Anfield Energy Inc.

(TSX.V: AEC; OTCQB: ANLDF; FRANKFURT:

0AD) (“Anfield” or the “Company”) is pleased to

announce that it has completed a 14-hole, 14,100-foot rotary drill

program at its Slick Rock uranium and vanadium project, located in

San Miguel County, Colorado. Anfield will use the drill results to

both upgrade its uranium and vanadium resource estimate for Slick

Rock – as found in its existing PEA – and prepare mine designs for

a large mine permit for the project.

Corey Dias, Anfield’s CEO, commented: “We are very pleased to

have completed our Slick Rock drill program as part of our plan to

advance our Slick Rock project through the permitting stage and,

ultimately, to production. Anfield will pursue a Plan of Operations

and mine plan for Slick Rock in 2025. The mine plan will also

include the potential of incorporating the uranium and vanadium

resources of one or more of the Anfield-controlled DOE leases in

the vicinity into a larger mining operation. The Company then will

pursue detailed mine planning and hydrological studies for the

purpose of obtaining a mine permit in 2026.

“This program has helped to confirm existing historical results

and to also provide data from which we can both recategorize some

of the current Inferred uranium and vanadium resource to Indicated

and delineate an updated uranium and vanadium resource. We expect

to have an updated resource estimate for Slick Rock in Q2/25. In

addition, as part of the current drill permit held for Slick Rock,

Anfield is authorized to install monitoring wells at site. Up to

four wells are planned with at least one to be cored for

metallurgical and equilibrium testing. The monitor wells will

provide initial groundwater characterization and will be sampled

quarterly to determine background water quality. The Company plans

to complete this work in Q2/25.

“Finally, Anfield intends to align the development timelines for

both the Slick Rock and Velvet-Wood mines. The aim is to have both

projects ready for production prior to the restart of the

Shootaring Canyon mill, with initial feed ready for transport once

the mill is ready to receive it. As a reminder, the

combined 2023 Preliminary Economic Assessment (PEA) for Slick Rock

and Velvet-Woods demonstrated a pre-tax NPV8% of US$238M and IRR of

40% assuming U3O8 and V2O5 prices of US$70/lb and US$12/lb,

respectively.”

Slick Rock Project Drilling

Highlights

- 14 drill holes completed at

the Slick Rock property in 2024 for 14,100 feet

drilled

- Gamma ray logging results

show elevated uranium mineralization exceeding 200ppm

eU3O8

in 7 of 14 drill holes

- Significant intercepts of

mineralization include:

- 10.0 ft grading 1560 ppm

eU3O8

(GT of 1.56) in Hole SR-24-01, peak of 2610 ppm

eU3O8

at 925.0 ft

- 5.0 ft grading 2180 ppm

eU3O8

(GT of 1.09) in Hole SR-24-04, peak of 5910 ppm

eU3O8

at 809.5 ft

Drilling results confirm the presence of

uranium mineralization at depths and locations consistent with the

historical drilling dataset

The objective of Anfield’s initial drilling

program was to verify the historical drilling dataset of 285 drill

holes at Slick Rock which was generated by the USGS and various

subsequent operators. The company has completed fourteen rotary

drill holes in the Slick Rock project area totaling 14,100 feet of

drilling. The drilling locations and results are summarized in

Figure 2 and Table 1.

The local drilling contractor, Tri Park

Corporation, mobilized out of Nucla Colorado on September 22, 2024.

The drilling employed standard circulation rotary drilling

techniques, varying between Air, Foam, and Mud circulation

depending on the depth and groundwater conditions. Lithological

samples were taken on 5-foot intervals and recorded by on-site

geologists. Fourteen drill holes were completed by November 12,

2024 and all associated drill pads were reclaimed and seeded by

November 22, 2024.

Figure 1: Exploratory Drilling Operation

Underway at Slick Rock

The drill holes were designed to offset and

verify drilling targets derived from historical drilling data used

in preparation of the Inferred Mineral Resource estimate for the

Slick Rock project (PEA dated May 6, 2023). The depths and grades

of mineralization encountered in this drilling program were

consistent with the historical depths and grades of mineralization

contained in the historical drilling data. Variance between the

historical drill hole intercepts and the verification holes was

experienced, with some intercepts yielding greater or lesser

values. Variances are to be expected due to the distances between

the historical collars and offset holes and the variable downhole

drift of the drill holes. The verification holes demonstrated close

stratigraphic correlation and a prevalence of mineralization of

similar tenor and character to the historical intercepts, placing a

high level of confidence in the quality and validity of the

historical drill hole data.

Figure 2: Slick Rock Drill Collar

Location Map

Table 1: Slick Rock Drilling

Results

*All depth units are Feet

below drill hole collar. **GT is calculated as:

Grade x Thickness (ft)

Intercepts are reported at a 0.02 (200 ppm)

eU3O8% grade cut-off. All grades were calculated from gamma-ray

logs measured by an experienced commercial independent logging

contractor, Hawkins CBM Logging of Cody, Wyoming. Hawkins CBM’s

downhole sonde was calibrated at the US Department of Energy’s

Casper, Wyoming logging test pits prior to deployment to the field.

The calibrated downhole sonde is used to measure natural gamma

emission from the rock formation down the borehole. The recorded

natural gamma data was used in creating the geophysical well log

and calculate “equivalent” (“e”) grades of U3O8.

The drill holes were vertical in orientation and

all drill holes were measured for downhole drift with the

geophysical probe. Drift values for each drill hole are listed in

Table 1 and in the most extreme cases, the drill

hole deviation value was less than 3 degrees from vertical. The

geologic units hosting the mineralization are generally flat lying,

therefore reported thicknesses are apparent true thicknesses.

Qualified PersonDouglas L.

Beahm, P.E., P.G., principal engineer at BRS Inc., is a Qualified

Person as defined in NI 43-101 and has reviewed and approved the

technical content of this news release.

For additional information regarding the

Company’s Slick Rock Project, including data verification related

to certain scientific and technical information described in this

news release, please see the Technical Report titled “The

Shootaring Canyon Mill and Velvet Wood and Slick Rock Uranium

Projects, Preliminary Economic Assessment” dated May 6, 2023, which

is available under the Company’s profile on SEDAR+ at

www.sedarplus.ca

About

Anfield

Anfield is a uranium and vanadium

development and near-term production company that is committed to

becoming a top-tier energy-related fuels supplier by creating value

through sustainable, efficient growth in its

assets. Anfield is a publicly traded corporation listed

on the TSX Venture Exchange (AEC-V), the OTCQB Marketplace (ANLDF)

and the Frankfurt Stock Exchange (0AD).

On behalf of the Board of Directors

ANFIELD ENERGY INC.Corey Dias, Chief Executive

Officer

Contact:

Anfield Energy

Inc.Corey Dias, Chief Executive OfficerClive

Mostert, Corporate

Communications780-920-5044contact@anfieldenergy.comwww.anfieldenergy.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release. No securities

regulatory authority has either approved or disapproved of the

contents of this news release.

Cautionary Statement Regarding

Forward-Looking Information

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. “Forward-looking information” includes, but is not

limited to, statements with respect to the activities, events or

developments that the Company expects or anticipates will or may

occur in the future, including the anticipated use of proceeds from

the Equity Financing, the receipt of regulatory approvals with

respect to the Equity Financing and the intention to pursue a

listing on a US stock exchange.

Generally, but not always, forward-looking

information and statements can be identified by the use of words

such as “plans”, “expects”, “is expected”, “budget”, “scheduled”,

“estimates”, “forecasts”, “intends”, “anticipates”, or “believes”

or the negative connotation thereof or variations of such words and

phrases or state that certain actions, events or results “may”,

“could”, “would”, “might” or “will be taken”, “occur” or “be

achieved” or the negative connotation thereof.

Such forward-looking information and statements

are based on numerous assumptions, including among others, that the

Company will use the proceeds of the Equity Financing as currently

anticipated; that the Company will receive regulatory approval with

respect to the Equity Financing; and that the Company will be able

to pursue a listing on a US stock exchange. Although the

assumptions made by the Company in providing forward-looking

information or making forward-looking statements are considered

reasonable by management at the time, there can be no assurance

that such assumptions will prove to be accurate.

There can be no assurance that such statements

will prove to be accurate and actual results and future events

could differ materially from those anticipated in such statements.

Important factors that could cause actual results to differ

materially from the Company’s plans or expectations include the

risk that the Company may not use the proceeds of the Equity

Financing as currently anticipated; that the Company may not

receive regulatory approval with respect to the Equity Financing;

the risk that the Company may not have the resources, or may

otherwise be unable to pursue a listing on a US stock exchange;

risks relating to the actual results of the Company’s operational

activities, fluctuating commodity prices, availability of capital

and financing, general economic, market or business conditions,

regulatory changes, timeliness of government or regulatory

approvals and other risks detailed herein and from time to time in

the filings made by the Company with securities regulators.

Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in the forward-looking information

or implied by forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking

information and statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated, estimated or intended. Accordingly, readers should not

place undue reliance on forward-looking statements or

information.

The Company expressly disclaims any intention or

obligation to update or revise any forward-looking statements

whether as a result of new information, future events or otherwise

except as otherwise required by applicable securities legislation.

We seek safe harbor.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/ae77b177-196b-4588-9b99-2e59611c7e9f

https://www.globenewswire.com/NewsRoom/AttachmentNg/1bbdebe0-952d-472f-8e48-283e8ff7dda0

https://www.globenewswire.com/NewsRoom/AttachmentNg/b2588224-3f0b-4b4d-a69f-365262c19b56

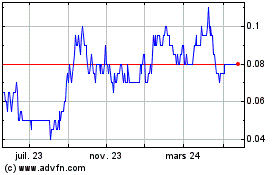

Anfield Energy (TSXV:AEC)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

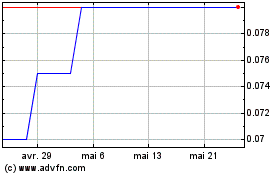

Anfield Energy (TSXV:AEC)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025