Anfield Energy Inc. (TSX.V: AEC; OTCQB: ANLDF; FRANKFURT:

0AD) (“

Anfield” or the

“

Company”) is pleased to announce that it has

entered into a credit agreement (the “

Credit

Agreement”) with existing shareholder Extract Advisors

LLC, as Agent, on behalf of Extract Capital Master Fund Ltd. (each

as “

Lender” and collectively,

“

Extract”) for a credit facility of $4.3 million

(the “

Credit Facility”). The Credit Facility, in

addition to the company’s recent equity financing, will support the

Company’s asset transaction strategy, including the Marquez-Juan

Tafoya transaction, and ongoing work programs in pursuit of the

Shootaring Canyon mill reactivation.

Corey Dias, Anfield’s CEO commented: “We are

pleased to have executed this dual-pronged financing plan,

facilitated with Extract, a shareholder of the Company. The

facility offers us repayment flexibility and moderated against what

would have been larger share dilution on the recent equity

financing. The funds not only help to advance the Shootaring Canyon

Mill – which represents only one of three licensed, permitted and

constructed conventional uranium mills in the United States - but

will also provide Anfield with additional financial flexibility as

we continue to advance and grow our strategic US-based uranium and

vanadium portfolio.”

The Credit Facility

Under the terms of the Credit Agreement, Extract

shall provide Anfield with a single-draw, secured loan for $4.3

million. The Credit Facility will have a maturity date which is

five years from the closing date (the “Maturity

Date”), which is anticipated to be completed on or before

September 30, 2023.

The Credit Facility will bear a coupon of the

Secured Overnight Financing Rate (“SOFR”) plus 5.0% per annum,

payable semi-annually. Anfield, with written notice, may elect to

capitalize the interest payable on the Facility semi-annually, in

arrears, at a rate of SOFR plus 7.0%. The Credit Facility will have

an original issue discount of 7%.

In connection with the Credit Facility, Anfield

will issue 42,105,263 warrants to Extract, with each warrant

entitling the holder to acquire one common share of the company at

an exercise price of $0.095 per warrant for a period ending on the

Maturity Date (the “Facility Warrants”). For so

long as the Credit Facility remains outstanding, all proceeds from

the exercise of the Facility Warrants by the Lender shall be used

to repay the principal amount of the Credit Facility.

The Credit Facility will contain a voluntary

prepayment option, allowing Anfield to prepay the Credit Facility

at any time after the twelve-month anniversary of the closing date

by paying a prepayment fee equal to 3% of the outstanding amount of

the Credit Facility. The Credit Facility is secured by a corporate

guarantee and share pledge from each of the subsidiaries of Anfield

and contains certain other customary provisions, including certain

covenants and default conditions in favour of Extract.

Closing of the Credit Facility and the issuance

of the Facility Warrants remain subject to the TSX Venture

Exchange.

About Extract

Extract Advisors LLC is a natural resources fund

manager with a concentration in the junior mining sector. Extract

was founded in 2012 and is based in Los Angeles and Toronto.

About Anfield

Anfield is a uranium and vanadium development

and near-term production company that is committed to becoming a

top-tier energy-related fuels supplier by creating value through

sustainable, efficient growth in its assets. Anfield is a publicly

traded corporation listed on the TSX-Venture Exchange (AEC-V), the

OTCQB Marketplace (ANLDF) and the Frankfurt Stock Exchange (0AD).

Anfield is focused on its conventional asset centre, as summarized

below:

Arizona/Utah/Colorado – Shootaring Canyon

Mill

A key asset in Anfield’s portfolio is the

Shootaring Canyon Mill in Garfield County, Utah. The Shootaring

Canyon Mill is strategically located within one of the historically

most prolific uranium production areas in the United States, and is

one of only three licensed uranium mills in the United States.

Anfield’s conventional uranium assets consist of

mining claims and state leases in southeastern Utah, Colorado, and

Arizona, targeting areas where past uranium mining or prospecting

occurred. Anfield’s conventional uranium assets include the

Velvet-Wood Project, the Slick Rock Project, the West Slope

Project, the Frank M Uranium Project, as well as the Findlay Tank

breccia pipe. A combined NI 43-101 PEA has been completed for the

Velvet-Wood and Slick Rock Projects. The PEA is preliminary in

nature, and includes inferred mineral resources that are considered

too speculative geologically to have economic considerations

applied to them that would enable them to be categorized as mineral

reserves and, resultantly, there is no certainty that the included

preliminary economic assessment would be realized. All conventional

uranium assets are situated within a 200-mile radius of the

Shootaring Mill.

On behalf of the Board of DirectorsANFIELD

ENERGY INC.Corey Dias, Chief Executive Officer

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Contact:Anfield Energy Inc.Clive MostertCorporate

Communications780-920-5044contact@anfieldenergy.com

www.anfieldenergy.com

Safe Harbor Statement

THIS NEWS RELEASE CONTAINS “FORWARD-LOOKING

STATEMENTS”. STATEMENTS IN THIS NEWS RELEASE THAT ARE NOT PURELY

HISTORICAL ARE FORWARD-LOOKING STATEMENTS AND INCLUDE ANY

STATEMENTS REGARDING BELIEFS, PLANS, EXPECTATIONS OR INTENTIONS

REGARDING THE FUTURE.

EXCEPT FOR ANY HISTORICAL INFORMATION PRESENTED

HEREIN, MATTERS DISCUSSED IN THIS NEWS RELEASE CONTAIN

FORWARD-LOOKING STATEMENTS THAT ARE SUBJECT TO CERTAIN RISKS AND

UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY

FROM ANY FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR

IMPLIED BY SUCH STATEMENTS. STATEMENTS THAT ARE NOT HISTORICAL

FACTS, INCLUDING STATEMENTS THAT ARE PRECEDED BY, FOLLOWED BY, OR

THAT INCLUDE SUCH WORDS AS “ESTIMATE,” “ANTICIPATE,” “BELIEVE,”

“PLAN” OR “EXPECT” OR SIMILAR STATEMENTS ARE FORWARD-LOOKING

STATEMENTS. RISKS AND UNCERTAINTIES FOR THE COMPANY INCLUDE, BUT

ARE NOT LIMITED TO, STATEMENTS OR INFORMATION RELATED TO THE USE OF

PROCEEDS FROM THE OFFERING, THE RISKS ASSOCIATED WITH MINERAL

EXPLORATION AND FUNDING AS WELL AS THE RISKS SHOWN IN THE COMPANY’S

MOST RECENT ANNUAL AND QUARTERLY REPORTS AND FROM TIME-TO-TIME IN

OTHER PUBLICLY AVAILABLE INFORMATION REGARDING THE COMPANY. OTHER

RISKS INCLUDE RISKS ASSOCIATED WITH THE REGULATORY

APPROVAL PROCESS, COMPETITIVE COMPANIES, FUTURE CAPITAL

REQUIREMENTS AND THE COMPANY’S ABILITY AND LEVEL OF SUPPORT FOR ITS

EXPLORATION AND DEVELOPMENT ACTIVITIES. THERE CAN BE NO ASSURANCE

THAT THE COMPANY’S EXPLORATION EFFORTS WILL SUCCEED OR THE COMPANY

WILL ULTIMATELY ACHIEVE COMMERCIAL SUCCESS. THESE FORWARD-LOOKING

STATEMENTS ARE MADE AS OF THE DATE OF THIS NEWS RELEASE, AND THE

COMPANY ASSUMES NO OBLIGATION TO UPDATE THE FORWARD-LOOKING

STATEMENTS, OR TO UPDATE THE REASONS WHY ACTUAL RESULTS COULD

DIFFER FROM THOSE PROJECTED IN THE FORWARD-LOOKING STATEMENTS.

ALTHOUGH THE COMPANY BELIEVES THAT THE BELIEFS, PLANS, EXPECTATIONS

AND INTENTIONS CONTAINED IN THIS NEWS RELEASE ARE REASONABLE, THERE

CAN BE NO ASSURANCE THOSE BELIEFS, PLANS, EXPECTATIONS OR

INTENTIONS WILL PROVE TO BE ACCURATE. INVESTORS SHOULD CONSIDER ALL

OF THE INFORMATION SET FORTH HEREIN AND SHOULD ALSO REFER TO THE

RISK FACTORS DISCLOSED IN THE COMPANY’S PERIODIC REPORTS FILED FROM

TIME-TO-TIME.

THIS NEWS RELEASE HAS BEEN PREPARED BY

MANAGEMENT OF THE COMPANY WHO TAKES FULL RESPONSIBILITY FOR ITS

CONTENTS.

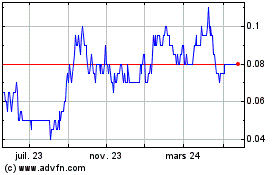

Anfield Energy (TSXV:AEC)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

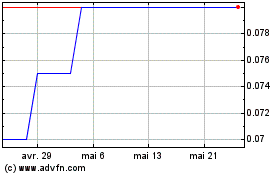

Anfield Energy (TSXV:AEC)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025