Mulvihill Capital Management Inc. Announces Special Meeting of World Financial Split Corp.

16 Mai 2024 - 2:51AM

(TSX: WFS) Mulvihill Capital

Management Inc. (the “

Manager”), the manager of

World Financial Split Corp. (the “

Fund”) announced

today that the board of directors of the Fund has approved a

proposal to change the investment objectives, strategy and

restrictions of the Fund and to amend the articles of the Fund, all

as more particularly described in the management information

circular (the “

Circular”) for the special meeting

(the “

Meeting”) of the Fund’s shareholders (the

“

Shareholders”).

The purpose of the Meeting is to consider and

vote upon a special resolution to reposition and recapitalize the

Fund to enhance its ability to meet its investment objectives going

forward by making the following changes. In this regard, the Fund

proposes to change the following (collectively, the

“Proposed Amendments”):

- the investment

objectives, strategy and restrictions of the Fund to expand and

diversify the portfolio of equity securities to global equity

securities selected by the Manager and increase the dividend on the

Preferred Shares to $0.0625 per month (7.5% on the original $10.00

issue price) and reinstate the Class A Share distribution (targeted

at 12.0% per annum payable monthly on the consolidated Class A

Share net asset value per share of approximately $8.00 per

share);

- the articles of

the Fund to:

-

change the name of the Fund to “Premium Global Income Split

Corp.”;

-

consolidate the Class A Shares of the Fund in order to reset the

net asset value per Class A Share to approximately $8.00 per

share;

-

change the existing Preferred Shares of the Fund into a number of

Class A Shares and a lesser number of the same class of Preferred

Shares to be determined based on the number of shares surrendered

pursuant to the Special Retraction Right referred to below (for

example, assuming a 4:1 Class A Share consolidation, the Manager

would expect 100 Preferred Shares to be exchanged into

approximately 41 Class A Shares and 66 Preferred Shares with a

value initially equal to the value of the Preferred Shares so

exchanged. The exact numbers into which such shares are proposed to

be changed shall be announced on June 17, 2024);

-

extend the Termination Date of the Fund from June 30, 2025 to June

30, 2029 and provide the directors of the Fund with the ability to

extend the Termination Date for successive five year terms;

-

eliminate the $15.00 net asset value per Unit dividend threshold on

Class A Shares;

-

provide holders of Class A Shares and Preferred Shares who do not

wish to continue their investment in the Fund with a special

retraction right (the “Special Retraction Right”)

to enable such Shareholders to retract their shares on June 28,

2024 on the same terms that would have applied had the Fund

redeemed all Shares as originally contemplated for June 30, 2025

and provide that the Shareholders who wish to exercise the Special

Retraction Right must give notice that they wish to exercise such

right on or prior to June 14, 2024; and

-

create an unlimited number of new classes of shares, issuable in an

unlimited number of series and authorize the directors of the Fund

to determine the rights, privileges and restrictions attaching to

each such series.

The Proposed Amendments will be beneficial for

the Fund and the Shareholders for the following reasons:

- Changing the

Fund’s investment strategy from global financials to a diversified

portfolio of primarily large capitalization global equity

securities should enable the Fund to better generate returns across

diverse sectors of the market. Eliminating the restriction on the

ability to invest in underlying funds to obtain this exposure will

provide flexibility to the Manager.

- The change of

name to Premium Global Income Split Corp. will reflect the renewed

focus of the Fund on global equities, while maintaining the Fund’s

call and put option writing strategy, which is expected to continue

to enhance distribution income and lower the overall cost of

acquiring portfolio securities. With the Fund’s existing capital

losses, the Manager expects distributions on the Shares to consist

primarily of return of capital for the foreseeable future.

- Consolidating

the Class A Shares will enable the Fund’s NAV per Class A Share to

restart at a higher level as well as reinstate the distribution on

the Class A Shares.

- Changing each

existing Preferred Share into a number of Class A Shares and a

number of Preferred Shares will increase coverage levels for the

Preferred Shares, provide potential for capital appreciation and

increase overall yield for the holders of such shares as well as

establish more appropriate leverage levels for the Class A

Shares.

If the Proposed Amendments are approved, the

Fund will (a) make consequential amendments to its investment

objectives and strategy (as described in the Circular), (b) make

consequential amendments to its investment restrictions (as

described in the Circular), and (c) subject to the approval of the

Toronto Stock Exchange, change the ticker symbol in respect of the

Class A Shares and Preferred Shares to “PGIC.A” and “PGIC.PR.A”,

respectively.

The board of directors of the Fund has

unanimously approved the Proposed Amendments, and recommends that

the Shareholders vote FOR the Proposed Amendments. The independent

review committee of the Fund has provided a positive recommendation

in favour of the Proposed Amendments.

A special meeting of the Shareholders has been

called and will be held virtually on June 21, 2024 with the close

of business on May 13, 2024 as the record date (the “Record

Date”) for the Meeting. The Meeting is scheduled to be

held as a virtual-only meeting conducted via live audio webcast

online on June 21, 2024 at 10:00 a.m. (Eastern time). Shareholders,

regardless of geographic location, will have an equal opportunity

to participate in the Meeting online. Shareholders will not be able

to attend the Meeting in person. Shareholders of record as of the

close of business on the Record Date are entitled to receive notice

of and vote at the Meeting. Shareholders are urged to vote well

before the proxy deadline of 5:00 p.m. (Eastern time) on June 19,

2024.

In order for the Proposed Amendments to become

effective, the Proposed Amendments must be approved by a two-thirds

majority of votes cast at the Meeting by holders of the Class A

Shares and the Preferred Shares, each voting separately as a

class.

The Circular is being mailed to Shareholders in

compliance with applicable laws, and will be available under the

Fund’s profile on SEDAR+ at www.sedarplus.com. The Circular

provides important information on the Proposed Amendments and

related matters, including the voting procedures and how to

virtually attend the Meeting. Shareholders are urged to read the

Circular and its schedules carefully and in their entirety.

For further information, please contact Investor Relations at

416.681.3966, toll free at 1-800-725-7172 or visit

www.mulvihill.com.

| John Germain, Senior

Vice-President & CFO |

Mulvihill Capital

Management Inc.121 King Street

West Suite 2600Toronto, Ontario, M5H 3T9 416.681.3966;

1.800.725.7172www.mulvihill.com info@mulvihill.com |

You will usually pay brokerage fees to your

dealer if you purchase or sell shares of the Fund on the TSX. If

the shares are purchased or sold on the TSX, investors may pay more

than the current net asset value when buying and may receive less

than current net asset value when selling them. There are ongoing

fees and expenses associated with owning shares of the Fund. An

investment fund must prepare disclosure documents that contain key

information about the Fund. You can find more detailed information

about the Fund in these documents. Investment funds are not

guaranteed, their values change frequently and past performance may

not be repeated.

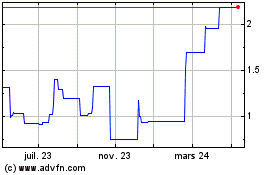

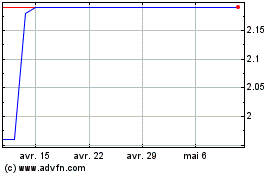

World Financial Split (TSX:WFS)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

World Financial Split (TSX:WFS)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025