WSP Announces Closing of Private Offering of $500 Million Senior Unsecured Notes

22 Novembre 2023 - 2:40PM

WSP Global Inc. (TSX: WSP) (“WSP” or the “Corporation”) announced

today the closing of its previously announced private offering (the

“Offering”) of $500 million aggregate principal amount of 5.548%

senior unsecured notes due November 22, 2030 (the “Notes”).

The Notes are being offered through an agency

syndicate led by CIBC Capital Markets, National Bank Financial

Markets and RBC Capital Markets, as joint bookrunners and co-lead

private placement agents, and including BMO Nesbitt Burns Inc.,

Scotia Capital Inc., TD Securities Inc., BNP Paribas (Canada)

Securities Inc., Desjardins Securities Inc., J.P. Morgan Securities

Canada Inc., HSBC Securities (Canada) Inc., Citigroup Global

Markets Canada Inc., Raymond James Ltd. and Laurentian Bank

Securities Inc., as co-managers. The Corporation intends to use the

net proceeds of the Offering to repay existing indebtedness and for

other general corporate purposes.

The Notes are issued at par and bear interest at

a fixed rate of 5.548% per annum, payable semi annually until

maturity on the 22nd day of May and November in each year beginning

on May 22, 2024. The Notes are direct, senior unsecured obligations

of WSP, and rank pari passu with all of the existing and future

senior unsecured indebtedness of WSP. The Notes are guaranteed,

jointly and severally, on a senior unsecured basis, by certain of

the Corporation’s subsidiaries. The Notes have been assigned a

rating of BBB (high), with a stable trend, by DBRS Limited.

The Notes are being offered in Canada on a

private placement basis in reliance upon exemptions from the

prospectus requirements under applicable securities legislation.

The Notes have not been and will not be qualified for sale to the

public under applicable securities laws in Canada and, accordingly,

any offer and sale of the Notes in Canada will be made on a basis

which is exempt from the prospectus requirements of such securities

laws. The Notes have not been and will not be registered under the

United States Securities Act of 1933, as amended (the “U.S.

Securities Act”), or the securities laws of any other jurisdiction,

and may not be offered or sold in the United States absent

registration under, or an applicable exemption from the

registration requirements of, the U.S. Securities Act. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy, nor shall there be any offer to sell or a

solicitation of an offer to buy the Notes in any jurisdiction where

it is unlawful to do so.

FORWARD-LOOKING

STATEMENTSCertain statements in this press release, such

as statements about the expected use of the net proceeds of the

Offering, and any other future events or developments constitute

forward-looking statements.

Forward-looking statements are based on

information currently available to us and on estimates and

assumptions made by us in light of our experience and perception of

current conditions and expected future developments, as well as

other factors that we believe are appropriate and reasonable in the

circumstances, but there can be no assurance that such estimates

and assumptions will prove to be correct. Many factors could cause

future events or developments to differ materially from those

expressed or implied by the forward-looking statements, including,

without limitation, the factors discussed or referred to in the

“Risk Factors” section of WSP’s Management’s Discussion and

Analysis for the year ended December 31, 2022, which is available

under WSP’s profile on SEDAR+ at www.sedarplus.ca.

These factors are not intended to represent a

complete list of the factors that could affect us; however, they

should be considered carefully. The purpose of the forward-looking

statements is to provide the reader with a description of

management’s expectations regarding the Offering and other future

events and may not be appropriate for other purposes; readers

should not place undue reliance on forward-looking statements made

herein. Furthermore, unless otherwise stated, the forward-looking

statements contained in this press release are made as of the date

hereof and except as required under applicable securities laws, WSP

does not undertake to update or revise any forward-looking

statements, whether written or verbal, that may be made from time

to time by itself or on its behalf, whether as a result of new

information, future events or otherwise. The forward-looking

statements contained in this press release are expressly qualified

by this cautionary statement.

ABOUT WSPAs one of the largest professional

services firms in the world, WSP exists to future-proof our cities

and our environment. It provides strategic advisory, engineering,

and design services to clients seeking sustainable solutions in the

transportation, infrastructure, environment, building, energy,

water, and mining sectors. Its 67,000 trusted professionals are

united by the common purpose of creating positive, long-lasting

impacts on the communities it serves through a culture of

innovation, integrity, and inclusion. In 2022, WSP reported $11.9 B

(CAD) in revenue. The Corporation’s shares are listed on the

Toronto Stock Exchange (TSX: WSP).

NOT FOR RELEASE OVER US NEWSWIRE

SERVICES OR DISSEMINATION IN THE US

FOR ADDITIONAL INFORMATION, PLEASE CONTACT:

Alain MichaudChief Financial OfficerWSP Global

Inc.alain.michaud@wsp.com Phone: 438-843-7317

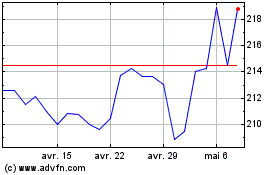

WSP Global (TSX:WSP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

WSP Global (TSX:WSP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024