovirus: a

first-in-class intravenously delivered immuno-oncolytic virus for

the treatment of solid tumors and hematological malignancies. The

compound induces selective tumor lysis and promotes an inflamed

tumor phenotype through innate and adaptive immune responses to

treat a variety of cancers and has been demonstrated to be able to

escape neutralizing antibodies found in patients.

About Oncolytics Biotech

Inc.Oncolytics is a biotechnology company developing

pelareorep, an intravenously delivered immuno-oncolytic virus. The

compound induces selective tumor lysis and promotes an inflamed

tumor phenotype -- turning "cold" tumors "hot" -- through innate

and adaptive immune responses to treat a variety of cancers.

Oncolytics' clinical development program emphasizes three pillars:

chemotherapy combinations to trigger selective tumor lysis and

immuno-therapy and immune modulator (IMiD) combinations to produce

innate and adaptive immune responses. Oncolytics is currently

conducting and planning additional studies in combination with

checkpoint inhibitors and targeted and IMiD therapies in solid and

hematological malignancies, as it prepares for a phase 3

registration study in metastatic breast cancer. For further

information, please visit: www.oncolyticsbiotech.com.

This press release contains forward-looking

statements, within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended and forward-looking information

under applicable Canadian securities laws (such forward-looking

statements and forward-looking information are collectively

referred to herein as “forward-looking statements”).

Forward-looking statements, including the Company's belief as to

the potential and mode of action of REOLYSIN, also known as

pelareorep, as a cancer therapeutic; the collaboration between

Merck and USC using pelareorep, including the timing,

enrollment and potential benefits to the Company thereof; and other

statements related to anticipated developments in the Company's

business and technologies involve known and unknown risks and

uncertainties, which could cause the Company's actual results to

differ materially from those in the forward-looking statements.

Such risks and uncertainties include, among others, the

availability of funds and resources to pursue research and

development projects, the efficacy of pelareorep as a cancer

treatment, the success and timely completion of clinical studies

and trials, the Company's ability to successfully commercialize

pelareorep, uncertainties related to the research and development

of pharmaceuticals, uncertainties related to the regulatory process

and general changes to the economic environment. Investors should

consult the Company's quarterly and annual filings with the

Canadian and U.S. securities commissions for additional information

on risks and uncertainties relating to the forward-looking

statements. Investors are cautioned against placing undue reliance

on forward-looking statements. The Company does not undertake to

update these forward-looking statements, except as required by

applicable laws.

|

Company ContactMichael MooreVice President,

Investor Relations & Corporate

Communications858-886-7813mmoore@oncolytics.ca |

| |

| Investor

RelationsRobert UhlWestwicke Partners858-356-5932

robert.uhl@westwicke.com |

Media

ContactJason SparkCanale Communications

619-849-6005jason@canalecomm.com |

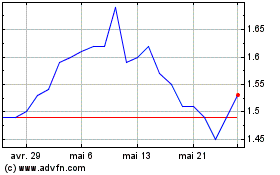

Oncolytics Biotech (TSX:ONC)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Oncolytics Biotech (TSX:ONC)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024