Stack Capital Group Inc. Reports 2022 Year End Results

01 Mars 2023 - 1:45PM

Stack Capital Group Inc., (“Stack Capital” or the “Company”) (TSX:

STCK and STCK.WT) today announced its financial results for the

year ended December 31, 2022. Stack Capital reports all amounts in

Canadian Dollars unless otherwise stated.

Company Commentary:

- As at December 31, 2022, Book Value

per Share of the Company was $11.28, slightly higher compared with

$11.26 as at December 31, 2021, despite a significant market

correction during 2022.

- The Company’s cash position as at

December 31, 2022, was $31.4 million or $3.43 per share.

- To date, the Company has completed

eight investments with fair value totalling $70.0 million or $7.65

per share as at December 31, 2022, into the following:

- Newfront Insurance, Inc. (insurance

& benefits)

- Locus Robotics, Inc.

(robotics)

- Prove Identity, Inc.

(cyber-security)

- Omio, Inc. (travel &

leisure)

- SpaceX (space exploration &

communications)

- Bolt Financial, Inc.

(e-commerce)

- Hopper, Inc. (travel &

leisure)

- Varo Money, Inc. (neo-banking)

- During Q4-2022, the Company

announced a normal course issuer bid to buy back its outstanding

common shares which it believes to be undervalued. During Q4-2022,

81,800 shares were repurchased at an average price of $5.84 per

share.

- The current market remains

attractive in relation to the opportunities available to deploy

capital across quality, high-growth companies, at reasonable

valuations, with the added downside protection offered through

preferred shares. Stack Capital will look to capitalize on the

current market weakness through both primary issuances and

secondary transactions.

“Despite the challenging market environment,

we’re quite pleased to report that several of our existing

portfolio companies have continued to generate growth,” said Jeff

Parks, CEO of Stack Capital. “With roughly 31% of the portfolio in

cash, we’re in excellent position to take advantage of

opportunities born out of the recent market weakness. As with our

previous investments, we will focus our efforts in targeting

preferred shares of leading private companies – which provide an

additional margin of safety for our shareholders.”

Q4-2022 Highlights

- As at December 31, 2022, the Book

Value of the Company was $103.2 million, and the Book Value per

Share was $11.28. A detailed summary of Book Value per Share is as

follows:

|

Breakdown of Book Value per Share as at December 31,

2022: |

|

|

Cash |

$ |

3.43 |

|

|

Investment – Prove Identity Inc. |

|

1.26 |

|

|

Investment – Newfront Insurance, Inc. |

|

1.18 |

|

|

Investment – Locus Robotics, Inc. |

|

1.18 |

|

|

Investment – Omio, Inc. |

|

1.04 |

|

|

Investment – SpaceX (FNEX Ventures LLC – Series 103) |

|

1.02 |

|

|

Investment – Bolt Financial, Inc. |

|

0.90 |

|

|

Investment – Hopper Inc. |

|

0.89 |

|

|

Investment – Varo Money, Inc. |

|

0.38 |

|

|

Net other assets |

|

(0.00 |

) |

|

Book Value per Share |

$ |

11.28 |

|

- During Q4-2022, Stack Capital

invested US$8.0 million in Locus Robotics, Inc. (“Locus”). Locus is

a leading provider of enterprise robotics solutions for some of the

world’s most dynamic warehouses and leading brands operating in

third-party logistics, retail & e-commerce, healthcare, and the

industrial sectors. Designed to work collaboratively alongside

human labor, Locus’ suite of robots transforms large-scale

warehouse fulfillment and distribution facilities with

industry-leading, intelligent, and dynamically scalable solutions

that reduce costs, improve productivity, and enhance overall

efficiency. Its Robotics-as-a-Service (“RaaS”) pricing model

dramatically reduces the upfront costs typically associated with

outfitting a warehouse facility, combined with monthly operating

savings in the form of a 2-3x increase in productivity, and a large

reduction in the cost per pick.

- During Q4-2022, Hopper Inc. raised

US$96.0 million from Capital One Financial Corporation and

announced a long-term strategic partnership with Capital One

Travel. Following the success of Capital One Travel powered by

Hopper, this extension of their partnership and additional capital

will help fuel future growth. Hopper also announced that their

market share of third-party air travel in the United States has

increased to 11.2% (source: MIDT) and Hopper is now the #3 largest

OTA in North America. Sales in their app are up 4-5x year-over-year

and holding at that high level and revenue is pacing 25X over

2019.

- During Q4-2022, the Company hedged

US$25.0 million US dollars to Canadian dollars at a rate of 1.3573

to limit the fluctuations due to foreign exchange. The gain on this

contract as at December 31, 2022 was $97,500. This required cash

collateral of $1.5 million and is held in Stack’s account and

earning market interest rates.

About Stack Capital

Stack Capital is an investment holding company

and its business objective is to invest in equity, debt and/or

other securities of growth-to-late-stage private businesses.

Through Stack Capital, shareholders have the opportunity to gain

exposure to a diversified private investment portfolio; participate

in the private market; and have liquidity due to the listing of the

Common Shares and Warrants on the TSX. At the same time, the public

structure also allows the Company to focus its efforts on

maximizing long-term performance through a portfolio of high growth

businesses, which are not widely available to most Canadian

investors. SC Partners Ltd. (the “Manager”) has taken the

initiative in creating the Company and acts as the Company's

administrator and is responsible to source and advise with respect

to all investments for the Company.

For more information, please visit our

website at www.stackcapitalgroup.com

or contact:Brian ViveirosVP, Corporate Development

and Investor Relations647.280.3307brian@stackcapitalgroup.com

Non-IFRS Financial Measures

This press release may make reference to the

following financial measures which are not recognized under

International Financial Reporting Standards (“IFRS”), and which do

not have a standard meaning prescribed by IFRS:

- Book Value - the

aggregate fair value of the assets of the Company on the referenced

date, less the aggregate carrying value of the liabilities,

excluding any deferred taxes or unrealized deferred gains or losses

if applicable, of the Company; and

- Book Value per Share

(BVPS) - the Book Value on the referenced day divided by

the aggregate number of Common Shares that are outstanding on such

day.

The Company’s Book Value and Book Value per

Share is a measure of the performance of the Company as a whole.

The Company’s method of determining this financial measure may

differ from other issuers’ methods and, accordingly, this amount

may not be comparable to measures used by other issuers. This

financial measure is not a performance measure as defined under

IFRS and should not be considered either in isolation of, or as a

substitute for, net earnings per share prepared in accordance with

IFRS.

Cautionary Note Regarding

Forward-Looking Information

This press release contains forward-looking

information. Such forward-looking statements or information are

provided for the purpose of providing information about

management’s current expectations and plans relating to the future.

Readers are cautioned that reliance on such information may not be

appropriate for other purposes. Any such forward-looking

information may be identified by words such as “proposed”,

“expects”, “intends”, “may”, “will”, and similar expressions.

Forward-looking information contained or referred to in this press

release includes, but may not be limited to the business of Stack

Capital and the risks associated therewith, including those

identified in the Annual Information Filing under the heading “Risk

Factors”.

Forward-looking statements or information are

based on a number of factors and assumptions which have been used

to develop such statements and information, but which may prove to

be incorrect. Although Stack Capital believes that the expectations

reflected in such forward-looking statements or information are

reasonable, undue reliance should not be placed on forward-looking

statements because Stack Capital can give no assurance that such

expectations will prove to be correct. Factors that could cause

actual results to differ materially from those described in such

forward-looking information include, but are not limited to, the

ability to capitalize on investment opportunities. The

forward-looking information in this press release reflects the

current expectations, assumptions and/or beliefs of Stack Capital

based on information currently available to Stack Capital.

Any forward-looking information speaks only as

of the date on which it is made and, except as may be required by

applicable securities laws, Stack Capital disclaims any intent or

obligation to update any forward-looking information, whether as a

result of new information, future events, or results or otherwise.

The forward-looking statements or information contained in this

press release are expressly qualified by this cautionary

statement.

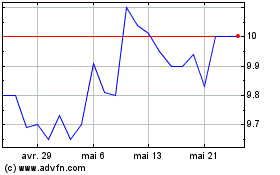

Stack Capital (TSX:STCK)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Stack Capital (TSX:STCK)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024