Stack Capital Group Inc. Reports Q3-2023 Financial Results

02 Novembre 2023 - 12:30PM

Stack Capital Group Inc., (“Stack Capital” or the “Company”) (TSX:

STCK and STCK.WT) today announced its financial results for the

three and nine months ended September 30, 2023. Stack Capital

reports all amounts in Canadian Dollars unless otherwise stated.

Company Commentary:

- As at September 30, 2023, Book

Value per Share of the Company was $11.30, compared with $11.17 as

at June 30, 2023.

- The Company’s cash position as at

September 30, 2023, was $25.8 million or $2.87 per share.

- To date, the Company has completed

eight investments contributing $8.46 to the Book Value per Share,

as at September 30, 2023, into the following:

- Prove Identity, Inc.

(cyber-security)

- Newfront Insurance, Inc. (insurance

& benefits)

- Locus Robotics, Inc.

(robotics)

- Omio, Inc. (travel &

leisure)

- SpaceX (space exploration &

communications)

- Bolt Financial, Inc.

(e-commerce)

- Hopper, Inc. (travel &

leisure)

- Varo Money, Inc. (neo-banking)

- The Company announced a normal

course issuer bid on November 15, 2022, to buy back its outstanding

common shares which it believes to be undervalued. For the nine

months ended September 30, 2023, 150,400 common shares were

repurchased at a weighted average price of $6.19 per share. Since

the initiation of the normal course issuer bid to September 30,

2023, 245,900 shares have been repurchased at an average price of

$6.14.

Portfolio Companies - Quarterly

Update:

- Locus Robotics -

during the quarter, Locus Robotics surpassed the 2 billion units

picked in customer warehouses, coming just 11 months after reaching

1 billion units picked in 2022. The first billion took more than 6

years, therefore, there has been a significant increase in pace

between the first and second billion picks. UPS also issued a press

release outlining its strengthened network capabilities through

automation - highlighting its partnership with Locus Robotics to

drive network efficiency and create a safer working environment for

employees.

- Hopper - Hopper

has continued to significantly grow with a recent partnership with

Air Canada to offer travelers more freedom and flexibility using

Hopper’s “Cancel for Any Reason” feature. Hopper also entered into

strategic partnerships with Turo for their auto inventory and

Hotelbeds and WebBeds, to expand their global hotel inventory by

adding 700,000+ hotel properties.

- SpaceX - during

the quarter, SpaceX had a tender offer for secondary shares at a

reported valuation of US$150 billion, or $81 per share, which

resulted in a fair value increase of $0.4 million for Stack

Capital. Starlink, a wholly owned subsidiary of SpaceX, reached

over 2 million global subscribers during the quarter as well as

signed key contracts with the US Space Force to provide customized

satellite communication for the US military and Qatar Airways to

offer in-flight WiFi on their fleet. SpaceX also signed a landmark

deal with the European Space Agency to launch satellites into

orbit.

- Omio – Stack

Capital invested an additional $1 million in Omio, increasing the

Company’s overall investment to $10.4 million. Omio has been

progressing well with its strategy in both its B2B and B2C business

units. In an interview with Skift at the end of September 2023, the

CEO of Uber discussed the success of their pilot in the UK saying

that 60% of users who have booked a bus or train are repeat

customers. Omio also recently introduced a plugin for ChatGPT in

their app, allowing travelers to utilize AI to plan seamless

travel.

- Prove Identity –

subsequent to the quarter, it was announced that Prove had

completed a US$40 million raise led by MassMutual and Capital One

Venture to continue their global expansion and continue building

its technology to face threats by public and private institutions.

This includes innovations like the Prove Pre-Fill® identity

verification solution which provides customers with seamless,

secure onboarding and authentication processes, driving results

such as up to 79% faster onboarding, a 35% reduction in

abandonment, and a 75% reduction in fraud (relative to attack

rate).

“The continued growth across our portfolio

companies is very encouraging,” said Jeff Parks, CEO of Stack

Capital. “The management teams of our underlying businesses have

demonstrated the ability to not only weather the current economic

environment but expand in the face of higher interest rates and

inflationary pressures. As 2024 approaches, we’re optimistic that

this positive momentum can continue, which bodes well for potential

future liquidity events.”

Book Value per Share Summary

(Q3-2023)

- As at September 30, 2023, the Book

Value of the Company was $101.7 million, and the Book Value per

Share was $11.30. A detailed summary of Book Value per Share is as

follows:

|

Cash |

$ |

2.87 |

|

|

Investment – Prove Identity, Inc.1 |

|

1.28 |

|

|

Investment – Hopper, Inc. |

|

1.21 |

|

|

Investment – Newfront Insurance, Inc. |

|

1.20 |

|

|

Investment – Locus Robotics, Inc. |

|

1.20 |

|

|

Investment – SpaceX (FNEX Ventures LLC – Series 103) |

|

1.17 |

|

|

Investment – Omio, Inc. |

|

1.16 |

|

|

Investment – Bolt Financial, Inc. |

|

0.91 |

|

|

Investment – Varo Money, Inc. |

|

0.33 |

|

|

Other assets and liabilities |

|

(0.03 |

) |

|

Book Value per Share |

$ |

11.30 |

|

|

|

|

1 This includes a deferred gain of $1.1 million

for Prove Identity Inc. This was due to an immediate gain in

valuation which per IFRS 9 Financial Instruments requires the gain

to be deferred and netted against the carrying value.

About Stack Capital

Stack Capital is an investment holding company

and its business objective is to invest in equity, debt and/or

other securities of growth-to-late-stage private businesses.

Through Stack Capital, shareholders have the opportunity to gain

exposure to a diversified private investment portfolio; participate

in the private market; and have liquidity due to the listing of the

Common Shares and Warrants on the TSX. At the same time, the public

structure also allows the Company to focus its efforts on

maximizing long-term performance through a portfolio of high growth

businesses, which are not widely available to most Canadian

investors. SC Partners Ltd. (the “Manager”) has taken the

initiative in creating the Company and acts as the Company's

administrator and is responsible to source and advise with respect

to all investments for the Company.

For more information, please visit our

website at www.stackcapitalgroup.com

or contact:

Brian ViveirosVP, Corporate Development, and

Investor Relations647.280.3307brian@stackcapitalgroup.com

Non-IFRS Financial Measures

This press release may make reference to the

following financial measures which are not recognized under

International Financial Reporting Standards (“IFRS”), and which do

not have a standard meaning prescribed by IFRS:

- Book Value - the

aggregate fair value of the assets of the Company on the referenced

date, less the aggregate carrying value of the liabilities,

excluding any deferred taxes or unrealized deferred gains or losses

if applicable, of the Company; and

- Book Value per Share

(BVPS) - the Book Value on the referenced day divided by

the aggregate number of Common Shares that are outstanding on such

day.

The Company’s Book Value and Book Value per

Share is a measure of the performance of the Company as a whole.

The Company’s method of determining this financial measure may

differ from other issuers’ methods and, accordingly, this amount

may not be comparable to measures used by other issuers. This

financial measure is not a performance measure as defined under

IFRS and should not be considered either in isolation of, or as a

substitute for, net earnings per share prepared in accordance with

IFRS.

Cautionary Note Regarding

Forward-Looking Information

This press release contains forward-looking

information. Such forward-looking statements or information are

provided for the purpose of providing information about

management’s current expectations and plans relating to the future.

Readers are cautioned that reliance on such information may not be

appropriate for other purposes. Any such forward-looking

information may be identified by words such as “proposed”,

“expects”, “intends”, “may”, “will”, and similar expressions.

Forward-looking information contained or referred to in this press

release includes but may not be limited to the business of Stack

Capital and the risks associated therewith, including those

identified in the Annual Information Filing under the heading “Risk

Factors”.

Forward-looking statements or information are

based on a number of factors and assumptions which have been used

to develop such statements and information, but which may prove to

be incorrect. Although Stack Capital believes that the expectations

reflected in such forward-looking statements or information are

reasonable, undue reliance should not be placed on forward-looking

statements because Stack Capital can give no assurance that such

expectations will prove to be correct. Factors that could cause

actual results to differ materially from those described in such

forward-looking information include, but are not limited to, the

ability to capitalize on investment opportunities. The

forward-looking information in this press release reflects the

current expectations, assumptions and/or beliefs of Stack Capital

based on information currently available to Stack Capital.

Any forward-looking information speaks only as

of the date on which it is made and, except as may be required by

applicable securities laws, Stack Capital disclaims any intent or

obligation to update any forward-looking information, whether as a

result of new information, future events, or results or otherwise.

The forward-looking statements or information contained in this

press release are expressly qualified by this cautionary

statement.

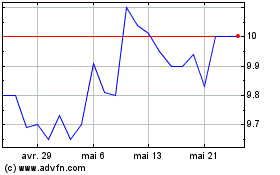

Stack Capital (TSX:STCK)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Stack Capital (TSX:STCK)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024